425: Filing under Securities Act Rule 425 of certain prospectuses and communications in connection with business combination transactions

Published on March 29, 2005

Filed by The PNC Financial Services Group, Inc.

Pursuant to Rule 425 under the Securities Act of 1933 and

deemed filed pursuant to Rule 14a-12 of the Securities Exchange Act of 1934

Subject Company: Riggs National Corporation

Commission File No. 000-09756

On March 29, 2005, Neil F. Hall, Chief Executive Officer of the Regional Community Banking business of The PNC Financial Services Group, Inc. (PNC), gave a presentation to investors at the Goldman Sachs Cross Country Field Trip in Hoboken, New Jersey. This presentation was accompanied by a series of electronic slides that included information pertaining to the financial results of PNC and the proposed acquisition of Riggs National Corporation. A copy of those slides and related material was previously furnished on March 29, 2005 by PNC on a Current Report on Form 8-K.

EXHIBIT 99.1

The PNC Financial Services Group, Inc.

Goldman Sachs Cross Country Field Trip

Hoboken, NJ March 29, 2005

Cautionary Statement Regarding Forward-Looking Information

This presentation contains forward-looking statements regarding our outlook or expectations relating to PNCs future business, operations, financial condition, financial performance and asset quality. Forward-looking statements are necessarily subject to numerous assumptions, risks and uncertainties.

The forward-looking statements in this presentation are qualified by the factors affecting forward-looking statements identified in the more detailed Cautionary Statement included in the written materials we distributed at this conference and in the version of the presentation materials posted on our corporate website at www.pnc.com, as well as those factors previously disclosed in our 2004 Form 10-K and other SEC reports (accessible on the SECs website at www.sec.gov and on our corporate website). Future events or circumstances may change our outlook or expectations and may also affect the nature of the assumptions, risks and uncertainties to which our forward-looking statements are subject. The forward-looking statements in this presentation speak only as of the date of this presentation. We do not assume any duty and do not undertake to update those statements.

This presentation may also include a discussion of non-GAAP financial measures, which, to the extent not so qualified therein, is qualified by GAAP reconciliation information available on our corporate website at www.pnc.com under For Investors.

Todays Discussion

Regional Community Banking

Strategies for accelerating growth Neil Hall

Q&A with leadership team Joe Rockey

John Rogers

Jeff Schmidt

Ellen van der Horst

Branch visit

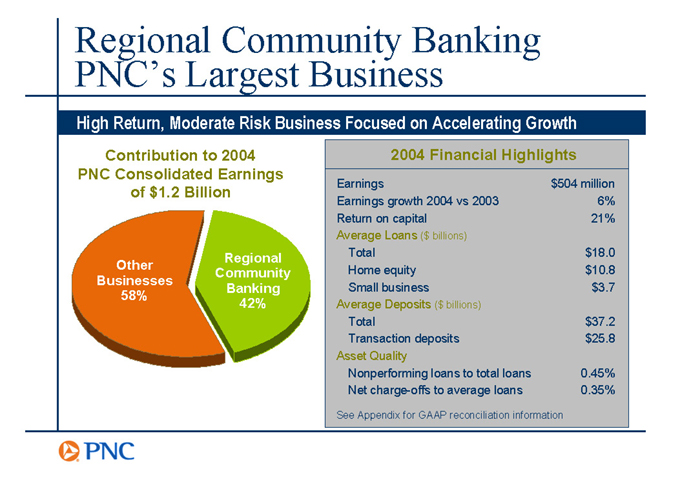

Regional Community Banking PNCs Largest Business

High Return, Moderate Risk Business Focused on Accelerating Growth

Contribution to 2004 PNC Consolidated Earnings of $1.2 Billion

Other Businesses 58%

Regional Community Banking 42%

2004 Financial Highlights

Earnings $504 million

Earnings growth 2004 vs 2003 6%

Return on capital 21%

Average Loans ($ billions)

Total $ 18.0

Home equity $ 10.8

Small business $ 3.7

Average Deposits ($ billions)

Total $ 37.2

Transaction deposits $ 25.8

Asset Quality

Nonperforming loans to total loans 0.45%

Net charge-offs to average loans 0.35%

See Appendix for GAAP reconciliation information

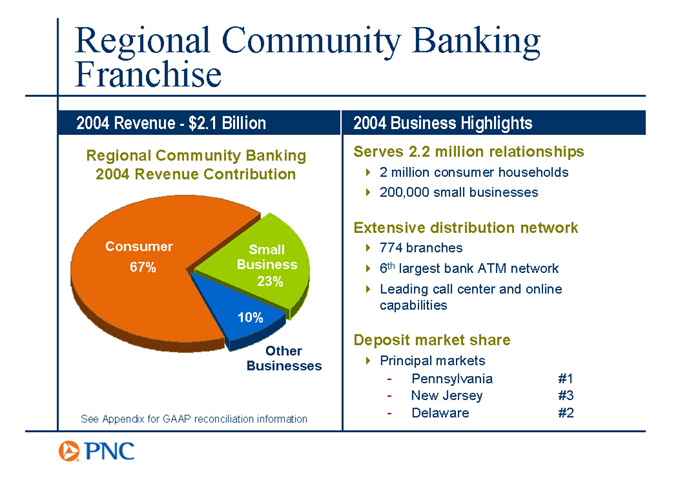

Regional Community Banking Franchise

2004 Revenue$2.1 Billion

Regional Community Banking 2004 Revenue Contribution

Consumer 67%

Small Business 23%

10%

Other Businesses

See Appendix for GAAP reconciliation information

2004 Business Highlights

Serves 2.2 million relationships

2 million consumer households 200,000 small businesses

Extensive distribution network

774 branches

6th largest bank ATM network Leading call center and online capabilities

Deposit market share

Principal markets

Pennsylvania #1

New Jersey #3

Delaware #2

Regional Community Banking -Keys to Our Success

Upgrading front-line employees

Expanding branch distribution and touch points

Creating a distinctive value proposition

Focusing on Checking Relationships

Best Source of Sustainable Value Is Growing Checking Relationships

97% of businesses and households have a checking account need

70%+ consider their checking account bank to be their primary financial services provider

Favorable economics: Fee revenues and low-cost funding source

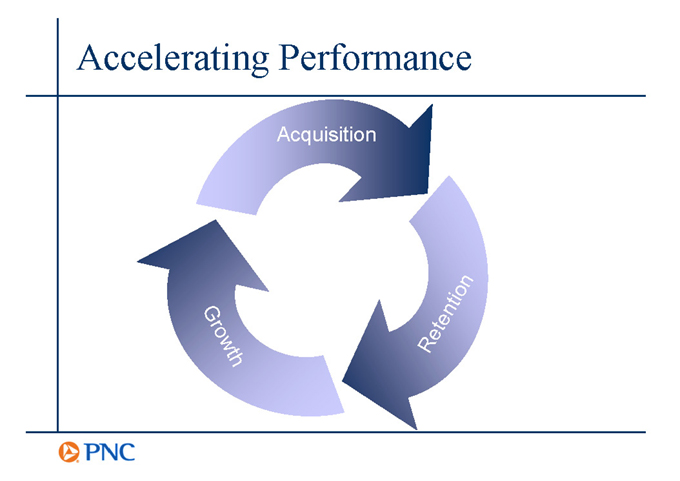

Accelerating Performance

Acquisition

Growth Retention

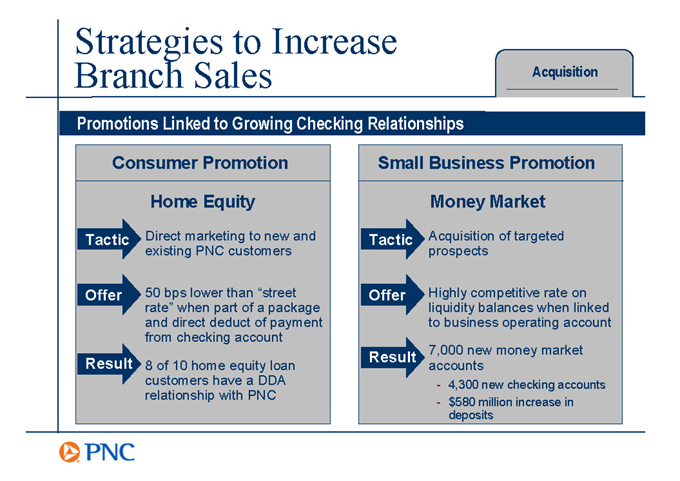

Strategies to Increase Branch Sales

Acquisition

Promotions Linked to Growing Checking Relationships

Consumer Promotion

Home Equity

Tactic Direct marketing to new and

existing PNC customers

Offer 50 bps lower than street

rate when part of a package

and direct deduct of payment

from checking account

Result 8 of 10 home equity loan

customers have a DDA

relationship with PNC

Small Business Promotion

Money Market

Tactic Acquisition of targeted

prospects

Offer Highly competitive rate on

liquidity balances when linked

to business operating account

Result 7,000 new money market

accounts

- 4,300 new checking accounts

- $580 million increase in

deposits

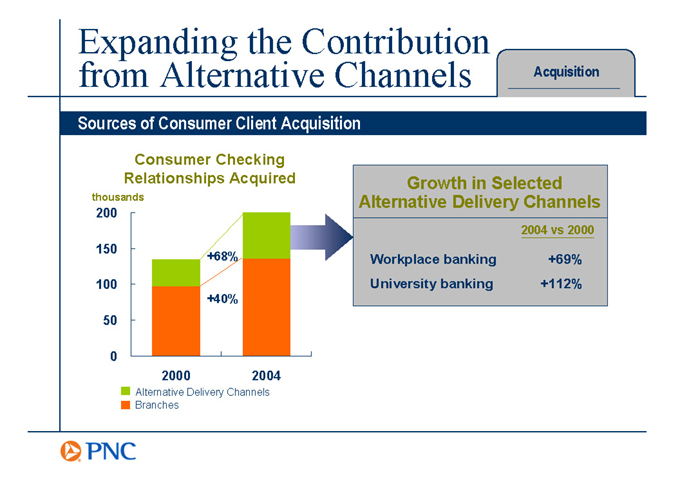

Expanding the Contribution from Alternative Channels

Acquisition

Sources of Consumer Client Acquisition

Consumer Checking Relationships Acquired thousands

200 150 100 50 0

+68%

+40%

2000 2004

Alternative Delivery Channels Branches

Growth in Selected Alternative Delivery Channels

2004 vs 2000

Workplace banking +69%

University banking +112%

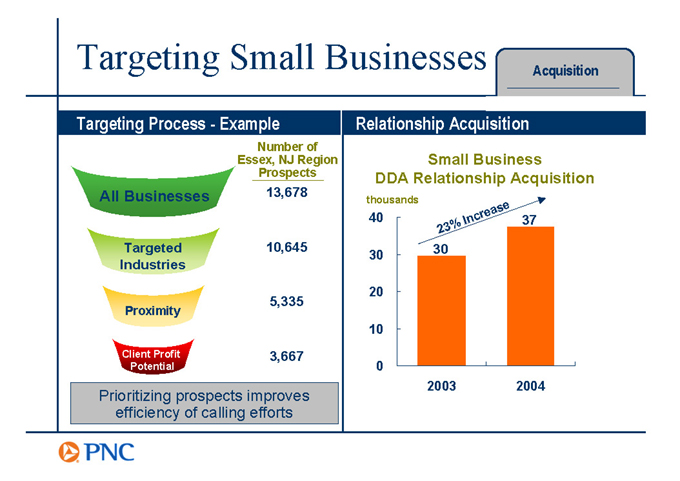

Targeting Small Businesses

Acquisition

Targeting ProcessExample

Number of

Essex, NJ Region

Prospects

All Businesses 13,678

Targeted 10,645

Industries

5,335

Proximity

Client Profit 3,667

Potential

Prioritizing prospects improves efficiency of calling efforts

Relationship Acquisition

Small Business DDA Relationship Acquisition thousands

40 30 20 10 0 Increase 23% 37

30

2003 2004

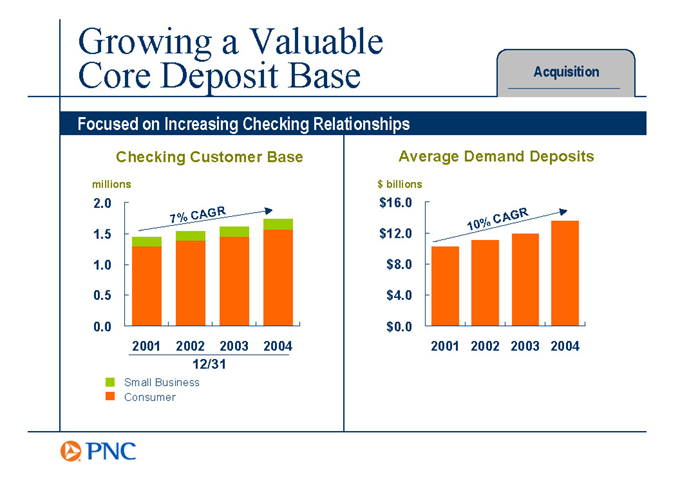

Growing a Valuable Core Deposit Base

Acquisition

Focused on Increasing Checking Relationships

Checking Customer Base

millions

2.0

1.5

1.0

0.5

0.0

CAGR 7%

2001 2002 2003 2004

12/31

Small Business Consumer

Average Demand Deposits $ billions

$16.0 $12.0 $8.0 $4.0 $0.0

10% CAGR

2001 2002 2003 2004

Accelerating Performance

Acquisition

Growth Retention

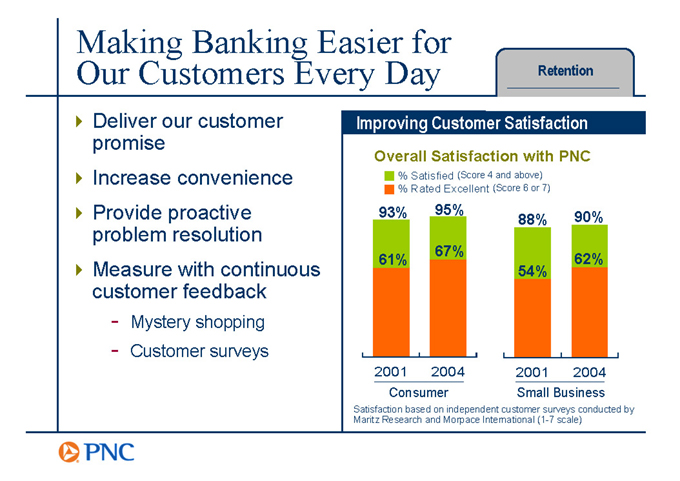

Making Banking Easier for Our Customers Every Day

Deliver our customer promise Increase convenience Provide proactive problem resolution Measure with continuous customer feedback

Mystery shopping Customer surveys

Retention

Improving Customer Satisfaction

Overall Satisfaction with PNC

% Satisfied (Score 4 and above)

% Rated Excellent (Score 6 or 7)

93% 95%

88% 90%

67%

61% 62%

54%

2001 2004 2001 2004

Consumer Small Business

Satisfaction based on independent customer surveys conducted by Maritz Research and Morpace International (1-7 scale)

14

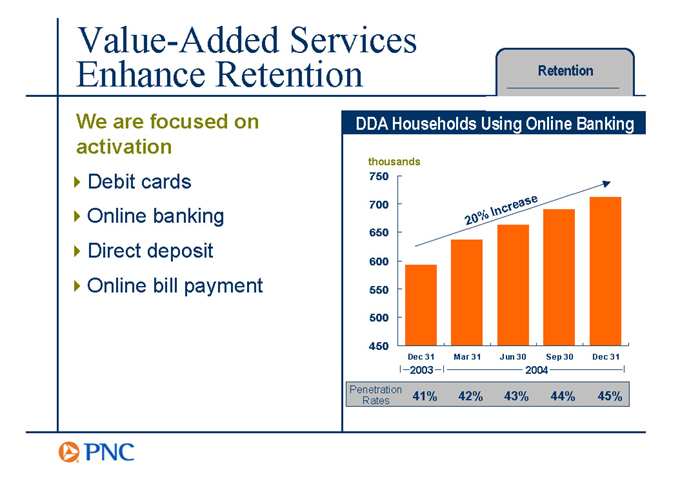

Value-Added Services Enhance Retention

Retention

We are focused on activation

Debit cards Online banking Direct deposit Online bill payment

DDA Households Using Online Banking thousands

750 700 650 600 550 500 450 Increase 20%

Dec 31 Mar 31 Jun 30 Sep 30 Dec 31

2003 2004

Penetration

Rates 41% 42% 43% 44% 45%

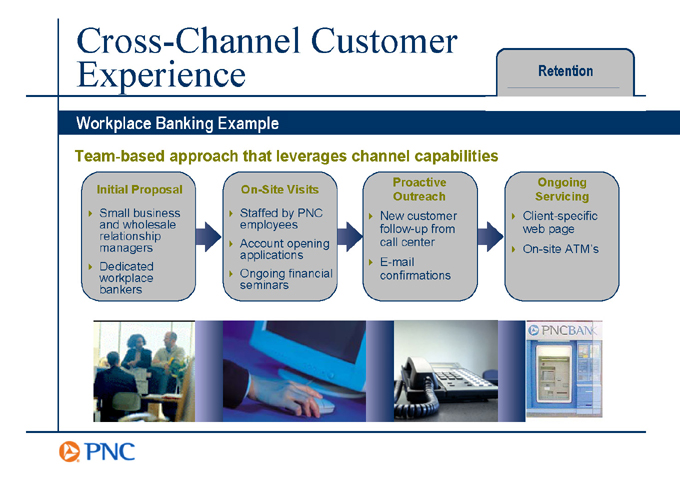

Cross-Channel Customer Experience

Retention

Workplace Banking Example

Team-based approach that leverages channel capabilities

Initial Proposal

Small business and wholesale relationship managers Dedicated workplace bankers

On-Site Visits

Staffed by PNC employees Account opening applications Ongoing financial seminars

Proactive Outreach

New customer follow-up from call center E-mail confirmations

Ongoing Servicing

Client-specific web page On-site ATMs

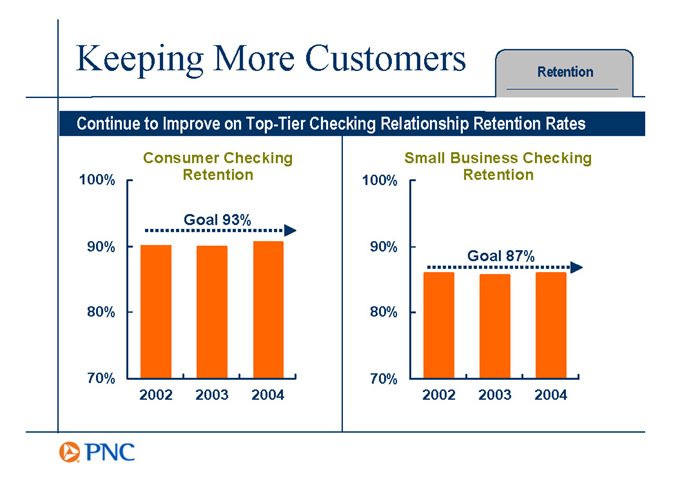

Keeping More Customers

Retention

Continue to Improve on Top-Tier Checking Relationship Retention Rates

Consumer Checking Retention

100% 90% 80% 70%

Goal 93%

2002 2003 2004

Small Business Checking Retention

100% 90% 80% 70%

Goal 87%

2002 2003 2004

Accelerating Performance

Acquisition

Growth

Retention

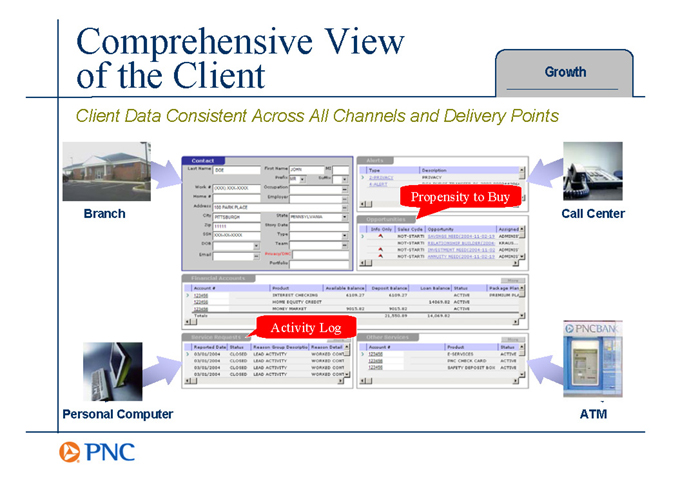

Comprehensive View of the Client

Growth

Client Data Consistent Across All Channels and Delivery Points

Branch

Personal Computer

Call Center

ATM

Propensity to Buy

Activity Log

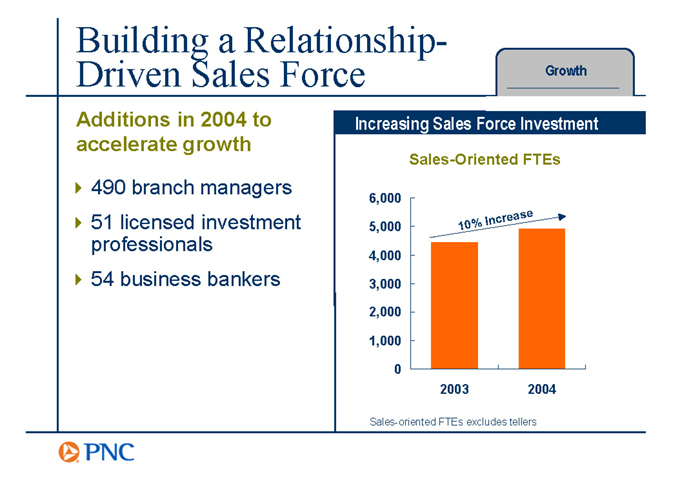

Building a Relationship-Driven Sales Force

Growth

Additions in 2004 to accelerate growth

490 branch managers 51 licensed investment professionals 54 business bankers

Increasing Sales Force Investment

Sales-Oriented FTEs

6,000 5,000 4,000 3,000 2,000 1,000 0

Increase 10%

2003 2004

Sales-oriented FTEs excludes tellers

Selling More to Customers

Growth

Proven Success in Deepening Checking Relationships

Multi-Service Checking Customers

millions

1.25

1.00

0.75

0.50

0.25

0.00

Small Business Consumer

10% CAGR

5% CAGR

2001 2002 2003 2004

12/31

Deepening Relationships

Small Business

25% loan growth over 2003

34% increase in merchant services revenue over 2003

Consumer

8 of 10 home equity loan customers have a DDA relationship with PNC

7.7% brokerage penetration rate

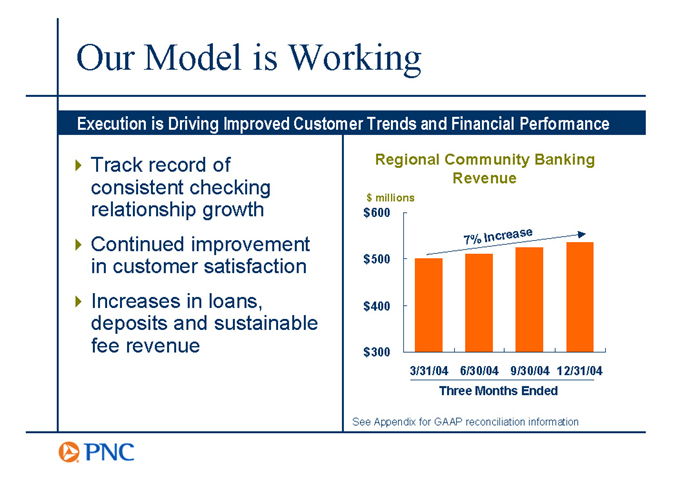

Our Model is Working

Execution is Driving Improved Customer Trends and Financial Performance

Track record of consistent checking relationship growth Continued improvement in customer satisfaction Increases in loans, deposits and sustainable fee revenue

Regional Community Banking Revenue $ millions $600

$500 $400 $300

3/31/04 6/30/04 9/30/04 12/31/04

Three Months Ended 7% Increase

See Appendix for GAAP reconciliation information

New Branch Design Makes Banking Easier

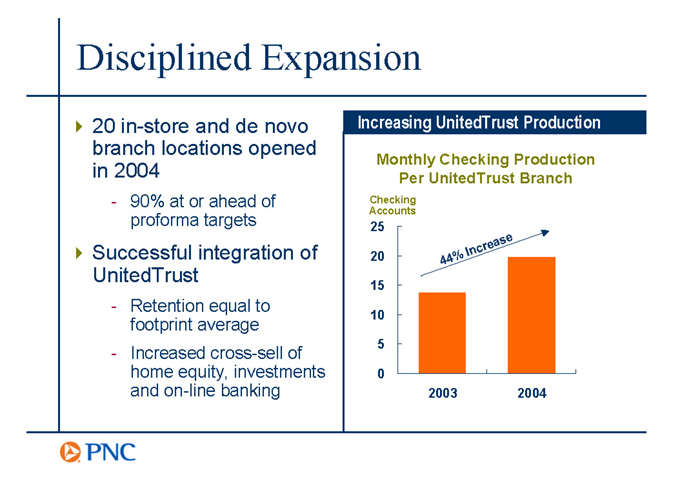

Disciplined Expansion

20 in-store and de novo branch locations opened in 2004

90% at or ahead of proforma targets

Successful integration of UnitedTrust

Retention equal to footprint average Increased cross-sell of home equity, investments and on-line banking

Increasing UnitedTrust Production

Monthly Checking Production Per UnitedTrust Branch

Checking Accounts

25 20 15 10 5 0 Increase 44%

2003 2004

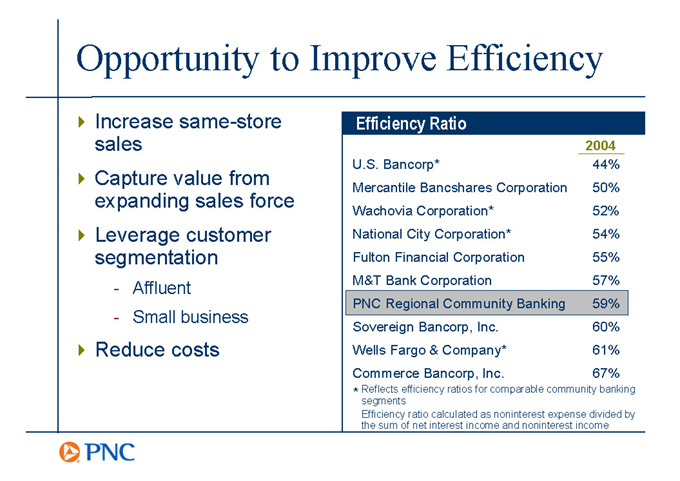

Opportunity to Improve Efficiency

Increase same-store sales Capture value from expanding sales force Leverage customer segmentation

Affluent Small business

Reduce costs

Efficiency Ratio

2004

U.S. Bancorp* 44%

Mercantile Bancshares Corporation 50%

Wachovia Corporation* 52%

National City Corporation* 54%

Fulton Financial Corporation 55%

M&T Bank Corporation 57%

PNC Regional Community Banking 59%

Sovereign Bancorp, Inc. 60%

Wells Fargo & Company* 61%

Commerce Bancorp, Inc. 67%

* Reflects efficiency ratios for comparable community banking

segments

Efficiency ratio calculated as noninterest expense divided by

the sum of net interest income and noninterest income

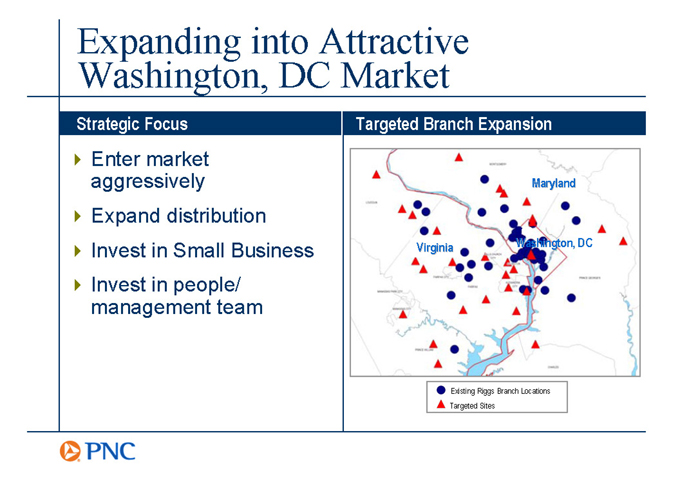

Expanding into Attractive Washington, DC Market

Strategic Focus

Enter market aggressively Expand distribution Invest in Small Business Invest in people/ management team

Targeted Branch Expansion

Maryland

Virginia

Washington, DC

Existing Riggs Branch Locations Targeted Sites

Summary

Regional Community Banking Making Banking Easy

Accelerating our relationship-driven model

Leveraging a high-return, moderate-risk franchise Executing strategies to drive growth Expanding into attractive markets

Focused on improving efficiency

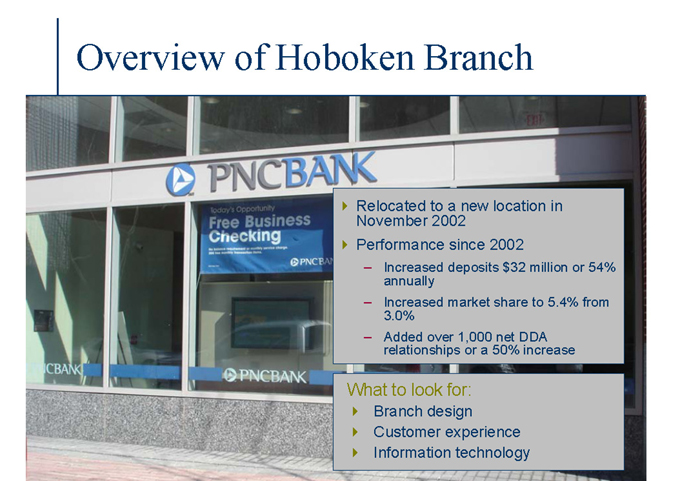

Overview of Hoboken Branch

Relocated to a new location in November 2002 Performance since 2002

Increased deposits $32 million or 54% annually Increased market share to 5.4% from 3.0% Added over 1,000 net DDA relationships or a 50% increase

What to look for:

Branch design Customer experience Information technology

Q&A with Leadership Team

Joe Rockey Executive Vice President

Branch Distribution

John Rogers Chief Financial Officer

Jeff Schmidt Senior Vice President

Manager of Business Banking

Ellen van der Horst Chief Marketing Officer

Appendix

Cautionary Statement Regarding Forward-Looking Information

We make statements in this presentation, and we may from time to time make other statements, regarding our outlook or expectations for earnings, revenues, expenses and/or other matters regarding or affecting PNC that are forward-looking statements. Forward-looking statements typically identified by words such as believe, expect, anticipate, intend, outlook, forecast, project and other similar words and expressions.

Forward-looking statements are subject to numerous assumptions, risks and uncertainties, change over time. Forward-looking statements speak only as of the date they are made. We not assume any duty and do not undertake to update our forward-looking statements. Actual results or future events could differ, possibly materially, from those that we anticipated in our forward-looking statements, and future results could differ materially from our historical performance.

In addition to factors that we have disclosed in our 2004 Annual Report on Form 10-K and in SEC reports (accessible on the SECs website at www.sec.gov and on or through PNCs corporate website at www.pnc.com), PNCs forward-looking statements are subject to, among others, the following risks and uncertainties, which could cause actual results or future events differ materially from those that we anticipated in our forward-looking statements or from our historical performance:

Changes in political, economic or industry conditions, the interest rate environment, or the financial and capital markets (including as a result of actions of the Federal Reserve Board affecting interest rates, the money supply, or otherwise reflecting changes in monetary policy), which could affect: (a) credit quality and the extent of our credit losses; (b) the extent of funding of our unfunded loan commitments and letters of credit; (c) our allowances for loan and lease losses and unfunded loan commitments and letters of credit; (d) demand for our credit or fee-based products and services; (e) our net interest income; (f) the value of assets under management and assets serviced, of private equity investments, of other debt and equity investments, of loans held for sale, or of other on-balance sheet or off-balance sheet assets; or (g) the availability and terms of funding necessary to meet our liquidity needs;

The impact on us of legal and regulatory developments, including the following: (a) the resolution of legal proceedings or regulatory and other governmental inquiries; (b) increased litigation risk from recent regulatory and other governmental developments; (c) the results of the regulatory examination process, our failure to satisfy the requirements of agreements with governmental agencies, and regulators future use of supervisory and enforcement tools; (d) legislative and regulatory reforms, including changes to tax laws; and (e) changes in accounting policies and principles, with the impact of any such developments possibly affecting our ability to operate our businesses or our financial condition or results of operations or our reputation, which in turn could have an impact on such matters as business generation and retention, our ability to attract and retain management, liquidity and funding;

The impact on us of changes in the nature or extent of our competition;

The introduction, withdrawal, success and timing of our business initiatives and strategies;

Cautionary Statement Regarding Forward-Looking Information (continued)

Customer acceptance of our products and services, and our customers borrowing, repayment, investment and deposit practices;

The impact on us of changes in the extent of customer or counterparty delinquencies, bankruptcies or defaults, which could affect, among other things, credit and asset quality risk and our provision for credit losses;

The ability to identify and effectively manage risks inherent in our businesses;

How we choose to redeploy available capital, including the extent and timing of any share repurchases and acquisitions or other investments in our businesses;

The impact, extent and timing of technological changes, the adequacy of intellectual property protection, and costs associated with obtaining rights in intellectual property claimed by others;

The timing and pricing of any sales of loans or other financial assets held for sale;

Our ability to obtain desirable levels of insurance and to successfully submit claims under applicable insurance policies;

The relative and absolute investment performance of assets under management;

The extent of terrorist activities and international hostilities, increases or continuations of which may adversely affect the economy and financial and capital markets generally or us specifically; and

Issues related to the completion of our pending acquisition of Riggs National Corporation and the integration of the remaining Riggs businesses into PNC, including the following:

Completion of the transaction is dependent on, among other things, receipt of stockholder and regulatory approvals and regulatory waivers, the timing of which cannot be predicted with precision at this point and which may not be received at all;

Successful completion of the transaction and our ability to realize the benefits that we anticipate from the acquisition also depend on the nature of any future developments with respect to Riggs regulatory and legal issues, the ability to comply with the terms of all current or future requirements (including any related action plan) resulting from these issues, and the extent of future costs and expenses arising as a result of these issues, including the impact of increased litigation risk and any claims for indemnification or advancement of costs;

Riggs regulatory and legal issues may cause reputational harm to PNC following the acquisition and integration of its business into ours;

The transaction may be materially more expensive to complete than anticipated as a result of unexpected factors or events;

Cautionary Statement Regarding Forward-Looking Information (continued)

The integration into PNC of the Riggs business and operations that we acquire, which will include conversion of Riggs different systems and procedures, may take longer or be more costly than anticipated and may have unanticipated adverse results relating to Riggs or PNCs existing businesses;

It may take longer than expected to realize the anticipated cost savings of the acquisition, and the anticipated cost savings may not be achieved in their entirety; and

The anticipated strategic and other benefits of the acquisition to PNC are dependent in part on the future performance of Riggs business, and we can provide no assurance as to actual future results, which could be affected by various factors, including the risks and uncertainties generally related to the performance of PNCs and Riggs businesses (with respect to Riggs, you may review Riggs SEC reports, which are accessible on the SECs website at www.sec.gov) or due to factors related to the acquisition of Riggs and the process of integrating Riggs business at closing into PNC.

In addition to the pending Riggs acquisition, we grow our business from time to time by acquiring other financial services companies. Other acquisitions generally present similar risks to those described above relating to the Riggs transaction. We could also be prevented from pursuing attractive acquisition opportunities due to regulatory restraints.

You can find additional information on the foregoing risks and uncertainties and additional factors that could affect results anticipated in our forward-looking statements or from our historical performance in the reports that we file with the SEC. You can access our SEC reports on the SECs website at www.sec.gov or on or through our corporate website at www.pnc.com.

Also, BlackRocks SEC reports (accessible on the SECs website or on or through BlackRocks website at www.blackrock.com) discuss in more detail those risks and uncertainties that involve BlackRock that could affect the results anticipated in forward-looking statements or from historical performance. You may review the BlackRock SEC reports for a more detailed discussion of those risks and uncertainties and additional factors as they may affect BlackRock.

Any annualized, proforma, estimated, third party or consensus numbers in this presentation are used for illustrative or comparative purposes only and may not reflect actual results. Any consensus earnings estimates are calculated based on the earnings projections made by analysts who cover that company. The analysts opinions, estimates or forecasts (and therefore the consensus earnings estimates) are theirs alone, are not those of PNC or its management, and may not reflect PNCs actual or anticipated results.

Additional Information About the Proposed Riggs National Corporation Acquisition

The PNC Financial Services Group, Inc. and Riggs National Corporation have filed a proxy statement/prospectus and will file other relevant documents concerning the merger with the United States Securities and Exchange Commission (the SEC). WE URGE INVESTORS TO READ THE PROXY STATEMENT/PROSPECTUS AND ANY OTHER DOCUMENTS TO BE FILED WITH THE SEC IN

CONNECTION WITH THE MERGER OR INCORPORATED BY REFERENCE IN THE PROXY STATEMENT/PROSPECTUS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors will be able to obtain these documents free of charge at the SECs web site (www.sec.gov). In addition, documents filed with the SEC by The PNC Financial Services Group, Inc. will be available free of charge from Shareholder Relations at (800) 843-2206. Documents filed with the SEC by Riggs will be available free of charge from www.riggsbank.com.

The directors, executive officers, and certain other members of management of Riggs may be soliciting proxies in favor of the merger from its shareholders. For information about these directors, executive officers, and members of management, shareholders are asked to refer to Riggss most recent annual meeting proxy statement, which is available at the web addresses provided in the preceding paragraph.

Non-GAAP to GAAP Reconcilement

Appendix

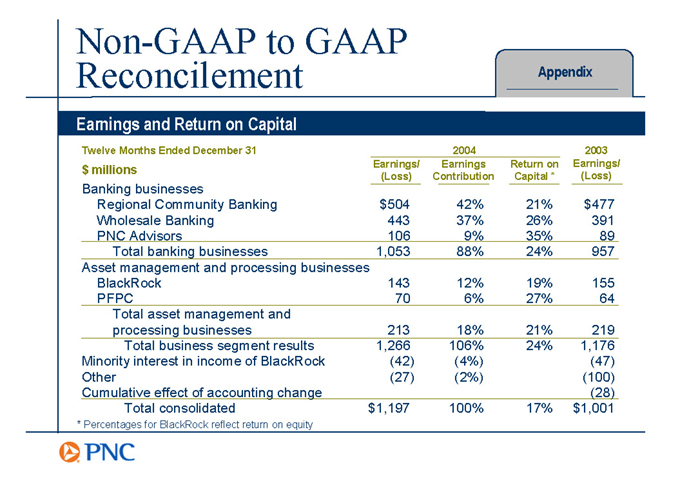

Earnings and Return on Capital

Twelve Months Ended December 31 2004 2003

Earnings/ Earnings Return on Earnings/

$ millions

(Loss) Contribution Capital * (Loss)

Banking businesses

Regional Community Banking $ 504 42% 21% $ 477

Wholesale Banking 443 37% 26% 391

PNC Advisors 106 9% 35% 89

Total banking businesses 1,053 88% 24% 957

Asset management and processing businesses

BlackRock 143 12% 19% 155

PFPC 70 6% 27% 64

Total asset management and

processing businesses 213 18% 21% 219

Total business segment results 1,266 106% 24% 1,176

Minority interest in income of BlackRock (42) (4%) (47)

Other (27) (2%) (100)

Cumulative effect of accounting change (28)

Total consolidated $ 1,197 100% 17% $ 1,001

* Percentages for BlackRock reflect return on equity

Non-GAAP to GAAP Reconcilement

Appendix

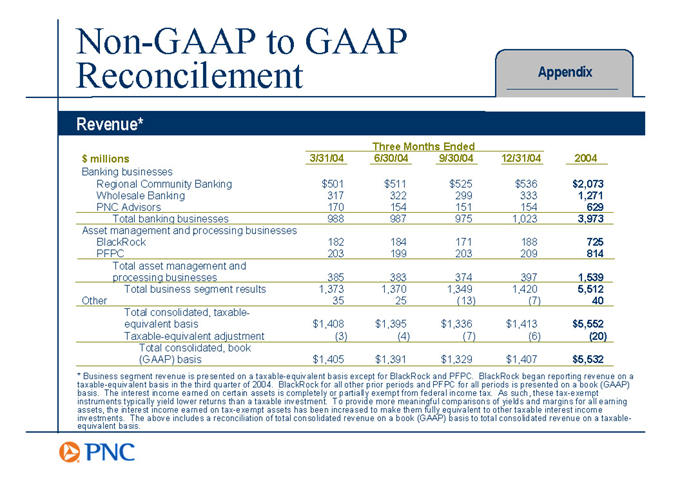

Revenue*

Three Months Ended

$ millions 3/31/04 6/30/04 9/30/04 12/31/04 2004

Banking businesses

Regional Community Banking $ 501 $ 511 $ 525 $ 536 $ 2,073

Wholesale Banking 317 322 299 333 1,271

PNC Advisors 170 154 151 154 629

Total banking businesses 988 987 975 1,023 3,973

Asset management and processing businesses

BlackRock 182 184 171 188 725

PFPC 203 199 203 209 814

Total asset management and

processing businesses 385 383 374 397 1,539

Total business segment results 1,373 1,370 1,349 1,420 5,512

Other 35 25 (13) (7) 40

Total consolidated, taxable-

equivalent basis $ 1,408 $ 1,395 $ 1,336 $ 1,413 $ 5,552

Taxable-equivalent adjustment (3) (4) (7) (6) (20)

Total consolidated, book

(GAAP) basis $ 1,405 $ 1,391 $ 1,329 $ 1,407 $ 5,532

* Business segment revenue is presented on a taxable-equivalent basis except for BlackRock and PFPC. BlackRock began reporting revenue on a taxable-equivalent basis in the third quarter of 2004. BlackRock for all other prior periods and PFPC for all periods is presented on a book (GAAP) basis. The interest income earned on certain assets is completely or partially exempt from federal income tax. As such, these tax-exempt instruments typically yield lower returns than a taxable investment. To provide more meaningful comparisons of yields and margins for all earning assets, the interest income earned on tax-exempt assets has been increased to make them fully equivalent to other taxable interest income investments. The above includes a reconciliation of total consolidated revenue on a book (GAAP) basis to total consolidated revenue on a taxable-equivalent basis.

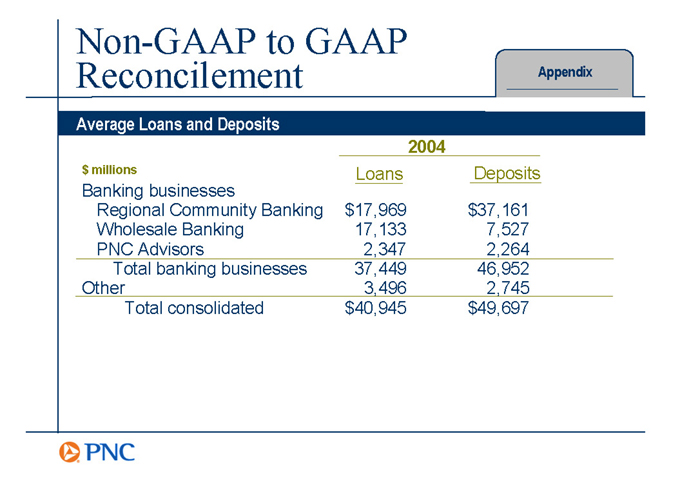

Non-GAAP to GAAP Reconcilement

Appendix

Average Loans and Deposits

2004

$ millions Loans Deposits

Banking businesses

Regional Community Banking $ 17,969 $ 37,161

Wholesale Banking 17,133 7,527

PNC Advisors 2,347 2,264

Total banking businesses 37,449 46,952

Other 3,496 2,745

Total consolidated $ 40,945 $ 49,697