425: Filing under Securities Act Rule 425 of certain prospectuses and communications in connection with business combination transactions

Published on January 17, 2008

Filed by The PNC Financial Services Group, Inc.

Pursuant to Rule 425 under the Securities Act of 1933 and

deemed filed pursuant to Rule 14a-12 of the Securities Exchange Act of 1934

Subject Company: Sterling Financial Corporation

Commission File No. 000-16276

On January 17, 2008, The PNC Financial Services Group, Inc. (PNC) issued a press release and held a conference call for investors regarding PNCs earnings and business results for the fourth quarter and year ended December 31, 2007. PNC also provided supplementary financial information on its web site, including financial information disclosed in connection with its press release, and provided electronic presentation slides on its web site used in connection with the related investor conference call. Such supplementary financial information and electronic presentation slides consisted of the following:

THE PNC FINANCIAL SERVICES GROUP, INC.

FINANCIAL SUPPLEMENT

FOURTH QUARTER AND FULL YEAR 2007

(UNAUDITED)

THE PNC FINANCIAL SERVICES GROUP, INC.

FINANCIAL SUPPLEMENT

FOURTH QUARTER AND FULL YEAR 2007

(UNAUDITED)

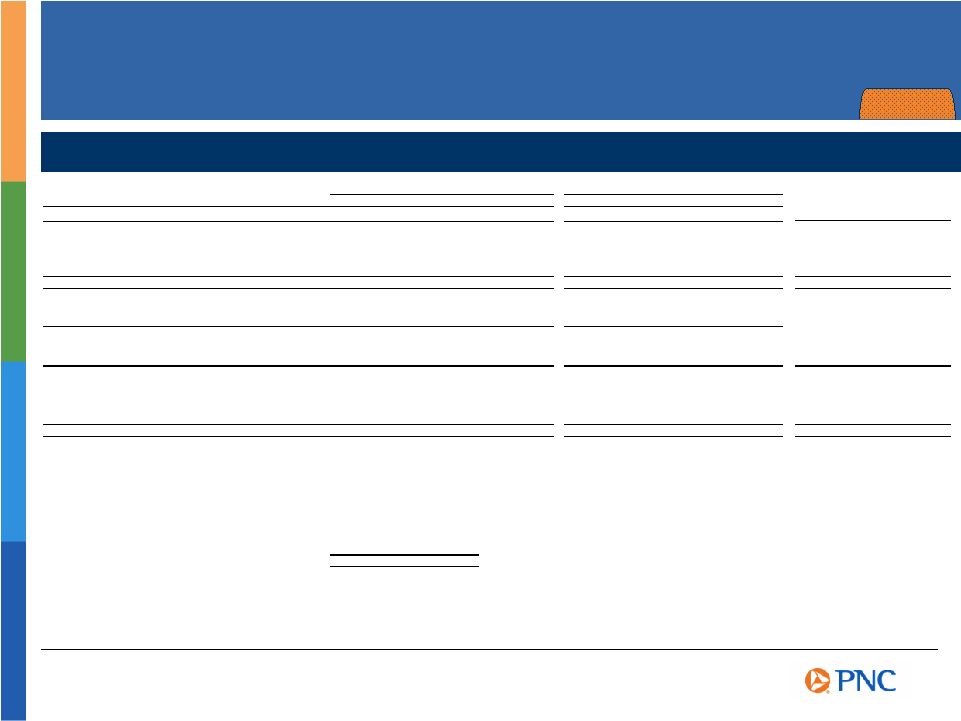

| Page | ||

| Consolidated Income Statement |

2 | |

| Adjusted Condensed Consolidated Income Statement |

3 | |

| Consolidated Balance Sheet |

4 | |

| Capital Ratios |

4 | |

| Results of Businesses |

||

| Summary of Business Segment Results |

5 | |

| Period-end Employees |

5 | |

| Retail Banking |

6-8 | |

| Corporate & Institutional Banking |

9 | |

| PFPC |

10 | |

| Efficiency Ratio |

11 | |

| Details of Net Interest Income, Net Interest Margin, and Trading Revenue |

12 | |

| Average Consolidated Balance Sheet and Supplemental Average Balance Sheet Information |

13-14 | |

| Details of Loans |

15 | |

| Allowances for Loan and Lease Losses and Unfunded Loan Commitments and Letters of Credit, and Net Unfunded Commitments |

16 | |

| Details of Nonperforming Assets |

17-18 | |

| Glossary of Terms |

19-21 | |

| Business Segment Products and Services |

22 | |

| Appendix - Adjusted Condensed Consolidated Income Statement Reconciliations |

A1-A5 | |

The information contained in this Financial Supplement is preliminary, unaudited and based on data available on January 17, 2008. We have reclassified certain prior period amounts included in this Financial Supplement to be consistent with the current period presentation. This information speaks only as of the particular date or dates included in the schedules. We do not undertake any obligation to, and disclaim any duty to, correct or update any of the information provided in this Financial Supplement. Our future financial performance is subject to risks and uncertainties as described in our United States Securities and Exchange Commission (SEC) filings.

Additional Information About The PNC/Sterling Financial Corporation Transaction

The PNC Financial Services Group, Inc. and Sterling Financial Corporation will be filing a proxy statement/prospectus and other relevant documents concerning the merger with the United States Securities and Exchange Commission (the SEC). WE URGE INVESTORS TO READ THE PROXY STATEMENT/PROSPECTUS AND ANY OTHER DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE MERGER OR INCORPORATED BY REFERENCE IN THE PROXY STATEMENT/PROSPECTUS BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION.

Investors will be able to obtain these documents free of charge at the SECs web site at http://www.sec.gov. In addition, documents filed with the SEC by The PNC Financial Services Group, Inc. will be available free of charge from Shareholder Relations at (800) 843-2206. Documents filed with the SEC by Sterling Financial Corporation will be available free of charge from Sterling Financial Corporation by contacting Shareholder Relations at (877) 248-6420.

The directors, executive officers, and certain other members of management and employees of Sterling Financial Corporation are participants in the solicitation of proxies in favor of the merger from the shareholders of Sterling Financial Corporation. Information about the directors and executive officers of Sterling Financial Corporation is included in the proxy statement for its May 8, 2007 annual meeting of shareholders, which was filed with the SEC on April 2, 2007. Additional information regarding the interests of such participants will be included in the proxy statement/prospectus and the other relevant documents filed with the SEC when they become available.

THE PNC FINANCIAL SERVICES GROUP, INC.

Yardville National Bancorp Acquisition

We completed our acquisition of Yardville National Bancorp (Yardville) on October 26, 2007 and our financial results include Yardville from that date. PNC issued approximately 3.4 million shares of PNC common stock and paid approximately $156 million in cash as consideration for the acquisition, and accounted for the transaction under the purchase method.

Mercantile Acquisition

We completed our acquisition of Mercantile Bankshares Corporation (Mercantile) on March 2, 2007 and our financial results include Mercantile from that date. PNC issued approximately 53 million shares of PNC common stock and paid approximately $2.1 billion in cash as consideration for the acquisition, and accounted for the transaction under the purchase method. PNC converted the Mercantile banks data onto PNCs financial and operational systems during September 2007.

BlackRock/MLIM Transaction

As further described in our Annual Report on Form 10-K for the year ended December 31, 2006, on September 29, 2006, Merrill Lynch contributed its investment management business (MLIM) to BlackRock, Inc. (BlackRock), formerly a majority-owned subsidiary of PNC, in exchange for 65 million shares of newly issued BlackRock common and preferred stock.

Our Consolidated Income Statement for the year ended December 31, 2006 reflects our former majority ownership interest in BlackRock for the first nine months of that year and our investment in BlackRock accounted for under the equity method for the fourth quarter of that year. Our Consolidated Income Statement for all other periods presented and our Consolidated Balance Sheet as of all dates included in this Financial Supplement reflect the September 29, 2006 deconsolidation of BlackRocks balance sheet amounts and recognize our approximate 34% ownership interest in BlackRock for those periods and as of those dates as an investment accounted for under the equity method.

We have also provided, for information purposes only, adjusted results in this Financial Supplement to reflect BlackRock as if it had also been accounted for under the equity method for the full year 2006.

Page 1

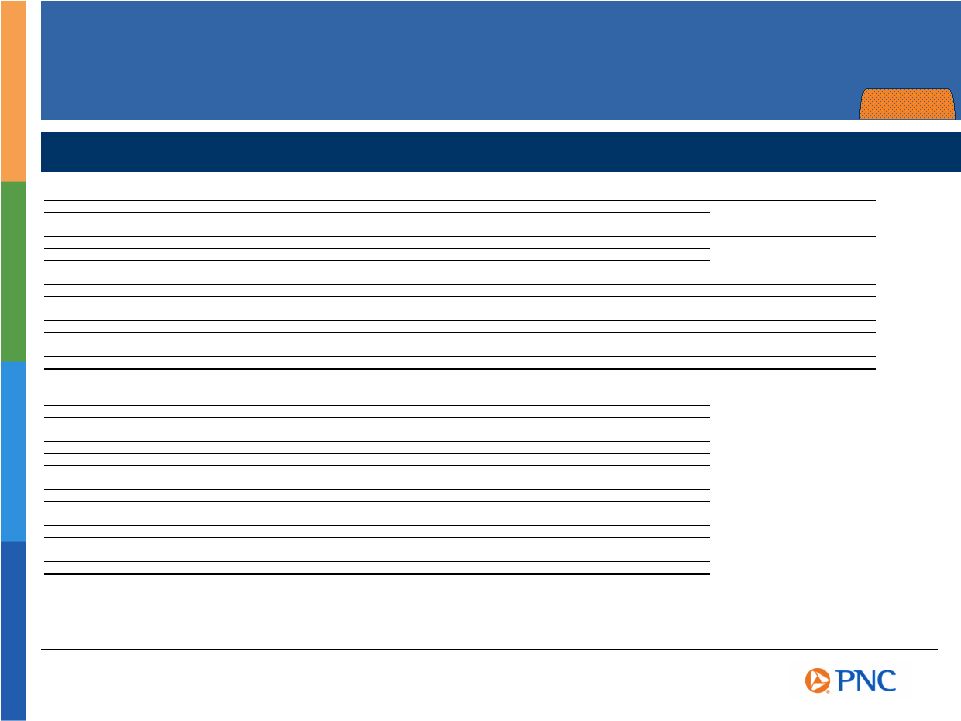

THE PNC FINANCIAL SERVICES GROUP, INC.

Consolidated Income Statement (Unaudited)

| Year ended | Three months ended | |||||||||||||||||||||||||||

| In millions, except per share data |

December 31 2007 |

December 31 2006 |

December 31 2007 |

September 30 2007 |

June 30 2007 |

March 31 2007 |

December 31 2006 |

|||||||||||||||||||||

| Interest Income |

||||||||||||||||||||||||||||

| Loans |

$ | 4,232 | $ | 3,203 | $ | 1,123 | $ | 1,129 | $ | 1,084 | $ | 896 | $ | 821 | ||||||||||||||

| Securities available for sale |

1,429 | 1,049 | 398 | 366 | 355 | 310 | 280 | |||||||||||||||||||||

| Other |

505 | 360 | 149 | 132 | 115 | 109 | 116 | |||||||||||||||||||||

| Total interest income |

6,166 | 4,612 | 1,670 | 1,627 | 1,554 | 1,315 | 1,217 | |||||||||||||||||||||

| Interest Expense |

||||||||||||||||||||||||||||

| Deposits |

2,053 | 1,590 | 522 | 531 | 532 | 468 | 450 | |||||||||||||||||||||

| Borrowed funds |

1,198 | 777 | 355 | 335 | 284 | 224 | 201 | |||||||||||||||||||||

| Total interest expense |

3,251 | 2,367 | 877 | 866 | 816 | 692 | 651 | |||||||||||||||||||||

| Net interest income |

2,915 | 2,245 | 793 | 761 | 738 | 623 | 566 | |||||||||||||||||||||

| Provision for credit losses |

315 | 124 | 188 | 65 | 54 | 8 | 42 | |||||||||||||||||||||

| Net interest income less provision for credit losses |

2,600 | 2,121 | 605 | 696 | 684 | 615 | 524 | |||||||||||||||||||||

| Noninterest Income |

||||||||||||||||||||||||||||

| Asset management |

784 | 1,420 | 225 | 204 | 190 | 165 | 149 | |||||||||||||||||||||

| Fund servicing |

835 | 893 | 215 | 208 | 209 | 203 | 249 | |||||||||||||||||||||

| Service charges on deposits |

348 | 313 | 90 | 89 | 92 | 77 | 79 | |||||||||||||||||||||

| Brokerage |

278 | 246 | 69 | 71 | 72 | 66 | 63 | |||||||||||||||||||||

| Consumer services |

414 | 365 | 110 | 106 | 107 | 91 | 93 | |||||||||||||||||||||

| Corporate services |

713 | 626 | 180 | 198 | 176 | 159 | 177 | |||||||||||||||||||||

| Equity management gains |

102 | 107 | 21 | 47 | 2 | 32 | 25 | |||||||||||||||||||||

| Net securities gains (losses) |

(5 | ) | (207 | ) | (1 | ) | (2 | ) | 1 | (3 | ) | |||||||||||||||||

| Trading |

104 | 183 | (10 | ) | 33 | 29 | 52 | 33 | ||||||||||||||||||||

| Net gains (losses) related to BlackRock |

(127 | ) | 2,066 | (128 | ) | (50 | ) | (1 | ) | 52 | (12 | ) | ||||||||||||||||

| Other |

344 | 315 | 63 | 86 | 98 | 97 | 113 | |||||||||||||||||||||

| Total noninterest income |

3,790 | 6,327 | 834 | 990 | 975 | 991 | 969 | |||||||||||||||||||||

| Noninterest Expense |

||||||||||||||||||||||||||||

| Compensation |

1,850 | 2,128 | 482 | 480 | 470 | 418 | 442 | |||||||||||||||||||||

| Employee benefits |

290 | 304 | 71 | 73 | 74 | 72 | 55 | |||||||||||||||||||||

| Net occupancy |

350 | 310 | 95 | 87 | 81 | 87 | 69 | |||||||||||||||||||||

| Equipment |

311 | 303 | 84 | 77 | 79 | 71 | 69 | |||||||||||||||||||||

| Marketing |

115 | 104 | 29 | 36 | 29 | 21 | 23 | |||||||||||||||||||||

| Other |

1,380 | 1,294 | 452 | 346 | 307 | 275 | 311 | |||||||||||||||||||||

| Total noninterest expense |

4,296 | 4,443 | 1,213 | 1,099 | 1,040 | 944 | 969 | |||||||||||||||||||||

| Income before minority interest and income taxes |

2,094 | 4,005 | 226 | 587 | 619 | 662 | 524 | |||||||||||||||||||||

| Minority interest in income of BlackRock |

47 | |||||||||||||||||||||||||||

| Income taxes |

627 | 1,363 | 48 | 180 | 196 | 203 | 148 | |||||||||||||||||||||

| Net income |

$ | 1,467 | $ | 2,595 | $ | 178 | $ | 407 | $ | 423 | $ | 459 | $ | 376 | ||||||||||||||

| Earnings Per Common Share |

||||||||||||||||||||||||||||

| Basic |

$ | 4.43 | $ | 8.89 | $ | .53 | $ | 1.21 | $ | 1.24 | $ | 1.49 | $ | 1.29 | ||||||||||||||

| Diluted |

$ | 4.35 | $ | 8.73 | $ | .52 | $ | 1.19 | $ | 1.22 | $ | 1.46 | $ | 1.27 | ||||||||||||||

| Average Common Shares Outstanding |

||||||||||||||||||||||||||||

| Basic |

331 | 292 | 338 | 337 | 342 | 308 | 291 | |||||||||||||||||||||

| Diluted |

335 | 297 | 341 | 340 | 346 | 312 | 295 | |||||||||||||||||||||

| Efficiency |

64 | % | 52 | % | 75 | % | 63 | % | 61 | % | 58 | % | 63 | % | ||||||||||||||

| Noninterest income to total revenue |

57 | % | 74 | % | 51 | % | 57 | % | 57 | % | 61 | % | 63 | % | ||||||||||||||

| Effective tax rate (a) |

29.9 | % | 34.0 | % | 21.2 | % | 30.7 | % | 31.7 | % | 30.7 | % | 28.2 | % | ||||||||||||||

| (a) | The effective tax rates are presented on a GAAP basis. The lower effective tax rate for the fourth quarter of 2007 was primarily due to lower pretax income in relation to tax credits and earnings that are not subject to tax. The higher effective tax rate for full year 2006 was primarily due to the third quarter 2006 gain on the BlackRock/MLIM transaction and a related $57 million cumulative adjustment to deferred taxes recorded in that quarter. The lower effective tax rate in the fourth quarter of 2006 was primarily due to a reduction in tax reserves for interest. |

Page 2

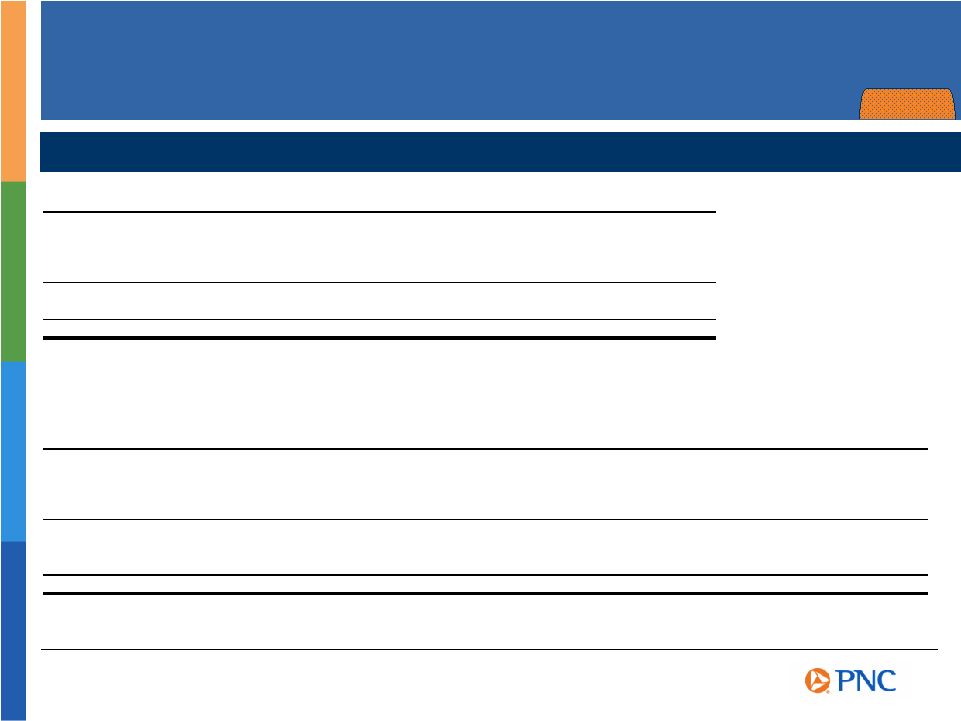

THE PNC FINANCIAL SERVICES GROUP, INC.

Adjusted Condensed Consolidated Income Statement (Unaudited) (a)

| For the year ended - in millions |

December 31 2007 |

December 31 2006 |

||||

| Net Interest Income |

||||||

| Net interest income |

$ | 2,915 | $ | 2,235 | ||

| Provision for credit losses |

270 | 124 | ||||

| Net interest income less provision for credit losses |

2,645 | 2,111 | ||||

| Noninterest Income |

||||||

| Asset management |

788 | 538 | ||||

| Other |

3,133 | 3,034 | ||||

| Total noninterest income |

3,921 | 3,572 | ||||

| Noninterest Expense |

||||||

| Compensation and benefits |

2,103 | 1,865 | ||||

| Other |

2,009 | 1,722 | ||||

| Total noninterest expense |

4,112 | 3,587 | ||||

| Income before income taxes |

2,454 | 2,096 | ||||

| Income taxes |

752 | 582 | ||||

| Net income |

$ | 1,702 | $ | 1,514 | ||

| For the three months ended - in millions |

December 31 2007 |

September 30 2007 |

June 30 2007 |

March 31 2007 |

December 31 2006 |

||||||||||

| Net Interest Income |

|||||||||||||||

| Net interest income |

$ | 793 | $ | 761 | $ | 738 | $ | 623 | $ | 566 | |||||

| Provision for credit losses |

143 | 65 | 54 | 8 | 42 | ||||||||||

| Net interest income less provision for credit losses |

650 | 696 | 684 | 615 | 524 | ||||||||||

| Noninterest Income |

|||||||||||||||

| Asset management |

224 | 206 | 191 | 167 | 159 | ||||||||||

| Other |

737 | 836 | 786 | 774 | 832 | ||||||||||

| Total noninterest income |

961 | 1,042 | 977 | 941 | 991 | ||||||||||

| Noninterest Expense |

|||||||||||||||

| Compensation and benefits |

543 | 537 | 535 | 488 | 497 | ||||||||||

| Other |

553 | 521 | 490 | 445 | 472 | ||||||||||

| Total noninterest expense |

1,096 | 1,058 | 1,025 | 933 | 969 | ||||||||||

| Income before income taxes |

515 | 680 | 636 | 623 | 546 | ||||||||||

| Income taxes |

150 | 211 | 202 | 189 | 155 | ||||||||||

| Net income |

$ | 365 | $ | 469 | $ | 434 | $ | 434 | $ | 391 | |||||

| (a) | This schedule is provided for informational purposes only and reflects historical condensed consolidated financial information of PNC: (1) with amounts adjusted for the impact of certain specified items; (2) as if we had recorded our investment in BlackRock on the equity method for all periods presented; and (3) adjusted in each case, as appropriate, for the tax impact. See the Appendix to this Financial Supplement for reconciliations of these amounts to the corresponding GAAP amounts for each of the periods presented. We have provided these adjusted amounts and reconciliations so that investors, analysts, regulators and others will be better able to evaluate the impact of these items on our results for these periods, in addition to providing a basis of comparability for the impact of the BlackRock deconsolidation given the magnitude of the impact of the deconsolidation on various components of our income statement. Adjusted information supplements our results as reported in accordance with GAAP and should not be viewed in isolation from, or as a substitute for, our GAAP results. |

Page 3

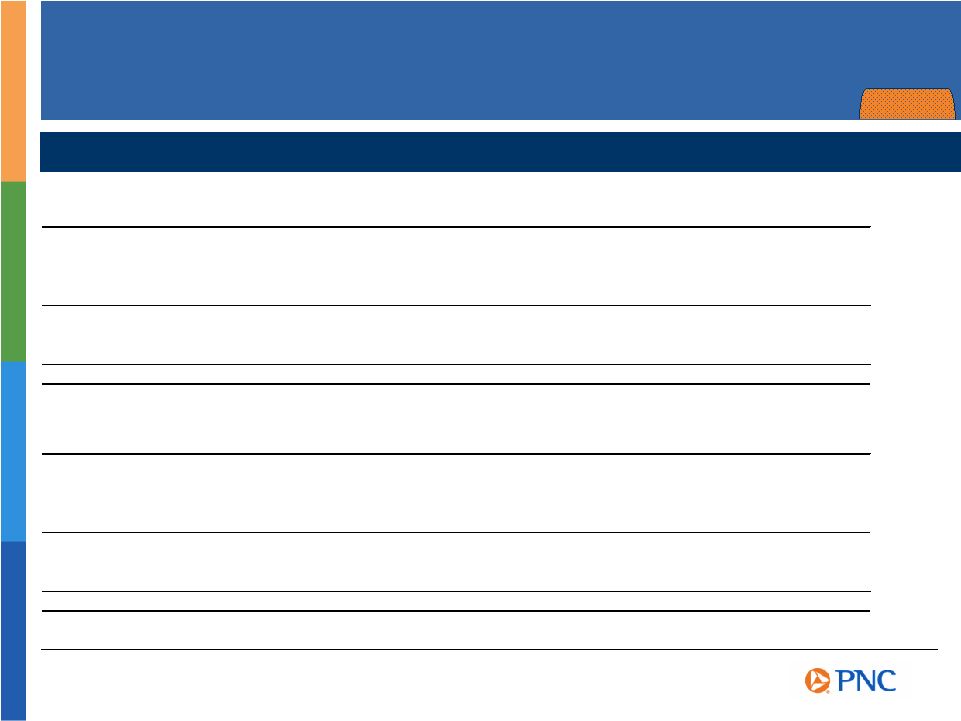

THE PNC FINANCIAL SERVICES GROUP, INC.

Consolidated Balance Sheet (Unaudited)

| In millions, except par value |

December 31 2007 |

September 30 2007 |

June 30 2007 |

March 31 2007 |

December 31 2006 |

|||||||||||||||

| Assets |

||||||||||||||||||||

| Cash and due from banks |

$ | 3,567 | $ | 3,318 | $ | 3,177 | $ | 3,234 | $ | 3,523 | ||||||||||

| Federal funds sold and resale agreements |

2,729 | 2,360 | 1,824 | 1,604 | 1,763 | |||||||||||||||

| Other short-term investments, including trading securities |

4,129 | 3,944 | 3,667 | 3,041 | 3,130 | |||||||||||||||

| Loans held for sale |

3,927 | 3,004 | 2,562 | 2,382 | 2,366 | |||||||||||||||

| Securities available for sale |

30,225 | 28,430 | 25,903 | 26,475 | 23,191 | |||||||||||||||

| Loans, net of unearned income of $990, $986, $1,004, $1,005, and $795 |

68,319 | 65,760 | 64,714 | 62,925 | 50,105 | |||||||||||||||

| Allowance for loan and lease losses |

(830 | ) | (717 | ) | (703 | ) | (690 | ) | (560 | ) | ||||||||||

| Net loans |

67,489 | 65,043 | 64,011 | 62,235 | 49,545 | |||||||||||||||

| Goodwill |

8,405 | 7,836 | 7,745 | 7,739 | 3,402 | |||||||||||||||

| Other intangible assets |

1,146 | 1,099 | 913 | 929 | 641 | |||||||||||||||

| Equity investments |

6,045 | 5,975 | 5,584 | 5,408 | 5,330 | |||||||||||||||

| Other |

11,258 | 10,357 | 10,265 | 9,516 | 8,929 | |||||||||||||||

| Total assets |

$ | 138,920 | $ | 131,366 | $ | 125,651 | $ | 122,563 | $ | 101,820 | ||||||||||

| Liabilities |

||||||||||||||||||||

| Deposits |

||||||||||||||||||||

| Noninterest-bearing |

$ | 19,440 | $ | 18,570 | $ | 18,302 | $ | 18,191 | $ | 16,070 | ||||||||||

| Interest-bearing |

63,256 | 59,839 | 58,919 | 59,176 | 50,231 | |||||||||||||||

| Total deposits |

82,696 | 78,409 | 77,221 | 77,367 | 66,301 | |||||||||||||||

| Borrowed funds |

||||||||||||||||||||

| Federal funds purchased |

7,037 | 6,658 | 7,212 | 5,638 | 2,711 | |||||||||||||||

| Repurchase agreements |

2,737 | 1,990 | 2,805 | 2,586 | 2,051 | |||||||||||||||

| Federal Home Loan Bank borrowings |

7,065 | 4,772 | 104 | 111 | 42 | |||||||||||||||

| Bank notes and senior debt |

6,821 | 7,794 | 7,537 | 4,551 | 3,633 | |||||||||||||||

| Subordinated debt |

4,506 | 3,976 | 4,226 | 4,628 | 3,962 | |||||||||||||||

| Other |

2,765 | 2,263 | 2,632 | 2,942 | 2,629 | |||||||||||||||

| Total borrowed funds |

30,931 | 27,453 | 24,516 | 20,456 | 15,028 | |||||||||||||||

| Allowance for unfunded loan commitments and letters of credit |

134 | 127 | 125 | 121 | 120 | |||||||||||||||

| Accrued expenses |

4,330 | 4,077 | 3,663 | 3,864 | 3,970 | |||||||||||||||

| Other |

4,321 | 5,095 | 4,252 | 4,649 | 4,728 | |||||||||||||||

| Total liabilities |

122,412 | 115,161 | 109,777 | 106,457 | 90,147 | |||||||||||||||

| Minority and noncontrolling interests in consolidated entities |

1,654 | 1,666 | 1,370 | 1,367 | 885 | |||||||||||||||

| Shareholders Equity |

||||||||||||||||||||

| Preferred stock (a) |

||||||||||||||||||||

| Common stock - $5 par value |

||||||||||||||||||||

| Authorized 800 shares, issued 353 shares |

1,764 | 1,764 | 1,764 | 1,764 | 1,764 | |||||||||||||||

| Capital surplus |

2,618 | 2,631 | 2,606 | 2,520 | 1,651 | |||||||||||||||

| Retained earnings |

11,497 | 11,531 | 11,339 | 11,134 | 10,985 | |||||||||||||||

| Accumulated other comprehensive loss |

(147 | ) | (255 | ) | (439 | ) | (162 | ) | (235 | ) | ||||||||||

| Common stock held in treasury at cost: 12, 16, 11, 7, and 60 shares |

(878 | ) | (1,132 | ) | (766 | ) | (517 | ) | (3,377 | ) | ||||||||||

| Total shareholders equity |

14,854 | 14,539 | 14,504 | 14,739 | 10,788 | |||||||||||||||

| Total liabilities, minority and noncontrolling interests, and shareholders equity |

$ | 138,920 | $ | 131,366 | $ | 125,651 | $ | 122,563 | $ | 101,820 | ||||||||||

| Capital Ratios |

||||||||||||||||||||

| Tier 1 risk-based (b) |

6.8 | % | 7.5 | % | 8.3 | % | 8.6 | % | 10.4 | % | ||||||||||

| Total risk-based (b) |

10.3 | 10.9 | 11.8 | 12.2 | 13.5 | |||||||||||||||

| Leverage (b) |

6.2 | 6.8 | 7.3 | 8.7 | 9.3 | |||||||||||||||

| Tangible common equity |

4.7 | 5.2 | 5.5 | 5.8 | 7.4 | |||||||||||||||

| Common shareholders equity to assets |

10.7 | 11.1 | 11.5 | 12.0 | 10.6 | |||||||||||||||

| (a) | Less than $.5 million at each date. |

| (b) | The ratios as of December 31, 2007 are estimated. |

Page 4

THE PNC FINANCIAL SERVICES GROUP, INC.

Summary of Business Segment Results (Unaudited)

| Year ended | Three months ended | |||||||||||||||||||||

| In millions (a) (b) |

December 31 2007 |

December 31 2006 |

December 31 2007 |

September 30 2007 |

June 30 2007 |

March 31 2007 |

December 31 2006 |

|||||||||||||||

| Earnings |

||||||||||||||||||||||

| Retail Banking |

$ | 893 | $ | 765 | $ | 215 | $ | 250 | $ | 227 | $ | 201 | $ | 184 | ||||||||

| Corporate & Institutional Banking |

432 | 454 | 91 | 87 | 122 | 132 | 126 | |||||||||||||||

| PFPC |

128 | 124 | 32 | 33 | 32 | 31 | 31 | |||||||||||||||

| Other, including BlackRock (b) |

14 | 1,252 | (160 | ) | 37 | 42 | 95 | 35 | ||||||||||||||

| Total consolidated net income |

$ | 1,467 | $ | 2,595 | $ | 178 | $ | 407 | $ | 423 | $ | 459 | $ | 376 | ||||||||

| Revenue (c) |

||||||||||||||||||||||

| Retail Banking |

$ | 3,801 | $ | 3,125 | $ | 999 | $ | 985 | $ | 978 | $ | 839 | $ | 799 | ||||||||

| Corporate & Institutional Banking |

1,538 | 1,455 | 399 | 388 | 381 | 370 | 390 | |||||||||||||||

| PFPC (d) |

831 | 762 | 214 | 209 | 208 | 200 | 194 | |||||||||||||||

| Other, including BlackRock (b) |

562 | 3,255 | 22 | 175 | 154 | 211 | 157 | |||||||||||||||

| Total consolidated revenue |

$ | 6,732 | $ | 8,597 | $ | 1,634 | $ | 1,757 | $ | 1,721 | $ | 1,620 | $ | 1,540 | ||||||||

| (a) | Our business information is presented based on our management accounting practices and our management structure. We refine our methodologies from time to time as our management accounting practices are enhanced and our businesses and management structure change. |

| (b) | We consider BlackRock to be a separate reportable business segment but have combined its results with Other for this presentation. Our Annual Report on Form 10-K for the year ended December 31, 2007 will provide additional business segment disclosures for BlackRock. Generally, PNCs business segment earnings from BlackRock can be estimated by multiplying our approximately 33.5% ownership interest by BlackRocks reported GAAP earnings, less the additional income taxes recorded by PNC on those earnings. The effective tax rate on those earnings is typically different than PNCs consolidated effective tax rate due to the tax treatment of dividends received, if any, from BlackRock. PNCs effective tax rate on its earnings from BlackRock for the fourth quarter of 2007 and full year 2007 was approximately 25%. |

| (c) | Business revenue is presented on a taxable-equivalent basis. The interest income earned on certain earning assets is completely or partially exempt from federal income tax. As such, these tax-exempt instruments typically yield lower returns than a taxable investment. To provide more meaningful comparisons of yields and margins for all earning assets, we also provide revenue on a taxable-equivalent basis by increasing the interest income earned on tax-exempt assets to make it fully equivalent to interest income earned on other taxable investments. This adjustment is not permitted under GAAP on the Consolidated Income Statement. The following is a reconciliation of total consolidated revenue on a book (GAAP) basis to total consolidated revenue on a taxable-equivalent basis (in millions): |

| Year ended | Three months ended | ||||||||||||||||||||

| December 31 2007 |

December 31 2006 |

December 31 2007 |

September 30 2007 |

June 30 2007 |

March 31 2007 |

December 31 2006 |

|||||||||||||||

| Total consolidated revenue, book (GAAP) basis |

$ | 6,705 | $ | 8,572 | $ | 1,627 | $ | 1,751 | $ | 1,713 | $ | 1,614 | $ | 1,535 | |||||||

| Taxable-equivalent adjustment |

27 | 25 | 7 | 6 | 8 | 6 | 5 | ||||||||||||||

| Total consolidated revenue, taxable-equivalent basis |

$ | 6,732 | $ | 8,597 | $ | 1,634 | $ | 1,757 | $ | 1,721 | $ | 1,620 | $ | 1,540 | |||||||

| (d) | PFPC revenue represents the sum of servicing revenue and nonoperating income (expense) less debt financing costs. Prior period servicing revenue amounts have been reclassified to conform with the current period presentation. |

| December 31 2007 |

September 30 2007 |

June 30 2007 |

March 31 2007 |

December 31 2006 |

||||||

| Period-end Employees |

||||||||||

| Full-time employees: |

||||||||||

| Retail Banking |

12,036 | 11,753 | 11,804 | 11,838 | 9,549 | |||||

| Corporate & Institutional Banking |

2,290 | 2,267 | 2,084 | 2,038 | 1,936 | |||||

| PFPC |

4,784 | 4,504 | 4,522 | 4,400 | 4,381 | |||||

| Other |

||||||||||

| Operations & Technology |

4,379 | 4,243 | 4,501 | 4,493 | 3,909 | |||||

| Staff Services |

1,991 | 2,044 | 2,115 | 2,059 | 1,680 | |||||

| Total Other |

6,370 | 6,287 | 6,616 | 6,552 | 5,589 | |||||

| Total full-time employees |

25,480 | 24,811 | 25,026 | 24,828 | 21,455 | |||||

| Total part-time employees |

2,840 | 2,823 | 3,028 | 2,867 | 2,328 | |||||

| Total employees |

28,320 | 27,634 | 28,054 | 27,695 | 23,783 | |||||

The period-end employee statistics disclosed for each business reflect staff directly employed by the respective business and exclude operations, technology and staff services employees. Yardville employees are included in the Retail Banking, Corporate & Institutional Banking, and Other businesses at December 31, 2007. Mercantile employees are included in the Retail Banking, Corporate & Institutional Banking, and Other businesses at December 31, 2007, September 30, 2007, June 30, 2007 and March 31, 2007. PFPC employee statistics are provided on a legal entity basis.

Page 5

THE PNC FINANCIAL SERVICES GROUP, INC.

Retail Banking (Unaudited)

| Year ended | Three months ended | |||||||||||||||||||||||||||

| Taxable-equivalent basis (a) Dollars in millions |

December 31 2007 |

December 31 2006 |

December 31 2007 |

September 30 2007 |

June 30 2007 |

March 31 2007 |

December 31 2006 |

|||||||||||||||||||||

| INCOME STATEMENT |

||||||||||||||||||||||||||||

| Net interest income |

$ | 2,065 | $ | 1,678 | $ | 543 | $ | 535 | $ | 535 | $ | 452 | $ | 419 | ||||||||||||||

| Noninterest income |

1,736 | 1,447 | 456 | 450 | 443 | 387 | 380 | |||||||||||||||||||||

| Total revenue |

3,801 | 3,125 | 999 | 985 | 978 | 839 | 799 | |||||||||||||||||||||

| Provision for credit losses |

138 | 81 | 70 | 8 | 37 | 23 | 35 | |||||||||||||||||||||

| Noninterest expense |

2,239 | 1,827 | 587 | 577 | 579 | 496 | 471 | |||||||||||||||||||||

| Pretax earnings |

1,424 | 1,217 | 342 | 400 | 362 | 320 | 293 | |||||||||||||||||||||

| Income taxes |

531 | 452 | 127 | 150 | 135 | 119 | 109 | |||||||||||||||||||||

| Earnings |

$ | 893 | $ | 765 | $ | 215 | $ | 250 | $ | 227 | $ | 201 | $ | 184 | ||||||||||||||

| AVERAGE BALANCE SHEET |

||||||||||||||||||||||||||||

| Loans |

||||||||||||||||||||||||||||

| Consumer |

||||||||||||||||||||||||||||

| Home equity |

$ | 14,209 | $ | 13,813 | $ | 14,417 | $ | 14,296 | $ | 14,237 | $ | 13,881 | $ | 13,807 | ||||||||||||||

| Indirect |

1,897 | 1,052 | 2,031 | 2,033 | 2,036 | 1,480 | 1,133 | |||||||||||||||||||||

| Other consumer |

1,597 | 1,248 | 1,688 | 1,610 | 1,596 | 1,490 | 1,322 | |||||||||||||||||||||

| Total consumer |

17,703 | 16,113 | 18,136 | 17,939 | 17,869 | 16,851 | 16,262 | |||||||||||||||||||||

| Commercial |

12,534 | 5,721 | 14,020 | 13,799 | 13,678 | 8,201 | 5,907 | |||||||||||||||||||||

| Floor plan |

978 | 910 | 983 | 939 | 1,037 | 952 | 853 | |||||||||||||||||||||

| Residential mortgage |

1,992 | 1,440 | 2,500 | 2,050 | 2,038 | 1,781 | 1,031 | |||||||||||||||||||||

| Other |

230 | 242 | 225 | 230 | 235 | 233 | 234 | |||||||||||||||||||||

| Total loans |

33,437 | 24,426 | 35,864 | 34,957 | 34,857 | 28,018 | 24,287 | |||||||||||||||||||||

| Goodwill and other intangible assets |

5,061 | 1,581 | 5,792 | 5,703 | 5,737 | 2,942 | 1,574 | |||||||||||||||||||||

| Loans held for sale |

1,564 | 1,607 | 1,572 | 1,567 | 1,554 | 1,562 | 1,505 | |||||||||||||||||||||

| Other assets |

2,362 | 1,634 | 2,487 | 2,848 | 2,626 | 1,927 | 1,671 | |||||||||||||||||||||

| Total assets |

$ | 42,424 | $ | 29,248 | $ | 45,715 | $ | 45,075 | $ | 44,774 | $ | 34,449 | $ | 29,037 | ||||||||||||||

| Deposits |

||||||||||||||||||||||||||||

| Noninterest-bearing demand |

$ | 10,513 | $ | 7,841 | $ | 10,967 | $ | 11,191 | $ | 11,065 | $ | 8,871 | $ | 7,834 | ||||||||||||||

| Interest-bearing demand |

8,876 | 7,906 | 9,173 | 8,869 | 9,097 | 8,354 | 7,865 | |||||||||||||||||||||

| Money market |

16,786 | 14,750 | 17,328 | 17,020 | 17,100 | 15,669 | 14,822 | |||||||||||||||||||||

| Total transaction deposits |

36,175 | 30,497 | 37,468 | 37,080 | 37,262 | 32,894 | 30,521 | |||||||||||||||||||||

| Savings |

2,678 | 2,035 | 2,651 | 2,831 | 2,981 | 2,243 | 1,877 | |||||||||||||||||||||

| Certificates of deposit |

16,637 | 13,861 | 16,768 | 16,502 | 17,531 | 15,738 | 14,694 | |||||||||||||||||||||

| Total deposits |

55,490 | 46,393 | 56,887 | 56,413 | 57,774 | 50,875 | 47,092 | |||||||||||||||||||||

| Other liabilities |

621 | 553 | 577 | 540 | 679 | 708 | 598 | |||||||||||||||||||||

| Capital |

3,558 | 2,986 | 3,626 | 3,595 | 3,724 | 3,287 | 3,034 | |||||||||||||||||||||

| Total funds |

$ | 59,669 | $ | 49,932 | $ | 61,090 | $ | 60,548 | $ | 62,177 | $ | 54,870 | $ | 50,724 | ||||||||||||||

| PERFORMANCE RATIOS |

||||||||||||||||||||||||||||

| Return on average capital |

25 | % | 26 | % | 24 | % | 28 | % | 24 | % | 25 | % | 24 | % | ||||||||||||||

| Noninterest income to total revenue |

46 | 46 | 46 | 46 | 45 | 46 | 48 | |||||||||||||||||||||

| Efficiency |

59 | 58 | 59 | 59 | 59 | 59 | 59 | |||||||||||||||||||||

| (a) | See notes (a) and (c) on page 5. |

Page 6

THE PNC FINANCIAL SERVICES GROUP, INC.

Retail Banking (Unaudited) (Continued)

| Year ended | Three months ended | |||||||||||||||||||||||||||

| Dollars in millions except as noted |

December 31 2007 |

December 31 2006 |

December 31 2007 |

September 30 2007 |

June 30 2007 |

March 31 2007 |

December 31 2006 |

|||||||||||||||||||||

| OTHER INFORMATION (a) (b) |

||||||||||||||||||||||||||||

| Credit-related statistics: |

||||||||||||||||||||||||||||

| Nonperforming assets |

$ | 225 | $ | 137 | $ | 140 | $ | 123 | $ | 106 | ||||||||||||||||||

| Net charge-offs |

$ | 131 | $ | 85 | $ | 45 | $ | 34 | $ | 25 | $ | 27 | $ | 21 | ||||||||||||||

| Annualized net charge-off ratio |

.39 | % | .35 | % | .50 | % | .39 | % | .29 | % | .39 | % | .34 | % | ||||||||||||||

| Other statistics: |

||||||||||||||||||||||||||||

| Full-time employees |

12,036 | 11,753 | 11,804 | 11,838 | 9,549 | |||||||||||||||||||||||

| Part-time employees |

2,309 | 2,248 | 2,360 | 2,224 | 1,829 | |||||||||||||||||||||||

| ATMs |

3,900 | 3,870 | 3,917 | 3,862 | 3,581 | |||||||||||||||||||||||

| Branches (c) |

1,109 | 1,072 | 1,084 | 1,077 | 852 | |||||||||||||||||||||||

| Gains on sales of education loans (d) |

$ | 24 | $ | 33 | $ | 4 | $ | 12 | $ | 5 | $ | 3 | $ | 11 | ||||||||||||||

| ASSETS UNDER ADMINISTRATION (in billions) (e) |

||||||||||||||||||||||||||||

| Assets under management |

||||||||||||||||||||||||||||

| Personal |

$ | 53 | $ | 57 | $ | 55 | $ | 54 | $ | 44 | ||||||||||||||||||

| Institutional |

20 | 20 | 22 | 22 | 10 | |||||||||||||||||||||||

| Total |

$ | 73 | $ | 77 | $ | 77 | $ | 76 | $ | 54 | ||||||||||||||||||

| Asset Type |

||||||||||||||||||||||||||||

| Equity |

$ | 42 | $ | 44 | $ | 43 | $ | 41 | $ | 34 | ||||||||||||||||||

| Fixed income |

18 | 20 | 20 | 20 | 12 | |||||||||||||||||||||||

| Liquidity/Other |

13 | 13 | 14 | 15 | 8 | |||||||||||||||||||||||

| Total |

$ | 73 | $ | 77 | $ | 77 | $ | 76 | $ | 54 | ||||||||||||||||||

| Nondiscretionary assets under administration |

||||||||||||||||||||||||||||

| Personal |

$ | 30 | $ | 31 | $ | 30 | $ | 31 | $ | 25 | ||||||||||||||||||

| Institutional |

83 | 81 | 81 | 80 | 61 | |||||||||||||||||||||||

| Total |

$ | 113 | $ | 112 | $ | 111 | $ | 111 | $ | 86 | ||||||||||||||||||

| Asset Type |

||||||||||||||||||||||||||||

| Equity |

$ | 49 | $ | 50 | $ | 47 | $ | 42 | $ | 33 | ||||||||||||||||||

| Fixed income |

28 | 27 | 28 | 28 | 24 | |||||||||||||||||||||||

| Liquidity/Other |

36 | 35 | 36 | 41 | 29 | |||||||||||||||||||||||

| Total |

$ | 113 | $ | 112 | $ | 111 | $ | 111 | $ | 86 | ||||||||||||||||||

| (a) | Presented as of period-end, except for net charge-offs, annualized net charge-off ratio and gains on sales of education loans. |

| (b) | Amounts subsequent to March 2, 2007 include the impact of Mercantile. Amounts subsequent to October 26, 2007 include the impact of Yardville. |

| (c) | Excludes certain satellite branches that provide limited products and service hours. |

| (d) | Included in Noninterest income on page 6. |

| (e) | Excludes brokerage account assets. |

Page 7

THE PNC FINANCIAL SERVICES GROUP, INC.

Retail Banking (Unaudited) (Continued)

| Dollars in millions except as noted |

December 31 2007 (b) |

September 30 2007 |

June 30 2007 (b) |

March 31 2007 (b) |

December 31 2006 |

|||||||||||||||

| OTHER INFORMATION (a) (b) |

||||||||||||||||||||

| Home equity portfolio credit statistics: |

||||||||||||||||||||

| % of first lien positions (c) |

39 | % | 39 | % | 42 | % | 43 | % | 43 | % | ||||||||||

| Weighted average loan-to-value ratios (c) |

73 | % | 72 | % | 70 | % | 70 | % | 70 | % | ||||||||||

| Weighted average FICO scores (d) |

727 | 726 | 727 | 726 | 728 | |||||||||||||||

| Loans 90 days past due |

.37 | % | .30 | % | .26 | % | .25 | % | .24 | % | ||||||||||

| Checking-related statistics: |

||||||||||||||||||||

| Retail Banking checking relationships |

2,272,000 | 2,275,000 | 1,967,000 | 1,962,000 | 1,954,000 | |||||||||||||||

| Consumer DDA households using online banking |

1,091,000 | 1,050,000 | 975,000 | 960,000 | 938,000 | |||||||||||||||

| % of consumer DDA households using online banking |

54 | % | 52 | % | 55 | % | 54 | % | 53 | % | ||||||||||

| Consumer DDA households using online bill payment |

667,000 | 604,000 | 505,000 | 450,000 | 404,000 | |||||||||||||||

| % of consumer DDA households using online bill payment |

33 | % | 30 | % | 29 | % | 25 | % | 23 | % | ||||||||||

| Small business loans and managed deposits: |

||||||||||||||||||||

| Small business loans |

$ | 13,049 | $ | 13,157 | $ | 5,410 | $ | 5,284 | $ | 5,116 | ||||||||||

| Managed deposits: |

||||||||||||||||||||

| On-balance sheet |

||||||||||||||||||||

| Noninterest-bearing demand |

$ | 5,994 | $ | 6,119 | $ | 4,250 | $ | 4,284 | $ | 4,383 | ||||||||||

| Interest-bearing demand |

1,873 | 2,027 | 1,505 | 1,517 | 1,649 | |||||||||||||||

| Money market |

3,152 | 3,389 | 2,595 | 2,635 | 2,592 | |||||||||||||||

| Certificates of deposit |

1,068 | 1,070 | 584 | 681 | 802 | |||||||||||||||

| Off-balance sheet (e) |

||||||||||||||||||||

| Small business sweep checking |

2,780 | 2,823 | 1,933 | 1,827 | 1,733 | |||||||||||||||

| Total managed deposits |

$ | 14,867 | $ | 15,428 | $ | 10,867 | $ | 10,944 | $ | 11,159 | ||||||||||

| Brokerage statistics: |

||||||||||||||||||||

| Margin loans |

$ | 151 | $ | 161 | $ | 162 | $ | 166 | $ | 163 | ||||||||||

| Financial consultants (f) |

769 | 765 | 767 | 757 | 758 | |||||||||||||||

| Full service brokerage offices |

100 | 100 | 99 | 99 | 99 | |||||||||||||||

| Brokerage account assets (billions) |

$ | 48 | $ | 49 | $ | 47 | $ | 46 | $ | 46 | ||||||||||

| (a) | Presented as of period-end. |

| (b) | This information excludes the impact of acquisitions between PNCs acquisition date and the date of conversion of the acquired companies data onto PNCs financial and operational systems because such information was not available prior to the conversion date. Therefore, information presented above as of June 30, 2007 and March 31, 2007 excludes the impact of Mercantile, which PNC acquired effective March 2, 2007 and converted during September 2007. Similarly, information presented above as of December 31, 2007 (except Brokerage statistics) excludes the impact of Yardville, which PNC acquired effective October 26, 2007 and expects to convert during March 2008. |

| (c) | Includes loans from acquired portfolios for which lien position and loan-to-value information was limited. |

| (d) | Represents the most recent FICO scores we have on file. |

| (e) | Represents small business balances. These balances are swept into liquidity products managed by other PNC business segments, the majority of which are off-balance sheet. |

| (f) | Financial consultants provide services in full service brokerage offices and PNC traditional branches. |

Page 8

THE PNC FINANCIAL SERVICES GROUP, INC.

Corporate & Institutional Banking (Unaudited)

| Year ended | Three months ended | |||||||||||||||||||||||||||

| Taxable-equivalent basis (a) Dollars in millions except as noted |

December 31 2007 |

December 31 2006 |

December 31 2007 |

September 30 2007 |

June 30 2007 |

March 31 2007 |

December 31 2006 |

|||||||||||||||||||||

| INCOME STATEMENT |

||||||||||||||||||||||||||||

| Net interest income |

$ | 818 | $ | 703 | $ | 237 | $ | 204 | $ | 194 | $ | 183 | $ | 186 | ||||||||||||||

| Noninterest income |

||||||||||||||||||||||||||||

| Corporate service fees |

564 | 526 | 137 | 161 | 139 | 127 | 149 | |||||||||||||||||||||

| Other (b) |

156 | 226 | 25 | 23 | 48 | 60 | 55 | |||||||||||||||||||||

| Noninterest income |

720 | 752 | 162 | 184 | 187 | 187 | 204 | |||||||||||||||||||||

| Total revenue |

1,538 | 1,455 | 399 | 388 | 381 | 370 | 390 | |||||||||||||||||||||

| Provision for (recoveries of) credit losses |

125 | 42 | 69 | 55 | 17 | (16 | ) | 6 | ||||||||||||||||||||

| Noninterest expense |

818 | 746 | 222 | 211 | 192 | 193 | 199 | |||||||||||||||||||||

| Pretax earnings |

595 | 667 | 108 | 122 | 172 | 193 | 185 | |||||||||||||||||||||

| Income taxes |

163 | 213 | 17 | 35 | 50 | 61 | 59 | |||||||||||||||||||||

| Earnings |

$ | 432 | $ | 454 | $ | 91 | $ | 87 | $ | 122 | $ | 132 | $ | 126 | ||||||||||||||

| AVERAGE BALANCE SHEET |

||||||||||||||||||||||||||||

| Loans |

||||||||||||||||||||||||||||

| Corporate (c) |

$ | 9,519 | $ | 8,633 | $ | 10,254 | $ | 9,625 | $ | 9,274 | $ | 8,909 | $ | 8,885 | ||||||||||||||

| Commercial real estate |

3,590 | 2,876 | 3,956 | 3,576 | 3,555 | 3,253 | 3,143 | |||||||||||||||||||||

| Commercial - real estate related |

3,580 | 2,433 | 4,065 | 3,746 | 3,736 | 2,733 | 2,189 | |||||||||||||||||||||

| Asset-based lending |

4,634 | 4,467 | 4,795 | 4,647 | 4,562 | 4,513 | 4,594 | |||||||||||||||||||||

| Total loans (c) |

21,323 | 18,409 | 23,070 | 21,594 | 21,127 | 19,408 | 18,811 | |||||||||||||||||||||

| Goodwill and other intangible assets |

1,919 | 1,352 | 2,232 | 2,085 | 1,837 | 1,544 | 1,399 | |||||||||||||||||||||

| Loans held for sale |

1,319 | 893 | 1,781 | 1,207 | 982 | 1,302 | 965 | |||||||||||||||||||||

| Other assets |

4,491 | 4,168 | 4,641 | 4,544 | 4,531 | 4,244 | 4,550 | |||||||||||||||||||||

| Total assets |

$ | 29,052 | $ | 24,822 | $ | 31,724 | $ | 29,430 | $ | 28,477 | $ | 26,498 | $ | 25,725 | ||||||||||||||

| Deposits |

||||||||||||||||||||||||||||

| Noninterest-bearing demand |

$ | 7,301 | $ | 6,771 | $ | 7,851 | $ | 7,238 | $ | 6,953 | $ | 7,083 | $ | 7,210 | ||||||||||||||

| Money market |

4,784 | 2,654 | 4,995 | 4,960 | 4,653 | 4,530 | 3,644 | |||||||||||||||||||||

| Other |

1,325 | 907 | 1,818 | 1,436 | 1,113 | 926 | 921 | |||||||||||||||||||||

| Total deposits |

13,410 | 10,332 | 14,664 | 13,634 | 12,719 | 12,539 | 11,775 | |||||||||||||||||||||

| Other liabilities |

3,347 | 2,863 | 4,452 | 3,109 | 2,960 | 2,850 | 3,093 | |||||||||||||||||||||

| Capital |

2,152 | 1,838 | 2,357 | 2,132 | 2,050 | 2,064 | 1,935 | |||||||||||||||||||||

| Total funds |

$ | 18,909 | $ | 15,033 | $ | 21,473 | $ | 18,875 | $ | 17,729 | $ | 17,453 | $ | 16,803 | ||||||||||||||

| PERFORMANCE RATIOS |

||||||||||||||||||||||||||||

| Return on average capital |

20 | % | 25 | % | 15 | % | 16 | % | 24 | % | 26 | % | 26 | % | ||||||||||||||

| Noninterest income to total revenue |

47 | 52 | 41 | 47 | 49 | 51 | 52 | |||||||||||||||||||||

| Efficiency |

53 | 51 | 56 | 54 | 50 | 52 | 51 | |||||||||||||||||||||

| COMMERCIAL MORTGAGE |

||||||||||||||||||||||||||||

| SERVICING PORTFOLIO (in billions) |

||||||||||||||||||||||||||||

| Beginning of period |

$ | 200 | $ | 136 | $ | 244 | $ | 222 | $ | 206 | $ | 200 | $ | 180 | ||||||||||||||

| Acquisitions/additions |

88 | 102 | 8 | 36 | 28 | 16 | 33 | |||||||||||||||||||||

| Repayments/transfers |

(45 | ) | (38 | ) | (9 | ) | (14 | ) | (12 | ) | (10 | ) | (13 | ) | ||||||||||||||

| End of period (d) |

$ | 243 | $ | 200 | $ | 243 | $ | 244 | $ | 222 | $ | 206 | $ | 200 | ||||||||||||||

| OTHER INFORMATION |

||||||||||||||||||||||||||||

| Consolidated revenue from: (e) |

||||||||||||||||||||||||||||

| Treasury Management |

$ | 476 | $ | 418 | $ | 131 | $ | 121 | $ | 114 | $ | 110 | $ | 107 | ||||||||||||||

| Capital Markets |

$ | 290 | $ | 283 | $ | 74 | $ | 73 | $ | 76 | $ | 67 | $ | 79 | ||||||||||||||

| Midland Loan Services |

$ | 220 | $ | 184 | $ | 51 | $ | 59 | $ | 56 | $ | 54 | $ | 53 | ||||||||||||||

| Total loans (f) |

$ | 23,861 | $ | 22,455 | $ | 21,662 | $ | 21,193 | $ | 18,957 | ||||||||||||||||||

| Nonperforming assets (f) |

$ | 243 | $ | 141 | $ | 100 | $ | 77 | $ | 63 | ||||||||||||||||||

| Net charge-offs |

$ | 70 | $ | 54 | $ | 39 | $ | 15 | $ | 7 | $ | 9 | $ | 24 | ||||||||||||||

| Full-time employees (f) |

2,290 | 2,267 | 2,084 | 2,038 | 1,936 | |||||||||||||||||||||||

| Net gains on commercial mortgage loan sales (d) |

$ | 39 | $ | 55 | $ | 10 | $ | 5 | $ | 9 | $ | 15 | $ | 18 | ||||||||||||||

| Valuation adjustment on commercial mortgage loans held for sale |

$ | (26 | ) | $ | (26 | ) | ||||||||||||||||||||||

| Net carrying amount of commercial mortgage servicing rights (d) (f) |

$ | 694 | $ | 708 | $ | 493 | $ | 487 | $ | 471 | ||||||||||||||||||

| (a) | See notes (a) and (c) on page 5. |

| (b) | Amounts for fourth quarter and full year 2007 include a $26 million of negative valuation adjustment on our commercial mortgage loans held for sale. |

| (c) | Includes lease financing. |

| (d) | Amounts at December 31, 2007 and September 30, 2007 include the impact of the July 2, 2007 acquisition of ARCS Commercial Mortgage. |

| (e) | Represents consolidated PNC amounts. |

| (f) | Presented as of period end. |

Page 9

THE PNC FINANCIAL SERVICES GROUP, INC.

PFPC (Unaudited) (a)

| Year ended | Three months ended | |||||||||||||||||||||||||||

| Dollars in millions except as noted |

December 31 2007 |

December 31 2006 |

December 31 2007 |

September 30 2007 |

June 30 2007 |

March 31 2007 |

December 31 2006 |

|||||||||||||||||||||

| INCOME STATEMENT |

||||||||||||||||||||||||||||

| Servicing revenue (b) |

$ | 863 | $ | 800 | $ | 223 | $ | 216 | $ | 216 | $ | 208 | $ | 203 | ||||||||||||||

| Operating expense (b) |

637 | 586 | 167 | 159 | 158 | 153 | 146 | |||||||||||||||||||||

| Operating income |

226 | 214 | 56 | 57 | 58 | 55 | 57 | |||||||||||||||||||||

| Debt financing |

38 | 42 | 10 | 9 | 9 | 10 | 10 | |||||||||||||||||||||

| Nonoperating income (c) |

6 | 4 | 1 | 2 | 1 | 2 | 1 | |||||||||||||||||||||

| Pretax earnings |

194 | 176 | 47 | 50 | 50 | 47 | 48 | |||||||||||||||||||||

| Income taxes |

66 | 52 | 15 | 17 | 18 | 16 | 17 | |||||||||||||||||||||

| Earnings |

$ | 128 | $ | 124 | $ | 32 | $ | 33 | $ | 32 | $ | 31 | $ | 31 | ||||||||||||||

| PERIOD-END BALANCE SHEET |

||||||||||||||||||||||||||||

| Goodwill and other intangible assets |

$ | 1,315 | $ | 1,002 | $ | 1,005 | $ | 1,008 | $ | 1,012 | ||||||||||||||||||

| Other assets |

1,161 | 1,169 | 1,395 | 1,370 | 1,192 | |||||||||||||||||||||||

| Total assets |

$ | 2,476 | $ | 2,171 | $ | 2,400 | $ | 2,378 | $ | 2,204 | ||||||||||||||||||

| Debt financing |

$ | 989 | $ | 702 | $ | 734 | $ | 760 | $ | 792 | ||||||||||||||||||

| Other liabilities |

865 | 878 | 1,109 | 1,091 | 917 | |||||||||||||||||||||||

| Shareholders equity |

622 | 591 | 557 | 527 | 495 | |||||||||||||||||||||||

| Total funds |

$ | 2,476 | $ | 2,171 | $ | 2,400 | $ | 2,378 | $ | 2,204 | ||||||||||||||||||

| PERFORMANCE RATIOS |

||||||||||||||||||||||||||||

| Return on average equity |

23 | % | 29 | % | 21 | % | 23 | % | 24 | % | 25 | % | 26 | % | ||||||||||||||

| Operating margin (d) |

26 | 27 | 25 | 26 | 27 | 26 | 28 | |||||||||||||||||||||

| SERVICING STATISTICS (at period end) |

||||||||||||||||||||||||||||

| Accounting/administration net fund assets (in billions)(e) |

||||||||||||||||||||||||||||

| Domestic |

$ | 869 | $ | 806 | $ | 765 | $ | 731 | $ | 746 | ||||||||||||||||||

| Offshore |

121 | 116 | 103 | 91 | 91 | |||||||||||||||||||||||

| Total |

$ | 990 | $ | 922 | $ | 868 | $ | 822 | $ | 837 | ||||||||||||||||||

| Asset type (in billions)(e) |

||||||||||||||||||||||||||||

| Money market |

$ | 373 | $ | 328 | $ | 286 | $ | 280 | $ | 281 | ||||||||||||||||||

| Equity |

390 | 377 | 373 | 352 | 354 | |||||||||||||||||||||||

| Fixed income |

123 | 117 | 118 | 111 | 117 | |||||||||||||||||||||||

| Other |

104 | 100 | 91 | 79 | 85 | |||||||||||||||||||||||

| Total |

$ | 990 | $ | 922 | $ | 868 | $ | 822 | $ | 837 | ||||||||||||||||||

| Custody fund assets (in billions) |

$ | 500 | $ | 497 | $ | 467 | $ | 435 | $ | 427 | ||||||||||||||||||

| Shareholder accounts (in millions) |

||||||||||||||||||||||||||||

| Transfer agency |

19 | 19 | 20 | 18 | 18 | |||||||||||||||||||||||

| Subaccounting |

53 | 51 | 50 | 50 | 50 | |||||||||||||||||||||||

| Total |

72 | 70 | 70 | 68 | 68 | |||||||||||||||||||||||

| OTHER INFORMATION |

||||||||||||||||||||||||||||

| Period-end full-time employees |

4,784 | 4,504 | 4,522 | 4,400 | 4,381 | |||||||||||||||||||||||

| (a) | See note (a) on page 5. |

| (b) | Certain out-of-pocket expense items which are then client billable are included in both servicing revenue and operating expense above, but offset each other entirely and therefore have no net effect on operating income. Distribution revenue and expenses which relate to 12b-1 fees that PFPC receives from certain fund clients for the payment of marketing, sales and service expenses also entirely offset each other, but are netted for presentation purposes above. Amounts for 2006 periods have been reclassified to conform with the current period presentation. |

| (c) | Net of nonoperating expense. |

| (d) | Total operating income divided by servicing revenue. |

| (e) | Includes alternative investment net assets serviced. |

Page 10

THE PNC FINANCIAL SERVICES GROUP, INC.

Efficiency Ratio (Unaudited)

| Year ended | Three months ended | ||||||||||||||||||||

| December 31 2007 |

December 31 2006 |

December 31 2007 |

September 30 2007 |

June 30 2007 |

March 31 2007 |

December 31 2006 |

|||||||||||||||

| Efficiency, as reported (a) |

64 | % | 52 | % | 75 | % | 63 | % | 61 | % | 58 | % | 63 | % | |||||||

| Efficiency, as adjusted (b) |

60 | % | 62 | % | 62 | % | 59 | % | 60 | % | 60 | % | 62 | % | |||||||

| (a) | Calculated as noninterest expense divided by the sum of net interest income and noninterest income on the Consolidated Income Statement. |

| (b) | Calculated as PNCs efficiency ratio adjusted: (1) for the impact of certain specified items; (2) as if we had recorded our investment in BlackRock on the equity method for all periods presented; and (3) in each case, as appropriate, adjusted for the tax impact. We have provided these adjusted amounts and reconciliations so that shareholders, investor analysts, regulators and others will be better able to evaluate the impact of these items on our as reported efficiency ratio for these periods, in addition to providing a basis of comparability for the impact of the BlackRock deconsolidation. Amounts used for these adjusted ratios are reconciled to amounts used in the PNC efficiency ratio as reported (GAAP basis) below. |

| Year ended | Three months ended | |||||||||||||||||||||||||||

| Dollars in millions |

December 31 2007 |

December 31 2006 |

December 31 2007 |

September 30 2007 |

June 30 2007 |

March 31 2007 |

December 31 2006 |

|||||||||||||||||||||

| Reconciliation of GAAP amounts with amounts used in the calculation of the adjusted efficiency ratio: |

||||||||||||||||||||||||||||

| GAAP basisnet interest income |

$ | 2,915 | $ | 2,245 | $ | 793 | $ | 761 | $ | 738 | $ | 623 | $ | 566 | ||||||||||||||

| Adjustment to net interest income: BlackRock equity method (c) |

(10 | ) | ||||||||||||||||||||||||||

| Adjusted net interest income |

$ | 2,915 | $ | 2,235 | $ | 793 | $ | 761 | $ | 738 | $ | 623 | $ | 566 | ||||||||||||||

| GAAP basisnoninterest income |

$ | 3,790 | $ | 6,327 | $ | 834 | $ | 990 | $ | 975 | $ | 991 | $ | 969 | ||||||||||||||

| Adjustments (c) : |

||||||||||||||||||||||||||||

| Gain on BlackRock/MLIM transaction |

(2,078 | ) | ||||||||||||||||||||||||||

| Securities portfolio rebalancing loss |

196 | |||||||||||||||||||||||||||

| Mortgage loan portfolio repositioning loss |

48 | |||||||||||||||||||||||||||

| Integration costs |

4 | 10 | (1 | ) | 2 | 1 | 2 | 10 | ||||||||||||||||||||

| BlackRock LTIP |

127 | 12 | 128 | 50 | 1 | (52 | ) | 12 | ||||||||||||||||||||

| BlackRock equity method |

(943 | ) | ||||||||||||||||||||||||||

| Adjusted noninterest income |

$ | 3,921 | $ | 3,572 | $ | 961 | $ | 1,042 | $ | 977 | $ | 941 | $ | 991 | ||||||||||||||

| Adjusted total revenue |

$ | 6,836 | $ | 5,807 | $ | 1,754 | $ | 1,803 | $ | 1,715 | $ | 1,564 | $ | 1,557 | ||||||||||||||

| GAAP basisnoninterest expense |

$ | 4,296 | $ | 4,443 | $ | 1,213 | $ | 1,099 | $ | 1,040 | $ | 944 | $ | 969 | ||||||||||||||

| Adjustments (c): |

||||||||||||||||||||||||||||

| Integration costs |

(102 | ) | (91 | ) | (35 | ) | (41 | ) | (15 | ) | (11 | ) | ||||||||||||||||

| Visa indemnification |

(82 | ) | (82 | ) | ||||||||||||||||||||||||

| BlackRock equity method |

(765 | ) | ||||||||||||||||||||||||||

| Adjusted noninterest expense |

$ | 4,112 | $ | 3,587 | $ | 1,096 | $ | 1,058 | $ | 1,025 | $ | 933 | $ | 969 | ||||||||||||||

| Adjusted efficiency ratio |

60 | % | 62 | % | 62 | % | 59 | % | 60 | % | 60 | % | 62 | % | ||||||||||||||

| (c) | See the Appendix to this Financial Supplement. |

Page 11

THE PNC FINANCIAL SERVICES GROUP, INC.

Details of Net Interest Income, Net Interest Margin, and Trading Revenue (Unaudited)

| Year ended | Three months ended | |||||||||||||||||||||||||||

| In millions |

December 31 2007 |

December 31 2006 |

December 31 2007 |

September 30 2007 |

June 30 2007 |

March 31 2007 |

December 31 2006 |

|||||||||||||||||||||

| Net Interest Income |

||||||||||||||||||||||||||||

| Interest income, taxable equivalent basis |

||||||||||||||||||||||||||||

| Loans |

$ | 4,248 | $ | 3,216 | $ | 1,127 | $ | 1,134 | $ | 1,088 | $ | 899 | $ | 824 | ||||||||||||||

| Securities available for sale |

1,431 | 1,050 | 398 | 368 | 355 | 310 | 279 | |||||||||||||||||||||

| Other |

514 | 371 | 152 | 131 | 119 | 112 | 119 | |||||||||||||||||||||

| Total interest income |

6,193 | 4,637 | 1,677 | 1,633 | 1,562 | 1,321 | 1,222 | |||||||||||||||||||||

| Interest expense |

||||||||||||||||||||||||||||

| Deposits |

2,053 | 1,590 | 522 | 531 | 532 | 468 | 450 | |||||||||||||||||||||

| Borrowed funds |

1,198 | 777 | 355 | 335 | 284 | 224 | 201 | |||||||||||||||||||||

| Total interest expense |

3,251 | 2,367 | 877 | 866 | 816 | 692 | 651 | |||||||||||||||||||||

| Net interest income, taxable-equivalent basis |

2,942 | 2,270 | 800 | 767 | 746 | 629 | 571 | |||||||||||||||||||||

| Less: Taxable-equivalent adjustment |

27 | 25 | 7 | 6 | 8 | 6 | 5 | |||||||||||||||||||||

| Net interest income, GAAP basis |

$ | 2,915 | $ | 2,245 | $ | 793 | $ | 761 | $ | 738 | $ | 623 | $ | 566 | ||||||||||||||

| Year ended | Three months ended | |||||||||||||||||||||||||||

| December 31 2007 |

December 31 2006 |

December 31 2007 |

September 30 2007 |

June 30 2007 |

March 31 2007 |

December 31 2006 |

||||||||||||||||||||||

| Net Interest Margin |

||||||||||||||||||||||||||||

| Average yields/rates |

||||||||||||||||||||||||||||

| Yield on interest-earning assets |

||||||||||||||||||||||||||||

| Loans |

6.80 | % | 6.49 | % | 6.62 | % | 6.89 | % | 6.81 | % | 6.68 | % | 6.63 | % | ||||||||||||||

| Securities available for sale |

5.39 | 4.93 | 5.46 | 5.42 | 5.37 | 5.31 | 5.27 | |||||||||||||||||||||

| Other |

5.70 | 5.45 | 5.51 | 5.56 | 5.94 | 5.83 | 5.56 | |||||||||||||||||||||

| Total yield on interest-earning assets |

6.32 | 5.97 | 6.19 | 6.37 | 6.35 | 6.23 | 6.15 | |||||||||||||||||||||

| Rate on interest-bearing liabilities |

||||||||||||||||||||||||||||

| Deposits |

3.47 | 3.25 | 3.31 | 3.49 | 3.52 | 3.52 | 3.54 | |||||||||||||||||||||

| Borrowed funds |

5.20 | 5.17 | 4.88 | 5.22 | 5.28 | 5.33 | 5.39 | |||||||||||||||||||||

| Total rate on interest-bearing liabilities |

3.95 | 3.70 | 3.81 | 3.99 | 3.98 | 3.95 | 3.97 | |||||||||||||||||||||

| Interest rate spread |

2.37 | 2.27 | 2.38 | 2.38 | 2.37 | 2.28 | 2.18 | |||||||||||||||||||||

| Impact of noninterest-bearing sources |

.63 | .65 | .58 | .62 | .66 | .67 | .70 | |||||||||||||||||||||

| Net interest margin |

3.00 | % | 2.92 | % | 2.96 | % | 3.00 | % | 3.03 | % | 2.95 | % | 2.88 | % | ||||||||||||||

| Year ended | Three months ended | |||||||||||||||||||||||||||

| In millions |

December 31 2007 |

December 31 2006 |

December 31 2007 |

September 30 2007 |

June 30 2007 |

March 31 2007 |

December 31 2006 |

|||||||||||||||||||||

| Trading Revenue (a) |

||||||||||||||||||||||||||||

| Net interest income (expense) |

$ | 7 | $ | (6 | ) | $ | 7 | $ | (1 | ) | $ | 1 | $ | (2 | ) | |||||||||||||

| Noninterest income |

104 | 183 | (10 | ) | 33 | 29 | $ | 52 | 33 | |||||||||||||||||||

| Total trading revenue |

$ | 111 | $ | 177 | $ | (3 | ) | $ | 32 | $ | 30 | $ | 52 | $ | 31 | |||||||||||||

| Securities underwriting and trading (b) |

$ | 41 | $ | 38 | $ | 10 | $ | 14 | $ | 8 | $ | 9 | $ | 11 | ||||||||||||||

| Foreign exchange |

58 | 55 | 16 | 15 | 13 | 14 | 13 | |||||||||||||||||||||

| Financial derivatives |

12 | 84 | (29 | ) | 3 | 9 | 29 | 7 | ||||||||||||||||||||

| Total trading revenue |

$ | 111 | $ | 177 | $ | (3 | ) | $ | 32 | $ | 30 | $ | 52 | $ | 31 | |||||||||||||

| (a) | See pages 13-14 for disclosure of average trading assets and liabilities. |

| (b) | Includes changes in fair value for certain loans accounted for at fair value. See page 13 for disclosure of average loans at fair value. |

Page 12

THE PNC FINANCIAL SERVICES GROUP, INC.

Average Consolidated Balance Sheet (Unaudited)

| Year ended | Three months ended | |||||||||||||||||||||||||||

| In millions |

December 31 2007 |

December 31 2006 |

December 31 2007 |

September 30 2007 |

June 30 2007 |

March 31 2007 |

December 31 2006 |

|||||||||||||||||||||

| Assets |

||||||||||||||||||||||||||||

| Interest-earning assets: |

||||||||||||||||||||||||||||

| Securities available for sale |

||||||||||||||||||||||||||||

| Residential mortgage-backed |

$ | 19,163 | $ | 14,881 | $ | 20,592 | $ | 19,541 | $ | 19,280 | $ | 17,198 | $ | 16,082 | ||||||||||||||

| Commercial mortgage-backed |

4,025 | 2,305 | 4,921 | 4,177 | 3,646 | 3,338 | 2,640 | |||||||||||||||||||||

| Asset-backed |

2,394 | 1,312 | 2,704 | 2,454 | 2,531 | 1,876 | 1,561 | |||||||||||||||||||||

| U.S. Treasury and government agencies |

293 | 2,334 | 155 | 281 | 344 | 394 | 441 | |||||||||||||||||||||

| State and municipal |

227 | 148 | 306 | 233 | 203 | 162 | 140 | |||||||||||||||||||||

| Other debt |

47 | 89 | 52 | 25 | 33 | 79 | 89 | |||||||||||||||||||||

| Corporate stocks and other |

392 | 246 | 458 | 381 | 383 | 347 | 277 | |||||||||||||||||||||

| Total securities available for sale |

26,541 | 21,315 | 29,188 | 27,092 | 26,420 | 23,394 | 21,230 | |||||||||||||||||||||

| Loans, net of unearned income |

||||||||||||||||||||||||||||

| Commercial |

25,509 | 20,201 | 27,528 | 26,352 | 25,845 | 21,479 | 20,458 | |||||||||||||||||||||

| Commercial real estate |

7,671 | 3,212 | 8,919 | 8,272 | 8,320 | 5,478 | 3,483 | |||||||||||||||||||||

| Lease financing |

2,559 | 2,777 | 2,552 | 2,581 | 2,566 | 2,534 | 2,789 | |||||||||||||||||||||

| Consumer |

17,718 | 16,125 | 18,150 | 17,954 | 17,886 | 16,865 | 16,272 | |||||||||||||||||||||

| Residential mortgage |

8,564 | 6,888 | 9,605 | 9,325 | 8,527 | 7,173 | 5,606 | |||||||||||||||||||||

| Other |

432 | 363 | 400 | 393 | 411 | 527 | 385 | |||||||||||||||||||||

| Total loans, net of unearned income |

62,453 | 49,566 | 67,154 | 64,877 | 63,555 | 54,056 | 48,993 | |||||||||||||||||||||

| Loans held for sale |

2,955 | 2,683 | 3,408 | 2,842 | 2,611 | 2,955 | 3,167 | |||||||||||||||||||||

| Federal funds sold and resale agreements |

2,152 | 1,143 | 2,516 | 2,163 | 1,832 | 2,092 | 2,049 | |||||||||||||||||||||

| Other |

3,909 | 2,985 | 4,926 | 4,342 | 3,606 | 2,735 | 3,198 | |||||||||||||||||||||

| Total interest-earning assets |

98,010 | 77,692 | 107,192 | 101,316 | 98,024 | 85,232 | 78,637 | |||||||||||||||||||||

| Noninterest-earning assets: |

||||||||||||||||||||||||||||

| Allowance for loan and lease losses |

(690 | ) | (591 | ) | (749 | ) | (708 | ) | (692 | ) | (612 | ) | (557 | ) | ||||||||||||||

| Cash and due from banks |

3,018 | 3,121 | 3,089 | 3,047 | 2,991 | 2,945 | 2,999 | |||||||||||||||||||||

| Other |

23,080 | 14,790 | 25,418 | 23,977 | 22,997 | 19,857 | 17,969 | |||||||||||||||||||||

| Total assets |

$ | 123,418 | $ | 95,012 | $ | 134,950 | $ | 127,632 | $ | 123,320 | $ | 107,422 | $ | 99,048 | ||||||||||||||

| Supplemental Average Balance Sheet Information (Unaudited) |

||||||||||||||||||||||||||||

| Trading Assets |

||||||||||||||||||||||||||||

| Securities (a) |

$ | 2,708 | $ | 1,712 | $ | 3,486 | $ | 3,293 | $ | 2,144 | $ | 1,569 | $ | 2,111 | ||||||||||||||

| Resale agreements (b) |

1,133 | 623 | 1,320 | 1,267 | 1,247 | 820 | 1,247 | |||||||||||||||||||||

| Financial derivatives (c) |

1,378 | 1,148 | 1,785 | 1,389 | 1,221 | 1,115 | 1,209 | |||||||||||||||||||||

| Loans at fair value (c) |

166 | 128 | 148 | 164 | 161 | 193 | 172 | |||||||||||||||||||||

| Total trading assets |

$ | 5,385 | $ | 3,611 | $ | 6,739 | $ | 6,113 | $ | 4,773 | $ | 3,697 | $ | 4,739 | ||||||||||||||

| (a) | Included in Interest-earning assets-Other above. |

| (b) | Included in Federal funds sold and resale agreements above. |

| (c) | Included in Noninterest-earning assets-Other above. |

Page 13

THE PNC FINANCIAL SERVICES GROUP, INC.

Average Consolidated Balance Sheet (Unaudited) (Continued)

| Year ended | Three months ended | ||||||||||||||||||||

| In millions |

December 31 2007 |

December 31 2006 |

December 31 2007 |

September 30 2007 |

June 30 2007 |

March 31 2007 |

December 31 2006 |

||||||||||||||

| Liabilities, Minority and Noncontrolling Interests, and Shareholders Equity |

|||||||||||||||||||||

| Interest-bearing liabilities: |

|||||||||||||||||||||

| Interest-bearing deposits |

|||||||||||||||||||||

| Money market |

$ | 23,840 | $ | 19,745 | $ | 24,697 | $ | 24,151 | $ | 23,979 | $ | 22,503 | $ | 20,879 | |||||||

| Demand |

9,259 | 8,187 | 9,587 | 9,275 | 9,494 | 8,671 | 8,143 | ||||||||||||||

| Savings |

2,687 | 2,081 | 2,662 | 2,841 | 2,988 | 2,250 | 1,882 | ||||||||||||||

| Retail certificates of deposit |

16,690 | 13,999 | 16,921 | 16,563 | 17,426 | 15,691 | 14,837 | ||||||||||||||

| Other time |

2,119 | 1,364 | 1,948 | 2,748 | 2,297 | 1,623 | 1,355 | ||||||||||||||

| Time deposits in foreign offices |

4,623 | 3,613 | 6,488 | 4,616 | 4,220 | 3,129 | 3,068 | ||||||||||||||

| Total interest-bearing deposits |

59,218 | 48,989 | 62,303 | 60,194 | 60,404 | 53,867 | 50,164 | ||||||||||||||

| Borrowed funds |

|||||||||||||||||||||

| Federal funds purchased |

5,533 | 3,081 | 5,232 | 6,249 | 6,102 | 4,533 | 3,167 | ||||||||||||||

| Repurchase agreements |

2,450 | 2,205 | 2,875 | 2,546 | 2,507 | 1,858 | 2,264 | ||||||||||||||

| Federal Home Loan Bank borrowings |

2,168 | 623 | 6,339 | 2,097 | 106 | 64 | 44 | ||||||||||||||

| Bank notes and senior debt |

6,282 | 3,128 | 7,676 | 7,537 | 5,681 | 4,182 | 2,757 | ||||||||||||||

| Subordinated debt |

4,247 | 4,417 | 4,118 | 4,039 | 4,466 | 4,370 | 4,361 | ||||||||||||||

| Other |

2,344 | 1,589 | 2,353 | 2,741 | 2,459 | 1,813 | 2,117 | ||||||||||||||

| Total borrowed funds |

23,024 | 15,043 | 28,593 | 25,209 | 21,321 | 16,820 | 14,710 | ||||||||||||||

| Total interest-bearing liabilities |

82,242 | 64,032 | 90,896 | 85,403 | 81,725 | 70,687 | 64,874 | ||||||||||||||

| Noninterest-bearing liabilities, minority and noncontrolling interests, and shareholders equity: |

|||||||||||||||||||||

| Demand and other noninterest-bearing deposits |

17,587 | 14,320 | 18,472 | 18,211 | 17,824 | 15,807 | 14,827 | ||||||||||||||

| Allowance for unfunded loan commitments and letters of credit |

125 | 106 | 127 | 125 | 121 | 126 | 117 | ||||||||||||||

| Accrued expenses and other liabilities |

8,195 | 6,672 | 9,035 | 8,117 | 7,655 | 7,961 | 7,882 | ||||||||||||||

| Minority and noncontrolling interests in consolidated entities |

1,335 | 600 | 1,658 | 1,414 | 1,367 | 893 | 542 | ||||||||||||||

| Shareholders equity |

13,934 | 9,282 | 14,762 | 14,362 | 14,628 | 11,948 | 10,806 | ||||||||||||||

| Total liabilities, minority and noncontrolling interests, and shareholders equity |

$ | 123,418 | $ | 95,012 | $ | 134,950 | $ | 127,632 | $ | 123,320 | $ | 107,422 | $ | 99,048 | |||||||

| Supplemental Average Balance Sheet Information (Unaudited) (Continued) |

|||||||||||||||||||||

| Deposits and Common Shareholders Equity |

|||||||||||||||||||||

| Interest-bearing deposits |

$ | 59,218 | $ | 48,989 | $ | 62,303 | $ | 60,194 | $ | 60,404 | $ | 53,867 | $ | 50,164 | |||||||

| Demand and other noninterest-bearing deposits |

17,587 | 14,320 | 18,472 | 18,211 | 17,824 | 15,807 | 14,827 | ||||||||||||||

| Total deposits |

$ | 76,805 | $ | 63,309 | $ | 80,775 | $ | 78,405 | $ | 78,228 | $ | 69,674 | $ | 64,991 | |||||||

| Transaction deposits |

$ | 50,686 | $ | 42,252 | $ | 52,756 | $ | 51,637 | $ | 51,297 | $ | 46,981 | $ | 43,849 | |||||||

| Common shareholders equity |

$ | 13,927 | $ | 9,275 | $ | 14,755 | $ | 14,355 | $ | 14,621 | $ | 11,941 | $ | 10,799 | |||||||

| Trading Liabilities |

|||||||||||||||||||||

| Securities sold short (a) |

$ | 1,657 | $ | 965 | $ | 1,748 | $ | 1,960 | $ | 1,431 | $ | 1,264 | $ | 1,553 | |||||||

| Repurchase agreements and other borrowings (b) |

520 | 833 | 630 | 637 | 669 | 363 | 1,096 | ||||||||||||||

| Financial derivatives (c) |

1,384 | 1,103 | 1,772 | 1,400 | 1,230 | 1,126 | 1,156 | ||||||||||||||

| Borrowings at fair value (c) |

39 | 31 | 39 | 41 | 40 | 39 | 34 | ||||||||||||||

| Total trading liabilities |

$ | 3,600 | $ | 2,932 | $ | 4,189 | $ | 4,038 | $ | 3,370 | $ | 2,792 | $ | 3,839 | |||||||

| (a) | Included in Borrowed funds-Other above. |

| (b) | Included in Borrowed funds-Repurchase agreements and Borrowed funds-Other above. |

| (c) | Included in Accrued expenses and other liabilities above. |

Page 14

THE PNC FINANCIAL SERVICES GROUP, INC.

Details of Loans (Unaudited)

| Period ended - in millions |

December 31 2007 |

September 30 2007 |

June 30 2007 |

March 31 2007 |

December 31 2006 |

|||||||||||||||

| Commercial |

||||||||||||||||||||

| Retail/wholesale |

$ | 6,653 | $ | 6,181 | $ | 6,031 | $ | 6,075 | $ | 5,301 | ||||||||||

| Manufacturing |

4,563 | 4,472 | 4,439 | 4,490 | 4,189 | |||||||||||||||

| Other service providers |

3,014 | 3,292 | 3,212 | 3,113 | 2,186 | |||||||||||||||

| Real estate related (a) |

5,730 | 4,502 | 4,939 | 4,869 | 2,825 | |||||||||||||||

| Financial services |

1,226 | 1,861 | 1,545 | 1,560 | 1,324 | |||||||||||||||

| Health care |

1,260 | 1,075 | 1,097 | 1,028 | 707 | |||||||||||||||

| Other |

6,161 | 5,352 | 4,681 | 4,603 | 4,052 | |||||||||||||||

| Total commercial |

28,607 | 26,735 | 25,944 | 25,738 | 20,584 | |||||||||||||||

| Commercial real estate |

||||||||||||||||||||

| Real estate projects |

6,114 | 5,807 | 5,767 | 5,756 | 2,716 | |||||||||||||||

| Mortgage |

2,792 | 2,507 | 2,564 | 2,597 | 816 | |||||||||||||||

| Total commercial real estate |

8,906 | 8,314 | 8,331 | 8,353 | 3,532 | |||||||||||||||

| Equipment lease financing |

3,500 | 3,539 | 3,587 | 3,527 | 3,556 | |||||||||||||||

| Total commercial lending |

41,013 | 38,588 | 37,862 | 37,618 | 27,672 | |||||||||||||||

| Consumer |

||||||||||||||||||||

| Home equity |

14,447 | 14,366 | 14,268 | 14,263 | 13,749 | |||||||||||||||

| Automobile |

1,513 | 1,521 | 1,962 | 1,956 | 1,135 | |||||||||||||||

| Other |

2,366 | 2,270 | 1,804 | 1,769 | 1,631 | |||||||||||||||

| Total consumer |

18,326 | 18,157 | 18,034 | 17,988 | 16,515 | |||||||||||||||

| Residential mortgage |

9,557 | 9,605 | 9,440 | 7,960 | 6,337 | |||||||||||||||

| Other |

413 | 396 | 382 | 364 | 376 | |||||||||||||||

| Unearned income |

(990 | ) | (986 | ) | (1,004 | ) | (1,005 | ) | (795 | ) | ||||||||||

| Total, net of unearned income |

$ | 68,319 | $ | 65,760 | $ | 64,714 | $ | 62,925 | $ | 50,105 | ||||||||||

| (a) | Includes loans related to customers in the real estate, rental, leasing and construction industries. |

Page 15

THE PNC FINANCIAL SERVICES GROUP, INC.

Allowances for Loan and Lease Losses and Unfunded Loan Commitments and Letters of Credit, and Net Unfunded Commitments (Unaudited)

Change in Allowance for Loan and Lease Losses

| Three months ended - in millions |

December 31 2007 |

September 30 2007 |

June 30 2007 |

March 31 2007 |

December 31 2006 |

|||||||||||||||

| Beginning balance |

$ | 717 | $ | 703 | $ | 690 | $ | 560 | $ | 566 | ||||||||||

| Charge-offs |

||||||||||||||||||||

| Commercial |

(60 | ) | (38 | ) | (27 | ) | (31 | ) | (23 | ) | ||||||||||

| Commercial real estate |

(12 | ) | (3 | ) | (1 | ) | (1 | ) | ||||||||||||

| Equipment lease financing |

(14 | ) | ||||||||||||||||||

| Consumer |

(24 | ) | (17 | ) | (15 | ) | (17 | ) | (15 | ) | ||||||||||

| Residential mortgage |

(1 | ) | ||||||||||||||||||

| Total charge-offs |

(96 | ) | (58 | ) | (43 | ) | (48 | ) | (54 | ) | ||||||||||

| Recoveries |

||||||||||||||||||||

| Commercial |

10 | 5 | 8 | 7 | 3 | |||||||||||||||

| Commercial real estate |

1 | 1 | ||||||||||||||||||

| Equipment lease financing |

1 | |||||||||||||||||||

| Consumer |

3 | 4 | 2 | 5 | 4 | |||||||||||||||

| Total recoveries |

13 | 9 | 11 | 12 | 9 | |||||||||||||||

| Net charge-offs |

||||||||||||||||||||

| Commercial |

(50 | ) | (33 | ) | (19 | ) | (24 | ) | (20 | ) | ||||||||||

| Commercial real estate |

(12 | ) | (3 | ) | ||||||||||||||||

| Equipment lease financing |

(13 | ) | ||||||||||||||||||

| Consumer |

(21 | ) | (13 | ) | (13 | ) | (12 | ) | (11 | ) | ||||||||||

| Residential mortgage |

(1 | ) | ||||||||||||||||||

| Total net charge-offs |

(83 | ) | (49 | ) | (32 | ) | (36 | ) | (45 | ) | ||||||||||

| Provision for credit losses |

188 | 65 | 54 | 8 | 42 | |||||||||||||||

| Acquired allowance (a) |

15 | (5 | ) | 142 | ||||||||||||||||

| Net change in allowance for unfunded loan commitments and letters of credit |

(7 | ) | (2 | ) | (4 | ) | 16 | (3 | ) | |||||||||||

| Ending balance |

$ | 830 | $ | 717 | $ | 703 | $ | 690 | $ | 560 | ||||||||||

| (a) Amount for the fourth quarter of 2007 related to Yardville and amounts for the first and second quarters of 2007 related to Mercantile. |

|

|||||||||||||||||||

| Supplemental Information |

||||||||||||||||||||

| Commercial lending net charge-offs (b) |

$ | (62 | ) | $ | (36 | ) | $ | (19 | ) | $ | (24 | ) | $ | (33 | ) | |||||

| Consumer lending net charge-offs (c) |

(21 | ) | (13 | ) | (13 | ) | (12 | ) | (12 | ) | ||||||||||

| Total net charge-offs |

$ | (83 | ) | $ | (49 | ) | $ | (32 | ) | $ | (36 | ) | $ | (45 | ) | |||||

| Net charge-offs to average loans |

||||||||||||||||||||

| Commercial lending |

.63 | % | .38 | % | .21 | % | .33 | % | .49 | % | ||||||||||

| Consumer lending |

.30 | .19 | .20 | .20 | .22 | |||||||||||||||

| (b) | Includes commercial, commercial real estate and equipment lease financing. |

| (c) | Includes consumer and residential mortgage. |

Change in Allowance for Unfunded Loan Commitments and Letters of Credit

| Three months ended - in millions |

December 31 2007 |

September 30 2007 |

June 30 2007 |

March 31 2007 |

December 31 2006 |

|||||||||||

| Beginning balance |

$ | 127 | $ | 125 | $ | 121 | $ | 120 | $ | 117 | ||||||

| Acquired allowance - Mercantile |

17 | |||||||||||||||

| Net change in allowance for unfunded loan commitments and letters of credit |

7 | 2 | 4 | (16 | ) | 3 | ||||||||||

| Ending balance |

$ | 134 | $ | 127 | $ | 125 | $ | 121 | $ | 120 | ||||||

| In millions |

December 31 2007 |

September 30 2007 |

June 30 2007 |

March 31 2007 |

December 31 2006 |

|||||||||||

| Net Unfunded Commitments |

||||||||||||||||

| Net unfunded commitments |

$ | 53,365 | $ | 52,590 | $ | 50,678 | $ | 49,263 | $ | 44,835 | ||||||

Page 16

THE PNC FINANCIAL SERVICES GROUP, INC.

Details of Nonperforming Assets (Unaudited)

Nonperforming Assets by Type

| Period ended - in millions |

December 31 2007 |

September 30 2007 |

June 30 2007 |

March 31 2007 |

December 31 2006 |

|||||||||||||||

| Nonaccrual loans |

||||||||||||||||||||

| Commercial |

$ | 193 | $ | 144 | $ | 126 | $ | 121 | $ | 109 | ||||||||||

| Commercial real estate |

212 | 75 | 62 | 25 | 12 | |||||||||||||||

| Consumer |

17 | 15 | 14 | 14 | 13 | |||||||||||||||

| Residential mortgage |

10 | 10 | 14 | 16 | 12 | |||||||||||||||

| Equipment lease financing |

3 | 3 | 2 | 2 | 1 | |||||||||||||||

| Total nonaccrual loans |

435 | 247 | 218 | 178 | 147 | |||||||||||||||

| Restructured loans |

2 | |||||||||||||||||||

| Total nonperforming loans |

437 | 247 | 218 | 178 | 147 | |||||||||||||||

| Foreclosed and other assets |

||||||||||||||||||||

| Residential mortgage |

16 | 16 | 12 | 11 | 10 | |||||||||||||||

| Equipment lease financing |

11 | 12 | 12 | 12 | 12 | |||||||||||||||

| Other |

14 | 11 | 4 | 3 | 2 | |||||||||||||||

| Total foreclosed and other assets |

41 | 39 | 28 | 26 | 24 | |||||||||||||||

| Total nonperforming assets (a) (b) |

$ | 478 | $ | 286 | $ | 246 | $ | 204 | $ | 171 | ||||||||||

| Nonperforming loans to total loans |

.64 | % | .38 | % | .34 | % | .28 | % | .29 | % | ||||||||||

| Nonperforming assets to total loans and foreclosed assets |

.70 | .43 | .38 | .32 | .34 | |||||||||||||||

| Nonperforming assets to total assets |

.34 | .22 | .20 | .17 | .17 | |||||||||||||||

| Net charge-offs to average loans (For the three months ended) |

.49 | .30 | .20 | .27 | .36 | |||||||||||||||

| Allowance for loan and lease losses to loans |

1.21 | 1.09 | 1.09 | 1.10 | 1.12 | |||||||||||||||

| Allowance for loan and lease losses to nonperforming loans |

190 | 290 | 322 | 388 | 381 | |||||||||||||||

| (a) Excludes equity management assets carried at estimated fair value (amounts include troubled debt restructured assets of $4 million at September 30, 2007, June 30, 2007, March 31, 2007 and December 31, 2006): |

$ | 4 | $ | 12 | $ | 13 | $ | 15 | $ | 11 | ||||||||||

| (b) Excludes loans held for sale carried at lower of cost or market value, related to the Mercantile and Yardville acquisitions: |

$ | 25 | $ | 7 | $ | 17 | $ | 18 | ||||||||||||

Change in Nonperforming Assets

| In millions |

Year ended | |||

| January 1, 2007 |

$ | 171 | ||

| Transferred in |

649 | |||

| Acquired - Mercantile and Yardville |

37 | |||

| Asset sales |

(10 | ) | ||

| Returned to performing |

(23 | ) | ||

| Charge-offs and valuation adjustments |

(167 | ) | ||

| Principal activity including payoffs |

(179 | ) | ||

| December 31, 2007 |

$ | 478 | ||

Page 17

THE PNC FINANCIAL SERVICES GROUP, INC.

Details of Nonperforming Assets (Unaudited) (Continued)

Nonperforming Assets by Business

| Period ended - in millions |

December 31 2007 |

September 30 2007 |

June 30 2007 |

March 31 2007 |

December 31 2006 |

||||||||||

| Retail Banking |

|||||||||||||||

| Nonperforming loans |

$ | 215 | $ | 127 | $ | 130 | $ | 114 | $ | 96 | |||||

| Foreclosed and other assets |