DEF 14A: Definitive proxy statements

Published on March 12, 2019

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

|

☑ Filed by the Registrant |

☐ Filed by a Party other than the Registrant |

|

Check the appropriate box: |

||

| ☐ |

Preliminary Proxy Statement | |

| ☐ |

CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14a-6(e)(2)) | |

| ☑ |

Definitive Proxy Statement | |

| ☐ |

Definitive Additional Materials | |

| ☐ |

Soliciting Material under §240.14a-12 | |

THE PNC FINANCIAL SERVICES GROUP, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

|

Payment of Filing Fee (Check the appropriate box): |

||

| ☑ |

No fee required. | |

| ☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| (1) Title of each class of securities to which transaction applies: | ||

| (2) Aggregate number of securities to which transaction applies: | ||

| (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | ||

| (4) Proposed maximum aggregate value of transaction: | ||

| (5) Total fee paid: | ||

| ☐ |

Fee paid previously with preliminary materials. | |

| ☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) Amount Previously Paid: | ||

| (2) Form, Schedule or Registration Statement No.: | ||

| (3) Filing Party: | ||

| (4) Date Filed: | ||

Table of Contents

Today the day 2019 proxy statement the PNC Financial services group PNC

Table of Contents

|

Letter from the Chairman and

|

Dear Shareholder,

We invite you to attend the 2019 Annual Meeting of Shareholders of The PNC Financial Services Group, Inc. on Tuesday, April 23, 2019.

The meeting will be held in the James E. Rohr Auditorium in The Tower at PNC Plaza, 300 Fifth Avenue, Pittsburgh, Pennsylvania 15222, beginning at 11:00 a.m., Eastern Time.

We will consider the matters described in the proxy statement and also review significant developments since last years annual meeting of shareholders.

We are again making our proxy materials available to you electronically. We hope this continues to offer you convenience while allowing us to reduce the number of copies we print.

The proxy statement contains important information and you should read it carefully. Your vote is important and we strongly encourage you to vote your shares using one of the voting methods described in the proxy statement. Please see the notice that follows for more information.

If you are unable to attend the annual meeting in person, you will be able to listen to the meeting by webcast or conference call.

We look forward to your participation and thank you for your support of PNC.

| March 12, 2019 |

Sincerely, |

William S. Demchak

Chairman, President and Chief Executive Officer

Table of Contents

PARTICIPATE IN THE FUTURE OF PNC PLEASE CAST YOUR VOTE

Your vote is important to us and we want your shares to be represented at the annual meeting. Please cast your vote on the proposals listed below.

Under New York Stock Exchange rules, if you hold your shares through a broker, bank or other nominee (referred to as holding your shares in street name) and you do not provide any voting instructions, your broker has discretionary authority to vote on your behalf only with respect to proposals that are considered routine items. The only routine item on this years ballot is the ratification of our auditor selection. If an item is non-routine and you do not provide voting instructions, no vote will be cast on your behalf with respect to that item.

Proposals requiring your vote

| More information |

Board recommendation |

Routine item? |

||||||

| Item 1 | Election of 13 nominated directors | Page 11 |

FOR each nominee |

No | ||||

|

Item 2 |

Ratification of independent registered public accounting firm for 2019 |

Page 84 |

FOR |

Yes |

||||

|

Item 3 |

Advisory approval of the compensation of PNCs named executive officers (say-on-pay) |

Page 87 |

FOR |

No |

With respect to each item, a majority of the votes cast will be required for approval. Abstentions will not be included in the total votes cast and will not affect the results.

Vote your shares

Please read the proxy statement with care and vote right away. We offer a number of ways for you to vote your shares. Voting instructions are included in the Notice of Internet Availability of Proxy Materials and the proxy card. If you hold shares in street name, you will receive information on how to give voting instructions to your broker, bank or other nominee. For registered holders, we offer the following methods to vote your shares and give us your proxy:

|

|

|

|

||

| www.envisionreports.com/PNC | Follow the instructions on the proxy card. |

Complete, sign and date the proxy card and return it in the envelope provided. |

||

Attend our 2019 Annual Meeting of Shareholders

| Directions to attend the annual meeting | Tuesday, April 23, 2019 at 11:00 a.m. | |

| are available at | The Tower at PNC Plaza James E. Rohr Auditorium | |

| www.pnc.com/annualmeeting | 300 Fifth Avenue | |

| Pittsburgh, Pennsylvania 15222 |

4 THE PNC FINANCIAL SERVICES GROUP, INC. - 2019 Proxy Statement

Table of Contents

PROXY STATEMENT SUMMARY

Proxy Statement Summary

To assist you in reviewing the proposals to be acted upon at the annual meeting, we have included a summary of certain relevant information. This summary does not contain all of the information you should consider. You should review the entire proxy statement and the 2018 Annual Report before you vote.

You may read the proxy statement and the 2018 Annual Report at www.envisionreports.com/PNC.

Who can vote (page 90)

You are entitled to vote if you were a PNC shareholder on the record date of February 1, 2019.

Voting methods (page 91)

We offer our shareholders a number of ways to vote, including by Internet, telephone or mail. Shareholders may also vote in person at the annual meeting.

Items of business

Item 1: Election of 13 nominated directors (page 11)

| | The proxy statement contains important information about the experience, qualifications, attributes and skills of the 13 nominees to our Board of Directors (the Board). The Boards Nominating and Governance Committee performs an annual assessment to confirm that our directors continue to have the skills and experience necessary to serve PNC, and that the Board and its committees continue to be effective in carrying out their duties. |

| | The Board recommends that you vote FOR all 13 director nominees. |

Item 2: Ratification of independent registered public accounting firm for 2019 (page 84)

| | Each year, the Boards Audit Committee selects our independent registered public accounting firm. For 2019, the Audit Committee selected PricewaterhouseCoopers LLP (PwC) to fulfill this role. |

| | The Board recommends that you vote FOR the ratification of the Audit Committees selection of PwC as our independent registered public accounting firm for 2019. |

Item 3: Say-on-pay (page 87)

| | Each year, we ask our shareholders to cast a non-binding advisory vote on the compensation of our named executive officersknown generally as the say-on-pay vote. We have offered an annual say-on-pay vote since 2009. Last year, over 97% of the votes cast by our shareholders approved the compensation of our named executive officers, and we have averaged over 95% support in say-on-pay votes over the past five years. |

| | We recommend that you read the Compensation Discussion and Analysis beginning on page 40, which explains how and why the Boards Personnel and Compensation Committee made its executive compensation decisions for 2018. |

| | The Board recommends that you vote FOR the approval, on a non-binding advisory basis, of the compensation of our named executive officers. |

THE PNC FINANCIAL SERVICES GROUP, INC. - 2019 Proxy Statement 5

Table of Contents

PROXY STATEMENT SUMMARY

2018 PNC performance (page 40)

|

|

PNC had a successful year in 2018, with net income of $5.3 billion, or $10.71 per diluted common share. Our return on average assets was 1.41% and our return on average common equity was 11.83%. At December 31, 2018, our tangible book value was $75.42 per common share.

|

|

|

|

We grew loans and deposits, and generated record total revenue, net interest income and fee income.

|

|

|

|

We generated positive operating leverage in 2018 by growing revenue and reducing noninterest expense, and we achieved our $250 million continuous improvement program savings goal for the year.

|

|

|

|

We returned $4.4 billion of capital to our shareholders through share repurchases of $2.8 billion and common stock dividends of $1.6 billion, including raising the quarterly common stock dividend to $0.95 per share, an increase of 27%.

|

|

|

|

Although our stock price at December 31, 2018 decreased from year-end 2017, we compared favorably to our peers with a total shareholder return that was above the peer median for 2018, slightly below the top quartile of peers over the past three years, and in the top quartile of peers during the five-year period ended December 31, 2018.

|

|

|

|

We successfully expanded our corporate banking business into new markets (Denver, Houston and Nashville).

|

|

|

|

We launched our national retail digital strategy in markets outside of our existing retail branch network.

|

|

|

|

We continued to focus on the strategies of transforming the customer experience in our Retail Banking segment and enhancing product and service offerings within our Corporate & Institutional Banking segment.

|

|

|

|

We made additional significant progress in leveraging technology to innovate and enhance our products, services, security and processes.

|

|

|

|

We significantly strengthened the companys risk management framework.

|

|

2018 compensation decisions (page 47)

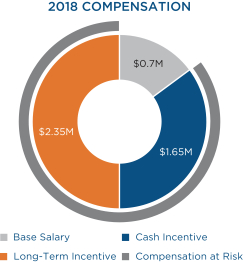

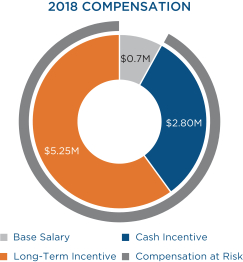

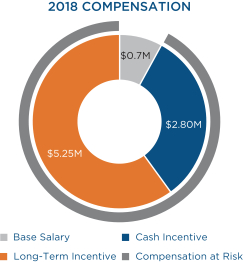

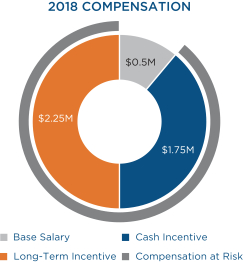

The table below shows, for each named executive officer, the incentive compensation target for 2018 and the actual annual cash incentive and long-term equity-based incentives awarded in 2019 for 2018 performance.

| William S. Demchak |

Robert Q. Reilly |

Michael P. Lyons |

E William Parsley, III |

Joseph E. Rockey |

||||||||||||||||

| Incentive compensation target |

$ | 11,500,000 | $ | 3,800,000 | $ | 7,300,000 | $ | 7,300,000 | $ | 3,250,000 | ||||||||||

| Incentive compensation awarded for 2018 performance |

$ | 12,650,000 | $ | 4,000,000 | $ | 8,050,000 | $ | 8,050,000 | $ | 4,000,000 | ||||||||||

| Annual cash incentive portion |

$ | 4,400,000 | $ | 1,650,000 | $ | 2,800,000 | $ | 2,800,000 | $ | 1,750,000 | ||||||||||

| Long-term incentive portion |

$ | 8,250,000 | $ | 2,350,000 | $ | 5,250,000 | $ | 5,250,000 | $ | 2,250,000 | ||||||||||

| Incentive compensation disclosed in the Summary compensation table(1) |

$ | 13,880,000 | $ | 4,012,500 | $ | 7,900,000 | $ | 8,500,000 | $ | 3,750,000 | ||||||||||

| Annual cash incentive portion (2018 performance) |

$ | 4,400,000 | $ | 1,650,000 | $ | 2,800,000 | $ | 2,800,000 | $ | 1,750,000 | ||||||||||

| Long-term incentive portion (2017 performance) |

$ | 9,480,000 | $ | 2,362,500 | $ | 5,100,000 | $ | 5,700,000 | $ | 2,000,000 | ||||||||||

| (1) | Under SEC regulations, the incentive compensation amounts disclosed in the Summary compensation table on page 60 include the cash incentive award paid in 2019 for 2018 performance (the Non-Equity Incentive Plan Compensation column) and the long-term incentive award granted in 2018 for 2017 performance (the Stock Awards column). The amounts shown in the Stock Awards column of the Summary compensation table differ slightly from the amounts shown in the table above due to the impact of fractional shares, which are not included in the Stock Awards column as they are paid out in cash. |

PNC corporate governance (page 18)

| | The entire Board is elected each year; we have no staggered elections. |

| | The election of directors is subject to a majority voting requirement; any director who does not receive a majority of the votes cast in an uncontested election must tender his or her resignation to the Board. |

6 THE PNC FINANCIAL SERVICES GROUP, INC. - 2019 Proxy Statement

Table of Contents

PROXY STATEMENT SUMMARY

| | Our corporate governance guidelines require the Board to have a substantial majority (at least two-thirds) of independent directors. All but one of our current directors and all but one of the nominees to the Board are independent, with the only exception in each case being our CEO. |

| | The Board has a Presiding Director, a lead independent director with specific duties. |

| | The Presiding Director approves Board meeting agendas. |

| | The Board meets regularly in executive session, with no members of management present. |

| | We have four primary standing Board committees: |

| | Audit Committee |

| | Personnel and Compensation Committee |

| | Nominating and Governance Committee |

| | Risk Committee |

| | The Risk Committee has formed two subcommittees: |

| | Compliance Subcommittee |

| | Technology Subcommittee |

| | In 2018, the Board met ten times and each of our directors attended at least 75% of the aggregate number of meetings of the Board and the committees of the Board on which he or she served. The average attendance of all directors at Board and applicable committee meetings was over 98%. All of our directors then serving attended our 2018 annual meeting of shareholders. |

| | You can find additional information about our governance policies and principles at www.pnc.com/corporategovernance. |

Board nominees (page 11)

| Name | Age | Director since | Independent | Primary Standing Board Committee & Subcommittee Memberships |

||||

|

Joseph Alvarado

|

66

|

2019

|

☑

|

Audit; Compliance

|

||||

| Charles E. Bunch

|

69

|

2007

|

☑

|

Compensation (Chair); Governance

|

||||

|

Debra A. Cafaro

|

61

|

2017

|

☑

|

Audit; Compensation

|

||||

| Marjorie Rodgers Cheshire

|

50

|

2014

|

☑

|

Governance; Risk; Compliance (Chair)

|

||||

|

William S. Demchak

|

56

|

2013

|

☐

|

Risk

|

||||

| Andrew T. Feldstein

|

54

|

2013

|

☑

|

Compensation; Governance; Risk (Chair)

|

||||

|

Richard J. Harshman

|

62

|

2019

|

☑

|

Audit; Compensation

|

||||

| Daniel R. Hesse

|

65

|

2016

|

☑

|

Risk; Technology (Chair)

|

||||

|

Richard B. Kelson

|

72

|

2002

|

☑

|

Audit (Chair); Compensation; Compliance

|

||||

| Linda R. Medler

|

62

|

2018

|

☑

|

Risk; Technology

|

||||

|

Martin Pfinsgraff

|

64

|

2018

|

☑

|

Audit; Risk; Compliance; Technology

|

||||

| Toni Townes-Whitley

|

55

|

2019

|

☑

|

Technology

|

||||

|

Michael J. Ward

|

68

|

2016

|

☑

|

Compensation; Governance

|

||||

THE PNC FINANCIAL SERVICES GROUP, INC. - 2019 Proxy Statement 7

Table of Contents

| NOTICE OF ANNUAL MEETING OF SHAREHOLDERS | 10 | |||

| ELECTION OF DIRECTORS (ITEM 1) | 11 | |||

| CORPORATE GOVERNANCE | 18 | |||

| 18 | ||||

| 18 | ||||

| 19 | ||||

| 20 | ||||

| 20 | ||||

| 21 | ||||

| 21 | ||||

| 30 | ||||

| DIRECTOR AND EXECUTIVE OFFICER RELATIONSHIPS | 31 | |||

| 31 | ||||

| 33 | ||||

| 34 | ||||

| 34 | ||||

| 35 | ||||

| 35 | ||||

| RELATED PERSON TRANSACTIONS | 36 | |||

| 36 | ||||

| 36 | ||||

| SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE | 37 | |||

| DIRECTOR COMPENSATION | 37 | |||

| 38 | ||||

| COMPENSATION DISCUSSION AND ANALYSIS | 40 | |||

| 40 | ||||

| 40 | ||||

| 41 | ||||

| 42 | ||||

| 47 | ||||

| 52 | ||||

| COMPENSATION COMMITTEE REPORT | 57 | |||

| COMPENSATION AND RISK | 58 | |||

| 58 | ||||

| 59 | ||||

8 THE PNC FINANCIAL SERVICES GROUP, INC. - 2019 Proxy Statement

Table of Contents

THE PNC FINANCIAL SERVICES GROUP, INC. - 2019 Proxy Statement 9

Table of Contents

|

of Shareholders

|

Tuesday, April 23, 2019

11:00 a.m. (Eastern Time)

The Tower at PNC Plaza James E. Rohr Auditorium, 300 Fifth Avenue, Pittsburgh, Pennsylvania 15222

WEBCAST

A listen-only webcast of the annual meeting will be available at www.pnc.com/annualmeeting. An archive of the webcast will be available on our website for 30 days.

CONFERENCE CALL

You may access the listen-only conference call of the annual meeting by calling 877-402-9134 or 303-223-4385 (international). A telephone replay will be available for one week by calling 800-633-8284 or 402-977-9140 (international), conference ID 21915453.

ITEMS OF BUSINESS

| 1. | Election of the 13 director nominees named in the proxy statement to serve until the next annual meeting and until their successors are elected and qualified; |

| 2. | Ratification of the Audit Committees selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2019; |

| 3. | An advisory vote to approve the compensation of our named executive officers; and |

| 4. | Such other business as may properly come before the meeting. |

RECORD DATE

The close of business on February 1, 2019 is the record date for determining shareholders entitled to receive notice of and to vote at the annual meeting and any adjournment.

MATERIALS TO REVIEW

We began providing access to the proxy statement and a form of proxy card on March 12, 2019. We have made our proxy materials available electronically. Certain shareholders will receive a Notice of Internet Availability of Proxy Materials explaining how to access our proxy materials and vote. Other shareholders will receive a paper copy of the proxy statement and a proxy card.

PROXY VOTING

Even if you plan to attend the annual meeting in person, we encourage you to cast your vote over the Internet, or if you have a proxy card, by mailing the completed proxy card or by telephone. This Notice of Annual Meeting and Proxy Statement and our 2018 Annual Report are available at www.envisionreports.com/PNC.

ADMISSION

To be admitted to the annual meeting, you must present proof of your stock ownership as of the record date and valid photo identification. Each shareholder may bring one guest who must also present valid photo identification. Please follow the admission procedures described beginning on page 89 of the proxy statement.

| March 12, 2019 By Order of the Board of Directors, |

Alicia G. Powell

Corporate Secretary

10 THE PNC FINANCIAL SERVICES GROUP, INC. - 2019 Proxy Statement

Table of Contents

Table of Contents

ELECTION OF DIRECTORS (ITEM 1)

12 THE PNC FINANCIAL SERVICES GROUP, INC. - 2019 Proxy Statement

Table of Contents

ELECTION OF DIRECTORS (ITEM 1)

THE PNC FINANCIAL SERVICES GROUP, INC. - 2019 Proxy Statement 13

Table of Contents

ELECTION OF DIRECTORS (ITEM 1)

14 THE PNC FINANCIAL SERVICES GROUP, INC. - 2019 Proxy Statement

Table of Contents

ELECTION OF DIRECTORS (ITEM 1)

THE PNC FINANCIAL SERVICES GROUP, INC. - 2019 Proxy Statement 15

Table of Contents

ELECTION OF DIRECTORS (ITEM 1)

16 THE PNC FINANCIAL SERVICES GROUP, INC. - 2019 Proxy Statement

Table of Contents

ELECTION OF DIRECTORS (ITEM 1)

THE PNC FINANCIAL SERVICES GROUP, INC. - 2019 Proxy Statement 17

Table of Contents

Table of Contents

Table of Contents

Table of Contents

Table of Contents

CORPORATE GOVERNANCE

Audit Committee

|

Chair | Other members: | ||

|

Richard B. Kelson |

Joseph Alvarado |

|||

| Debra A. Cafaro | ||||

| Richard J. Harshman | ||||

| Martin Pfinsgraff | ||||

| Donald J. Shepard | ||||

The Audit Committee consists entirely of directors who are independent as defined in the NYSEs corporate governance rules and in SEC regulations related to audit committee members. When the Board meets on April 23, 2019 to organize its committees, only independent directors will be appointed to the Committee.

As Mr. Shepard has reached the mandatory retirement age established by the Board, he will not stand for re-election to the Board at the annual meeting, and following the annual meeting will no longer be a member of the Audit Committee.

The Board has determined that each Audit Committee member is financially literate and possesses accounting or related financial management expertise. The Board made these determinations in its business judgment, based on its interpretation of the NYSEs requirements for audit committee members. Acting on the recommendation of the Nominating and Governance Committee, the Board determined that Mr. Kelson is an audit committee financial expert, as that term is defined by the SEC.

The Audit Committee satisfies the requirements of SEC Rule 10A-3, which addresses the following topics:

| | The independence of committee members |

| | The responsibility for selecting and overseeing our independent auditors |

| | The establishment of procedures for handling complaints regarding our accounting practices |

| | The authority of the committee to engage advisors |

| | The determination of appropriate funding for payment of the independent auditors and any outside advisors engaged by the committee and for the payment of the committees ordinary administrative expenses |

The Board most recently approved the charter of the Audit Committee on November 15, 2018, and it is available on our website at www.pnc.com/corporategovernance.

The Audit Committees primary purposes are to assist the Board by:

| | Monitoring the integrity of our consolidated financial statements |

| | Monitoring the effectiveness of our internal control over financial reporting |

| | Monitoring compliance with our Code of Business Conduct and Ethics |

| | Monitoring compliance with certain legal and regulatory requirements |

| | Evaluating and monitoring the qualifications and independence of our independent auditors |

| | Evaluating and monitoring the performance of our internal audit function and our independent auditors |

At each in-person meeting of the full Board, the Chair of the Audit Committee presents a report of the items discussed and actions approved at previous meetings of the Committee.

The Audit Committees responsibility is one of oversight. Management is responsible for preparing our consolidated financial statements, for maintaining internal controls, and for our compliance with laws and regulations, and the independent auditors are responsible for auditing our consolidated financial statements. The Audit Committee typically approves the internal and external audit plans, and reviews and discusses audit reports and results with representatives of our internal audit function and our independent auditors.

The Audit Committee has the authority to retain independent legal, accounting, economic or other advisors. The Committee is directly responsible for the selection, appointment, compensation and oversight of our independent auditors (including the resolution of any disagreements that may arise between management and the auditors regarding financial reporting) for the purpose of preparing or issuing an audit report or related work. The independent auditors report directly to the Committee. We describe the role of the Committee as it relates to the independent auditors, including consideration of the rotation of the independent audit firm, in more detail on page 84.

22 THE PNC FINANCIAL SERVICES GROUP, INC. - 2019 Proxy Statement

Table of Contents

CORPORATE GOVERNANCE

With respect to work performed by the independent auditors, the Audit Committee must approve all audit engagement fees and terms, as well as all permitted non-audit engagements. The Committee (or its delegate) pre-approves all audit services, audit-related services and permitted non-audit services to be performed by the independent auditors. The Committee also considers whether the provision of any audit services, audit-related services or permitted non-audit services will impair the auditors independence. We describe the Committees procedures for the pre-approval of audit services, audit-related services and permitted non-audit services on page 85.

The Audit Committee receives periodic reports on finance, reserve adequacy, ethics, and internal and external audit.

The Audit Committee also appoints our General Auditor, who leads our internal audit function and reports directly to the Committee. The Committee holds regular executive sessions with management, the General Auditor, the Chief Ethics Officer and the independent auditors. The Committee reviews the performance and approves the compensation of the General Auditor, and annually reviews the General Auditor succession plan with the CEO and the Board.

Under our corporate governance guidelines, Audit Committee members may serve on the audit committees of no more than three public companies at the same time, including PNC.

The Audit Committee has approved the report on page 86 as required under its charter and in accordance with SEC regulations.

THE PNC FINANCIAL SERVICES GROUP, INC. - 2019 Proxy Statement 23

Table of Contents

CORPORATE GOVERNANCE

Nominating and Governance Committee

|

Chair

Donald J. Shepard |

Other members:

Charles E. Bunch Marjorie Rodgers Cheshire Andrew T. Feldstein

Michael J. Ward |

The Nominating and Governance Committee consists entirely of independent directors. When the Board meets on April 23, 2019 to organize its committees, only independent directors will be appointed to the Nominating and Governance Committee.

As Mr. Shepard has reached the mandatory retirement age established by the Board, he will not stand for re-election to the Board at the annual meeting, and following the annual meeting will no longer be a member of the Nominating and Governance Committee. The new Chair of the Committee will be selected when the Board meets on April 23, 2019 to organize its committees.

The Board most recently approved the charter of the Nominating and Governance Committee on November 15, 2018, and it is available on our website at www.pnc.com/corporategovernance.

At each in-person meeting of the full Board, the Chair of the Nominating and Governance Committee presents a report of the items discussed and actions approved at previous meetings of the Committee. The primary purpose of the Nominating and Governance Committee is to assist the Board in promoting the best interests of PNC and its shareholders through the implementation of sound corporate governance principles and practices. The Committee also assists the Board by identifying individuals qualified to become Board members. The Committee recommends to the Board the director nominees for each annual meeting of shareholders, and may also recommend the appointment of qualified individuals as directors between annual meetings.

In addition to conducting its annual committee self-evaluation, the Nominating and Governance Committee oversees the annual evaluation of the performance of the Board and other Board committees and reports to the Board on the evaluation results as necessary or appropriate. The Committee also annually reviews and recommends any changes to the Executive Committee charter.

How we evaluate directors and director candidates. At least annually, the Nominating and Governance Committee assesses the skills, qualifications and experience of our directors and recommends a slate of director nominees to the Board. In evaluating existing directors and new director candidates, the Committee assesses the needs of the Board and the qualifications of the individual. From time to time, the Committee also considers whether to change the composition of the Board. See the discussion on pages 12 to 17 for additional information regarding each of our current director nominees.

The Board and its committees must satisfy SEC, NYSE and banking regulatory standards. At least a majority of our directors must be independent under NYSE standards. Our corporate governance guidelines impose a more rigorous standard and require that a substantial majority (at least two-thirds) of our directors be independent. We require a sufficient number of independent directors to satisfy the membership needs of Board committees that also require independence.

The Nominating and Governance Committee expects directors to gain a sound understanding of our strategic vision, our mix of businesses and our approach to regulatory relations and risk management. The Board must possess a mix of qualities and skills adequate to address the various risks facing PNC. For a discussion of the Boards oversight of risk, see Corporate GovernanceBoard committeesRisk Committee on page 29.

When evaluating each director, as well as new director candidates for nomination, the Committee considers the following criteria set forth in our Corporate Governance Guidelines:

| | A sustained record of high achievement in financial services, business, industry, government, academia, the professions, or civic, charitable or non-profit organizations |

| | Manifest competence and integrity |

| | A strong commitment to the ethical and diligent pursuit of shareholders best interests |

| | The strength of character necessary to challenge managements recommendations and actions when appropriate and to confirm the adequacy and completeness of managements responses to such challenges to his or her satisfaction |

24 THE PNC FINANCIAL SERVICES GROUP, INC. - 2019 Proxy Statement

Table of Contents

CORPORATE GOVERNANCE

| | The Boards strong desire to maintain its diversity in terms of race and gender |

| | Personal qualities that will help to sustain an atmosphere of mutual respect and collegiality among the members of the Board |

The Nominating and Governance Committee also considers the diversity of perspective, experience, knowledge, education, age and skills of each director, as well as the current needs of the Board and its committees, meeting attendance and participation, and the value of a directors contribution to the effectiveness of the Board and its committees.

Although the Board has not adopted a formal policy on diversity, the Board recognizes the value of a diverse Board. Therefore, the Nominating and Governance Committee considers the diversity of directors in the context of the Boards overall needs. The Committee evaluates diversity in a broad sense, recognizing the benefits of demographic and cognitive diversity, and the breadth of diverse backgrounds, skills and experiences the directors bring to the Board.

How we identify new directors. The Nominating and Governance Committee utilizes as a discussion tool a matrix of certain skills and experiences the Committee believes would be beneficial to have represented on the Board and its committees. The Committee considers PNCs strategy and industry trends in developing a view of those skills and characteristics that would benefit the Board. The Committee is also focused on what skills are required or beneficial for those serving in key Board positions such as committee chairs, and considers succession planning for those positions. The Committee leverages the matrix, and considers the Board-approved evaluation criteria and various regulatory requirements described above, when identifying potential director candidates, which it does in a number of ways. The Committee may consider recommendations made by our current or former directors or members of executive management. The Committee may also identify potential directors through contacts in the business, civic, academic, legal and non-profit communities. When appropriate, the Committee may retain a search firm to identify candidates. In 2018, the Committee retained a third party search firm to further develop the pool of director candidates, and emphasized to the search firm the importance of diversity in its consideration of director candidates.

In addition, the Nominating and Governance Committee will consider director candidates recommended by our shareholders for nomination at the next years annual meeting of shareholders. For the Committee to consider a director candidate recommended by a shareholder, the shareholder must submit the recommendation in writing to the Corporate Secretary at our principal executive offices. The submission must include the information described under Director Nomination Process in Section 3 of our corporate governance guidelines, which can be found at www.pnc.com/corporategovernance. To be considered for the 2020 annual meeting of shareholders, the submission must be received by November 13, 2019.

The Nominating and Governance Committee will evaluate director candidates recommended by a shareholder in the same manner as candidates identified by the Committee or recommended by others. The Committee will not consider any candidate with an obvious impediment to serving as one of our directors.

The Nominating and Governance Committee will meet to review and discuss relevant available information regarding a director candidate, considering the Board-approved evaluation criteria, the candidates contribution to the diversity of the Board and PNCs evolving strategic needs. If the Committee decides not to recommend a candidate for nomination or appointment, or for additional evaluation, no further action is taken. The Chair of the Committee will later report that decision to the full Board, and in the case of a shareholder-recommended candidate, the Corporate Secretary will communicate the decision to the shareholder.

If the Nominating and Governance Committee decides to recommend a director candidate to the Board as a nominee for election at an annual meeting of shareholders or for appointment by the Board, the Chair of the Committee will report that decision to the full Board. Following a discussion regarding the recommendation, the full Board will vote on whether to nominate the candidate for election or appoint the candidate to the Board, as applicable. Invitations to join the Board are extended by the Chairman of the Board and the Presiding Director, jointly acting on behalf of the Board.

Shareholders who wish to nominate a director candidate directly at an annual meeting of shareholders or nominate and include a director candidate in our annual meeting proxy materials must do so in accordance with the procedures contained in our By-laws, as described in Shareholder Proposals for the 2020 Annual Meeting on page 94 under the headings Advance notice procedures and Proxy access procedures, respectively.

THE PNC FINANCIAL SERVICES GROUP, INC. - 2019 Proxy Statement 25

Table of Contents

CORPORATE GOVERNANCE

Personnel and Compensation Committee

|

Chair

Charles E. Bunch |

Other members:

Debra A. Cafaro Andrew T. Feldstein Richard J. Harshman Richard B. Kelson

Michael J. Ward |

The Personnel and Compensation Committee consists entirely of independent directors. The Committee membership is intended to satisfy the independence standards established by applicable federal income tax and securities laws, as well as NYSE standards. When the Board meets on April 23, 2019 to organize its committees, only independent directors will be appointed to the Committee.

The Board most recently approved the charter of the Personnel and Compensation Committee on November 15, 2018, and it is available on our website at www.pnc.com/corporategovernance.

The Personnel and Compensation Committees principal purpose is to discharge the Boards oversight responsibilities relating to the compensation of our executive officers and other specified responsibilities related to personnel and compensation matters affecting PNC. The Committee may also evaluate and approve, or recommend for approval, benefit, incentive compensation, severance, equity-based or other compensation plans, policies and programs.

The Personnel and Compensation Committee has the authority to retain independent legal, compensation, accounting or other advisors. The charter provides the Committee with the sole authority to retain and terminate an independent compensation consultant acting on the Committees behalf, and to approve the consultants fees and other retention terms. The Committee retained an independent compensation consultant in 2018 and prior years. See Role of compensation consultants below.

The Personnel and Compensation Committee reviews with management the Compensation Discussion and Analysis section of the proxy statement, which begins on page 40. The Compensation Committee Report is included on page 57. The Committee also evaluates the relationship between risk management and our incentive compensation programs and plans. See Compensation and Risk beginning on page 58.

The Personnel and Compensation Committee has responsibility for periodically reviewing our workforce diversity initiatives and for reviewing and evaluating our executive management succession plan (except for the review and evaluation of the General Auditor and Chief Risk Officer succession plans, which is performed by the Audit Committee and the Risk Committee, respectively). The executive management succession plan, including for the CEO, is reviewed with the full Board from time to time. The Committee reviews a detailed succession planning report at least annually. The materials in the report typically include a discussion of the individual performance of each executive officer, as well as succession plans and development initiatives for other emerging talent. These materials provide necessary background and context to the Committee, and give each Committee member a familiarity with the employees position, duties, responsibilities and performance.

How we make decisions. The Personnel and Compensation Committee meets at least four times a year. Before each meeting, the Chair of the Committee reviews the agenda, materials and issues with members of management and the Committees independent compensation consultant, as appropriate. The Committee may invite legal counsel or other external consultants to advise the Committee during meetings and preparatory sessions.

The Personnel and Compensation Committee regularly meets in executive sessions without management present. At each in-person meeting of the full Board, during an executive session of the Board, the Chair of the Committee presents a report of the items discussed and actions approved at previous meetings of the Committee. The Committee consults with independent directors before approving the CEOs compensation.

The Personnel and Compensation Committee has adopted guidelines for information that will be presented to the Committee. The guidelines contemplate, among other things, that any material change to a compensation program, plan or arrangement will be considered over the course of at least two separate meetings of the Committee, with any vote occurring no earlier than the second meeting.

The Personnel and Compensation Committee reviews all of the elements of our compensation programs periodically and adjusts those programs as appropriate. Each year, the Committee makes decisions regarding the amount of annual compensation and equity-based or other longer-term compensation for our executive officers and other designated senior employees. For the most part, these decisions are made in the first quarter of each year, following an evaluation of the prior years performance.

26 THE PNC FINANCIAL SERVICES GROUP, INC. - 2019 Proxy Statement

Table of Contents

CORPORATE GOVERNANCE

Delegations of authority. The Personnel and Compensation Committee has delegated authority to management to make certain decisions or take certain actions with respect to compensation or benefit plans or arrangements, other than those that are solely or predominantly for the benefit of executive officers. For employee benefit, bonus, incentive compensation, severance, equity-based and other compensation or incentive plans and arrangements, the Committee has delegated to our Chief Human Resources Officer (or her designee) the ability to adopt a new plan or arrangement or amend an existing one if:

| | the adoption or amendment is not expected to result in a significant increase in incremental expense to PNC (defined as an incremental annual expense that exceeds $50 million for that plan category), the plan is broadly available to employees and the new plan or amendment would not confer a disproportionate benefit upon executives; or |

| | the new plan or amendment is of a technical or administrative nature, is required by a change in applicable law, is not otherwise material or, with respect to employee benefit plans, will not result in a significant impact on PNCs overall employee benefits program. |

This delegation also includes the authority to take certain actions to implement, administer, interpret or construe, or make eligibility determinations under the plans and arrangements, including the ability to appoint a plan manager, administrator or committee and to adopt policies and procedures with respect to the plan, except with respect to plans that are overseen by the PNC administrative committee under its charter.

For grants of equity or equity-based awards, the Personnel and Compensation Committee has delegated to the CEO and the Chief Human Resources Officer (or the designee of either) the responsibility to make decisions with respect to equity grants for individuals who are not designated by the Committee as executives, including the determination of participants and grant sizes, allocation of the pool from which grants will be made, establishment and documentation of the terms and conditions of such grants, approval of amendments to outstanding grants (subject to any limitations set forth in the applicable plan or the Committees delegation of authority) and exercise of any discretionary authority provided to PNC or the Committee pursuant to the terms of the grants and the applicable plan.

The Audit Committee and the Risk Committee (or, in the case of equity-based grants, a qualified subcommittee of the Risk Committee) have the authority to award compensation under applicable plans to our General Auditor and our Chief Risk Officer, respectively.

Managements role in compensation decisions. Our executive officers, including the CEO and the Chief Human Resources Officer, often review compensation information with the Personnel and Compensation Committee during Committee meetings and may present managements views or recommendations. The Committee evaluates these recommendations, generally in consultation with an independent compensation consultant retained by the Committee who attends each meeting.

The Chair of the Personnel and Compensation Committee typically meets with management and an independent compensation consultant before each meeting of the Committee to discuss agenda topics, areas of focus or outstanding issues. The Chair of the Committee schedules other meetings with the Committees independent compensation consultant without management present as needed. Occasionally, management will schedule meetings with the Chair of the Committee or other Committee members to discuss substantive issues. For more complicated issues, these one-on-one meetings provide a dedicated forum for Committee members to ask questions outside of the meeting environment.

During Personnel and Compensation Committee meetings, the CEO often reviews corporate and individual performance as part of the compensation discussions, and other members of executive management may be invited to speak to the Committee about specific elements of performance or risk management. Our Chief Risk Officer regularly presents to the Committee regarding risk management, including its impact on the Committees discussions and decisions regarding executive compensation. The Committee reviews compensation decisions for the Chief Human Resources Officer and the CEO in executive session, without either officer present for the discussion of their compensation. Any recommendations for CEO compensation are also discussed with the full Board, with no members of management present for the discussion.

Role of compensation consultants. The Personnel and Compensation Committee has the sole authority to retain and terminate any compensation consultant directly assisting it. The Committee also has the sole authority to approve fees and other engagement terms. The Committee receives comparative compensation data from management, from proxy statements and other public disclosures, and through surveys and reports prepared by compensation consultants.

The Personnel and Compensation Committee retained Meridian Compensation Partners, LLC (Meridian) as its independent compensation consultant for 2018. In this capacity, Meridian reported directly to the Committee. In 2018, one or more representatives of Meridian attended all of the in-person and telephonic meetings of the Committee, and met regularly with the Committee without members of management present. Meridian also reviewed meeting agendas and materials prepared by management.

THE PNC FINANCIAL SERVICES GROUP, INC. - 2019 Proxy Statement 27

Table of Contents

CORPORATE GOVERNANCE

Meridian and members of management assisted the Personnel and Compensation Committee in its review of proposed compensation packages for our executive officers. For the 2018 performance year, Meridian prepared discussion materials for the compensation of the CEO, which were reviewed in executive session. Meridian also prepared other benchmarking reviews and pay for performance analyses for the Committee. PNC paid no fees to Meridian in 2018 other than fees paid in connection with work performed by Meridian for the Committee.

The Personnel and Compensation Committee evaluated whether the work of Meridian raised any conflicts of interest. The Committee considered various factors, including the six factors mandated by SEC rules, and determined that no conflict of interest was raised by the work performed by Meridian for the Committee.

Management retains other compensation consultants for its own use. In 2018, management retained McLagan to provide certain market data in the financial services industry. Management also engages Willis Towers Watson, a global professional services firm, to provide various actuarial and management consulting services from time to time, including:

| | Preparing specific actuarial calculations on values under our retirement plans |

| | Preparing surveys of competitive pay practices |

| | Analyzing our director compensation packages and providing related reports to management and the Nominating and Governance Committee |

| | Providing insurance brokerage and consulting services to mitigate certain property and casualty risks |

| | Providing guidance on certain aspects of total rewards, talent management and other human resources initiatives |

Reports prepared by Willis Towers Watson and McLagan that relate to executive compensation may also be shared with the Personnel and Compensation Committee.

Compensation committee interlocks and insider participation. During 2018, the members of the Personnel and Compensation Committee included Charles E. Bunch, Debra A. Cafaro, Andrew T. Feldstein, Richard B. Kelson, Dennis F. Strigl and Michael J. Ward. None of these directors were officers or employees of PNC during 2018, nor are they former officers of PNC or any of our subsidiaries. During 2018, no executive officer of PNC served on the board of directors or compensation committee (or other board committee performing equivalent functions) of an entity that had an executive officer who served on the Board or the Personnel and Compensation Committee.

Certain members of the Personnel and Compensation Committee, their immediate family members or entities with which they are affiliated were our customers or had transactions with us (or our subsidiaries) during 2018. Transactions that involved loans or commitments by subsidiary banks were made in the ordinary course of business on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with other persons and did not involve more than the normal risk of collectability or present other unfavorable features, and otherwise complied with regulatory restrictions applicable to such transactions.

For additional information, see Director and Executive Officer RelationshipsRegulation O policies and procedures beginning on page 34.

28 THE PNC FINANCIAL SERVICES GROUP, INC. - 2019 Proxy Statement

Table of Contents

CORPORATE GOVERNANCE

Risk Committee

|

Chair | Other members: | ||||

| Andrew T. Feldstein | Marjorie Rodgers Cheshire | |||||

| William S. Demchak | ||||||

| Daniel R. Hesse | ||||||

| Linda R. Medler | ||||||

| Martin Pfinsgraff | ||||||

| Donald J. Shepard |

The Board performs its risk oversight function primarily through the Risk Committee, which includes both independent and management directors.

As Mr. Shepard has reached the mandatory retirement age established by the Board, he will not stand for re-election to the Board at the annual meeting, and following the annual meeting will no longer be a member of the Risk Committee.

The Board most recently approved the charter of the Risk Committee on November 15, 2018, and it is available on our website at www.pnc.com/corporategovernance.

The Risk Committees purpose is to require and oversee the establishment and implementation of our enterprise-wide risk governance framework, including related policies, procedures, activities and processes to identify, measure, monitor and manage material risks at PNC, consisting primarily of credit, market, liquidity, compliance, operational, business, strategic, model, conduct and reputational risks. Accounting and financial reporting risk exposures and related reputational risks are the responsibility of the Audit Committee. The Risk Committees responsibility is one of oversight, and the Committee has no duty to assure compliance with laws and regulations.

The Risk Committee serves as the primary point of contact between the Board and the management-level committees dealing with risk management. The Committee receives regular reports on enterprise-wide risk management and capital and liquidity management, as well as credit, operational, line of business, model and reputational risks. At each in-person meeting of the full Board, the Chair of the Risk Committee presents a report of the items discussed and actions approved at previous meetings of the Committee.

The Risk Committee also appoints our Chief Risk Officer, who leads our risk management function. The Committee reviews the performance and approves the compensation of the Chief Risk Officer, except with respect to his equity-based grants, which are approved by a qualified subcommittee of the Risk Committee. The Committee reviews the Chief Risk Officer succession plan with the CEO annually and with the Board from time to time.

The Risk Committee, along with the Personnel and Compensation Committee, reviews the risk components of our incentive compensation plans. For a discussion of the relationship between compensation and risk, see Compensation and Risk beginning on page 58.

Subcommittees. The Risk Committee may form subcommittees as appropriate from time to time.

The Risk Committee has formed a Technology Subcommittee to assist in fulfilling the Committees oversight responsibilities with respect to technology risk, technology risk management, cybersecurity, information security, business continuity and significant technology initiatives and programs. The members of the Technology Subcommittee are:

| Chair

|

Other members:

|

|||||

| Daniel R. Hesse | Linda R. Medler | |||||

| Martin Pfinsgraff | ||||||

| Toni Townes-Whitley |

The Risk Committee has also formed a Compliance Subcommittee to assist in fulfilling the Committees oversight responsibilities with respect to compliance risk, significant compliance-related initiatives and programs, and the maintenance of a strong compliance risk management culture. The members of the Compliance Subcommittee are:

| Chair

|

Other members:

|

|||||

| Marjorie Rodgers Cheshire | Joseph Alvarado | |||||

| Richard B. Kelson | ||||||

| Martin Pfinsgraff |

THE PNC FINANCIAL SERVICES GROUP, INC. - 2019 Proxy Statement 29

Table of Contents

CORPORATE GOVERNANCE

|

|

|

|

|

|

|

|

|

|

|

|

Meetings |

|

|||||||||||||

| (2) | (1) | (3) | ||||||||||||||||||||||||

| Audit |

l |

|

l | l | 12 | |||||||||||||||||||||

| Nominating and Governance |

l | l | l |

|

l | 7 | ||||||||||||||||||||

| Personnel and Compensation |

|

l | l | l | l | 6 | ||||||||||||||||||||

| Risk |

l | l |

|

l | l | l | l | 9 | ||||||||||||||||||

|

Chair |

| (1) | Designated as an audit committee financial expert under SEC regulations |

| (2) | Management director |

| (3) | Presiding Director (lead independent director) |

30 THE PNC FINANCIAL SERVICES GROUP, INC. - 2019 Proxy Statement

Table of Contents

Table of Contents

DIRECTOR AND EXECUTIVE OFFICER RELATIONSHIPS

32 THE PNC FINANCIAL SERVICES GROUP, INC. - 2019 Proxy Statement

Table of Contents

DIRECTOR AND EXECUTIVE OFFICER RELATIONSHIPS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Personal or Family Relationships | Deposit, Wealth Management and Similar Banking Products(1) |

l | l | l | l | l | l | l | l | l | l | l | l | |||||||||||||||||

| Credit Relationships(2) | l | l | l | l | l | l | l | l | l | l | l | l | ||||||||||||||||||

| Charitable Contributions(3) | l | l | l | l | l | l | l | l | l | l | l | |||||||||||||||||||

| Affiliated Entity Relationships | Deposit, Wealth Management and Similar Banking Products(1) |

l | l | l | l | l | l | |||||||||||||||||||||||

| Credit Relationships or Commercial Banking Products(4) |

l | l | l | l | l |

| (1) | Includes deposit accounts, trust accounts, certificates of deposit, safe deposit boxes, workplace banking and wealth management products. |

| (2) | Includes extensions of credit, including mortgages, commercial loans, home equity loans, credit cards and similar products, as well as credit and credit-related products. |

| (3) | Does not include matching gifts provided to charities personally supported by the director, because under the Boards director independence guidelines, matching gifts are not a material relationship and are not included in considering the value of contributions against our guidelines. Matching gifts are capped at $5,000 for non-employee directors and are included in the All Other Compensation column in the Director compensation in 2018 table. |

| (4) | Includes extensions of credit, including commercial loans, credit cards and similar products, as well as credit-related products, and other commercial banking products, including treasury management, purchasing card programs, foreign exchange and global trading services. |

THE PNC FINANCIAL SERVICES GROUP, INC. - 2019 Proxy Statement 33

Table of Contents

Table of Contents

Table of Contents

Table of Contents

RELATED PERSON TRANSACTIONS

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

The following table describes the components of director compensation in 2018:

|

Annual Retainer

|

||||

|

Each director

|

$

|

90,000

|

|

|

|

Additional retainer for Presiding Director

|

$

|

30,000

|

|

|

|

Additional retainer for Chairs of Audit, Nominating and Governance, Personnel and Compensation, and Risk Committees

|

$

|

25,000

|

|

|

|

Additional retainer for Chairs of Compliance Subcommittee and Technology Subcommittee

|

$

|

25,000

|

|

|

|

Meeting Fees (Committee/Subcommittee)

|

||||

|

First six meetings

|

$

|

1,500

|

|

|

|

All other meetings

|

$

|

2,000

|

|

|

|

Equity-Based Grants

|

||||

|

Value of 999 deferred stock units awarded as of April 24, 2018

|

$

|

144,865

|

|

THE PNC FINANCIAL SERVICES GROUP, INC. - 2019 Proxy Statement 37

Table of Contents

DIRECTOR COMPENSATION

For fiscal year 2018, we provided the following compensation to our non-employee directors:

| Director Name | Fees Earned(a) | Stock Awards(b) | All Other Compensation(c) |

Total | ||||||||||||

|

Charles E. Bunch

|

|

$135,000

|

|

|

$144,865

|

|

|

$ 70,447

|

|

|

$350,312

|

|

||||

|

Debra A. Cafaro

|

|

$115,500

|

|

|

$144,865

|

|

|

$ 2,579

|

|

|

$262,944

|

|

||||

|

Marjorie Rodgers Cheshire

|

|

$155,000

|

|

|

$144,865

|

|

|

$ 22,342

|

|

|

$322,207

|

|

||||

|

Andrew T. Feldstein

|

|

$149,500

|

|

|

$144,865

|

|

|

$ 44,535

|

|

|

$338,900

|

|

||||

|

Daniel R. Hesse

|

|

$136,000

|

|

|

$144,865

|

|

|

$ 15,745

|

|

|

$296,610

|

|

||||

|

Kay Coles James*

|

|

$ 25,500

|

|

|

$

|

|

|

$ 18,812

|

|

|

$ 44,312

|

|

||||

|

Richard B. Kelson

|

|

$158,000

|

|

|

$144,865

|

|

|

$ 95,794

|

|

|

$398,659

|

|

||||

|

Linda R. Medler

|

|

$111,000

|

|

|

$144,865

|

|

|

$ 5,359

|

|

|

$261,224

|

|

||||

|

Jane G. Pepper**

|

|

$ 36,000

|

|

|

$

|

|

|

$ 84,012

|

|

|

$120,012

|

|

||||

|

Martin Pfinsgraff

|

|

$135,000

|

|

|

$144,865

|

|

|

$ 5,000

|

|

|

$284,865

|

|

||||

|

Donald J. Shepard

|

|

$192,000

|

|

|

$144,865

|

|

|

$137,250

|

|

|

$474,115

|

|

||||

|

Lorene K. Steffes**

|

|

$ 34,500

|

|

|

$

|

|

|

$ 93,018

|

|

|

$127,518

|

|

||||

|

Dennis F. Strigl**

|

|

$ 37,500

|

|

|

$

|

|

|

$128,323

|

|

|

$165,823

|

|

||||

|

Michael J. Ward

|

|

$106,500

|

|

|

$144,865

|

|

|

$ 13,687

|

|

|

$265,052

|

|

||||

|

Gregory D. Wasson***

|

|

$109,500

|

|

|

$144,865

|

|

|

$ 17,068

|

|

|

$271,433

|

|

||||

| * | Ms. James resigned from the Board effective February 15, 2018. |

| ** | Ms. Pepper, Ms. Steffes and Mr. Strigl served as directors through April 24, 2018. |

| *** | Mr. Wasson resigned from the Board effective October 1, 2018. |

| (a) | This column includes the annual retainer, additional retainers for the Presiding Director and the chairs of standing committees and subcommittees, and meeting fees earned for 2018. The amounts in this column also include the fees voluntarily deferred by certain directors under our Directors Deferred Compensation Plan, a non-qualified defined contribution plan, as follows: Debra A. Cafaro ($115,500); Marjorie Rodgers Cheshire ($62,000); Andrew T. Feldstein ($149,500); Daniel R. Hesse ($136,000); Linda R. Medler ($27,000); Jane G. Pepper ($36,000); Donald J. Shepard ($192,000); Lorene K. Steffes ($10,350); Michael J. Ward ($106,500); and Gregory D. Wasson ($109,500). |

38 THE PNC FINANCIAL SERVICES GROUP, INC. - 2019 Proxy Statement

Table of Contents

DIRECTOR COMPENSATION

| (b) | The amounts in this column reflect the grant date fair value under Financial Accounting Standards Board Accounting Standards Codification Topic 718, CompensationStock Compensation (FASB ASC Topic 718) of 999 deferred stock units awarded to each director under our Outside Directors Deferred Stock Unit Program as of April 24, 2018, the date of grant. The grant date fair value is calculated based on the NYSE closing price of our common stock on the date of grant of $145.01 per share. |

| As of December 31, 2018, the non-employee directors listed in the table below had outstanding stock units in the following amounts: |

| Director Name |

Cash-Payable Stock Units |

Stock-Payable Stock Units |

||||||

|

Charles E. Bunch

|

|

20,292

|

|

|

2,247

|

|

||

|

Debra A. Cafaro

|

|

1,064

|

|

|

1,012

|

|

||

|

Marjorie Rodgers Cheshire

|

|

5,256

|

|

|

2,247

|

|

||

|

Andrew T. Feldstein

|

|

12,189

|

|

|

2,247

|

|

||

|

Daniel R. Hesse

|

|

2,591

|

|

|

2,247

|

|

||

|

Richard B. Kelson

|

|

17,659

|

|

|

2,247

|

|

||

|

Linda R. Medler

|

|

184

|

|

|

1,012

|

|

||

|

Martin Pfinsgraff

|

|

|

|

|

1,012

|

|

||

|

Donald J. Shepard

|

|

41,483

|

|

|

2,247

|

|

||

|

Michael J. Ward

|

|

4,355

|

|

|

2,247

|

|

||

| None of our non-employee directors had any outstanding stock options or unvested stock awards as of December 31, 2018. |

| (c) | This column includes income under the Directors Deferred Compensation Plan and the Outside Directors Deferred Stock Unit Plan as follows: Charles E. Bunch ($67,947); Debra A. Cafaro ($2,579); Marjorie Rodgers Cheshire ($17,342); Andrew T. Feldstein ($39,535); Daniel R. Hesse ($13,245); Kay Coles James ($18,812); Richard B. Kelson ($90,794); Linda R. Medler ($359); Jane G. Pepper ($79,012); Donald J. Shepard ($137,250); Lorene K. Steffes ($87,218); Dennis F. Strigl ($128,323); Michael J. Ward ($13,687); and Gregory D. Wasson ($17,068). This column also includes the dollar amount of matching gifts made by us in 2018 to charitable organizations. For one director, the matching gift amount included above exceeds $5,000 because certain of the directors donations from prior years were matched in 2018. No non-employee director received any incidental benefits in 2018, and there were no incremental costs to PNC for personal use of our corporate aircraft by any non-employee director in 2018. |

THE PNC FINANCIAL SERVICES GROUP, INC. - 2019 Proxy Statement 39

Table of Contents

COMPENSATION DISCUSSION AND ANALYSIS

This Compensation Discussion and Analysis (CD&A) explains our executive compensation philosophy, describes our compensation programs and reviews our compensation decisions for the following named executive officers (NEOs):

| Name of NEO

|

Title

|

|

|

William S. Demchak

|

Chairman, President and Chief Executive Officer

|

|

| Robert Q. Reilly

|

Executive Vice President and Chief Financial Officer

|

|

| Michael P. Lyons

|

Executive Vice President, Head of Corporate & Institutional Banking and Asset Management Group

|

|

| E William Parsley, III

|

Executive Vice President and Chief Operating Officer

|

|

| Joseph E. Rockey

|

Executive Vice President and Chief Risk Officer

|

|

|

PNC had a successful year in 2018, with net income of $5.3 billion, or $10.71 per diluted common share. Our return on average assets was 1.41% and our return on average common equity was 11.83%. At December 31, 2018, our tangible book value was $75.42 per common share. | |

|

|

We grew loans and deposits, and generated record total revenue, net interest income and fee income. | |

|

|

We generated positive operating leverage in 2018 by growing revenue and reducing noninterest expense, and we achieved our $250 million continuous improvement program savings goal for the year. | |

|

|

We returned $4.4 billion of capital to our shareholders through share repurchases of $2.8 billion and common stock dividends of $1.6 billion, including raising the quarterly common stock dividend to $0.95 per share, an increase of 27%. | |

|

|

Although our stock price at December 31, 2018 decreased from year-end 2017, we compared favorably to our peers with a total shareholder return that was above the peer median for 2018, slightly below the top quartile of peers over the past three years, and in the top quartile of peers during the five-year period ended December 31, 2018. | |

|

|

We successfully expanded our corporate banking business into new markets (Denver, Houston and Nashville). | |

|

|

We launched our national retail digital strategy in markets outside of our existing retail branch network. | |

|

|

We continued to focus on the strategies of transforming the customer experience in our Retail Banking segment and enhancing product and service offerings within our Corporate & Institutional Banking (C&IB) segment. | |

|

|

We made additional significant progress in leveraging technology to innovate and enhance our products, services, security and processes. | |

|

|

We significantly strengthened the companys risk management framework. | |

On pages 47 to 52, we discuss in more detail how our 2018 performance affected our compensation decisions.

| COMPENSATION PRINCIPLES

|

|||||||||

| Pay for performance Provide appropriate

|

Create value Align executive

|

Manage talent Provide competitive compensation opportunities to attract, retain and motivate high-quality executives

|

Discourage excessive risk-taking Encourage focus on the long-term success of PNC and discourage excessive risk-taking

|

||||||

40 THE PNC FINANCIAL SERVICES GROUP, INC. - 2019 Proxy Statement

Table of Contents

COMPENSATION DISCUSSION AND ANALYSIS

| WHAT WE DO | WHAT WE DONT DO | |||||

|

|

We pay for performance. We link most of our executive pay to performance, including financial and operating performance measures, qualitative measures and risk-based metrics. |

û |

We do not allow tax gross-ups. We do not provide excise tax gross-ups in our current change of control agreements and we have eliminated these gross-ups from all existing change of control agreements. We do not offer tax gross-ups on the primary perquisites that we offer. | |||

|

|

We discourage excessive risk-taking. Our program discourages executives from taking inappropriate, excessive risks in several ways including by relying on multiple performance metrics, deferring payouts over a long period, establishing clawback and forfeiture provisions, and requiring meaningful stock ownership. |

û |

We will not enter into substantial severance arrangements without shareholder approval. If a severance arrangement would pay more than 2.99 times base and bonus (in the year of termination), it requires shareholder approval. | |||

|

|

We require executives to hold PNC stock. Our executives must hold a substantial amount of stock, and this amount continues to increase as their equity awards vest. |

û |

We do not grant equity that accelerates upon a change in control (no single trigger). We require a double trigger for equity to vest upon a change in control not only must the change in control occur, but the executive must be terminated. | |||

|

|

We have a clawback and forfeiture policy. Our policy requires us to claw back prior incentive compensation that we awarded based on materially inaccurate performance metrics. Our policy gives us broad discretion to cancel unvested equity awards due to risk-related issues or detrimental conduct. |

û |

We do not reprice stock options. Although we currently do not grant stock options, our equity plan does not permit us to reprice stock options that are out-of-the-money, unless approved by shareholders. | |||

|

|

We limit the perquisites we provide. We limit the primary perquisites we offer to our executives to three: financial planning and tax preparation services; executive physicals (for two NEOs); and occasional personal use of corporate aircraft, subject to an annual limit ($100,000 for the CEO and $10,000 for other NEOs). |

û |

We do not enter into employment agreements. We do not enter into individual employment agreements with our executive officers they serve at the will of the Board. | |||

|

|

We retain an independent compensation consultant. The Committee retains an independent compensation consultant that provides no other services to PNC. | |||||

|

|

We prohibit hedging, pledging or short sales of PNC securities. We do not allow any director or employee to hedge or short-sell PNC securities. We do not allow any director or executive officer to pledge PNC securities. |

|||||

Stakeholder engagement and impact of 2018 say-on-pay vote

|

|

The annual advisory vote on executive compensation (say-on-pay) that we provide to shareholders received another year of strong support in 2018, with over 97% of our shareholders voting in favor.

|

|

|

|

For the past several years, we have initiated outreach efforts with certain institutional investors based on investor interest. In 2018, we continued to engage in a productive dialogue with our investors and certain other stakeholders.

|

|

|

|

The Committee considered the results of the say-on-pay vote as one factor in its compensation decisions, among the other factors discussed in this CD&A. The Committee did not recommend any changes to the executive compensation program based on the say-on-pay vote or specific feedback from shareholders.

|

THE PNC FINANCIAL SERVICES GROUP, INC. - 2019 Proxy Statement 41

Table of Contents

COMPENSATION DISCUSSION AND ANALYSIS

Key program features

Taken as a whole, our executive compensation program includes several complementary features:

|

|

We provide incentives for performance over different time horizons (short- and long-term). | |

|

|

We embed performance goals into a significant portion of our long-term incentives, and include a risk-based performance review that could reduce or eliminate the awards.

|

|

|

|

We reward achievement against both quantitative and qualitative goals, while allowing for discretion. | |

|

|

We connect pay to our own performance, relative to our internal objectives and controls, as well as relative to the performance of a carefully selected peer group. | |

|

|

We consider market data and trends when making pay decisions. | |

|

|

We place a substantial majority of compensation at risk. | |

|

|

We pay some incentive compensation in cash today, while deferring a majority of incentives for several years through potential equity-based payouts. | |

42 THE PNC FINANCIAL SERVICES GROUP, INC. - 2019 Proxy Statement

Table of Contents

COMPENSATION DISCUSSION AND ANALYSIS

|

|

Targets are informed by market data but take several factors into account. The Committee reviews available market data, but does not use a formula to set the target. The Committee evaluates many factors, including the appropriateness of the job match and market data, the responsibilities of the position and the executives demonstrated performance, skills and experience. | |||

|

|

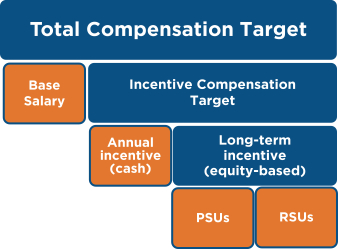

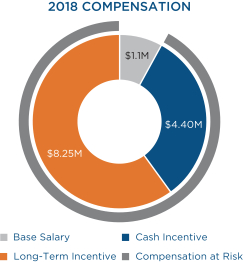

At least 50% of compensation is equity-based and not payable for several years. The Committee believes that a significant portion of compensation should be at risk, tied to PNC stock performance and not payable, if at all, for several years. Long-term equity-based awards make up at least 50% of the value of the total compensation target, with that percentage rising to 60% for our CEO and two other NEOs. The remainder of the annual incentive payout is delivered as a cash incentive award. | |||

|

|

The equity-based incentive is split between two forms of awards. Each NEO generally receives a long-term incentive award in two primary forms, a Performance Share Unit (PSU) and a Restricted Share Unit (RSU). Payouts under these awards are deferred for multiple years. For information on the terms of the PSU and RSU awards, see the Long-term incentive program section immediately below on pages 43 to 45.

|

|||

Long-term incentive program

| Name of Award

|

% of

|

Vesting

|

Metrics

|

Payout Range (% of target)

|

Stock or Cash Payout

|

|||||

| Performance |

60% |

After

3-year

|

PNCs return on equity (ROE) compared to performance targets

EPS growth rank against our peer group |

0-150% |

Stock |

|||||

| Restricted Share Unit (RSU) |

40% | Annual installments over 3 years |

Time-based | 0-100% | Stock | |||||

THE PNC FINANCIAL SERVICES GROUP, INC. - 2019 Proxy Statement 43

Table of Contents

COMPENSATION DISCUSSION AND ANALYSIS

|

Three-year average EPS growth (relative)

|

||||||||

|

PNC percentile rank

|

PNC percentile rank

|

PNC percentile rank

|

||||||

| Three-year average ROE (absolute)

|

13.00%

|

100.0%

|

125.0%

|

150.0%

|

||||

|

12.25%

|

87.5%

|

112.5%

|

137.5%

|

|||||

|

11.25%

|

75.0%

|

100.0%

|

125.0%

|

|||||

|

10.25%