DEF 14A: Definitive proxy statements

Published on March 15, 2017

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

| ☑ Filed by the Registrant |

☐ Filed by a Party other than the Registrant |

| Check the appropriate box: |

||

| ☐ |

Preliminary Proxy Statement | |

| ☐ |

CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14a-6(e)(2)) | |

| ☑ |

Definitive Proxy Statement | |

| ☐ |

Definitive Additional Materials | |

| ☐ |

Soliciting Material under §240.14a-12 | |

THE PNC FINANCIAL SERVICES GROUP, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

| Payment of Filing Fee (Check the appropriate box): |

||

| ☑ |

No fee required. | |

| ☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| (1) Title of each class of securities to which transaction applies: | ||

| (2) Aggregate number of securities to which transaction applies: | ||

| (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | ||

| (4) Proposed maximum aggregate value of transaction: | ||

| (5) Total fee paid: | ||

| ☐ |

Fee paid previously with preliminary materials. | |

| ☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) Amount Previously Paid: | ||

| (2) Form, Schedule or Registration Statement No.: | ||

| (3) Filing Party: | ||

| (4) Date Filed: | ||

Table of Contents

2017 PROXY STATEMENT THE PNC FINANCIAL SERVICES GROUP Together, We Prosper

Table of Contents

|

|

LETTER FROM THE CHAIRMAN AND

|

Table of Contents

PARTICIPATE IN THE FUTURE OF PNC PLEASE CAST YOUR VOTE

Your vote is important to us and we want your shares to be represented at the annual meeting. Please cast your vote on the proposals listed below.

Under New York Stock Exchange (NYSE) rules, if you hold your shares through a broker, bank, or other nominee (street name), and you do not provide any voting instructions, your broker has discretionary authority to vote on your behalf for items that are considered routine. The only routine item on this years ballot is the ratification of our auditor selection. If an item is non-routine and you do not provide voting instructions, no vote will be cast on your behalf.

Proposals requiring your vote

| More information |

Board recommendation |

Routine item? |

||||||

| Item 1 | Election of 13 nominated directors | Page 11 |

FOR each nominee |

No | ||||

|

Item 2 |

Ratification of independent registered public accounting firm for 2017 |

Page 80 |

FOR |

Yes |

||||

|

Item 3 |

Advisory approval of the compensation of PNCs named executive officers (say-on-pay) |

Page 83 |

FOR |

No |

||||

|

Item 4 |

Advisory approval of the frequency of future votes on executive compensation (frequency of say-on-pay) |

Page 85 |

FOR one year |

No |

||||

|

Item 5 |

Shareholder proposal requesting additional diversity disclosure, if properly presented |

Page 86 |

AGAINST |

No |

With respect to each item, a majority of the votes cast will be required for approval. Abstentions will not be included in the total votes cast and will not affect the results.

Vote your shares

Please read this proxy statement with care and vote right away. We offer a number of ways for you to vote your shares. We include voting instructions in the Notice of Availability of Proxy Materials and the proxy card. If you hold shares in street name, you will receive information on how to give voting instructions to your broker or bank. For registered holders, we offer the following methods to vote your shares and give us your proxy:

|

|

|

||

| www.envisionreports.com/PNC | Follow the instructions on the proxy card. |

Complete, sign and date the proxy card and return it in the envelope provided. |

||

Attend our 2017 Annual Meeting of Shareholders

| Directions to attend the annual meeting | Tuesday, April 25, 2017 at 11:00 a.m. | |

| are available at | The Tower at PNC Plaza James E. Rohr Auditorium | |

| www.pnc.com/annualmeeting | 300 Fifth Avenue | |

| Pittsburgh, Pennsylvania 15222 |

4 THE PNC FINANCIAL SERVICES GROUP, INC. - 2017 Proxy Statement

Table of Contents

PROXY STATEMENT SUMMARY

Proxy Statement Summary

To assist you in reviewing the proposals to be acted upon, we have included a summary of certain information. This summary does not contain all of the information that you should consider, and you should review our entire proxy statement and the 2016 Annual Report before you vote.

You may also read our proxy statement and 2016 Annual Report at www.envisionreports.com/PNC.

Who can vote (page 89)

You are entitled to vote if you were a shareholder on the record date of February 3, 2017.

How to vote (page 90)

We offer our shareholders a number of ways to vote, including by Internet, telephone, or mail. Shareholders may also vote in person at the annual meeting.

Voting matters

Item 1: Election of 13 nominated directors (page 11)

| | The proxy statement contains important information about the experience, qualifications, attributes, and skills of the 13 nominees to our Board of Directors. Our Boards Nominating and Governance Committee performs an annual assessment to confirm that our directors continue to have the skills and experience to serve PNC, and that our Board and its committees continue to be effective in carrying out their duties. |

| | Our Board recommends that you vote FOR all 13 director nominees. |

Item 2: Ratification of independent registered public accounting firm for 2017 (page 80)

| | Each year, our Boards Audit Committee selects PNCs independent registered public accounting firm. For 2017, the Audit Committee selected PricewaterhouseCoopers LLP (PwC) to fulfill this role. |

| | Our Board recommends that you vote FOR the ratification of the Audit Committees selection of PwC as our independent registered public accounting firm for 2017. |

Item 3: Say-on-pay (page 83)

| | We ask shareholders to cast a non-binding advisory vote on our executive compensation program known generally as the say-on-pay vote. We have offered an annual say-on-pay vote since 2009. Last year, 97% of the votes cast by our shareholders supported our executive compensation program, and PNC has averaged 92% support in its say-on-pay votes over the past five years. |

| | We recommend that you read the Compensation Discussion and Analysis (CD&A) (beginning on page 38), which explains how and why our Boards Personnel and Compensation Committee made executive compensation decisions for 2016. |

| | Our Board recommends that you vote FOR the non-binding advisory vote on executive compensation (say-on-pay). |

Item 4: Frequency of say-on-pay (page 85)

| | We ask shareholders to cast a non-binding advisory vote on the frequency of future votes on our executive compensation program. After our shareholders voted in 2011 recommending that we hold an annual say-on-pay vote, the Board affirmed that recommendation and elected to hold future say-on-pay votes on an annual basis. We are once again soliciting input from our shareholders on how frequently we should hold a say-on-pay vote in the future. You may vote for a say-on-pay vote to be held every one, two or three years, or you may abstain from voting. |

| | Our Board recommends that you vote FOR a frequency of ONE YEAR for future advisory votes on executive compensation. |

Item 5: Shareholder proposal requesting additional diversity disclosure (page 86)

| | You are asked to consider a shareholder proposal described in this proxy statement. The proposal requests PNC to prepare a diversity report including a chart identifying employees according to gender and race in major Equal Employment Opportunity Commission-defined job categories and certain other diversity disclosures. |

| | Our Board recommends that you vote AGAINST the shareholder proposal. |

THE PNC FINANCIAL SERVICES GROUP, INC. - 2017 Proxy Statement 5

Table of Contents

PROXY STATEMENT SUMMARY

2016 PNC performance (page 38)

|

|

We delivered consistent results in a challenging operating environment, with net income of approximately $4.0 billion and diluted earnings per common share of $7.30. | |

|

|

We grew net interest income despite the low interest rate environment, and we increased our fee income. We grew deposits and loans and managed our loan portfolio within our desired risk appetite. We maintained strong capital and liquidity positions. | |

|

|

We delivered value for our shareholders. Our one-year total shareholder return (TSR) was 25.8% and our three-year TSR was 17.3%, which was the highest in our peer group. | |

|

|

We met our continuous improvement goal of $400 million in expense savings and continued to keep our noninterest expenses stable. | |

|

|

We continued to execute against our strategic priorities of building a leading banking franchise in our underpenetrated markets, capturing more investable assets, reinventing the retail banking experience, and bolstering critical infrastructure and streamlining core processes. | |

|

|

We returned more than $3 billion in capital to our shareholders through share repurchases and common stock dividends, including raising the quarterly common stock dividend. | |

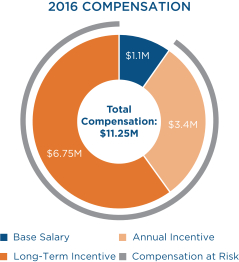

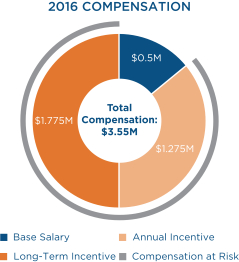

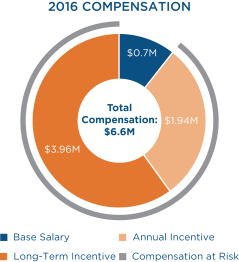

2016 compensation decisions (page 46)

The table below shows, for each named executive officer, the incentive compensation target for 2016 and the actual annual cash incentive and long-term equity-based incentives awarded in 2017 for 2016 performance.

| William S. Demchak |

Robert Q. Reilly |

Michael P. Lyons |

E William Parsley, III |

Steven C. Van Wyk |

||||||||||||||||

| Incentive compensation target |

$ | 10,500,000 | $ | 3,000,000 | $ | 6,050,000 | $ | 6,900,000 | $ | 2,750,000 | ||||||||||

| Incentive compensation awarded for 2016 performance |

$ | 10,150,000 | $ | 3,050,000 | $ | 5,900,000 | $ | 6,600,000 | $ | 2,660,000 | ||||||||||

| Annual cash incentive portion |

$ | 3,400,000 | $ | 1,275,000 | $ | 1,940,000 | $ | 2,250,000 | $ | 1,080,000 | ||||||||||

| Long-term incentive portion |

$ | 6,750,000 | $ | 1,775,000 | $ | 3,960,000 | $ | 4,350,000 | (1) | $ | 1,580,000 | |||||||||

| Incentive compensation disclosed in the Summary compensation table(2) |

$ | 11,200,000 | $ | 3,175,000 | $ | 6,020,000 | $ | 7,050,000 | $ | 2,680,000 | ||||||||||

| Annual cash incentive portion (2016 performance) |

$ | 3,400,000 | $ | 1,275,000 | $ | 1,940,000 | $ | 2,250,000 | $ | 1,080,000 | ||||||||||

| Long-term incentive portion (2015 performance) |

$ | 7,800,000 | $ | 1,900,000 | $ | 4,080,000 | $ | 4,800,000 | $ | 1,600,000 | ||||||||||

| (1) | Mr. Parsleys incentive compensation target and award includes two grants the grant of equity-based awards that all other NEOs would otherwise receive (with a target value of $3,000,000) and a separate grant of incentive performance units related to the management of our Asset & Liability Management (ALM) unit, with a target value of $1,500,000. Please see page 61 for a discussion of Mr. Parsleys ALM units. |

| (2) | Due to SEC regulations, the incentive compensation amounts disclosed in the Summary compensation table on page 56 include the cash incentive award paid in 2017 (for 2016 performance) and the long-term incentive award granted in 2016 (for 2015 performance). |

PNC governance (page 17)

| | You can find out more about our governance policies and principles at www.pnc.com/corporategovernance. |

| | Our entire Board is re-elected every year; we have no staggered elections. |

| | Our Board is subject to a majority voting requirement; any director not receiving a majority of votes in an uncontested election must tender his or her resignation to the Board. |

| | Our corporate governance guidelines require the Board to have a substantial majority (at least 2/3) of independent directors. Currently, 12 out of 13 directors (92%) are independent, and our only non-independent director is our CEO. All of our current directors are nominees to the Board. |

| | Our Board has had a Presiding Director, a lead independent director with specific duties, since 2004. |

| | Our Presiding Director approves Board meeting schedules and agendas. |

| | Our Board meets regularly in executive session, with no members of management present. |

6 THE PNC FINANCIAL SERVICES GROUP, INC. - 2017 Proxy Statement

Table of Contents

PROXY STATEMENT SUMMARY

| | In 2016, our Board met 13 times and each of our directors attended at least 75% of the aggregate number of meetings of the Board and the committees on which he or she served. The average attendance of all directors at Board and committee meetings was 97%. All current directors then serving attended our 2016 Annual Meeting of Shareholders. |

We have four primary standing board committees:

| | Audit Committee |

| | Personnel and Compensation Committee (Compensation) |

| | Nominating and Governance Committee (Governance) |

| | Risk Committee |

Board nominees (page 11)

| Name | Age | Director since | Independent | Primary Standing Committee Memberships | ||||

| Charles E. Bunch |

67 | 2007 | ☑ | Compensation; Governance |

||||

| Marjorie Rodgers Cheshire |

48 | 2014 | ☑ | Audit; Risk |

||||

| William S. Demchak |

54 | 2013 | ☐ | Risk |

||||

| Andrew T. Feldstein |

52 | 2013 | ☑ | Compensation; Risk (Chair) |

||||

| Daniel R. Hesse |

63 | 2016 | ☑ | Risk |

||||

| Kay Coles James |

67 | 2006 | ☑ | Governance; Risk |

||||

| Richard B. Kelson |

70 | 2002 | ☑ | Audit (Chair); Compensation |

||||

| Jane G. Pepper |

71 | 1997 | ☑ | Risk |

||||

| Donald J. Shepard |

70 | 2007 | ☑ | Audit; Governance (Chair); Risk |

||||

| Lorene K. Steffes |

71 | 2000 | ☑ | Risk |

||||

| Dennis F. Strigl |

70 | 2001 | ☑ | Compensation (Chair); Governance |

||||

| Michael J. Ward |

66 | 2016 | ☑ | Compensation; Governance |

||||

| Gregory D. Wasson |

58 | 2015 | ☑ | Audit |

THE PNC FINANCIAL SERVICES GROUP, INC. - 2017 Proxy Statement 7

Table of Contents

| NOTICE OF ANNUAL MEETING OF SHAREHOLDERS | 10 | |||

| ELECTION OF DIRECTORS (ITEM 1) | 11 | |||

| CORPORATE GOVERNANCE | 17 | |||

| 17 | ||||

| 17 | ||||

| 18 | ||||

| 19 | ||||

| 19 | ||||

| 19 | ||||

| 28 | ||||

| DIRECTOR AND EXECUTIVE OFFICER RELATIONSHIPS | 29 | |||

| 29 | ||||

| 31 | ||||

| 32 | ||||

| 32 | ||||

| 33 | ||||

| 33 | ||||

| RELATED PERSON TRANSACTIONS | 34 | |||

| 34 | ||||

| 34 | ||||

| SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE | 35 | |||

| DIRECTOR COMPENSATION | 35 | |||

| 36 | ||||

| COMPENSATION DISCUSSION AND ANALYSIS | 38 | |||

| 38 | ||||

| 38 | ||||

| 39 | ||||

| 40 | ||||

| 44 | ||||

| 48 | ||||

| COMPENSATION COMMITTEE REPORT | 53 | |||

| COMPENSATION AND RISK | 54 | |||

| 54 | ||||

| 55 | ||||

8 THE PNC FINANCIAL SERVICES GROUP, INC. - 2017 Proxy Statement

Table of Contents

THE PNC FINANCIAL SERVICES GROUP, INC. - 2017 Proxy Statement 9

Table of Contents

|

of Shareholders

|

Tuesday, April 25, 2017

11:00 a.m. (Eastern time)

The Tower at PNC Plaza James E. Rohr Auditorium, 300 Fifth Avenue, Pittsburgh, Pennsylvania 15222

WEBCAST

A listen-only webcast of our annual meeting will be available at www.pnc.com/annualmeeting. An archive of the webcast will be available on our website for thirty days.

CONFERENCE CALL

You may access the listen-only conference call of the annual meeting by calling 877-272-3498 or 303-223-4384 (international). A telephone replay will be available for one week by calling 800-633-8284 or 402-977-9140 (international), conference ID 21843204.

ITEMS OF BUSINESS

| 1. | Electing as directors the 13 nominees named in the proxy statement that follows, to serve until the next annual meeting and until their successors are elected and qualified; |

| 2. | Ratifying the Audit Committees selection of PricewaterhouseCoopers LLP as PNCs independent registered public accounting firm for 2017; |

| 3. | An advisory vote to approve named executive officer compensation; |

| 4. | An advisory vote to approve the frequency of future votes on executive compensation; |

| 5. | Considering a shareholder proposal requesting additional diversity disclosure, if properly presented before the meeting; and |

| 6. | Such other business as may properly come before the meeting. |

RECORD DATE

The close of business on February 3, 2017 is the record date for determining shareholders entitled to receive notice of and to vote at the meeting and any adjournment.

MATERIALS TO REVIEW

We began providing access to this proxy statement and a form of proxy card on March 15, 2017. We have made our proxy materials available electronically. Certain shareholders will receive a notice explaining how to access our proxy materials and vote. Other shareholders will receive a paper copy of this proxy statement and a proxy card.

PROXY VOTING

Even if you plan to attend the annual meeting in person, we encourage you to cast your vote over the Internet, or if you have a proxy card, by mailing the completed proxy card or by telephone. This Notice of Annual Meeting and Proxy Statement and our 2016 Annual Report are available at www.envisionreports.com/PNC.

ADMISSION

To be admitted to our annual meeting you must present proof of your stock ownership as of the record date and valid photo identification. Each shareholder may bring one guest who must present valid photo identification. Please follow the admission procedures described beginning on page 88 of this proxy statement.

| March 15, 2017 By Order of the Board of Directors, |

Christi Davis

Corporate Secretary

10 THE PNC FINANCIAL SERVICES GROUP, INC. - 2017 Proxy Statement

Table of Contents

ELECTION OF DIRECTORS (ITEM 1)

THE PNC FINANCIAL SERVICES GROUP, INC. - 2017 Proxy Statement 11

Table of Contents

ELECTION OF DIRECTORS (ITEM 1)

12 THE PNC FINANCIAL SERVICES GROUP, INC. - 2017 Proxy Statement

Table of Contents

ELECTION OF DIRECTORS (ITEM 1)

THE PNC FINANCIAL SERVICES GROUP, INC. - 2017 Proxy Statement 13

Table of Contents

ELECTION OF DIRECTORS (ITEM 1)

14 THE PNC FINANCIAL SERVICES GROUP, INC. - 2017 Proxy Statement

Table of Contents

ELECTION OF DIRECTORS (ITEM 1)

THE PNC FINANCIAL SERVICES GROUP, INC. - 2017 Proxy Statement 15

Table of Contents

ELECTION OF DIRECTORS (ITEM 1)

16 THE PNC FINANCIAL SERVICES GROUP, INC. - 2017 Proxy Statement

Table of Contents

Corporate governance guidelines

Our Board leadership structure

THE PNC FINANCIAL SERVICES GROUP, INC. - 2017 Proxy Statement 17

Table of Contents

CORPORATE GOVERNANCE

18 THE PNC FINANCIAL SERVICES GROUP, INC. - 2017 Proxy Statement

Table of Contents

CORPORATE GOVERNANCE

Our Code of Business Conduct and Ethics

THE PNC FINANCIAL SERVICES GROUP, INC. - 2017 Proxy Statement 19

Table of Contents

CORPORATE GOVERNANCE

20 THE PNC FINANCIAL SERVICES GROUP, INC. - 2017 Proxy Statement

Table of Contents

CORPORATE GOVERNANCE

Audit Committee

|

Chair | Other members: | ||

|

Richard B. Kelson |

Marjorie Rodgers Cheshire |

|||

| Donald J. Shepard | ||||

| Gregory D. Wasson | ||||

The Audit Committee consists entirely of directors who are independent as defined in the NYSEs corporate governance rules and in the regulations of the Securities and Exchange Commission related to audit committee members. When our Board meets on April 25, 2017 to organize its committees, only independent directors will be appointed to the Committee.

The Board has determined that each Audit Committee member is financially literate and that at least two members possess accounting or related financial management expertise. The Board made these determinations in its business judgment, based on its interpretation of the NYSEs requirements for committee members. Acting on the recommendation of the Nominating and Governance Committee, the Board of Directors determined that Mr. Kelson and Mr. Wasson are each an audit committee financial expert, as that term is defined by the SEC.

Our Board most recently approved the charter of the Audit Committee on November 17, 2016, and it is available on our website.

The Audit Committee satisfies the requirements of SEC Rule 10A-3, which includes the following topics:

| | The independence of committee members |

| | The responsibility for selecting and overseeing our independent auditors |

| | The establishment of procedures for handling complaints regarding our accounting practices |

| | The authority of the committee to engage advisors |

| | The determination of appropriate funding for payment of the independent auditors and any outside advisors engaged by the committee and for the payment of the committees ordinary administrative expenses |

The Audit Committees primary purposes are to assist the Board by:

| | Monitoring the integrity of our consolidated financial statements |

| | Monitoring internal control over financial reporting |

| | Monitoring compliance with our Code of Business Conduct and Ethics |

| | Evaluating and monitoring the qualifications and independence of our independent auditors |

| | Evaluating and monitoring the performance of our internal audit function and our independent auditors |

At each in-person meeting of our full Board, the Chair of the Committee presents a report of the items discussed and the actions approved at previous meetings.

The Audit Committees responsibility is one of oversight. Our management is responsible for preparing our consolidated financial statements, for maintaining internal controls, and for our compliance with laws and regulations, and the independent auditors are responsible for auditing our consolidated financial statements.

The Committee typically reviews and approves the internal and external audit plans. The Committee is directly responsible for the selection, appointment, compensation and oversight of our independent auditors (including the resolution of any disagreements between management and the auditors regarding financial reporting if disagreements occur) for the purpose of preparing or issuing an audit report or related work. We describe the role of the Committee in regard to the independent auditors, including consideration of rotation of the independent audit firm, in more detail on page 80. For work performed by the independent auditors, the Committee must pre-approve all audit engagement fees and terms, as well as all permitted non-audit engagements. The Committee (or delegate) pre-approves all audit services, audit-related services, and permitted non-audit services. The Committee considers whether providing audit services, audit-related services, and permitted non-audit services will impair the auditors independence.

THE PNC FINANCIAL SERVICES GROUP, INC. - 2017 Proxy Statement 21

Table of Contents

CORPORATE GOVERNANCE

We describe the Committees procedures for the pre-approval of audit services, audit-related services, and permitted non-audit services on page 81. The Committee receives routine reports on finance, reserve adequacy, ethics, and internal and external audit.

The Committee has the authority to retain independent legal, accounting, economic, or other advisors. The Committee holds regular executive sessions with our management, the General Auditor, the Chief Ethics Officer, and the independent auditors. The independent auditors report directly to the Committee. The Committee annually reviews with the CEO the General Auditor succession plan. The Committee appoints our General Auditor, who leads PNCs internal audit function and reports directly to the Committee. The Committee reviews the performance and approves the compensation of our General Auditor.

Under our corporate governance guidelines, Audit Committee members may serve on the audit committee of no more than three public companies, including PNC.

The Audit Committee has approved the report on page 82 as required under its charter and in accordance with SEC regulations.

22 THE PNC FINANCIAL SERVICES GROUP, INC. - 2017 Proxy Statement

Table of Contents

CORPORATE GOVERNANCE

Nominating and Governance Committee

|

Chair | Other members: | ||

|

Donald J. Shepard |

Charles E. Bunch |

|||

| Kay Coles James | ||||

| Dennis F. Strigl | ||||

| Michael J. Ward | ||||

The Nominating and Governance Committee consists entirely of independent directors. When our Board meets on April 25, 2017, only independent directors will be appointed to the Committee.

Our Board most recently approved the charter of the Nominating and Governance Committee on November 17, 2016, and it is available on our website.

At each in-person meeting of our full Board, the Chair of the Committee presents a report of the items discussed and the actions approved at previous meetings. The primary purpose of our Nominating and Governance Committee is to assist our Board in promoting the best interests of PNC and its shareholders through the implementation of sound corporate governance principles and practices. The Committee also assists the Board by identifying individuals qualified to become Board members. The Committee recommends to the Board the director nominees for each annual meeting, and may also recommend the appointment of qualified individuals as directors between annual meetings.

In addition to its annual committee self-evaluation, the Nominating and Governance Committee oversees the annual evaluation of the performance of the Board and committees and reports to the Board on the evaluation results, as necessary or appropriate. The Committee annually reviews and recommends any changes to the Executive Committee charter.

How we evaluate directors and candidates. At least annually, the Committee assesses the skills, qualifications and experience of our directors and recommends a slate of nominees to the Board. From time to time, the Committee also considers whether to change the composition of our Board. In evaluating existing directors or new candidates, the Committee assesses the needs of the Board and the qualifications of the individual. Please see the discussion on pages 12 to 16 for more information on each of our current director nominees.

Our Board and its committees must satisfy SEC, NYSE, and banking regulatory standards. At least a majority of our directors must be independent under the NYSE standards; however, our corporate governance guidelines require that a substantial majority (at least 2/3) of our directors be independent. We require a sufficient number of independent directors to satisfy the membership needs of committees that also require independence.

Beyond that, the Nominating and Governance Committee expects directors to gain a sound understanding of our strategic vision, our mix of businesses, and our approach to regulatory relations and risk management. The Board must possess a mix of qualities and skills to address the various risks facing PNC. For a discussion of our Boards oversight of risk, please see the section entitled Risk Committee, on pages 27 and 28.

The Committee has not adopted any specific, minimum qualifications for director candidates. When evaluating each director, as well as new candidates for nomination, the Committee considers the following Board-approved criteria:

| | A sustained record of high achievement in financial services, business, industry, government, academia, the professions, or civic, charitable, or non-profit organizations |

| | Manifest competence and integrity |

| | A strong commitment to the ethical and diligent pursuit of shareholders best interests |

| | The strength of character necessary to challenge managements recommendations and actions when appropriate and to confirm the adequacy and completeness of managements responses to such challenges to his or her satisfaction |

| | Our Boards strong desire to maintain its diversity in terms of race and gender |

| | Personal qualities that will help to sustain an atmosphere of mutual respect and collegiality among the members of our Board |

THE PNC FINANCIAL SERVICES GROUP, INC. - 2017 Proxy Statement 23

Table of Contents

CORPORATE GOVERNANCE

The Committee also considers the diversity, age, skills, experience in the context of the current needs of the Board and its committees, meeting attendance and participation, and the value of a directors contributions to the effectiveness of our Board and its committees.

Although the Board has not adopted a formal policy on diversity, the Board recognizes the value of a diverse Board. Therefore, the Committee considers the diversity of directors in the context of the Boards overall needs. The Committee evaluates diversity in a broad sense, recognizing the benefits of demographic diversity, but also considering the breadth of diverse backgrounds, skills, and experiences that directors may bring to our Board.

How we identify new directors. The Nominating and Governance Committee may identify potential directors in a number of ways. The Committee may consider recommendations made by current or former directors or members of executive management. The Committee may also identify potential directors through contacts in the business, civic, academic, legal and non-profit communities. When appropriate, the Committee may retain a search firm to identify candidates.

In addition, the Committee will consider director candidates recommended by our shareholders for nomination at next years annual meeting. For the Committee to consider a director candidate for nomination, the shareholder must submit the recommendation in writing to the Corporate Secretary at our principal executive office. Each submission, to be considered for the 2018 annual meeting, must include the information required under Director nomination process in Section 3 of our corporate governance guidelines found at www.pnc.com/corporategovernance and must be received by November 15, 2017.

The Committee will evaluate candidates recommended by a shareholder in the same manner as candidates identified by the Committee or recommended by others. The Committee will not consider any candidate with an obvious impediment to serving as one of our directors.

The Committee will meet to consider relevant information regarding a director candidate, in light of the Board approved evaluation criteria and needs of our Board. If the Committee does not recommend a candidate for nomination or appointment, or for more evaluation, no further action is taken. The Chair of the Committee will later report this decision to the full Board. For shareholder-recommended candidates, the Corporate Secretary will communicate the decision to the shareholder.

If the Committee decides to recommend a candidate to our Board as a nominee for election at an annual meeting of shareholders or for appointment by our Board, the Chair of the Committee will report that decision to the full Board. After allowing for a discussion, the full Board will vote on whether to nominate the candidate for election or appoint the candidate to the Board.

As our corporate governance guidelines describe, invitations to join the Board come from the Presiding Director and the Chairman, jointly acting on behalf of our Board.

Shareholders who wish to directly nominate a director candidate at an annual meeting or nominate and include a candidate in PNCs annual meeting proxy materials must do so in accordance with the procedures contained in our By-laws and should follow the instructions in the section entitled Shareholder proposals for 2018 annual meetingAdvance notice procedures or Proxy access procedures, respectively, on page 93.

24 THE PNC FINANCIAL SERVICES GROUP, INC. - 2017 Proxy Statement

Table of Contents

CORPORATE GOVERNANCE

Personnel and Compensation Committee

|

Chair | Other members: | ||

|

Dennis F. Strigl |

Charles E. Bunch |

|||

| Andrew T. Feldstein | ||||

| Richard B. Kelson | ||||

| Michael J. Ward | ||||

The Personnel and Compensation Committee consists entirely of independent directors. The Committee membership is intended to satisfy the independence standards established by applicable federal income tax and securities laws, as well as NYSE standards. When our Board meets on April 25, 2017, only independent directors will be appointed to the Committee.

Our Board most recently approved the charter of the Committee on November 17, 2016, and it is available on our website.

The Committees principal purpose is to discharge our Boards oversight responsibilities relating to the compensation of our executive officers and other specified responsibilities related to personnel and compensation matters affecting PNC. The Committee may also evaluate and approve, or recommend for approval, benefit, incentive compensation, severance, equity-based or other compensation plans, policies, and programs.

The Committee has the authority to retain independent legal, compensation, accounting, or other advisors. The charter provides the Committee with the sole authority to retain and terminate an independent compensation consultant acting on the Committees behalf, and to approve the consultants fees and other retention terms. The Committee retained an independent compensation consultant in 2016 and prior years. See Role of compensation consultants below.

The Committee also reviews the Compensation Discussion and Analysis (CD&A) section of the proxy statement with management. See the Compensation Committee Report on page 53. The CD&A begins on page 38. The Committee evaluates the relationship between risk management and our incentive compensation programs and plans. See Compensation and Risk on pages 54 and 55.

The Committee has responsibility for reviewing and evaluating the development of an executive management succession plan and for reviewing our workforce diversity objectives. The executive management succession plan, including for the CEO, is reviewed with the full Board from time to time. The Committee reviews a detailed succession planning report at least annually. The materials typically include a discussion of the individual performance of executive officers as well as succession plans and development initiatives for other emerging talent. These materials provide necessary background and context to the Committee, and give each member a familiarity with the employees position, duties, responsibilities, and performance.

How we make decisions. The Committee meets at least four times a year. Before each meeting, the Chair of the Committee reviews the agenda, materials, and issues with members of our management and the Committees independent executive compensation consultant, as appropriate. The Committee may invite legal counsel or other external consultants to advise the Committee during meetings and preparatory sessions.

The Committee regularly meets in executive sessions without management present. At each in-person meeting of our full Board, the Chair of the Committee presents a report of the items discussed and the actions approved at previous meetings. The Chair provides these reports during an executive session of the Board. The Committee consults with independent directors before approving the CEOs compensation.

The Committee adopted guidelines for information that will be presented to the Committee. The guidelines contemplate, among other things, that any major changes in policies or programs be considered over the course of two separate Committee meetings, with any vote occurring at the later meeting.

The Committee reviews all of the elements of the compensation programs periodically and adjusts those programs as appropriate. Each year, the Committee makes decisions regarding the amount of annual compensation and equity-based or other longer-term compensation for our executive officers and other designated senior employees. For the most part, these decisions are made in the first quarter of each year, following the evaluation of the prior years performance.

THE PNC FINANCIAL SERVICES GROUP, INC. - 2017 Proxy Statement 25

Table of Contents

CORPORATE GOVERNANCE

Delegations of authority. The Committee has delegated authority to management to make certain decisions or to take certain actions with respect to compensation or benefit plans or arrangements (other than those that are solely or predominantly for the benefit of executive officers).

For employee benefit, bonus, incentive compensation, severance, equity-based and other compensation or incentive plans and arrangements, the Committee delegated to our Chief Human Resources Officer (or her designee) the ability to adopt a new plan or arrangement or amend an existing one if:

| | the decision is not expected to result in a material increase in incremental expense to PNC, defined as an expense that exceeds 5% of the relevant expense for that plan category, or |

| | the change is of a technical nature or is otherwise not material. |

This delegation also includes authority to take certain actions to implement, administer, interpret, construe or make eligibility determinations under the plans and arrangements except for plans that are overseen by the PNC administrative committee under its charter.

For grants of equity or equity-based awards, the Committee has delegated to our Chief Executive Officer and our Chief Human Resources Officer (or the designee of either) the responsibility to make decisions with respect to equity grants for individuals who are not designated by the Committee as executives, including the determination of participants and grant sizes, allocation of the pool from which grants will be made, establishment of the terms of such grants, approval of amendments to outstanding grants and exercise of any discretionary authority pursuant to the terms of the grants.

The Committee has also delegated to the Audit Committee (or a qualified subcommittee) and to a qualified subcommittee of the Risk Committee the authority to make equity-based grants and other compensation under applicable plans to the General Auditor and Chief Risk Officer, respectively.

Managements role in compensation decisions. Our executive officers, including our CEO and our Chief Human Resources Officer, often review information with the Committee during meetings and may present managements views or recommendations. The Committee evaluates these recommendations, generally in consultation with an independent compensation consultant retained by the Committee, who attends each meeting.

The Chair of the Committee typically meets with management and an independent compensation consultant before each Committee meeting to discuss agenda topics, areas of focus, or outstanding issues. The Chair schedules other meetings with the Committees compensation consultant without management present, as needed. Occasionally, management will schedule meetings with each Committee member to discuss substantive issues. For more complicated issues, these one-on-one meetings provide a dedicated forum for Committee members to ask questions outside of the meeting environment.

During Committee meetings, the CEO often reviews corporate and individual performance as part of the compensation discussions, and other members of executive management may be invited to speak to the Committee about specific performance or risk management. The Committee reviews any compensation decisions for the Chief Human Resources Officer and CEO in executive session, without either officer present for the discussion of their compensation. Any recommendations for CEO compensation are also discussed with the full Board, with no members of management present for the discussion.

Role of compensation consultants. The Committee has the sole authority to retain and terminate any compensation consultant directly assisting it. The Committee also has the sole authority to approve fees and other engagement terms. The Committee receives comparative compensation data from our management, from proxy statements and other public disclosures, and through surveys and reports prepared by compensation consultants.

The Committee retained Meridian Compensation Partners as its independent compensation consultant for 2016. In this capacity, Meridian reported directly to the Committee. In 2016, one or more representatives attended all of the in-person and telephonic meetings of the Committee, and met regularly with the Committee without members of management present. Meridian also reviewed meeting agendas and materials prepared by management.

Meridian and members of management assisted the Committee in its review of proposed compensation packages for our executive officers. For the 2016 performance year, Meridian prepared discussion materials for the compensation of the CEO, which were reviewed in executive session without any members of management present. Meridian also prepared other benchmarking reviews and pay for performance analyses for the Committee. PNC did not pay any fees to Meridian in 2016 other than in connection with work for the Committee.

The Committee evaluated whether the work of Meridian raised any conflict of interest. The Committee considered various factors, including six factors mandated by the SEC rules, and determined that no conflict of interest was raised by the work of Meridian described in this proxy statement.

26 THE PNC FINANCIAL SERVICES GROUP, INC. - 2017 Proxy Statement

Table of Contents

CORPORATE GOVERNANCE

Our management retains other compensation consultants for its own use. In 2016, our management retained McLagan to provide certain market data in the financial services industry. It also uses Willis Towers Watson, a global professional services firm, to provide, from time to time, various actuarial and management consulting services to us, including:

| | Preparing specific actuarial calculations on values under our retirement plans |

| | Preparing surveys of competitive pay practices |

| | Analyzing our director compensation packages and providing reports to our management and the Boards Nominating and Governance Committee |

| | providing insurance brokerage and consulting services to mitigate certain property and casualty risks |

| | Providing guidance on certain aspects of total rewards, talent management and other human resources initiatives |

Reports prepared by Willis Towers Watson and McLagan that relate to executive compensation may also be shared with the Committee.

Compensation committee interlocks and insider participation. None of the current members of the Personnel and Compensation Committee are officers or employees or former officers of PNC or any of our subsidiaries. No PNC executive officer served on the compensation committee of another entity that employed an executive officer who also served on our Board. No PNC executive officer served as a director of an entity that employed an executive officer who also served on our Personnel and Compensation Committee.

Certain members of the Personnel and Compensation Committee, their immediate family members, and entities with which they are affiliated, were our customers or had transactions with us (or our subsidiaries) during 2016. Transactions that involved loans or commitments by subsidiary banks were made in the ordinary course of business and on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with other persons and did not involve more than the normal risk of collectability or present other unfavorable features and otherwise complied with regulatory restrictions on such transactions.

Please see Director and Executive Officer RelationshipsRegulation O policies and procedures, which begins on page 32, for more information.

Risk Committee

|

Chair | Other members: | ||||

| Andrew T. Feldstein | Marjorie Rodgers Cheshire | Jane G. Pepper | ||||

| William S. Demchak | Donald J. Shepard | |||||

| Daniel R. Hesse | Lorene K. Steffes | |||||

| Kay Coles James | ||||||

The Board performs its risk oversight function primarily through the Risk Committee, which includes both independent and management directors.

Our Board most recently approved the charter of the Committee on November 17, 2016, and it is available on our website.

At each in-person meeting of our full Board, the Chair of the Committee presents a report of the items discussed and the actions approved at previous meetings. The Committees purpose is to require and oversee the establishment and implementation of our enterprise-wide risk governance framework, including related policies, procedures, activities and the processes to identify, measure, monitor, and manage material risks at PNC including (Credit, Liquidity, Market, Operational (including compliance), Strategic and Reputational risks). PNCs major financial risk exposures are the responsibility of the Audit Committee. The Risk Committee serves as the primary point of contact between our Board and the management-level committees dealing with risk management. The Committees responsibility is one of oversight, and the Committee has no duty to assure compliance with laws and regulations.

The Committee receives regular reports on enterprise-wide risk management and Credit, Liquidity, Market, Operational (including compliance), Strategic and Reputational risks.

THE PNC FINANCIAL SERVICES GROUP, INC. - 2017 Proxy Statement 27

Table of Contents

CORPORATE GOVERNANCE

The Committee may also form subcommittees from time to time. The Committee has formed a subcommittee to assist in fulfilling the Committees oversight responsibilities with respect to technology risk, technology risk management, cybersecurity, information security, business continuity, and significant technology initiatives and programs.

The Committee appoints our Chief Risk Officer, who leads PNCs risk management function. The Committee reviews the performance and approves the compensation of our Chief Risk Officer.

The Risk Committee, along with the Personnel and Compensation Committee, each reviews the risk components of our incentive compensation plans. For a discussion of the relationship between compensation and risk, please see Compensation and Risk, beginning on page 54.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Meetings |

|

|||||||||||||||

| (2) | (1) | (3) | (1) | |||||||||||||||||||||||||||

| Audit |

l |

|

l | l | 12 | |||||||||||||||||||||||||

| Nominating and Governance |

l | l |

|

l | l | 5 | ||||||||||||||||||||||||

| Personnel and Compensation |

l | l | l |

|

l | 6 | ||||||||||||||||||||||||

| Risk |

l | l |

|

l | l | l | l | l | 9 | |||||||||||||||||||||

|

Chair |

| (1) | Designated as audit committee financial expert under SEC regulations |

| (2) | Management director |

| (3) | Presiding director (lead independent director) |

28 THE PNC FINANCIAL SERVICES GROUP, INC. - 2017 Proxy Statement

Table of Contents

DIRECTOR AND EXECUTIVE OFFICER RELATIONSHIPS

THE PNC FINANCIAL SERVICES GROUP, INC. - 2017 Proxy Statement 29

Table of Contents

DIRECTOR AND EXECUTIVE OFFICER RELATIONSHIPS

30 THE PNC FINANCIAL SERVICES GROUP, INC. - 2017 Proxy Statement

Table of Contents

DIRECTOR AND EXECUTIVE OFFICER RELATIONSHIPS

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

| Personal or Family Relationships |

Deposit, Wealth Management and Similar Banking Products(1) | l | l | l | l | l | l | l | l | l | l | l | ||||||||||||||||

| Credit Relationships(2) | l | l | l | l | l | l | l | l | l | l | l | |||||||||||||||||

| Charitable Contributions(3) | l | l | l | l | l | l | l | l | ||||||||||||||||||||

| Affiliated Entity Relationships |

Deposit, Wealth Management and Similar Banking Products(1) | l | l | l | l | l | l | |||||||||||||||||||||

| Credit Relationships or Commercial Banking Products(4) | l | l | l | l | l | l |

| (1) | Includes deposit accounts, trust accounts, certificates of deposit, safe deposit boxes, workplace banking, or wealth management products. |

| (2) | Includes extensions of credit, including mortgages, commercial loans, home equity loans, credit cards, or similar products, as well as credit and credit-related products. |

| (3) | Does not include matching gifts provided to charities personally supported by the director because under our Board guidelines matching gifts are not a material relationship and are not included in considering the value of contributions against our guidance. Matching gifts are capped at $5,000 and are included as other compensation in the director compensation table. |

| (4) | Includes extensions of credit, including commercial loans, credit cards, or similar products, as well as credit-related products, and other commercial banking products, including treasury management, purchasing card programs, foreign exchange, and global trading services. |

THE PNC FINANCIAL SERVICES GROUP, INC. - 2017 Proxy Statement 31

Table of Contents

DIRECTOR AND EXECUTIVE OFFICER RELATIONSHIPS

Code of Business Conduct and Ethics

Regulation O policies and procedures

32 THE PNC FINANCIAL SERVICES GROUP, INC. - 2017 Proxy Statement

Table of Contents

DIRECTOR AND EXECUTIVE OFFICER RELATIONSHIPS

Indemnification and advancement of costs

THE PNC FINANCIAL SERVICES GROUP, INC. - 2017 Proxy Statement 33

Table of Contents

Related person transactions policy

Certain related person transactions

34 THE PNC FINANCIAL SERVICES GROUP, INC. - 2017 Proxy Statement

Table of Contents

RELATED PERSON TRANSACTIONS

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

The following table describes the components of director compensation in 2016:

| Annual Retainer |

||||

| Each director |

$ | 67,500 | ||

| Additional retainer for Presiding Director |

$ | 30,000 | ||

| Additional retainer for Chairs of Audit, Risk, and Personnel and Compensation Committees |

$ | 20,000 | ||

| Additional retainer for Chair of Nominating and Governance Committee |

$ | 15,000 | ||

| Additional retainer for Chair of Executive Committee |

$ | 10,000 | ||

| Additional retainer for Chairs of Special Compliance Committee and Technology Subcommittee |

$ | 15,000 | ||

| Meeting Fees (Board) |

||||

| Each meeting (except for quarterly scheduled telephonic meetings) |

$ | 1,500 | ||

| Each quarterly scheduled telephonic meeting |

$ | 1,000 | ||

| Meeting Fees (Committee/Subcommittee) |

||||

| First six meetings |

$ | 1,500 | ||

| All other meetings |

$ | 2,000 | ||

| Equity-Based Grants |

||||

| Value of 1,547 deferred stock units awarded as of April 26, 2016 |

$ | 137,497 |

THE PNC FINANCIAL SERVICES GROUP, INC. - 2017 Proxy Statement 35

Table of Contents

DIRECTOR COMPENSATION

For the fiscal year 2016, we provided the following compensation to our non-employee directors:

| Director Name | Fees Earned(a) | Stock Awards(b) | All Other Compensation(c) |

Total | ||||||||||||

| Charles E. Bunch |

$ | 101,500 | $ | 137,497 | $ | 42,754 | $ | 281,751 | ||||||||

| Paul W. Chellgren* |

$ | 47,750 | - | $ | 100,307 | $ | 148,057 | |||||||||

| Marjorie Rodgers Cheshire |

$ | 127,000 | $ | 137,497 | $ | 16,696 | $ | 281,193 | ||||||||

| Andrew T. Feldstein |

$ | 141,000 | $ | 137,497 | $ | 21,838 | $ | 300,335 | ||||||||

| Daniel R. Hesse** |

$ | 109,350 | $ | 137,497 | $ | 2,404 | $ | 249,251 | ||||||||

| Kay Coles James |

$ | 108,000 | $ | 137,497 | $ | 54,783 | $ | 300,280 | ||||||||

| Richard B. Kelson |

$ | 143,000 | $ | 137,497 | $ | 66,863 | $ | 347,360 | ||||||||

| Anthony A. Massaro* |

$ | 49,250 | - | $ | 34,880 | $ | 84,130 | |||||||||

| Jane G. Pepper |

$ | 122,000 | $ | 137,497 | $ | 63,790 | $ | 323,287 | ||||||||

| Donald J. Shepard |

$ | 167,000 | $ | 137,497 | $ | 81,584 | $ | 386,081 | ||||||||

| Lorene K. Steffes |

$ | 130,000 | $ | 137,497 | $ | 72,866 | $ | 340,363 | ||||||||

| Dennis F. Strigl |

$ | 135,000 | $ | 137,497 | $ | 99,920 | $ | 372,417 | ||||||||

| Thomas J. Usher* |

$ | 59,750 | - | $ | 60,413 | $ | 120,163 | |||||||||

| Michael J. Ward** |

$ | 94,850 | $ | 137,497 | $ | 2,927 | $ | 235,274 | ||||||||

| Gregory D. Wasson |

$ | 121,000 | $ | 137,497 | $ | 4,338 | $ | 262,835 | ||||||||

| * | Mr. Chellgren, Mr. Massaro and Mr. Usher served as directors through April 26, 2016. |

| ** | Mr. Hesse and Mr. Ward were appointed as directors on January 7, 2016. |

| (a) | This column includes the annual retainers, additional retainers for chairs of standing committees and meeting fees earned for 2016. The amounts in this column also include the fees voluntarily deferred by the following directors under our Directors Deferred Compensation Plan, a non-qualified defined contribution plan: Paul W. Chellgren ($47,750); Marjorie Rodgers |

36 THE PNC FINANCIAL SERVICES GROUP, INC. - 2017 Proxy Statement

Table of Contents

DIRECTOR COMPENSATION

| Cheshire ($50,800); Andrew T. Feldstein ($141,000); Daniel R. Hesse ($106,945); Jane G. Pepper ($122,000); Donald J. Shepard ($167,000); Lorene K. Steffes ($39,000); Michael J. Ward ($92,445); and Gregory D. Wasson ($121,000). |

| (b) | The dollar values in this column include the grant date fair value, under Financial Accounting Standards Board Accounting Standards Codification Topic 718, CompensationStock Compensation, of 1,547 deferred stock units awarded to each directors account under our Outside Directors Deferred Stock Unit Plan as of April 26, 2016, the date of grant. The closing stock price of PNC on the date of grant was $88.88 a share. See Note 12 in the Notes to Consolidated Financial Statements in our Annual Report on Form 10-K for the year ended December 31, 2016 for more information. |

| As of December 31, 2016, the non-employee directors listed in the table below had outstanding stock units in the following amounts: |

| Director Name | Stock Units | |||

| Charles E. Bunch |

19,423 | |||

| Marjorie Rodgers Cheshire |

4,098 | |||

| Andrew T. Feldstein |

9,450 | |||

| Daniel R. Hesse |

1,913 | |||

| Kay Coles James |

24,584 | |||

| Richard B. Kelson |

28,161 | |||

| Jane G. Pepper |

30,805 | |||

| Donald J. Shepard |

37,562 | |||

| Lorene K. Steffes |

31,982 | |||

| Dennis F. Strigl |

32,183 | |||

| Michael J. Ward |

2,604 | |||

| Gregory D. Wasson |

3,358 | |||

| None of our non-employee directors had any unvested stock awards as of December 31, 2016. |

| (c) | This column includes income under the Directors Deferred Compensation Plan, the Outside Directors Deferred Stock Unit Plan, and the Mercantile Bankshares Corporation Deferred Compensation Plan (for Mr. Shepard only) as follows: Charles E. Bunch ($39,004); Paul W. Chellgren ($100,307); Marjorie Rodgers Cheshire ($6,696); Andrew T. Feldstein ($16,838); Daniel R. Hesse ($2,404); Kay Coles James ($49,783); Richard B. Kelson ($61,863); Anthony A. Massaro ($34,880); Jane G. Pepper ($63,790); Donald J. Shepard ($76,584); Lorene K. Steffes ($68,666); Dennis F. Strigl ($89,920); Thomas J. Usher ($55,413); Michael J. Ward ($2,927); and Gregory D. Wasson ($4,338). This column also includes the dollar amount of matching gifts made by us in 2016 to charitable organizations. For two directors, the 2016 matching gift amount included above exceeds $5,000 because their director donations from prior years were matched in 2016. No director received any incidental benefits. No non-employee director had incremental cost to PNC for personal use of our corporate aircraft in 2016. |

THE PNC FINANCIAL SERVICES GROUP, INC. - 2017 Proxy Statement 37

Table of Contents

COMPENSATION DISCUSSION AND ANALYSIS

This section (CD&A) explains our executive compensation philosophy, describes our compensation programs, and reviews compensation decisions for the following named executive officers (NEOs):

| Name of NEO | Title | |

| William S. Demchak |

Chairman, President and Chief Executive Officer |

|

| Robert Q. Reilly |

Executive Vice President and Chief Financial Officer |

|

| Michael P. Lyons |

Executive Vice President and Head of Corporate & Institutional Banking |

|

| E William Parsley, III |

Executive Vice President, Chief Investment Officer, Treasurer and Head of Consumer Lending |

|

| Steven C. Van Wyk |

Executive Vice President and Head of Technology and Operations |

|

|

We delivered consistent results in a challenging operating environment, with net income of approximately $4.0 billion and diluted earnings per common share of $7.30. | |

|

|

We grew net interest income despite the low interest rate environment, and we increased our fee income. We grew deposits and loans and managed our loan portfolio within our desired risk appetite. We maintained strong capital and liquidity positions. | |

|

|

We delivered value for our shareholders. Our one-year total shareholder return (TSR) was 25.8% and our three-year TSR was 17.3%, which was the highest in our peer group. | |

|

|

We met our continuous improvement goal of $400 million in expense savings and continued to keep our noninterest expenses stable. | |

|

|

We continued to execute against our strategic priorities of building a leading banking franchise in our underpenetrated markets, capturing more investable assets, reinventing the retail banking experience, and bolstering critical infrastructure and streamlining core processes. | |

|

|

We returned more than $3 billion in capital to our shareholders through share repurchases and common stock dividends, including raising the quarterly common stock dividend. | |

On pages 44 to 48, we discuss in more detail how our 2016 performance affected our compensation decisions.

| COMPENSATION PRINCIPLES

|

||||||

| Pay for performance Provide appropriate compensation for demonstrated performance across the enterprise

|

Create value Align executive compensation with long-term shareholder value creation

|

Engage talent Provide competitive compensation opportunities to attract, retain, and motivate executives

|

Discourage excessive risk-taking Encourage focus on the long-term success of PNC and discourage excessive risk-taking

|

|||

38 THE PNC FINANCIAL SERVICES GROUP, INC. - 2017 Proxy Statement

Table of Contents

COMPENSATION DISCUSSION AND ANALYSIS

| WHAT WE DO | WHAT WE DONT DO | |||||

|

|

We pay for performance. The vast majority of our executive pay is not guaranteed. Our standard long-term equity incentive awards are 100% performance-based. |

û |

We do not allow tax gross-ups. We do not provide excise tax gross-ups in our current change in control agreements and we have eliminated these gross-ups from all existing agreements. We do not provide tax gross-ups on the limited perquisites that we offer. | |||

|

|

We discourage excessive risk taking. We build in several features to discourage our executives from taking excessive risks including a reliance on multiple performance metrics, long deferral periods, and clawback, forfeiture and stock ownership provisions. |

û |

We will not enter into substantial severance arrangements without shareholder approval. If a severance arrangement would pay more than 2.99 times base and bonus (in the year of termination), it requires shareholder approval. | |||

|

|

We require executives to hold PNC stock. Our executives must hold a substantial amount of stock and this amount continues to increase as their equity awards vest. |

û |

We will not accelerate equity upon a change in control (no single trigger). We require a double trigger for equity to vest upon a change in control not only must the change in control occur, but the executive must be terminated. | |||

|

|

We have clawback and forfeiture policies. Our policy requires us to claw back prior incentive compensation that we awarded based on materially inaccurate performance metrics. Our policy gives us broad discretion to cancel unvested equity awards due to risk-related issues or detrimental conduct. |

û |

We do not reprice stock options. Although we currently do not grant stock options, our equity plan does not permit us to reprice stock options that are out-of-the-money, unless approved by shareholders. | |||

|

|

We limit the perquisites we provide. We limit our perquisites to financial planning and tax preparation services, executive physicals (for four individuals) and occasional personal use of the aircraft, subject to an annual limit ($100,000 for the CEO and $10,000 for other NEOs). |

û |

We do not enter into employment agreements. We do not enter into individual employment agreements with our NEOs they serve at the will of the Board. | |||

|

|

We retain an independent compensation consultant. Our Boards Personnel and Compensation Committee retains an independent compensation consultant that provides no other services to PNC. |

û |

We prohibit hedging, pledging, or short sales of PNC securities. We do not allow any director or employee to hedge or short-sell PNC securities. We do not allow any director or executive officer to pledge PNC securities. | |||

|

|

We engage with our shareholders. We actively engage with our shareholders on governance and compensation issues. | |||||

Stakeholder engagement and impact of 2016 say-on-pay vote

|

|

We have given our shareholders the annual right to cast an advisory vote on executive compensation (say-on-pay) for seven years. In 2016, we received the support of 97% of our shareholders who voted - our highest-ever support for say-on-pay. | |

|

|

For several years, we have initiated outreach efforts with certain institutional investors. In 2016, we invited many of our largest institutional shareholders to participate in telephone conferences to discuss governance, compensation, and other matters included in the proxy statement. We had productive conversations with the shareholders who agreed to participate. | |

|

|

Based on the results of these efforts and in light of our record investor support in 2016, the Committee did not recommend any significant changes to the compensation program. The Committee considered the results of the say-on-pay vote as one factor in its compensation decisions, among the other factors discussed in this CD&A. |

THE PNC FINANCIAL SERVICES GROUP, INC. - 2017 Proxy Statement 39

Table of Contents

COMPENSATION DISCUSSION AND ANALYSIS

Key program features

Taken as a whole, our executive compensation program includes several complementary features:

|

|

We provide incentives for performance over different time horizons (short and long-term). | |

|

|

We embed performance goals in our long-term incentives, and include risk-based triggers that could reduce or eliminate the awards. | |

|

|

We reward achievement against both quantitative and qualitative goals, while allowing for discretion. | |

|

|

We connect pay to our own performance, as well as the performance of a carefully selected peer group. | |

|

|

We consider market data and trends when making pay decisions. | |

|

|

We place a substantial majority of compensation at risk, with all incentive compensation being performance-based. | |

|

|

We pay some incentive compensation in cash today, while deferring potential equity-based payouts for several years. |

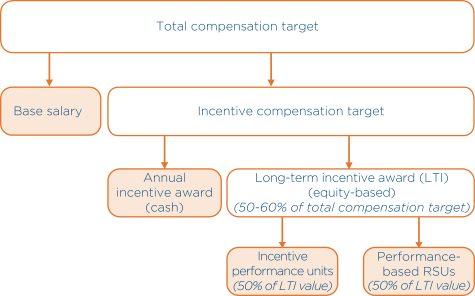

A total compensation target includes the following components:

40 THE PNC FINANCIAL SERVICES GROUP, INC. - 2017 Proxy Statement

Table of Contents

COMPENSATION DISCUSSION AND ANALYSIS

When constructing an appropriate total compensation target for an NEO, the Committee uses a framework that is consistent with our compensation principles:

|

|

Targets are informed by data but take several factors into account. The Committee reviews available market data, but does not use a formula to set the target. The Committee evaluates many factors, including the appropriateness of the job match and market data, the responsibilities of the position and the executives demonstrated performance, skills, and experience. | |

|

|

At least 50% of compensation is equity-based and not payable for several years. The Committee believes that a significant portion of compensation should be at risk, tied to PNC stock performance, and not payable, if at all, for several years. Long-term equity-based awards make up at least 50% of the value of the total compensation target, with that percentage rising to 60% for our CEO (and one other NEO). The remainder of the annual incentive payout is delivered as an annual cash incentive award. | |

|

|

The equity-based incentive is split evenly between two forms of awards. Each NEO generally receives a long-term incentive award in two primary forms that are equally weighted by dollar value the standard incentive performance unit (Standard IPU), which measures PNC performance over a three-year period, and the performance-based restricted share unit (RSU), which vests in equal annual installments over a four-year period. In light of Mr. Parsleys management of our Asset & Liability Management (ALM) function, he also receives an incentive performance unit (ALM IPU), tied to the performance of that function. Each long-term incentive award also contains forfeiture provisions that can reduce or eliminate payouts if PNC does not meet risk-based criteria. |

The equity-based awards are made under PNCs shareholder-approved 2016 Incentive Award Plan. The table below summarizes the material terms and conditions of these awards:

| Incentive performance units | Performance-based RSUs | |||||||||||||||||||

| How do we measure performance? |

Standard IPUs:

Vests after a three-year performance period

Performance based on absolute and relative metrics

- 50% based on our return on common equity without goodwill (ROCE) compared to our cost of common equity (COCE)

- 50% based on our EPS growth rank against our peers

0-125% of target award, payable in common stock up to target (0-100%) and payable in cash above target (100-125%)

ALM IPUs:

Vests after a three-year performance period

Performance based on PNCs ALM performance compared to a benchmark performance index

0-200% of target award, payable in cash |

Vests in annual installments over a four-year performance period

Vested amount adjusted based on PNCs annual total shareholder return (TSR)

75-125% of target award

Units payable in PNC common stock

|

||||||||||||||||||

THE PNC FINANCIAL SERVICES GROUP, INC. - 2017 Proxy Statement 41

Table of Contents

COMPENSATION DISCUSSION AND ANALYSIS

| Incentive performance units |

Performance-based RSUs |

|||||||||||||

| What is the payout? |

The payout percentage grid ranges are listed below. Actual payout percentages will be interpolated, which takes into account how close the performance metric or peer group rank is to the actual metric or rank above and below. |

|||||||||||||

| Standard IPUs: |

||||||||||||||

|

EPS |

Payout % |

ROCE as % of COCE |

Payout % |

Annual TSR |

Payout % | |||||||||||||

| 1 | 125% | >= 110% |

125% |

>= +25% | 125% | |||||||||||||

| 2 | 125% | 105% |

100% |

0% | 100% | |||||||||||||

| 3 | 125% | 100% |

75% |

<= -25% | 75% | |||||||||||||

| 4 | 120% | 75% |

50% |

|||||||||||||||

| 5 | 115% | <= 50% |

0% |

|||||||||||||||

| 6 | 105% | |||||||||||||||||

| 7 | 95% | |||||||||||||||||

| 8 | 80% | |||||||||||||||||

| 9 | 60% | |||||||||||||||||

| 10 | 40% | |||||||||||||||||

| 11 | 0% | |||||||||||||||||

| 12 | 0% | |||||||||||||||||

| ALM IPUs: |

||||||||||||||||||

| ALM vs. Index | Payout % | |||||||||||||||||

| >= +40 basis points | 200% | |||||||||||||||||

| +20 basis points | 150% | |||||||||||||||||

| 0 to -25 basis points | 100% | |||||||||||||||||

| -35 basis points | 40% | |||||||||||||||||

| <= -40 basis points | 0% | |||||||||||||||||

| What are other important provisions? | If we do not meet or exceed the Tier 1 risk-based capital ratio for well-capitalized institutions, the award will not vest. If our return on economic capital does not exceed our cost of capital, the Committee may reduce or eliminate the award. No long-term incentive award has voting rights. Dividends will accrue until vesting and be paid out in cash, adjusted for actual performance (Standard IPUs and performance-based RSUs) the ALM IPUs do not have any accrued dividends.

|

|

||||||||||||||||

Other compensation and benefits

In addition to the components included in the total compensation target outlined above, our executive compensation program also includes the following components:

|

Perquisites |

Limited perquisites provided to executives, with a modest dollar value. No tax gross-ups on the perquisites we provide. |

|

|

Change in Control Arrangements |

Provide for continuity of management in connection with a change in control. Described in more detail on pages 71 to 77. |

|

|

Health and Retirement Plans |

Promote health and wellness. Help employees achieve financial security after retirement. |

Evaluating performance:

42 THE PNC FINANCIAL SERVICES GROUP, INC. - 2017 Proxy Statement

Table of Contents

COMPENSATION DISCUSSION AND ANALYSIS

The following chart describes some of the key metrics that the Committee evaluates, and a brief explanation of why we use them. We consider all of these metrics in our overall evaluation of executive compensation, and some of these metrics are also used to calculate payouts under the long-term incentive program.

| Capital and risk metrics | ||

| Economic capital |

Economic capital represents the capital that we should hold against unexpected losses. Economic capital serves as a common currency of risk that allows us to compare different risks on a similar basis across our company. | |

| Return on economic capital (ROEC) vs. cost of capital |

ROEC is our annualized net income divided by our economic capital. Comparing our profits to how much capital we are holding against potential losses helps to provide a risk-based evaluation of profitability. When we compare ROEC to our cost of capital that is, a minimum rate of return on the overall capital that we hold it provides a good measure of the excess value that we provide to shareholders. | |

| Tier 1 risk-based capital ratio |

The Tier 1 risk-based capital ratio is used by banking regulators to assess the capital adequacy and financial strength of a bank. This capital ratio must exceed 6% for PNC to be considered well-capitalized by our regulators. | |

| Expense metrics | ||

| Efficiency ratio |

The efficiency ratio helps us evaluate how efficiently we operate our business. The ratio divides our noninterest expense (such as compensation and benefits, occupancy costs, equipment, and marketing) by our revenue. In general, a smaller ratio is better. A banks efficiency ratio will be affected, however, by its particular mix of businesses. | |

| Profitability metrics | ||

| Earnings per share (EPS) |

EPS is a common metric used by investors to evaluate the profitability of a company. It shows the earnings (net income) we make on each outstanding share of common stock. | |

| EPS growth |

While EPS represents a specific dollar amount, EPS growth represents the percentage growth of EPS since last year. EPS growth helps us to compare our annual earnings strength to our peers. | |

| Return on assets (ROA) |

Investors often evaluate banks by their asset size, with loans and investment securities making up the largest components of assets. ROA is our annualized net income divided by our average assets and represents how efficiently we use assets to generate profit. | |

| Return on common equity |

Return on common equity is our annualized net income attributable to our common shareholders divided by average common shareholders equity. It shows how efficiently we use our investor funds (common equity) to generate profit. | |

| Revenue metrics | ||

| Net interest income |

Net interest income measures the revenue generated from lending and other activities minus all interest expenses (such as interest paid on deposits and borrowings). It is a good indicator of performance for banks given the importance of interestearning assets and interestbearing sources of funds. | |

| Noninterest income |

Noninterest income measures the fees and other revenue we derive from our businesses (other than interest income). A healthy mix of net interest income and noninterest income provides diverse earnings streams and lessens a banks reliance on the interest rate environment. | |

| Valuation metrics | ||

| Tangible book value per share |

This non-GAAP financial measure takes our total tangible common shareholders equity (intangible assets, such as goodwill, are excluded) and divides that by the number of shares outstanding. This provides investors with an objective valuation method and allows them to compare relative values of similar companies. | |

| Total shareholder return (TSR) |

TSR is a common metric used to show the total returns to an investor in our common stock. Annual TSR takes into account the change in stock price from the beginning to the end of the year, as well as the reinvestment of any dividends issued throughout the year. | |

THE PNC FINANCIAL SERVICES GROUP, INC. - 2017 Proxy Statement 43

Table of Contents

COMPENSATION DISCUSSION AND ANALYSIS

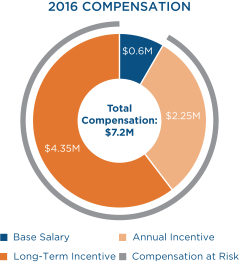

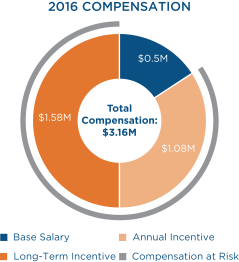

2016 total compensation targets

For 2016, the Committee set the following total compensation targets for our NEOs:

| William S. Demchak |

Robert Q. Reilly |

Michael P. Lyons |

E William Parsley, III |

Steven C. Van Wyk |

||||||||||||||||

| Base salary (annualized) |

$ | 1,100,000 | $ | 500,000 | $ | 700,000 | $ | 600,000 | $ | 500,000 | ||||||||||

| Incentive compensation target |

$ | 10,500,000 | $ | 3,000,000 | $ | 6,050,000 | $ | 6,900,000 | $ | 2,750,000 | ||||||||||

| Annual cash incentive portion |

$ | 3,540,000 | $ | 1,250,000 | $ | 2,000,000 | $ | 2,400,000 | $ | 1,125,000 | ||||||||||

| Long-term incentive portion |

$ | 6,960,000 | $ | 1,750,000 | $ | 4,050,000 | $ | 4,500,000 | (1) | $ | 1,625,000 | |||||||||

| Total compensation target |

$ | 11,600,000 | $ | 3,500,000 | $ | 6,750,000 | $ | 7,500,000 | $ | 3,250,000 | ||||||||||

| (1) | Mr. Parsleys long-term incentive (LTI) target includes two anticipated grants the grant of equity-based awards that all other NEOs would otherwise receive and a separate grant of incentive performance units related to the management of our Asset & Liability Management (ALM) unit. The overall target LTI amount remained the same for 2015 and 2016, but the Committee changed the amounts allocated to each award in 2016, decreasing the ALM performance unit value (from $3,000,000 to $1,500,000) and increasing the value of the other equity-based by the same amount (from $1,500,000 to $3,000,000). The Committee made this decision in light of Mr. Parsleys increasing responsibilities for lines of business other than the ALM unit. Please see page 61 for more information about Mr. Parsleys ALM units. |