UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

|

|

|

| ☑ Filed by the

Registrant

|

|

☐ Filed by a Party other than the Registrant

|

|

|

|

| |

| Check the appropriate box:

|

| |

|

| ☐

|

|

Preliminary Proxy Statement |

| |

|

| ☐

|

|

CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY

RULE 14a-6(e)(2)) |

| |

|

| ☑

|

|

Definitive Proxy Statement |

| |

|

| ☐

|

|

Definitive Additional Materials |

| |

|

| ☐

|

|

Soliciting Material under §240.14a-12 |

THE PNC FINANCIAL SERVICES GROUP, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

|

|

|

| |

| Payment of Filing Fee (Check the appropriate box):

|

| |

|

| ☑

|

|

No fee required. |

| |

|

| ☐

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and

0-11. |

| |

|

| |

|

(1) Title of each class of securities to which transaction

applies: |

| |

|

| |

|

(2) Aggregate number of securities to which transaction

applies: |

| |

|

| |

|

(3) Per unit price or other underlying value of transaction computed pursuant

to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

|

| |

|

(4) Proposed maximum aggregate value of transaction: |

| |

|

| |

|

(5) Total fee paid: |

| |

|

| ☐

|

|

Fee paid previously with preliminary materials. |

| |

|

| ☐

|

|

Check box if any part of the fee is offset as provided by Exchange Act

Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

|

| |

|

(1) Amount Previously Paid: |

| |

|

| |

|

(2) Form, Schedule or Registration Statement No.: |

| |

|

| |

|

(3) Filing Party: |

| |

|

| |

|

(4) Date Filed: |

|

|

|

|

|

|

|

|

|

Letter from the Chairman and

Chief Executive Officer to Our

Shareholders

|

Dear Shareholder,

We invite you to attend the 2018 Annual Meeting of Shareholders of The PNC Financial

Services Group, Inc. on Tuesday, April 24, 2018.

The meeting will be held in the James E. Rohr Auditorium in The Tower at

PNC Plaza, 300 Fifth Avenue, Pittsburgh, Pennsylvania 15222, beginning at 11:00 a.m., Eastern Time.

We will consider the matters

described in this proxy statement and also review significant developments since last years annual meeting of shareholders.

We are again making our proxy materials available to you electronically. We hope that this continues to offer you convenience while allowing us to reduce the number of copies we print.

The proxy statement contains important information and you should read it carefully. Your vote is important and we strongly encourage you to vote

your shares using one of the voting methods described in the proxy statement. Please see the notice that follows for more information.

If you are unable to attend the meeting in person, you will be able to listen to the meeting by webcast or conference call.

We look forward to your participation and thank you for your support of PNC.

| March 13, 2018

|

Sincerely,

|

William S. Demchak

Chairman, President and Chief Executive Officer

PARTICIPATE IN THE FUTURE OF PNC PLEASE CAST YOUR VOTE

Your vote is important to us and we want your shares to be represented at the annual meeting. Please cast your vote on the proposals listed

below.

Under New York Stock Exchange rules, if you hold your shares through a broker, bank, or other nominee (referred to as holding

your shares in street name) and you do not provide any voting instructions, your broker has discretionary authority to vote on your behalf with respect to proposals that are considered routine items. The only routine item on

this years ballot is the ratification of our auditor selection. If an item is non-routine and you do not provide voting instructions, no vote will be cast on your behalf with respect to that item.

Proposals requiring your vote

|

|

|

|

|

|

|

|

|

| |

|

|

|

More

information

|

|

Board

recommendation

|

|

Routine

item?

|

| Item 1 |

|

Election of 12 nominated directors |

|

Page 11 |

|

FOR

each nominee

|

|

No |

| Item 2

|

|

Ratification of independent registered public accounting

firm for 2018

|

|

Page 84

|

|

FOR

|

|

Yes

|

|

Item 3

|

|

Advisory

approval of the compensation of PNCs named executive officers (say-on-pay)

|

|

Page 87

|

|

FOR

|

|

No

|

With respect to each item, a majority of the votes cast will be required for approval. Abstentions will not be

included in the total votes cast and will not affect the results.

Vote your shares

Please read the proxy statement with

care and vote right away. We offer a number of ways for you to vote your shares. Voting instructions are included in the Notice of Internet Availability of Proxy Materials and the proxy card. If you hold shares in street name, you will receive

information on how to give voting instructions to your broker, bank, or other nominee. For registered holders, we offer the following methods to vote your shares and give us your proxy:

|

|

|

|

|

|

|

|

|

|

|

|

|

| www.envisionreports.com/PNC |

|

Follow the instructions

on the proxy card.

|

|

Complete, sign and date the proxy card

and return it in the envelope provided.

|

Attend our 2018 Annual Meeting of Shareholders

|

|

|

| Directions to attend the annual meeting |

|

Tuesday, April 24, 2018 at 11:00 a.m. |

| are available at |

|

The Tower at PNC Plaza James E. Rohr Auditorium |

| www.pnc.com/annualmeeting |

|

300 Fifth Avenue |

|

|

Pittsburgh, Pennsylvania 15222 |

4 THE

PNC FINANCIAL SERVICES GROUP, INC. - 2018 Proxy Statement

PROXY STATEMENT SUMMARY

Proxy Statement Summary

To assist you in reviewing the proposals to be acted upon at the annual meeting, we have included a summary of certain relevant information.

This summary does not contain all of the information you should consider. You should review the entire proxy statement and the 2017 Annual Report before you vote.

You may read the proxy statement and the 2017 Annual Report at www.envisionreports.com/PNC.

Who can vote (page 90)

You are entitled to vote if you were a PNC shareholder on the record date of February 2, 2018.

Voting methods (page 91)

We offer our shareholders a number of ways to vote, including by Internet, telephone, or mail. Shareholders may also vote in person at the annual

meeting.

Items of business

Item 1: Election of 12 nominated directors (page 11)

| |

|

The proxy statement contains important information about the experience, qualifications, attributes, and skills of the 12 nominees to our Board of Directors (the Board). The Boards Nominating

and Governance Committee performs an annual assessment to confirm that our directors continue to have the skills and experience necessary to serve PNC, and that the Board and its committees continue to be effective in carrying out their duties.

|

| |

|

The Board recommends that you vote FOR all 12 director nominees. |

Item 2: Ratification of independent registered public accounting firm for 2018 (page 84)

| |

|

Each year, the Boards Audit Committee selects our independent registered public accounting firm. For 2018, the Audit Committee selected PricewaterhouseCoopers LLP (PwC) to fulfill this role.

|

| |

|

The Board recommends that you vote FOR the ratification of the Audit Committees selection of PwC as our independent registered public accounting firm for 2018.

|

Item 3: Say-on-pay (page 87)

| |

|

Each year, we ask our shareholders to cast a non-binding advisory vote on the compensation of our named executive officersknown generally as the say-on-pay vote. We have offered an annual say-on-pay vote since 2009. Last year,

approximately 98% of the votes cast by our shareholders approved the compensation of our named executive officers, and we have averaged nearly 93% support in say-on-pay

votes over the past five years. |

| |

|

We recommend that you read the Compensation Discussion and Analysis (beginning on page 39), which explains how and why the Boards Personnel and Compensation Committee made its executive

compensation decisions for 2017. |

| |

|

The Board recommends that you vote FOR the approval, on a non-binding advisory basis, of the compensation of our named executive officers.

|

THE PNC

FINANCIAL SERVICES GROUP, INC. - 2018 Proxy Statement 5

PROXY STATEMENT SUMMARY

2017 PNC performance (page 39)

|

|

|

|

|

|

|

|

We had a successful year in 2017, reporting record net income of $5.4 billion, or $10.36 per diluted common share. Our return

on average assets was 1.45%, and our return on average common equity was 12.09%. Our results benefited from new federal tax legislation enacted in December 2017. We recognized an income tax benefit of $1.2 billion primarily attributable to

revaluation of deferred tax liabilities at the lower statutory tax rate.

|

|

|

|

|

|

We grew loans and deposits, and generated record fee income for the year. We added customers across our

businesses.

|

|

|

|

|

|

We delivered value for our shareholders. We ranked 3rd in our peer group

in total shareholder return over a one-year period (26.0%), 4th over a three-year period (19.1%), and 1st over a five-year period.

|

|

|

|

|

|

We continued to focus on expense management, having achieved our $350 million Continuous Improvement Program target in

2017.

|

|

|

|

|

|

We also continued to execute on our strategic priorities of building a leading banking franchise in our underpenetrated

markets, capturing more investable assets, reinventing the retail banking experience, and bolstering critical infrastructure and streamlining core processes.

|

|

|

|

|

|

We returned $3.6 billion in capital to our shareholders through share repurchases and common stock dividends, including

raising the quarterly common stock dividend to $0.75 per share, an increase of 36%.

|

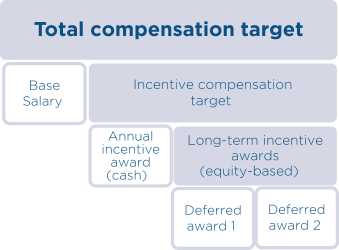

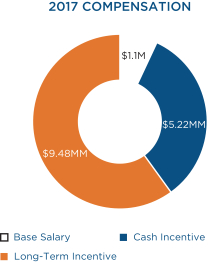

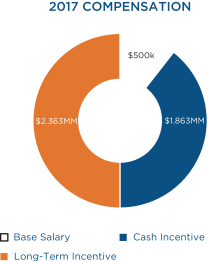

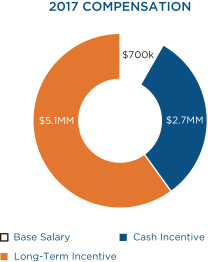

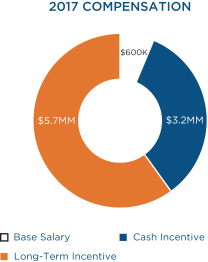

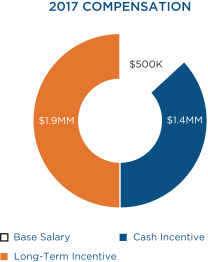

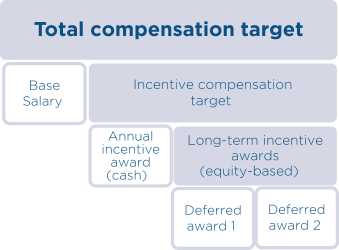

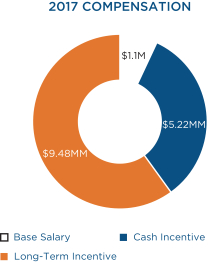

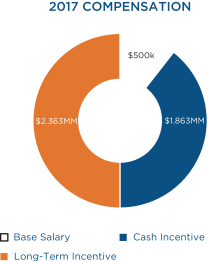

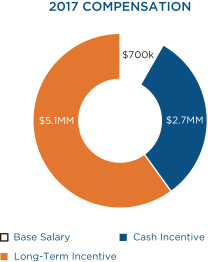

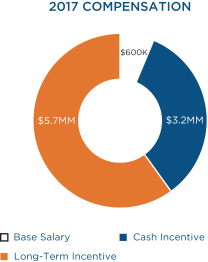

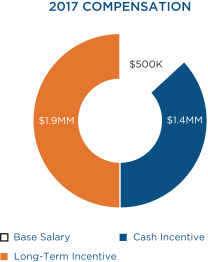

2017 compensation decisions (page 44)

The table below shows, for each named executive officer, the incentive compensation target for 2017 and the actual annual cash incentive and

long-term equity-based incentives awarded in 2018 for 2017 performance.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

William S.

Demchak |

|

|

Robert Q.

Reilly

|

|

|

Michael P.

Lyons

|

|

|

E William

Parsley, III

|

|

|

Steven C.

Van Wyk

|

|

| Incentive compensation target

|

|

$ |

10,500,000 |

|

|

$ |

3,250,000 |

|

|

$ |

6,050,000 |

|

|

$ |

6,900,000 |

(1) |

|

$ |

2,750,000 |

|

|

|

|

|

|

|

| Incentive compensation awarded for 2017 performance

|

|

$ |

14,700,000 |

|

|

$ |

4,225,000 |

|

|

$ |

7,800,000 |

|

|

$ |

8,900,000 |

|

|

$ |

3,300,000 |

|

| Annual cash incentive portion

|

|

$ |

5,220,000 |

|

|

$ |

1,862,500 |

|

|

$ |

2,700,000 |

|

|

$ |

3,200,000 |

|

|

$ |

1,400,000 |

|

| Long-term incentive portion

|

|

$ |

9,480,000 |

|

|

$ |

2,362,500 |

|

|

$ |

5,100,000 |

|

|

$ |

5,700,000 |

|

|

$ |

1,900,000 |

|

|

|

|

|

|

|

| Incentive compensation disclosed in the Summary compensation table(2)

|

|

$ |

11,970,000 |

|

|

$ |

3,637,500 |

|

|

$ |

6,660,000 |

|

|

$ |

7,550,000 |

|

|

$ |

2,980,000 |

|

| Annual cash incentive portion (2017 performance)

|

|

$ |

5,220,000 |

|

|

$ |

1,862,500 |

|

|

$ |

2,700,000 |

|

|

$ |

3,200,000 |

|

|

$ |

1,400,000 |

|

| Long-term incentive portion (2016

performance)

|

|

$ |

6,750,000 |

|

|

$ |

1,775,000 |

|

|

$ |

3,960,000 |

|

|

$ |

4,350,000 |

(1) |

|

$ |

1,580,000 |

|

| (1) |

The long-term incentive award that Mr. Parsley received in 2017 (for 2016 performance) included three separate grants the two equity-based awards that all of our NEOs received

(valued at $2,850,000) and a separate grant of incentive performance units related to the management of our Asset & Liability Management (ALM) unit (valued at $1,500,000). Mr. Parsleys incentive compensation target for 2017 also

anticipated a grant of ALM-based incentive performance units. Mr. Parsley did not receive ALM-based incentive performance units in 2018. Instead, he was awarded the same long-term incentive awards that all of our NEOs received based on his

overall incentive compensation target for 2017. |

| (2) |

Due to SEC regulations, the incentive compensation amounts disclosed in the Summary compensation table on page 60 include the cash incentive award paid in 2018 (for 2017 performance) and the

long-term incentive award granted in 2017 (for 2016 performance). |

PNC corporate governance (page 17)

| |

|

The entire Board is elected each year; we have no staggered elections. |

| |

|

The election of directors is subject to a majority voting requirement; any director who does not receive a majority of the votes cast in an uncontested election must tender his or her resignation

to the Board. |

| |

|

Our corporate governance guidelines require the Board to have a substantial majority (at least 2/3) of independent directors. All but one of our current directors and all but one the nominees to

the Board are independent, with the only exception in each case being our CEO. |

| |

|

The Board has a Presiding Director, a lead independent director with specific duties. |

6 THE

PNC FINANCIAL SERVICES GROUP, INC. - 2018 Proxy Statement

PROXY STATEMENT SUMMARY

| |

|

The Presiding Director approves Board meeting schedules and agendas. |

| |

|

The Board meets regularly in executive session, with no members of management present. |

| |

|

We have four primary standing Board committees: |

| |

|

|

Personnel and Compensation Committee (Compensation) |

| |

|

|

Nominating and Governance Committee (Governance) |

| |

|

In 2017, the Board met 11 times and each of our directors attended at least 75% of the aggregate number of meetings of the Board and the committees of the Board on which he or she served. The

average attendance of all directors at Board and applicable committee meetings was approximately 99%. All of our directors then serving attended our 2017 annual meeting of shareholders. |

| |

|

You can find additional information about our governance policies and principles at www.pnc.com/corporategovernance. |

Board nominees (page 11)

|

|

|

|

|

|

|

|

|

| Name |

|

Age |

|

Director since |

|

Independent |

|

Primary Standing Board Committee Memberships |

| Charles E. Bunch

|

|

68 |

|

2007 |

|

☑ |

|

Compensation; Governance

|

| Debra A. Cafaro

|

|

60 |

|

2017 |

|

☑ |

|

Audit

|

| Marjorie Rodgers Cheshire

|

|

49 |

|

2014 |

|

☑ |

|

Audit; Risk

|

| William S. Demchak

|

|

55 |

|

2013 |

|

☐ |

|

Risk

|

| Andrew T. Feldstein

|

|

53 |

|

2013 |

|

☑ |

|

Compensation; Risk (Chair)

|

| Daniel R. Hesse

|

|

64 |

|

2016 |

|

☑ |

|

Risk

|

| Richard B. Kelson

|

|

71 |

|

2002 |

|

☑ |

|

Audit (Chair); Compensation

|

| Linda R. Medler

|

|

61 |

|

2018 |

|

☑ |

|

Risk

|

| Martin Pfinsgraff

|

|

63 |

|

2018 |

|

☑ |

|

Audit; Risk

|

| Donald J. Shepard

|

|

71 |

|

2007 |

|

☑ |

|

Audit; Governance (Chair); Risk

|

| Michael J. Ward

|

|

67 |

|

2016 |

|

☑ |

|

Compensation; Governance

|

| Gregory D. Wasson

|

|

59 |

|

2015 |

|

☑ |

|

Audit

|

THE PNC

FINANCIAL SERVICES GROUP, INC. - 2018 Proxy Statement 7

Table of Contents

8 THE

PNC FINANCIAL SERVICES GROUP, INC. - 2018 Proxy Statement

THE PNC

FINANCIAL SERVICES GROUP, INC. - 2018 Proxy Statement 9

|

|

Notice of Annual Meeting

of Shareholders

|

Tuesday, April 24, 2018

11:00 a.m. (Eastern Time)

The Tower at PNC Plaza James E. Rohr Auditorium, 300 Fifth Avenue, Pittsburgh, Pennsylvania

15222

WEBCAST

A listen-only webcast of the annual meeting will be available at www.pnc.com/annualmeeting. An archive of

the webcast will be available on our website for 30 days.

CONFERENCE CALL

You may access the listen-only conference call of the annual meeting by calling 877-272-3515 or 303-223-4381 (international). A telephone replay will be available for one week by calling 800-633-8284 or 402-977-9140 (international), conference ID 21881374.

ITEMS OF BUSINESS

| |

1. |

Election of the 12 director nominees named in the proxy statement to serve until the next annual meeting and until their successors are elected and qualified; |

|

| |

2. |

Ratification of the Audit Committees selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2018; |

|

| |

3. |

An advisory vote to approve the compensation of our named executive officers; and |

|

| |

4. |

Such other business as may properly come before the meeting. |

|

RECORD DATE

The close of business on February 2, 2018 is the record date for determining shareholders entitled to receive

notice of and to vote at the annual meeting and any adjournment.

MATERIALS TO REVIEW

We began providing access to the proxy statement and a form of proxy card on March 13, 2018.

We have made our proxy materials available electronically. Certain shareholders will receive a Notice of Internet Availability of Proxy Materials explaining how to access our proxy materials and vote. Other shareholders will receive a paper copy of

the proxy statement and a proxy card.

PROXY VOTING

Even if you plan to attend the annual meeting in person, we encourage you to cast your vote over the Internet, or

if you have a proxy card, by mailing the completed proxy card or by telephone. This Notice of Annual Meeting and Proxy Statement and our 2017 Annual Report are available at www.envisionreports.com/PNC.

ADMISSION

To be admitted to the annual meeting, you must present proof of your stock ownership as of the record date and

valid photo identification. Each shareholder may bring one guest who must present valid photo identification. Please follow the admission procedures described beginning on page 89 of the proxy statement.

| March 13, 2018

By Order of the Board of

Directors,

|

Christi Davis

Corporate Secretary

10 THE

PNC FINANCIAL SERVICES GROUP, INC. - 2018 Proxy Statement

ELECTION OF DIRECTORS (ITEM 1)

Our Board of Directors (the Board) determines the number of directors to nominate for election to

the Board. Our By-laws contemplate a range in the size of the Board from five to 36 directors. For the annual meeting, the Board fixed the number of directors to be elected at 12.

On August 10, 2017, the Board appointed Debra A. Cafaro to serve as a director. Ms. Cafaro was initially recommended as a director

candidate by our CEO. On January 4, 2018, the Board appointed Linda R. Medler and Martin Pfinsgraff to serve as directors. Ms. Medler was initially recommended as a director candidate by our Presiding Director and Mr. Pfinsgraff was

initially recommended as a director candidate by our CEO. Each of the candidates initially recommended by our CEO was reviewed with our Presiding Director, as Chair of the Nominating and Governance Committee. The Presiding Director concurred with

each recommendation before the candidate, along with a pool of potential candidates provided by a third-party search firm, was evaluated by the Nominating and Governance Committee, and each candidate ultimately recommended for appointment by the

Committee was reviewed by the Board. Each of Ms. Cafaro, Ms. Medler and Mr. Pfinsgraff are included as nominees for election to the Board at the annual meeting.

Each of the 12 nominees currently serves on the Board. Beginning on page 12, we include the following information regarding the nominees:

| |

|

The years they first became directors of PNC |

| |

|

Their principal occupations and public company directorships over the past five years |

| |

|

A brief discussion of the specific experience, qualifications, attributes, or skills that led to the Boards conclusion that the individual should serve as a director |

The directors elected at the annual meeting will serve for one year, unless they leave the Board early. We do not stagger our electionsthe

entire Board will be considered for election at the

annual meeting. If elected, each nominee will hold office until the next annual meeting of our shareholders, and until the election and qualification of his or her successor.

Each nominee consents to being named in this proxy statement and to serve if elected. The Board has no reason to believe that any nominee will be

unavailable or unable to serve as a director.

In addition to information regarding the background and qualifications of each nominee,

this proxy statement contains other important information related to your evaluation of the nominees, including:

| |

|

The Boards leadership structure |

| |

|

Relationships between PNC and our directors |

| |

|

How we evaluate director independence |

| |

|

How we pay our directors |

| |

|

Our director stock ownership requirement |

See the following sections

for more details on these topics:

| |

|

Corporate Governance (page 17) |

| |

|

Director and Executive Officer Relationships (page 30) |

| |

|

Related Person Transactions (page 35) |

| |

|

Director Compensation (page 36) |

| |

|

Security Ownership of Management and Certain Beneficial Owners (page 82) |

If you sign, date and return your proxy card but do not give voting instructions, or if you do not provide voting instructions when voting over the Internet, we will vote your shares FOR all of the nominees listed on pages 12 to 16.

See page 92 for information regarding the vote required for election of the director nominees.

The Board of Directors recommends a

vote FOR each of the nominees listed on pages 12 to 16.

THE PNC

FINANCIAL SERVICES GROUP, INC. - 2018 Proxy Statement 11

ELECTION OF DIRECTORS (ITEM 1)

Charles E. Bunch

Age 68

Director Since 2007

Experience, Qualifications, Attributes, or Skills

Charles E. Bunch is the retired Executive Chairman

and former Chief Executive Officer of PPG Industries, Inc., a Pittsburgh-based global supplier of paints, coatings, optical products, specialty materials, chemicals, glass and fiberglass.

Mr. Bunch received an undergraduate degree from Georgetown University and an MBA from the Harvard Business School.

Mr. Bunchs service as a public company CEO, his extensive management and finance experience, and his involvement in the Pittsburgh

community add significant value to the Board. In addition, Mr. Bunch brings regulatory and banking industry experience to the Board as he formerly served as a Director and the Chairman of the Federal Reserve Bank of Cleveland, our principal

banking regulator.

PNC Board Committee Memberships

Nominating and Governance Committee

Personnel and Compensation Committee

Public Company Directorships

ConocoPhillips

H.J. Heinz Company

(until June 2013)

Marathon Petroleum Corporation

Mondelēz International, Inc.

PPG Industries, Inc. (until September 2016)

Debra A. Cafaro

Age 60

Director Since 2017

Experience, Qualifications, Attributes, or Skills

Debra A. Cafaro is Chairman of the Board and Chief

Executive Officer of Ventas, Inc., an S&P 500 company that is a leading owner of seniors housing, healthcare, and research properties.

Building on an early career in law and her 19-year tenure at Ventas, Ms. Cafaro is broadly engaged across business, public policy, and non-profit

sectors. She is Chair elect of the Real Estate Roundtable, is a member of the Business Council, and serves on the boards of the Economic and Executives Clubs of Chicago, University of Chicago, Chicago Infrastructure Trust, Chicago Symphony

Orchestra, World Business Chicago and the management committee of the Pittsburgh Penguins.

Ms. Cafaro received a JD cum laude in

1982 from the University of Chicago Law School and a BA magna cum laude from the University of Notre Dame in 1979.

The Board values

Ms. Cafaros extensive corporate leadership, knowledge, and experience. Her years of experience as a public company CEO in the financial sector provide insight into the oversight of financial and accounting matters. Her vision as a

strategic thinker adds depth and strength to the Board in its oversight of PNCs continued growth. The Board also values Ms. Cafaros active involvement in the Chicago and Pittsburgh communities.

PNC Board Committee Memberships

Audit Committee

Public Company Directorships

Ventas, Inc.

Weyerhaeuser Company

(until February 2016)

Marjorie Rodgers Cheshire

Age 49

Director Since 2014

Experience, Qualifications, Attributes, or Skills

Marjorie Rodgers Cheshire is President and Chief

Operating Officer of A&R Development Corp. A&R is a diversified real estate development organization focused on the Baltimore and Washington markets. A&Rs portfolio includes residential, commercial, and mixed-use developments, ranging in value from $1 million to $152 million. In its history, A&R has developed 50 projects with an aggregate value of more than $900 million.

Prior to joining A&R, Ms. Cheshire spent many years in the media and sports industries. Her most recent position was as Senior

Director of Brand & Consumer Marketing for the National Football League. Prior to that, Ms. Cheshire held positions as Vice President of Business Development for Oxygen Media, Director and Special Assistant to the Chairman &

CEO of ESPN, and Manager of Strategic Marketing for ABC Daytime. Ms. Cheshire also worked as a consultant with The Boston Consulting Group, a strategic consulting firm serving Fortune 500 companies.

Ms. Cheshire received a BS in Economics from the Wharton School of the University of Pennsylvania and an MBA from the Stanford University

Graduate School of Business. She is a Trustee of Baltimore Equitable Insurance, Baltimore School for the Arts, and Johns Hopkins Hospital.

The Board values Ms. Cheshires executive management experience and her background in real estate, marketing, and media, as well as her involvement in the Baltimore community and her familiarity with this important market

for PNC.

PNC Board Committee Memberships

Audit Committee

Risk Committee

Compliance Subcommittee (Chair)

Public Company Directorships

None

12 THE

PNC FINANCIAL SERVICES GROUP, INC. - 2018 Proxy Statement

ELECTION OF DIRECTORS (ITEM 1)

William S. Demchak

Age 55

Director Since 2013

Experience, Qualifications, Attributes, or Skills

William S. Demchak is Chairman, President and Chief

Executive Officer of The PNC Financial Services Group, Inc., one of the largest diversified financial services companies in the United States. Mr. Demchak joined PNC in 2002 as chief financial officer. In July 2005, he was named head of

PNCs Corporate & Institutional Banking segment responsible for PNCs middle market and large corporate businesses, as well as capital markets, real estate finance, equity management, and leasing. Mr. Demchak was promoted to

senior vice chairman in 2009, named head of PNC businesses in August 2010, elected president in April 2012 and chief executive officer in April 2013, and appointed chairman in April 2014.

Before joining PNC in 2002, Mr. Demchak served as the Global Head of Structured Finance and Credit Portfolio for JPMorgan Chase. He

also held key leadership roles at JPMorgan prior to its merger with the Chase Manhattan Corporation in 2000. He was actively involved in developing JPMorgans strategic agenda and was a member of the companys capital and credit risk

committees.

Mr. Demchak is a director of BlackRock, Inc. He is a member of The Financial Services Roundtable. In addition, he

serves on the boards of directors of the Extra Mile Education Foundation and the YMCA of Pittsburgh. He is Chairman of the Allegheny Conference on Community Development, Chairman of The Clearing House, a member of the Board of the Pittsburgh

Cultural Trust, and a member of The Business Council. Mr. Demchak also is the Chair of the Advisory Committee of Envision Downtown.

Mr. Demchak received a BS from Allegheny College and an MBA with an emphasis in accounting from the University of Michigan.

The Board believes that the current CEO should also serve as a director. Under the leadership structure discussed elsewhere in this proxy statement,

a CEO-director acts as a liaison between directors and management, and assists the Board in its oversight of the company. Mr. Demchaks experiences and strong leadership provide the Board with

insight into the business and strategic priorities of PNC.

PNC Board Committee Memberships

Executive Committee

Risk Committee

Public Company Directorships

BlackRock, Inc.

Andrew T. Feldstein

Age 53

Director Since 2013

Experience, Qualifications, Attributes, or Skills

Andrew T. Feldstein is the Chief

Executive Officer and Chief Investment Officer of BlueMountain Capital Management, a leading alternative asset manager with $20 billion in assets under management and approximately 245 professionals worldwide. Mr. Feldstein is the

Chair of the firms Management Committee and a member of the Investment and Risk Committees.

Prior to co-founding BlueMountain in 2003, Mr. Feldstein spent over a decade at JPMorgan where he was a Managing Director and served as Head of Structured Credit; Head of High Yield Sales, Trading and Research; and Head

of Global Credit Portfolio. Mr. Feldstein is a Trustee of Third Way, a public policy think tank; a Trustee of the Santa Fe Institute, an independent research and education center; and a member of the Harvard Law School Leadership Council.

Mr. Feldstein received a BA from Georgetown University and a JD from Harvard Law School.

The Board values Mr. Feldsteins extensive financial and risk management expertise. As founder and CEO of BlueMountain Capital and through

his senior management positions at JPMorgan, Mr. Feldstein has built a reputation for innovation and significant insight into risk management. The Board believes that these skills are particularly valuable to its effective oversight of risk

management and will also be a valuable resource to PNC as it continues to grow its business and strengthen its balance sheet.

PNC

Board Committee Memberships

Executive Committee

Personnel and Compensation Committee

Risk Committee (Chair)

Compliance

Subcommittee

Public Company Directorships

None

Daniel R. Hesse

Age 64

Director Since 2016

Experience, Qualifications, Attributes, or Skills

Daniel R. Hesse is the former President and Chief Executive

Officer of Sprint Corporation, one of the United States largest wireless carriers.

Mr. Hesse received a BA from

the University of Notre Dame, an MBA from Cornell University, and an MS from Massachusetts Institute of Technology where he was awarded the Brooks Thesis Prize.

Mr. Hesse brings extensive corporate leadership experience to the Board, having served in a variety of executive positions, including as CEO of

Sprint Corporation. His years of experience in the wireless communications industry provide insight into the dynamic and strategic issues overseen by the Board. The broad spectrum of technological issues in this industry give him a strong

understanding to assist the Board in its oversight of technological issues.

PNC Board Committee Memberships

Risk Committee

Technology

Subcommittee

Public Company Directorships

Akamai Technologies, Inc.

THE PNC

FINANCIAL SERVICES GROUP, INC. - 2018 Proxy Statement 13

ELECTION OF DIRECTORS (ITEM 1)

Richard B. Kelson

Age 71

Director Since 2002

Experience, Qualifications, Attributes, or Skills

Richard B. Kelson is the Chairman, President and Chief

Executive Officer of ServCo, LLC, a strategic sourcing and supply chain management company. He has also served as an Operating Advisor with Pegasus Capital Advisors, L.P., a private equity fund manager.

Mr. Kelson retired in 2006 as Chairmans Counsel for Alcoa, a leader in the production and management of primary aluminum,

fabricated aluminum, and alumina. At Alcoa, he served as a member of the executive council, the senior leadership group for the company. From 1994 to 1997, Mr. Kelson served as Alcoas General Counsel. From 1997 through 2005, he served as

Alcoas Chief Financial Officer.

Mr. Kelson received a BA from the University of Pennsylvania, and a JD from the University of

Pittsburgh.

Mr. Kelsons service as a public company CFO and his designation as an audit committee financial

expert assist the Board and Audit Committee with the oversight of financial and accounting issues. His financial background provides strong leadership of our Audit Committee as its Chair. The Board also values Mr. Kelsons executive

management experience and his background as a public company general counsel, although he does not serve in a legal capacity or provide legal advice to PNC or the Board.

PNC Board Committee Memberships

Audit Committee (Chair)

Executive Committee

Personnel and Compensation Committee

Compliance Subcommittee

Public

Company Directorships

ANADIGICS, Inc. (until March 2016)

Commercial Metals Company (Lead Director)

Ingevity Corporation (Non-Executive Chairman of Board)

MeadWestvaco Corp.

(until July 2015)

Linda R. Medler

Age 61

Director Since 2018

Experience, Qualifications, Attributes, or Skills

Linda R. Medler, Brigadier General, United States Air

Force (Retired), is Founder, President and CEO of L A Medler & Associates, LLC, providing cyber strategy consulting services to commercial clients and numerous U.S. Department of Defense customers. Ms. Medler served as the Chief

Information Security Officer and Director of IT Security of Raytheon Missile Systems, a major business unit of Raytheon Company, in December 2017. Raytheon Company is a technology and innovation leader specializing in defense, civil government and

cybersecurity solutions. She was Director of Cyber for the Advanced Missile Systems Product Line of Raytheon Missile Systems from June 2015 to December 2016.

In 2014, she completed 30 years of total military service, including 27 years of service in the U.S. Air Force, retiring as a Brigadier

General. She began her military service as an enlisted U.S. Marine. Her last position held was Director of Capability and Resource Integration for the United States Cyber Command. Her previous assignments included Director of Communications and

Networks for the Joint Staff, Joint Chiefs of Staff Deputy CIO, Chief of Staff for Air Force Materiel Command, and Commander/Vice Commander for the 75th Air Base Wing.

Ms. Medler received a BBA in Management & Computer Information Systems from the University of Arkansas at Little Rock, an MS in

National Security & Strategic Studies from the Naval War College, and an MBA in Management Information Systems Concentration from the University of Arizona.

The Board values Ms. Medlers extensive leadership experience and her deep knowledge of cybersecurity and information technology. Her

years of experience leading cybersecurity, information technology, and multi-function organizations facing a broad range of technology and operational issues provide the Board with additional skills to facilitate oversight of the cybersecurity and

technology issues facing PNC.

PNC Board Committee Memberships

Risk Committee

Technology

Subcommittee

Public Company Directorships

None

14 THE

PNC FINANCIAL SERVICES GROUP, INC. - 2018 Proxy Statement

ELECTION OF DIRECTORS (ITEM 1)

Martin Pfinsgraff

Age 63

Director Since 2018

Experience, Qualifications, Attributes, or Skills

Martin Pfinsgraff retired as Senior Deputy Comptroller

Large Bank Supervision of the Office of the Comptroller of the Currency (OCC) in February 2017. He held the position of Deputy Comptroller for Credit and Market Risk from 2011 to 2013. Mr. Pfinsgraff served on the

Executive Committee of the OCC and as a member of the Senior Supervisors Group, an international committee comprised of supervisors from 10 Organisation for Economic Co-operation and Development member

countries and the European Central Bank.

Prior to his career with the OCC, Mr. Pfinsgraff held various positions from

2000 to 2009 at iJet International, a provider of operating risk management solutions, including Chief Operating Officer and Chief Financial Officer. Mr. Pfinsgraff held various positions with Prudential Securities from 1989 through 2000, the

latest of which was President Capital Markets, Prudential Securities from 1997 to 2000.

Mr. Pfinsgraff received a BBA in Psychology

from Allegheny College and an MBA from Harvard Business School.

The Board values Mr. Pfinsgraffs leadership experience as

well as his extensive knowledge of the financial services industry and the regulatory requirements applicable to the industry. His experience in banking regulation, risk management, and finance, along with his years of executive leadership, provide

the Board with additional skills to oversee complex regulatory, risk management, and financial matters.

PNC Board Committee

Memberships

Audit Committee

Risk Committee

Public Company Directorships

None

Donald J. Shepard

Age 71

Director Since 2007

Experience, Qualifications, Attributes, or Skills

Donald J. Shepard is the retired Chairman of the

Executive Board and Chief Executive Officer of AEGON N.V., a large life insurance and pension company.

Mr. Shepard received an MBA from the University of Chicago.

Mr. Shepard joined the Board following PNCs

acquisition of Mercantile Bankshares Corporation. He joined the Mercantile Board of Directors in 1992.

Mr. Shepards service

as the CEO of a large, international public company, particularly a company in the financial services sector, gives him insights into many issues facing PNC, and supports the Boards ability to oversee complex and dynamic issues.

Mr. Shepards duties and experiences at AEGON also assist the Board with its oversight of financial and risk issues. The Board also values Mr. Shepards experience on the board of a public company in the banking business and his

familiarity with the Baltimore community.

PNC Board Committee Memberships

Audit Committee

Executive Committee

(Chair)

Nominating and Governance Committee (Chair)

Risk Committee

Public Company

Directorships

CSX Corporation (until June 2017)

The Travelers Companies, Inc.

Michael J. Ward

Age 67

Director Since 2016

Experience, Qualifications, Attributes, or Skills

Michael J. Ward is the former Chairman and Chief Executive

Officer of CSX Corporation, one of the worlds largest railroad companies.

Mr. Ward received a BS from the

University of Maryland and an MBA from the Harvard Business School.

Mr. Ward has extensive operations, sales, marketing, and

finance experience from his various management roles with CSX and its subsidiaries. As a public company CEO with years of corporate leadership experience in a regulated industry, he brings knowledge and insight to the Board in its oversight of

complex issues. His management of an executive team and a large group of employees adds value to his oversight of compensation issues.

PNC Board Committee Memberships

Nominating and Governance Committee

Personnel and Compensation Committee

Public Company Directorships

Ashland Inc. (until September 2016)

Ashland Global Holdings, Inc.

CSX

Corporation (until March 2017)

THE PNC

FINANCIAL SERVICES GROUP, INC. - 2018 Proxy Statement 15

ELECTION OF DIRECTORS (ITEM 1)

Gregory D. Wasson

Age 59

Director Since 2015

Experience, Qualifications, Attributes, or Skills

Gregory D. Wasson is the former President and Chief Executive

Officer of Walgreens Boots Alliance, a global pharmacy-led health and wellbeing enterprise.

Mr. Wasson received a BS from Purdue University in Pharmaceutical Science.

Mr. Wasson has extensive

operational and executive management experience at a complex organization with a large, diverse workforce. Mr. Wasson brings an in-depth knowledge of the retail industry and insight into the consumer

experience. His background of leading a company with thousands of retail locations in an industry that, like banking, is undergoing rapid transformation will provide insight that benefits PNC as we work on our strategic priorities. His service as a

public company CEO and his designation as an audit committee financial expert assist the Board and Audit Committee with the oversight of financial and accounting issues.

PNC Board Committee Memberships

Audit Committee

Technology Subcommittee

Public Company Directorships

AmerisourceBergen Corporation (until January 2015)

Verizon Communications Inc.

16 THE

PNC FINANCIAL SERVICES GROUP, INC. - 2018 Proxy Statement

CORPORATE GOVERNANCE

The Board is committed to maintaining strong corporate governance practices. Through the Nominating

and Governance Committee, the Board evaluates its corporate governance policies and practices against evolving best practices. This section highlights some of our corporate governance policies and practices. See

www.pnc.com/corporategovernance for additional information about corporate governance at PNC, including:

| |

|

Corporate governance guidelines |

| |

|

Code of Business Conduct and Ethics

|

| |

|

Board committee charters |

To receive free printed copies of any of these

documents, please send a request to:

Corporate Secretary

The PNC Financial Services Group, Inc.

300 Fifth Avenue

Pittsburgh, Pennsylvania 15222

or

corporate.secretary@pnc.com

This proxy statement is also available at

www.pnc.com/proxystatement

Recent corporate governance developments

Three of our current directors, Jane G. Pepper, Lorene K. Steffes, and Dennis F. Strigl, reach the

mandatory retirement age of 72 in connection with the annual meeting and are not nominated for election as directors. As part of its continuing efforts to provide for director succession and strong Board composition in light of these anticipated

retirements, on August 10, 2017, the Board appointed Debra A. Cafaro to serve as a director

and on January 4, 2018, the Board appointed Linda R. Medler and Martin Pfinsgraff to serve as directors, in each case upon the recommendation of the Nominating and Governance Committee.

In addition, Kay Coles James resigned from the Board effective following the February 15, 2018 meeting of the Board due to a change in

Ms. James principal occupation.

Corporate governance guidelines

The Board has approved corporate governance guidelines that address important principles adopted by

the Board, including:

| |

|

The qualifications a director should possess |

| |

|

The director nomination process |

| |

|

The duties of our lead independent director (Presiding Director) |

| |

|

How the Board committees serve to support the Boards duties |

| |

|

A description of ordinary course relationships that will not impair a directors independence |

| |

|

The importance of the Board meeting in executive session without management present |

| |

|

The importance of the Board having access to management |

| |

|

The mandatory director retirement age (72)

|

| |

|

How the Board evaluates our CEOs performance |

| |

|

How the Board considers management succession planning |

| |

|

Our views on directors holding board positions at other public companies |

| |

|

How the Board continually evaluates its own performance |

| |

|

Our approach to director education |

| |

|

The Boards role in strategic planning |

| |

|

The Boards responsibility for oversight of significant corporate social responsibility issues |

The Nominating and Governance Committee reviews the corporate governance guidelines at least once a year. Any changes recommended by the Committee

are approved by the Board.

Our Board leadership structure

Based on an assessment of its current needs and composition, as well as the skills and

qualifications of the directors, the Board believes that the appropriate Board leadership structure should include the following attributes:

| |

|

A substantial majority (at least 2/3) of independent directors

|

| |

|

Regular executive sessions of all independent directors without management present |

The Boards current leadership structure includes all three attributes. The Board has not adopted a policy with respect to separating the Chairman and CEO positions. The Board believes that the leadership

THE PNC

FINANCIAL SERVICES GROUP, INC. - 2018 Proxy Statement 17

CORPORATE GOVERNANCE

structure should be flexible enough to accommodate different approaches based on an evaluation of relevant facts and circumstances. The Board considers its structure and leadership each year. The

Personnel and Compensation Committee discusses whether to separate the positions of Chairman and CEO as part of its ongoing evaluation of management succession plans.

William S. Demchak, our current CEO, also serves as Chairman of the Board. Donald J. Shepard, the Boards Presiding Director and Chair of the

Nominating and Governance Committee, serves as our lead independent director. We describe his duties in more detail below.

Substantial majority of independent directors. We have long maintained a Board with a substantial majority of directors who are not

PNC employees. The New York Stock Exchange (NYSE) requires at least a majority of our directors be independent from management.

Mr. Demchak is the only director who is not independent under the NYSEs bright-line tests for independence because he is

our CEO. The Board has affirmed the independence of each of our other 11 nominees for director. See Director and Executive Officer Relationships beginning on page 30 for a description of how we evaluate the independence of our directors,

including information about the NYSEs bright-line tests for independence.

Presiding Director duties. As the

Presiding Director, Mr. Shepard is the lead independent director for the Board. The Boards independent and non-management directors selected him for this role. The Board approved the following

duties for the Presiding Director, which are included in our corporate governance guidelines:

| |

|

Preside at meetings of the Board in the event of the Chairmans unavailability |

| |

|

Preside at regularly scheduled executive sessions of the Boards independent directors |

| |

|

When the Presiding Director considers it appropriate, convene and preside at meetings or executive sessions of the Boards independent directors |

| |

|

If the Board includes non-management directors who are not independent, when the Presiding Director considers it appropriate to do so, convene and preside at

meetings or executive sessions including such non-management directors |

| |

|

Convene and preside at meetings of the Board

|

| |

|

Confer with the Chairman or CEO immediately following the meetings or executive sessions of the Boards independent or non-management directors to

convey the substance of the discussions held during those sessions, subject to any limitations specified by the independent directors |

| |

|

Act as the principal liaison between the Chairman and the CEO and the Boards independent and non-management directors |

| |

|

Be available for confidential discussions with any director who may have concerns that he or she believes have not been properly considered by the Board as a whole |

| |

|

Following consultation with the Chairman, CEO and other directors as appropriate, approve the Boards meeting schedule and agendas, and the information provided to the Board, in order to

promote the effectiveness of the Boards operation and decision making and help ensure there is sufficient time for discussion of all agenda items |

| |

|

Be available for consultation and direct communication with major shareholders as appropriate |

| |

|

Discharge such other responsibilities as the Boards independent directors may assign from time to time |

During the course of the year, the Presiding Director may suggest, revise, or otherwise discuss agenda items for Board meetings with the Chairman

or CEO. In between meetings, each director is encouraged to raise any topics or issues with the Presiding Director that the director believes should be discussed in executive session.

As Chair of the Nominating and Governance Committee, the Presiding Director leads the Board and committee annual self-evaluation process and the

evaluation of the independence of directors. The Nominating and Governance Committee also reviews, and the Presiding Director as Chair of the Committee reports to the Board, significant developments in corporate governance.

Regular executive sessions of independent directors. Our independent directors have met and will continue to meet in regularly

scheduled executive sessions without management present. The NYSE requires our independent directors to meet in executive session at least once a year. Under the Boards own policy, our independent directors meet in executive session at least

quarterly. Our Presiding Director leads these executive sessions.

18 THE

PNC FINANCIAL SERVICES GROUP, INC. - 2018 Proxy Statement

CORPORATE GOVERNANCE

Communicating with the Board

Shareholders and other interested parties who wish to communicate with the Board, any director

(including the Presiding Director), the non-management or independent directors as a group, or any Board committee may send an email to corporate.secretary@pnc.com or a letter to the following address:

Presiding Director

The PNC Financial Services Group, Inc.

Board of Directors

P.O. Box 2705

Pittsburgh, Pennsylvania 15230-2705

The Corporate Secretary will forward the email communication to the appropriate director(s) named. The Corporate Secretary may elect not to

forward communications that she believes are: (i) a commercial, charitable, or other solicitation; (ii) a

complaint about PNC products or services that would be customarily handled in the ordinary course of business; (iii) abusive, improper, or otherwise irrelevant to the Boards duties and

responsibilities; or (iv) subject to the policies or procedures that specify the proper handling of a communication that addresses such subject matter.

The Corporate Secretary will not open the written communication addressed to the Board, any director (including the Presiding Director) or group

of directors, the non-management or independent directors as a group, or any Board committee. The Corporate Secretary will forward the communication to the Presiding Director who will determine how to respond.

Depending on the content, the Presiding Director may forward the communication to a PNC employee, a third party, another director, a Board committee, or the full Board.

Our Code of Business Conduct and Ethics

PNC has adopted, and the Audit Committee has approved, a Code of Business Conduct and Ethics that

applies generally to all employees and directors.

The Code of Business Conduct and Ethics addresses these important topics, among

others:

| |

|

Our commitment to ethics and values |

| |

|

Fair dealing with customers, suppliers, competitors, and employees |

| |

|

Conflicts and potential conflicts of interest |

| |

|

Self-dealing and outside employment |

| |

|

Insider trading and other trading restrictions |

| |

|

Gifts and entertainment |

| |

|

Creating business records, document retention, and protecting confidential information |

| |

|

Protection and proper use of our assets, including intellectual property and electronic media |

| |

|

Communicating with the public |

| |

|

Political contributions and fundraising |

| |

|

Compliance with laws and regulations

|

| |

|

Protection from retaliation |

The Code of Business Conduct and Ethics

is available on our website at www.pnc.com/corporategovernance. Any shareholder may also request a free printed copy by writing to our Corporate Secretary at the address provided on page 17.

Our adoption of the Code of Business Conduct and Ethics is intended to satisfy the Securities and Exchange Commissions (SEC) requirement to

adopt a code that applies to a companys CEO and senior financial officers. The Audit Committee must approve any waivers of or exceptions to code provisions granted to our directors or executive officers. We will post on our website any future

amendments to, or waivers from, a provision of the Code of Business Conduct and Ethics that applies to any of our directors or executive officers (including our Chairman and CEO, CFO, and Controller).

PNC has also adopted, and the Audit Committee has approved, Ethics Guidelines for Directors to supplement the Code of Business Conduct and Ethics.

Orientation and education

All of our new directors undergo a director orientation and education program. In addition to

written materials provided to new directors, in-person sessions are held with each new director. These in-person sessions generally include meetings with members of

senior management to familiarize

new directors with our strategic plans, significant financial, accounting, and risk management issues, capital markets activities, compliance programs, regulatory and legal matters, the Code of

Business Conduct and Ethics and related policies, principal officers, and internal and independent auditors, as

THE PNC

FINANCIAL SERVICES GROUP, INC. - 2018 Proxy Statement 19

CORPORATE GOVERNANCE

well as specific matters related to the Board committees or subcommittees to which a new director has been appointed.

We also provide a continuing education program for our directors that considers their knowledge and experience and our risk profile, and includes

training on complex products and services, our lines of business, significant risks to the company, applicable laws, regulations, and supervisory

requirements, and other relevant topics identified by the Board and management. The continuing education program is provided through a combination of

in-person sessions and coordination of attendance by directors at outside seminars relevant to the duties of a director. The in-person sessions may be held in connection

with, or as part of, a meeting of the Board or a Board committee.

Board committees

The Board currently has five standing committees. The four primary standing committeesAudit,

Nominating and Governance, Personnel and Compensation, and Riskmeet on a regular basis. The Executive Committee, which is composed of our CEO and the chairs of the four primary standing committees, meets as needed. The Executive Committee may

act on behalf of the Board and reports regularly to the full Board. Our Presiding Director chairs the Executive Committee, which did not meet in 2017.

Our By-laws provide that, unless otherwise stated in its charter, each committee may form and delegate its authority to subcommittees of one or more committee members. The Risk Committee has

formed a Technology Subcommittee to facilitate Board-level oversight of technology risk, technology risk management, cybersecurity, information security, business continuity, and significant technology initiatives and programs. The Risk Committee

has also formed a Compliance Subcommittee to facilitate Board-level oversight of compliance risk, significant compliance-related initiatives and programs, and the maintenance of a

strong compliance risk management culture. Our By-laws also authorize the Board to establish other committees.

Each committee operates under a written charter approved by the Board, and each subcommittee operates under a written charter approved by the

applicable committee. Each committee and subcommittee annually reviews and reassesses its charter. The Nominating and Governance Committee assesses the Executive Committee charter. Each committee and subcommittee, other than the Executive Committee,

performs an annual self-evaluation to determine whether it is functioning effectively and fulfilling its charter duties.

We describe

the main responsibilities of the Boards four primary standing committees below. The descriptions of the committee functions in this proxy statement are qualified by reference to the applicable committee charter and our relevant By-law provisions. The charters for the four primary standing Board committees are available on our website at www.pnc.com/corporategovernance.

20 THE

PNC FINANCIAL SERVICES GROUP, INC. - 2018 Proxy Statement

CORPORATE GOVERNANCE

Audit Committee

|

|

|

|

|

|

|

Chair |

|

Other members: |

| |

Richard B. Kelson

|

|

Debra A. Cafaro

|

| |

|

|

Marjorie Rodgers Cheshire |

| |

|

|

Martin Pfinsgraff |

| |

|

|

Donald J. Shepard |

| |

|

|

Gregory D. Wasson |

| |

|

|

|

The Audit Committee consists entirely of directors who are independent as

defined in the NYSEs corporate governance rules and in SEC regulations related to audit committee members. When the Board meets on April 24, 2018 to organize its committees, only independent directors will be appointed to the Committee.

The Board has determined that each Audit Committee member is financially literate and that at least

two members possess accounting or related financial management expertise. The Board made these determinations in its business judgment, based on its interpretation of the NYSEs requirements for audit committee members. Acting on the

recommendation of the Nominating and Governance Committee, the Board determined that each of Mr. Kelson and Mr. Wasson is an audit committee financial expert, as that term is defined by the SEC.

The Audit Committee satisfies the requirements of SEC Rule 10A-3, which

addresses the following topics:

| |

|

|

The independence of committee members |

|

| |

|

|

The responsibility for selecting and overseeing our independent auditors |

|

| |

|

|

The establishment of procedures for handling complaints regarding our accounting practices |

|

| |

|

|

The authority of the committee to engage advisors |

|

| |

|

|

The determination of appropriate funding for payment of the independent auditors and any outside advisors engaged by the committee and for the payment of the committees ordinary

administrative expenses |

|

The Board most recently approved the charter of the Audit Committee on

November 14, 2017, and it is available on our website at www.pnc.com/corporategovernance.

The Audit Committees primary purposes are to assist the Board by:

| |

|

|

Monitoring the integrity of our consolidated financial statements |

|

| |

|

|

Monitoring our internal control over financial reporting |

|

| |

|

|

Monitoring compliance with our Code of Business Conduct and Ethics |

|

| |

|

|

Evaluating and monitoring the qualifications and independence of our independent auditors |

|

| |

|

|

Evaluating and monitoring the performance of our internal audit function and our independent auditors |

|

At each in-person meeting of the

full Board, the Chair of the Audit Committee presents a report of the items discussed and actions approved at previous meetings of the Committee.

The Audit Committees responsibility is one of oversight. Our management is responsible for preparing our

consolidated financial statements, for maintaining internal controls, and for our compliance with laws and regulations, and the independent auditors are responsible for auditing our consolidated financial statements. The Audit Committee typically

reviews and approves the internal and external audit plans.

The Audit Committee has the authority to

retain independent legal, accounting, economic, or other advisors. The Committee is directly responsible for the selection, appointment, compensation, and oversight of our independent auditors (including the resolution of any disagreements that may

arise between management and the auditors regarding financial reporting) for the purpose of preparing or issuing an audit report or related work. The independent auditors report directly to the Committee. We describe the role of the Committee as it

relates to the independent auditors, including consideration of the rotation of the independent audit firm, in more detail on page 84

With respect to work performed by the independent auditors, the Audit Committee must pre-approve all audit engagement fees and terms, as well as all permitted non-audit engagements. The Committee (or its delegate)

pre-approves all audit services, audit-related services, and permitted non-audit services. The Committee also considers whether providing audit services, audit-related

services, and permitted non-audit services will impair the auditors independence. We describe the Committees procedures for the pre-approval of audit

services, audit-related services, and permitted non-audit services on page 85

THE PNC

FINANCIAL SERVICES GROUP, INC. - 2018 Proxy Statement 21

CORPORATE GOVERNANCE

The Audit Committee receives routine reports on finance, reserve adequacy, ethics, and internal

and external audit.

The Audit Committee also appoints our General Auditor, who leads our internal

audit function and reports directly to the Committee. The Committee holds regular executive sessions with management, the General Auditor, the Chief Ethics Officer, and the independent auditors. The Committee reviews the performance and approves the

compensation of the General Auditor, and annually reviews the General Auditor succession plan with the CEO.

Under our corporate governance guidelines, Audit Committee members may serve on the audit committees of no more than three public companies at the same time, including PNC.

The Audit Committee has approved the report on page 86 as required under its charter and in

accordance with SEC regulations.

22 THE

PNC FINANCIAL SERVICES GROUP, INC. - 2018 Proxy Statement

CORPORATE GOVERNANCE

Nominating and Governance Committee

|

|

|

|

|

|

|

Chair

Donald J. Shepard

|

|

Other members:

Charles E. Bunch

Dennis F. Strigl Michael J.

Ward

|

The Nominating and Governance Committee consists entirely of independent

directors. When the Board meets on April 24, 2018 to organize its committees, only independent directors will be appointed to the Nominating and Governance Committee.

Mr. Strigl will not stand for re-election to the Board at the annual

meeting and, following the annual meeting, will no longer be a member of the Nominating and Governance Committee.

The Board most recently approved the charter of the Nominating and Governance Committee on November 14, 2017, and it is available on our website at www.pnc.com/corporategovernance.

At each in-person meeting of the full Board, the Chair of the Nominating

and Governance Committee presents a report of the items discussed and actions approved at previous meetings of the Committee. The primary purpose of the Nominating and Governance Committee is to assist the Board in promoting the best interests of

PNC and its shareholders through the implementation of sound corporate governance principles and practices. The Committee also assists the Board by identifying individuals qualified to become Board members. The Committee recommends to the Board the

director nominees for each annual meeting of shareholders, and may also recommend the appointment of qualified individuals as directors between annual meetings.

In addition to conducting its annual committee self-evaluation, the Nominating and Governance Committee oversees

the annual evaluation of the performance of the Board and other Board committees and reports to the Board on the evaluation results as necessary or appropriate. The Committee also annually reviews and recommends any changes to the Executive

Committee charter.

How we evaluate directors and director candidates. At least

annually, the Nominating and Governance Committee assesses the skills, qualifications, and experience of our directors and recommends a slate of director nominees to the Board. From time to time, the Committee also considers whether to change the

composition of the Board. In evaluating existing directors or new director candidates, the Committee assesses the needs of the Board and the qualifications of the individual. See the discussion on pages 12 to 16 for additional information regarding

each of our current director nominees.

The Board and its committees must satisfy SEC, NYSE, and

banking regulatory standards. At least a majority of our directors must be independent under NYSE standards. Our corporate governance guidelines impose a more rigorous standard and require that a substantial majority (at least 2/3) of our directors

be independent. We require a sufficient number of independent directors to satisfy the membership needs of Board committees that also require independence.

The Nominating and Governance Committee expects directors to gain a sound understanding of our strategic vision,

our mix of businesses, and our approach to regulatory relations and risk management. The Board must possess a mix of qualities and skills adequate to address the various risks facing PNC. For a discussion of the Boards oversight of risk, see

Corporate GovernanceBoard committeesRisk Committee beginning on page 27.

The

Nominating and Governance Committee has not adopted any specific minimum qualifications for director candidates. When evaluating each director, as well as new director candidates for nomination, the Committee considers the following Board-approved

criteria:

| |

|

|

A sustained record of high achievement in financial services, business, industry, government, academia, the professions, or civic, charitable, or non-profit

organizations |

|

| |

|

|

Manifest competence and integrity |

|

| |

|

|

A strong commitment to the ethical and diligent pursuit of shareholders best interests |

|

| |

|

|

The strength of character necessary to challenge managements recommendations and actions when appropriate and to confirm the adequacy and completeness of managements responses to such

challenges to his or her satisfaction |

|

| |

|

|

The Boards strong desire to maintain its diversity in terms of race and gender |

|

THE PNC

FINANCIAL SERVICES GROUP, INC. - 2018 Proxy Statement 23

CORPORATE GOVERNANCE

| |

|

|

Personal qualities that will help to sustain an atmosphere of mutual respect and collegiality among the members of the Board |

|

The Nominating and Governance Committee also considers the diversity of

perspective, experience, knowledge, education, age, and skills of each director, as well as the current needs of the Board and its committees, meeting attendance and participation, and the value of a directors contribution to the effectiveness

of the Board and its committees.

Although the Board has not adopted a formal policy on diversity, the

Board recognizes the value of a diverse Board. Therefore, the Nominating and Governance Committee considers the diversity of directors in the context of the Boards overall needs. The Committee evaluates diversity in a broad sense, recognizing

the benefits of demographic diversity, but also considering the breadth of diverse backgrounds, skills, and experiences that directors may bring to the Board.

How we identify new directors. The Nominating and Governance Committee may identify potential

directors in a number of ways. The Committee may consider recommendations made by our current or former directors or members of executive management. The Committee may also identify potential directors through contacts in the business, civic,

academic, legal, and non-profit communities. When appropriate, the Committee may retain a search firm to identify candidates.

In addition, the Nominating and Governance Committee will consider director candidates recommended by our

shareholders for nomination at the next years annual meeting of shareholders. For the Committee to consider a director candidate recommended by a shareholder, the shareholder must submit the recommendation in writing to the Corporate Secretary

at our principal executive offices. The submission must include the information described under Director nomination process in Section 3 of our corporate governance guidelines, which can be found at

www.pnc.com/corporategovernance. To be considered for the 2019 annual meeting of shareholders, the submission must be received by November 13, 2018.

The Nominating and Governance Committee will evaluate director candidates recommended by a shareholder in the

same manner as candidates identified by the Committee or recommended by others. The Committee will not consider any candidate with an obvious impediment to serving as one of our directors.

The Nominating and Governance Committee will meet to consider relevant information regarding a director candidate

in light of the Board-approved evaluation criteria and the needs of the Board. If the Committee decides not to recommend a candidate for nomination or appointment, or for additional evaluation, no further action is taken. The Chair of the Committee

will later report that decision to the full Board, and in the case of a shareholder-recommended candidate, the Corporate Secretary will communicate the decision to the shareholder.

If the Nominating and Governance Committee decides to recommend a director candidate to the Board as a nominee

for election at an annual meeting of shareholders or for appointment by the Board, the Chair of the Committee will report that decision to the full Board. Following a discussion regarding the recommendation, the full Board will vote on whether to

nominate the candidate for election or appoint the candidate to the Board, as applicable. Invitations to join the Board are extended by the Chairman of the Board and the Presiding Director, jointly acting on behalf of the Board.

Shareholders who wish to nominate a director candidate directly at an annual meeting of

shareholders or nominate and include a director candidate in our annual meeting proxy materials must do so in accordance with the procedures contained in our By-laws, as described in Shareholder Proposals

for the 2019 Annual Meeting on page 94 under the headings Advance notice procedures and Proxy access procedures, respectively.

24 THE

PNC FINANCIAL SERVICES GROUP, INC. - 2018 Proxy Statement

CORPORATE GOVERNANCE

Personnel and Compensation Committee

|

|

|

|

|

|

|

Chair

Dennis F. Strigl

|

|

Other members:

Charles E. Bunch

Andrew T. Feldstein Richard B.

Kelson Michael J. Ward

|

The Personnel and Compensation Committee consists entirely of independent