PX14A6G: Notice of exempt solicitation

Published on April 5, 2013

Proxy Memo: PNC Financial

AGM: April 23, 2013 in Pittsburgh, PA

Climate Change Exposure and Contribution

MEMO

|

SUBJECT:

|

Proxy Advisors and Shareowners should vote “FOR” the resolution requesting PNC’s assessment of its exposure to climate change related risks and its assessment of greenhouse gas emissions resulting from its lending.

|

|

DATE:

|

March 18, 2013

|

|

CONTACT:

|

Meredith Benton, Boston Common Asset Management

(650) 472-2264, mbenton@bostoncommonasset.com

|

Resolved: “Given the broader societal implications of climate change, shareowners request that the Board of Directors report to shareholders by September 2013, at reasonable cost and omitting proprietary information, PNC’s assessment of the greenhouse gas emissions resulting from its lending portfolio and its exposure to climate change risk in its lending, investing, and financing activities.”

Rationale for a Yes vote:

|

|

1.

|

The Banking Sector is Significantly Impacted by Climate Change

|

|

|

2.

|

PNC is Exceptionally Exposed to Climate Risk

|

Banks and other financial institutions contribute to climate change through their financed emissions, which are the greenhouse gas footprint of loans, investments, and other financial services. A bank's financed emissions can dwarf its other climate impacts and expose it to reputational and operational risks. PNC Financial Services (PNC) itself has commented that "a lack of a clear carbon emissions strategy, or a low perceived action plan, could cause PNC to lose valuable customers and investors, or limit our ability to attract new customers and investors."

Coal emits the greatest amount of CO2 per unit of energy of any fuel source. Financing and lending to a coal dependent infrastructure, as PNC continues to do, requires assumptions that there will be no shifts in public policy and that current rates of greenhouse gas emissions will be allowed to continue. Investors have reasons to be concerned that businesses based on current levels of greenhouse gas emissions are unsustainable.

Investors should seek additional disclosure from PNC regarding its climate change related programs as well as assurance that it understands the implications climate change may have for their business.

THE BANKING SECTOR IS SIGNIFICANTLY IMPACTED BY CLIMATE CHANGE

Climate change’s ability to destroy (or raise) shareholder value is exponentially increased by the fundamental structure of the banking industry. A financial institution’s success relies on its ability to effectively predict and manage risks, accurately assess predictive valuations, and leverage potential future events. It is inherently more susceptible to the wide range of potential negative impacts of climate change on economic and political stability given its reliance on outcome and risk scenarios in its lending models.

President Obama declared his intention to address climate change in his State of the Union address on February 12, 2013:

[I]f Congress won't act soon to protect future generations, I will. I will direct my Cabinet to come up with executive actions we can take, now and in the future, to reduce pollution, prepare our communities for the consequences of climate change, and speed the transition to more sustainable sources of energy.1

Early indications are that the National Environmental Policy Act of 1970 will be broadened, requiring lifecycle assessments of projects such as the proposed the coal-export facility in Oregon. This would require consideration of the greenhouse gases emitted from the coal's use, regardless of destination.2 While it remains unclear what form regulations will take, it is clear that U.S. legislative complacency in addressing climate change will not continue. The uncertainty around regulations, let alone the regulations themselves, add complexity and risk to valuation and project analysis exercises for project managers and their financiers. Upcoming regulations may dramatically shift the profitability of projects currently seeking financing. Even without direct legislation, coal will be impacted by incentives driving consumers towards renewable and alternative energy.

The Carbon Tracker Initiative released a report in August of 2012 which calculated the world's carbon budget until 2050, should we wish to hold global warming below 3.6°F (2°C). Their research determined that, of known reserves, only 20% could be used.3 Even if an 80% cut is too severe and unlikely to be legislatively imposed, it is likely that all known fossil fuel reserves will not be allowed to be burned. Current valuations, however, are based on known fossil fuel reserves, with an implied belief that they can be fully exploited. These fossil fuel assets will become stranded as we transition to a low carbon economy. This indicates that a mispricing in the market.

Indeed, Carbon Tracker argues that equity investors could be facing a potential 'carbon bubble', with assets in excess of what can be safely and profitably exploited. This growing concern, about fossil fuels becoming stranded assets, draws parallels to the sub-prime crisis. Investors have a fiduciary duty to assess this risk.

Standard & Poor’s March, 2013, report “What A Carbon-Constrained Future Could Mean For Oil Companies' Creditworthiness” conducted an analysis of the potential impact on oil sands and large oil companies from climate policies seeking to stabilize atmospheric concentrations of greenhouse gasses at 3.6°F. In its “stress scenario” analysis, it predicted that pressure would be put on cash flows, projects might be cancelled and dividends cut. As Simon Redmond, a director in S&P's oil and gas team explained, "However, as the price declines persist in our stress scenario of weaker oil demand, meaningful pressure could build on ratings. First the relatively focused, higher cost producers, and then also the more diversified integrated players, as operating cash flows decline, weakening free cash flow and credit measures, and returns on investment become less certain and reserve replacement less robust."4

In addition, HSBC Global Research released a "Coal and Carbon, Stranded Assets: assessing the risk" report on June 21, 2012 which stated that “that carbon constraints post-2020 could impact DCF valuations of coal assets by as much as 44%." Should the HSBC Global Research report be correct, the ability of coal and carbon dependent companies to generate the revenues required to service their debt may be called in to question.5

Banks must reassess their valuation and risk assessment models given the new realities presented by climate change. Business as usual is, unfortunately, no longer an option for the financial services industry.

Opportunities and Risks Abound

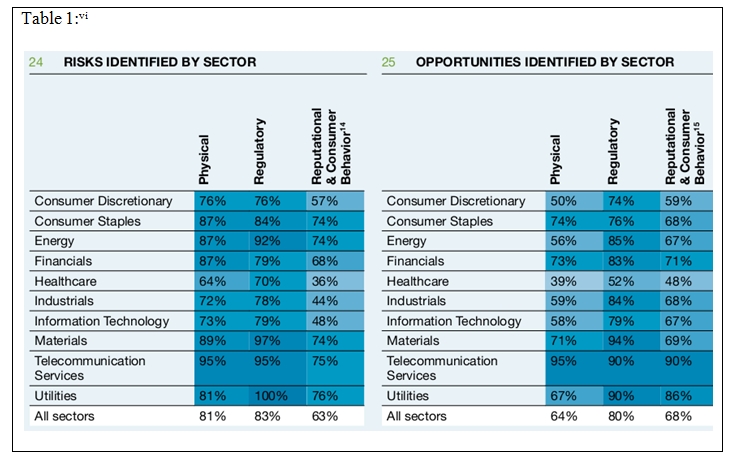

The Carbon Disclosure Project (CDP), based in the United Kingdom, works with shareholders and corporations that voluntarily disclose greenhouse gas emissions. The results of the CDP questionnaire illustrate the extent to which climate change is viewed as a key business issue in various sectors. Within the Financials sector, 70% of companies responded to the questionnaire. As shown in Table 1, 87% of respondents to the CDP survey foresaw Physical risks from climate change, 79% from Regulatory restrictions, and 68% from Reputational and Customer Behavior. 73% of these respondents saw opportunities from these same Physical risks, 83% from Regulatory changes and 71% from Reputational and Consumer Behavior. In each category, there was more perceived opportunity than risk. Understanding how a bank like PNC is managing these issues is essential in allowing investors to assess its competitive approach and therefore potential value.

A further study extensively reviewed the ways in which climate change poses both opportunities and risks for banks. “Banking & Climate Change: Opportunities and Risks” analyzed the climate change strategies of more than 100 banks worldwide. In doing so, it identified a number of significant ways in which climate change might meaningfully change the business model of the banks. The following are the changes identified:7

|

|

·

|

Commercial/Wholesale banking: Lending volumes and revenues may contract should climate change or carbon restrictions reduce economic activity. Extreme weather events, or regulatory risks may increase client default risk from underestimated mitigation costs and physical damages to corporate assets. Real estate, agribusiness, and infrastructure are particularly vulnerable to extreme weather events. New business opportunities will emerge for the provision of investment capital for clean technology and climate mitigation solutions. Opportunities also exist to provide services and develop financial products that address the need for mitigation and accommodation of climate change.

|

|

|

·

|

Investment banking: Investment banking stands to benefit from climate change. Primary markets may benefit from the necessary new technology adoption and associated investments addressing climate change reduction and adaptation. Secondary markets may profit from new trading markets. New business opportunities related will develop related to renewable energy and global carbon trading market. Examples provided included initial public offerings for renewable energy companies, development of weather derivatives, emission trading services, and offering climate change management advice.

|

|

|

·

|

Asset management: Climate change will have an unpredictable impact on global markets and may impair equity valuations or bond/equity issues. Investment strategies will need to incorporate forecasts of future carbon prices, emissions footprints of companies, carbon markets hedging strategies and revenue opportunities associated with climate change.

|

PNC IS EXCEPTIONALLY EXPOSED TO CLIMATE RISK

PNC actively presents itself as a “green” bank, and leads with this branding in both its advertising and employee recruitment. As it states on its website, “Among America's top financial institutions, no company has done more to spur the charge, or energize the green cause than PNC.”8 While investors are unaware of a strategic approach to climate change risk, PNC does participate in a number of projects which encourage the reduction of greenhouse gases. Chief among these is its PNC Energy Capital Business, which supports alternative energy use by helping its customers implement renewable energy projects. It has also developed an exceptional green branches initiative.

PNC itself has emphasized the import of an effective climate risk management plan, stating in its written response to the Carbon Disclosure Project:

As a community-based bank, our reputation and commitment to the community can be a factor in attracting and retaining customers. A subset of our customers and investors increasingly care about social and environmental issues and the impact that their consumption spend has on climate change. The increasingly eco-conscious business environment has meant that some customers and investors use a company’s response to climate change as a differentiator between potential options. A lack of a clear carbon emissions strategy, or a low perceived action plan, could cause PNC to lose valuable customers and investors, or limit our ability to attract new customers and investors.

It also noted climate change as a concern in its Form 8-K filing with the SEC: “Changes resulting from legislative and regulatory initiatives relating to climate change that have or may have a negative impact on our customers demand for or use of our products and services in general and their credit worthiness in particular.”9

Despite these statements, PNC has shown challenges in successfully addressing stakeholder climate change and broader environmental concerns. For example, its reputation has become linked to the controversial practice of coal Mountaintop Removal (MTR). Coal, according to the U.S. Energy Information Association, emits the greatest amount of CO2 per unit of energy of any fuel source.10In addition, according to the United States Environmental Protection Agency, MTR is an environmentally damaging form of coal extraction which involves the removal of mountain tops to expose coal seams. The “associated mining overburden” is then placed in nearby valleys. Direct environmental impacts associated with this practice include loss of local ecosystem diversity and native species and watershed pollution.11

In the Philadelphia Citypaper, PNC was referred to as “the largest financier of mountaintop removal coal mining.”12 This has catalyzed environmentalists' focus on the company. In 2010, the Earth Quaker Action Team (EQAT) began to pressure PNC to stop financing MTR with non-violent actions, including walking 200 miles from Philadelphia to PNC’s headquarters in Pittsburgh.13 PNC responded to the campaign in their 2011 Corporate Sustainability Report, in which the bank states its mountaintop removal-specific policy: “PNC does not extend credit to individual MTR mining projects or to a coal producer that receives a majority of its production from MTR mining.”14

Though EQAT viewed this as a step in the right direction, the organization also noted that this pledge “appears not to effect any of the major MTR companies that PNC does business with” – thus rendering PNC’s policy statement essentially meaningless. According to EQAT, PNC has also refused to share evidence of any impacts of the policy when asked. 15 Given the import of this issue, indications of an ineffective or poorly implemented policy should be highly concerning to investors.

Research conducted on November 12, 2012, indicated that, despite its policy, PNC continues to have significant relationships with mountain top removal mining companies. Selected examples follow:

| Company | PNC Involvement | |

|

Alpha Natural Resources

|

● |

6/1/11 – PNC Capital Markets underwrote $20 million for Alpha Natural Resources’ $800 million bond offering

|

| ● | 6/1/11 – PNC Capital Markets underwrote $17.5 million for Alpha Natural Resources’ $700 million bond offering for the acquisition of Massey Energy | |

| ● | 9/28/2012 – PNC Capital Markets underwrote $17.5 million and served as a senior co-manager for a $500 million bond offering for Alpha Natural Resources. | |

| Arch Coal | ● | 8/9/10 – PNC Capital Markets LLC underwrote $25 million for Arch Coal’s $500 million bond offering |

| ● | 6/14/11 – PNC Capital Markets participated in Arch Coal’s 2 $1 billion bond offerings | |

| ● | 6/12/12 – PNC Capital Markets served as lead manager for Arch Coal Inc’s offer to exchange $1 billion in notes due 2019 | |

|

Patriot Coal

|

● |

5/5/10 – PNC Capital Markets underwrote $10 million for Patriot Coal Corp’s $250 million bond offering

|

| ● | 1/6/11 and 1/31/12 – PNC National Association served as a lender for the first and second amendment for Patriot Coal’s $500 million credit agreement (loan) |

PNC challenged the placement of this shareholder resolution onto its proxy ballot. The Securities Exchange Commission (SEC), however, ruled in favor of the resolution proponents, allowing the resolution to remain. In doing so, it made clear that the allowance of a climate change risk resolution at PNC was reflective of “the nature of the bank’s own lending criteria and public statements.”16

Beyond disjointed, albeit admirable, programs and vague statements, PNC has not shared with investors the ways in which it has sought to analyze, assess, or strategically manage its exposure to climate change risk. Broad vague public statements are an insufficient basis for analysis and benchmarking of investment opportunities.

CONCLUSION

A number of opportunities exist for those banks seeking to address climate disruption - in the development of alternative energy and emissions reduction products, as well as climate adaptation services. It is equally important that banks develop strategic management plans to address climate change risk, considering its implications in their valuations and risk assessments. For those banks involved in industries with high greenhouse gas emissions, such as coal, this assessment is particularly important.

PNC has not provided meaningful reporting to investors about the ways in which it factors climate change issues into its financing decisions. Investors, however, have reason to be concerned that the company is not effectively managing the risks associated with this global challenge. As such, they should seek additional disclosure from PNC regarding its assessment of the greenhouse gas emissions resulting from its lending portfolio and the exposure it faces to climate change risk in its lending, investing, and financing activities.

1 "Transcript of Obama's State of the Union speech," FoxNews.com, <http://www.foxnews.com/politics/2013/02/12/transcript-obama-state-union-speech/

2 Drajem, Mark, "Obama will use Nixon-Era Law to Fight Climate Change," Bloomberg, March 15, 2013 < http://www.bloomberg.com/news/2013-03-15/obama-will-use-nixon-era-law-to-fight-climate-change.html>

3 “Unburnable Carbon” Carbon Tracker Initiative, 2012 <http://www.carbontracker.org/wp-content/uploads/downloads/2012/08/Unburnable-Carbon-Full1.pdf>

4 James Murray, BusinessGreen “ Standard & Poor's warns oil firms could soon be facing credit downgrades” </bg/news/2251879/standard poors-warns-oil-firms-could-soon-be-facing-credit-downgrade> 04 Mar 2013

5 Robbins, Nick, Keen, Andrew and Knight, Zoe “Coal and Carbon” HSBC Global Research, June 21,2012

6 “Business resilience in an uncertain, resource-constrained world,” CDP Global 500 Climate Change Report 2012, 2012 < https://www.cdproject.net/CDPResults/CDP-Global-500-Climate-Change-Report-2012.pdf>

7 Furrer, Bettina, Hoffman, Volker and Swoboda, Marion “Banking & Climate Change: Opportunities and Risks. An analysis of climate change strategies in more than 100 banks worldwide.” March, 2009 <http://ec.europa.eu/enterprise/policies/sustainable-business/corporate-social-responsibility/reporting-disclosure/swedish-presidency/files/surveys_and_reports/banking_and_climate_change_-_sam_group_en.pdf>

8 Accessed March 14, 2013 < http://www.pnccommunityinvolvement.com/environment.htm>

9 Form 8-K, United States Securities and Exchange Commission, PNC Financial, February 24, 2010, < https://www.pnc.com/webapp/unsec/Requester?resource=/wps/wcm/connect/7eff03004179531fa198ef1bd593aedb/IR_8K_022410_CFA_Society.pdf?MOD=AJPERES&CACHEID=7eff03004179531fa198ef1bd593aedb>

10 “Frequently Asked Questions,” U.S. Energy Information Association, Accessed March 14, 2013 < http://www.eia.gov/tools/faqs/faq.cfm?id=73&t=11>

CITATIONS

11 “Mid-Atlantic Mountain Top Mining, U.S. Environmental Protection Agency, Accessed March 14, 2013 < http://www.epa.gov/region3/mtntop/>

12 “PNC could pay for funding mountaintop removal mining,” Philadelphia Citypaper, February 27 2012. <http://www.citypaper.net/blogs/nakedcity/EQAT-demands-PNC-help-stop-MTR.html>

13 http://www.philly.com/philly/blogs/public_health/Quakers-vs-PNC-Bank-on-the-mountaintop-.html

14<https://www.pnc.com/webapp/unsec/Requester?resource=/wps/wcm/connect/0336ca0043c8b165986f994737af402a/2010_1025_v4_PNCCR_rev.pdf?MOD=AJPERES&CACHEID=0336ca0043c8b165986f994737af402a>, p. 3

15< http://eqat.wordpress.com/our-campaign-bank-like-appalachia-matters/>

16 Erickson, David and Antoetter, "SEC says no general duty to report financed greenhouse gas emissions." Lexology < http://www.lexology.com/library/detail.aspx?g=322cc47f-d573-46ca-aab9-9ee7cbe07b58>