PNC FINANCIAL SERVICES GROUP, INC. 2005 SUMMARY ANNUAL REPORT

Published on March 24, 2006

Exhibit 99.1

PNC 2005 SUMMARY ANNUAL REPORT

Focus on Performance

CONTENTS

| 1 | CONSOLIDATED FINANCIAL HIGHLIGHTS | |

| 2 |

LETTER TO SHAREHOLDERS | |

| 7 |

PNC FOCUS ON PERFORMANCE | |

| 8 |

RETAIL BANKING | |

| 12 |

CORPORATE & INSTITUTIONAL BANKING | |

| 16 |

BLACKROCK | |

| 18 |

PFPC | |

| 20 |

PNC IN THE COMMUNITY | |

| 22 |

BOARD OF DIRECTORS & EXECUTIVE MANAGEMENT | |

| 23 |

CONDENSED CONSOLIDATED INCOME STATEMENT | |

| 24 |

CONDENSED CONSOLIDATED BALANCE SHEET | |

| 25 |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | |

| 26 |

BUSINESS SEGMENTS | |

| 27 |

CAUTIONARY STATEMENT | |

| 28 |

CORPORATE INFORMATION | |

| PNC BANK REGIONAL OFFICES | ||

| PNC 2005 SUMMARY ANNUAL REPORT | 1 |

CONSOLIDATED FINANCIAL HIGHLIGHTS

THE PNC FINANCIAL SERVICES GROUP, INC.

For more information regarding certain factors that could cause actual results to differ materially from historical performance or from those anticipated in forward-looking statements, see the Cautionary Statement on page 27 and in our 2005 Annual Report on Form 10-K filed with the Securities and Exchange Commission.

| Year ended December 31 Dollars in millions, except per share data |

2005 | 2004 | 2003 | |||||||||

| Summary of Operations |

||||||||||||

| Net interest income |

$ | 2,154 | $ | 1,969 | $ | 1,996 | ||||||

| Provision for credit losses |

21 | 52 | 177 | |||||||||

| Noninterest income |

4,162 | 3,563 | 3,257 | |||||||||

| Noninterest expense |

4,333 | 3,735 | 3,476 | |||||||||

| Income before minority and noncontrolling interests and income taxes |

1,962 | 1,745 | 1,600 | |||||||||

| Minority and noncontrolling interests in income of consolidated entities |

33 | 10 | 32 | |||||||||

| Income taxes |

604 | 538 | 539 | |||||||||

| Income before cumulative effect of accounting change |

1,325 | 1,197 | 1,029 | |||||||||

| Cumulative effect of accounting change, net of tax |

(28 | ) | ||||||||||

| Net income |

$ | 1,325 | $ | 1,197 | $ | 1,001 | ||||||

| Per Common Share |

||||||||||||

| Diluted earnings (loss) |

||||||||||||

| Before cumulative effect of accounting change |

$ | 4.55 | $ | 4.21 | $ | 3.65 | ||||||

| Cumulative effect of accounting change |

(.10 | ) | ||||||||||

| Net income |

$ | 4.55 | $ | 4.21 | $ | 3.55 | ||||||

| Book value (at December 31) |

$ | 29.21 | $ | 26.41 | $ | 23.97 | ||||||

| Cash dividends declared |

$ | 2.00 | $ | 2.00 | $ | 1.94 | ||||||

| Selected Ratios |

||||||||||||

| Net interest margin |

3.00 | % | 3.22 | % | 3.64 | % | ||||||

| Efficiency(a) |

69 | 68 | 66 | |||||||||

| Return on |

||||||||||||

| Average common shareholders equity |

16.58 | 16.82 | 15.06 | |||||||||

| Average assets |

1.50 | 1.59 | 1.49 | |||||||||

| Loans to deposits |

81 | 82 | 80 | |||||||||

| Leverage(b) |

7.2 | 7.6 | 8.2 | |||||||||

| Common shareholders equity to total assets |

9.3 | 9.4 | 9.7 | |||||||||

Certain prior-period amounts have been reclassified to conform with the current period presentation, which we believe is more meaningful to readers of our consolidated financial statements.

| (a) | Computed as noninterest expense divided by the sum of net interest income and noninterest income. |

| (b) | The leverage ratio represents tier 1 capital divided by adjusted average total assets as defined by regulatory capital requirements for bank holding companies. |

| 2 | PNC LETTER TO SHAREHOLDERS |

TO OUR SHAREHOLDERS

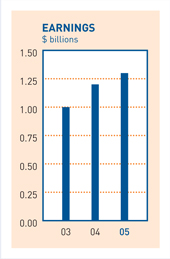

I am pleased to report that our company delivered extraordinary results in 2005. Earnings grew 11 percent to a record $1.3 billion, or $4.55 per diluted share. Customer satisfaction ratings reached all-time highs in retail banking and other businesses. We took aggressive action to expand and grow our company. Asset quality remained very strong, among the best in our peer group. And our company and employees did more to support our communities than ever before.

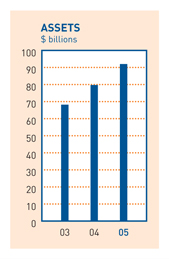

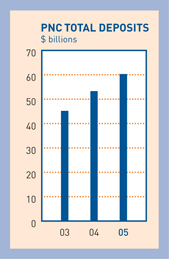

The fundamental strength of our operating platform helped drive this performance and fuel 16 percent growth in both average deposits and average loans, and boost total assets to a record $92 billion. Led by outstanding growth at BlackRock and PFPC, we grew noninterest income by 17 percent.

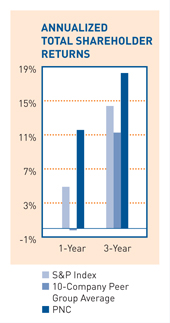

These accomplishments helped earn investor confidence: PNCs stock price grew by 8 percent over the year, and our total return to shareholders over the one- and three-year periods was the best in our 10-company peer group.

Our performance is a tribute to the 25,000-member PNC team and it reflects the marked progress we have made toward our vision of delivering consistently strong earnings growth while adhering to disciplined risk management.

Executing Strategies to Win

The groundwork for this success took place during the three-year period leading into 2005. Over that time, we took extensive measures to strengthen areas that were weak, and we made core competencies that were already good even better.

Through those actions, we significantly improved the customer experience; we built one of the industrys premier risk management programs; we added depth and experience to our management team; and we enhanced one of the industrys top technology platforms.

To build on these strengths, we have vigorously executed strategies surrounding the priorities I outlined for you last year.

I am pleased to report that our company delivered extraordinary results in 2005.

JAMES E. ROHR

CHAIRMAN AND

CHIEF EXECUTIVE OFFICER

(pictured at one of PNCs new green branches)

First, we continued to grow our customer base. Our actions helped us achieve client growth in virtually every business. We started by streamlining our banking businesses. Joe Guyaux, our president, heads the Retail Banking business. Vice Chairman Bill Demchak leads Corporate & Institutional Banking. Each has a wealth of industry experience and a record of building growth-driven cultures.

Under their leadership, these teams are now able to serve customers in a more unified and streamlined fashion and through a simplified and enhanced PNC brand position. This structure will help us build upon already strong results. Retail Banking delivered outstanding earnings and record customer satisfaction, and our Corporate & Institutional Banking team grew average loans 12 percent year over year.

And client growth at our global funds provider, PFPC, helped increase total fund assets serviced to $1.9 trillion.

Second, we leveraged our market leadership positions to grow our businesses. We have grown our client base because we compete to win. In the areas we have targeted for growth, we have built the size, scale and expertise necessary to be very effective.

For example, we are one of the major retail banks in virtually every market we serve; and we are the number one small business lender in Pennsylvania, New Jersey and Delaware.

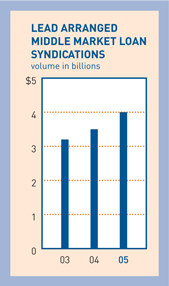

The story is similar in the middle market space, where we have the number one middle market loan syndications group in the Northeast and one of the leading national middle market M&A advisors.

Nationally, we are a top-five asset-based lender and a top-10 treasury management provider. And PFPC remains one of the nations largest providers of transfer agency services to mutual fund and other investment companies.

| 4 | PNC LETTER TO SHAREHOLDERS |

WILLIAM S. DEMCHAK

VICE CHAIRMAN

HEAD OF CORPORATE &

INSTITUTIONAL BANKING

JAMES E. ROHR

CHAIRMAN AND

CHIEF EXECUTIVE OFFICER

JOSEPH C. GUYAUX

PRESIDENT

HEAD OF RETAIL BANKING

Third, we have taken measures to improve our operating leverage. Although our business mix does not lend itself to a best-in-class efficiency ratio for a financial institution, we knew we could do a much better job of improving operating leverage, which, in essence, means growing revenue at a faster rate than expenses.

Last year we launched the One PNC initiative, undertaking the most comprehensive review ever of our company. Through streamlining processes, moving decision-making functions closer to the customer and reorganizing our businesses, we built a more efficient and unified company. As a result, we are also taking the difficult but necessary step of eliminating 3,000 positions, mostly through attrition.

One PNC expense reduction and revenue growth ideas contributed a net $90 million pre-tax benefit toward the bottom line in 2005, $55 million more than originally anticipated at this point. We are very much on track to achieve the expected $400 million total by 2007.

The true impact of One PNC will be felt in the long-term change it has effected, as we create a culture of continuous improvement.

Fourth, we have the power to invest in and grow our company. Through expense savings and efficient use of our capital, we continue to make disciplined investments to drive growth and create shareholder value, including three key strategic acquisitions to expand our franchise and broaden our capabilities.

Early in 2005, BlackRock added State Street Research and Management, an acquisition that was accretive to earnings in 2005. We entered the greater Washington, D.C., area in May, taking a foothold in that very attractive market. And in September, we added Harris Williams, a leading national middle market mergers and acquisitions advisory firm that is helping PNC make further inroads with middle market clients. The Harris Williams transaction was also accretive to earnings last year, and we expect that the Riggs transaction will be accretive this year.

BlackRocks agreement to acquire Merrill Lynchs investment management business, which will create one of the worlds largest asset management firms, will provide us with a great deal of capital flexibility and additional benefits.

| PNC 2005 SUMMARY ANNUAL REPORT | 5 |

For the period ending December 31, 2005

We will retain a 34 percent stake in the new, larger BlackRock and, as a result, expect an increase in its contribution to PNCs earnings and a large unrecognized gain when compared to our original $240 million investment in 1995. In addition, based on a recent BlackRock stock price, we currently estimate that we will record a $1.8 billion after-tax gain upon the transactions close, which provides us with the ability to create shareholder value through activities such as repurchasing shares and making additional investments in our businesses.

Finally, we managed risk to drive consistent growth.

To this end, we have made remarkable progress in building a best-in-class risk management program. By investing wisely, we have created flexibility in our balance sheet. Unlike some banks, we carefully avoided the cash and carry gamble (making long-term investments in a low-rate environment to boost short-term earnings) and therefore we are not saddled with the resulting lower-performing investments.

We have also followed prudent risk-return criteria to help maintain strong asset quality. Our ongoing objective is to manage risk in a way that mitigates earnings volatility yet enables us to grow profitability.

Just as important, Rick Johnson, our chief financial officer, has led the implementation of a series of changes to improve financial reporting and disclosure, making it easier for you, the shareholder, to understand our strategies and track our performance. And as we entered 2006, Institutional Shareholder Services rated PNCs corporate governance policies in the 99th percentile of the banking industry.

Looking Ahead

Our ability to execute the strategies we have outlined and our capital flexibility will help us build on the progress and growth we achieved in 2005. We believe our proven ability to execute our strategies even when facing stiffening competition and industry-wide challenges such as a flat yield curve and potentially higher credit costs differentiates our company.

More so than ever, growth is a mind-set at PNC. And we view growth broadly: we do not limit it to increases

For the period ending

December 31, 2005

| 6 | PNC LETTER TO SHAREHOLDERS |

At December 31

in the bottom line, though that is critically important to our goals. True growth must also encompass our employees through opportunities for professional and personal development and our communities through investments in economic expansion and vitality.

We empower our employees to achieve the highest levels of performance, and we support them and their families through top-tier benefits programs. In fact, PNCs 401(k) plan is rated by an independent benefits consulting firm to be in the top 10 percent when compared to other large companies that offer employees both a pension and a savings plan.

Through programs such as PNC Grow Up Great, our 10-year, $100 million initiative to help children from birth to age 5 become better prepared for school and life, our company and our employees are making a difference in our communities that can help fuel growth for generations to come.

In 2005, our efforts helped programs that support nearly 30,000 children across eight states and Washington, D.C.; and PNC Grow Up Great was recognized by Reading Is Fundamental and others for being the most comprehensive corporate program of its kind.

This performance would not be possible without the tremendous contributions of our 25,000-member team and our board of directors. I thank each of them for their leadership and support.

On behalf of everyone at PNC, I would also like to thank our customers and our shareholders for their continued trust in our company. As always, we will work hard to exceed your expectations.

| Sincerely, |

|

| JAMES E. ROHR |

| CHAIRMAN AND |

| CHIEF EXECUTIVE OFFICER |

| PNC 2005 SUMMARY ANNUAL REPORT | 7 |

Performance has long served dual roles at PNC. It is both a hallmark of our successful history and a rallying point for our future. On the pages that follow, you will read of the varied ways in which PNCs Focus on Performance creates value for our customers, shareholders, employees and the communities we serve.

| 8 | PNC RETAIL BANKING |

| PNC 2005 SUMMARY ANNUAL REPORT | 9 |

Performance is Our Passion

|

|

|

| At December 31 | ||

Two and a half million consumer and small business customers count on PNC to help meet their banking needs and achieve their financial goals. We thrive on that responsibility and, through our passion to perform, we strive to earn their trust every day.

At the core of Retail Bankings success and growth is our commitment to serve our customers and make banking easy for them. Our integrated system of products, services and distribution channels helps to distinguish PNC from our peers. And we have developed a team of employees deeply committed to addressing our customers simplest or most complex needs whether it is a college student opening his first checking account, an entrepreneur seeking financing for her own business, or a retiree saving for his granddaughters education.

In 2005, we strengthened and expanded this highly successful retail banking model. Consistent with our corporate goal to invest and grow, we invested nearly $65 million to enhance and expand our branch network, PNCs most visible and widely-used distribution channel. We refurbished nearly 300 existing branches, in many cases adding space to assist small business and investment customers, and we built 25 offices in new locations.

Perhaps most important, we empowered our branch managers to operate these offices with the type of entrepreneurial spirit that makes doing business easy for our customers and coming to work enjoyable for our employees.

We listen to our customers and take pride in providing solutions tailored to each one. We also learn. Our conversations and our robust database of transaction information offer insights that enable us to create products our customers value.

Customer-Focused Growth

To expand our model, we entered the very attractive greater Washington, D.C., area last May. We plan to build on this 51-branch foothold by adding 30 new branches there over the next two years.

| 10 | PNC RETAIL BANKING |

|

|

Combined, these actions helped earn the confidence of those who bank with us, fueling record-high customer satisfaction as well as strong customer growth and retention. In 2005, we increased checking customer relationships and average deposits by 10 percent each. This growth also generated an increase in Retail Banking fee income.

Strengths in Business Banking and Wealth Management

The small business banking and wealth management areas of Retail Banking have been important contributors to this success.

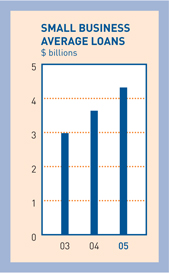

In small business, we have added more business bankers to deliver our broad array of payments solutions. Through PNC, customers can access the types of merchant services, online banking and core treasury management products that will help them manage and grow their businesses. These strengths complement our breadth of traditional banking services, which helped drive growth in both small business deposits and commercial loans.

Another priority is to establish PNC as a trusted advisor for wealth management clients. Through this approach, we can understand client goals and work in concert with them to help plan, grow and manage their wealth in accordance with their objectives.

In addition to providing high net worth planning, investments, banking and trust services, our wealth management platform also includes comprehensive brokerage capabilities through PNC Investments and Hilliard Lyons, a full service broker dealer. For the ultra high net worth segment, our Hawthorn unit provides extensive, often family-office oriented, advisory capabilities.

PNC PERFORMANCE IS OUR PASSION

Our wealth management relationship managers command an array of creative yet proven solutions to nurture our clients personal assets. Through their expertise, supported by a team of specialists, we deliver a growing network of advice-based solutions designed to meet the evolving needs of our clients.

We have exciting new strategies designed to build on the success we achieved across Retail Banking in 2005. These measures include simplifying our product set and enhancing our Web site to make banking easier for our customers. We will also use our branch system and other distribution channels to establish a private client group, expanding how we deliver investment, planning and trust capabilities to the growing base of affluent clients across the regions we serve.

| PNC 2005 SUMMARY ANNUAL REPORT | 11 |

WEALTH & VALUES Managing wealth requires keen insight and a deep understanding of our clients needs and aspirations on many levels. One way we capture helpful insights is by conducting PNC Wealth & Values, an annual survey of high-net-worth individuals. The January 2006 survey highlights concerns about healthcare and elder care costs, as well as views on the changing dynamics of the real estate market. Understanding these trends helps PNC management and relationship managers shape service strategies and deliver better solutions to our clients, including Bob Ready, of Cincinnati, shown here.

This is a highly competitive industry. To stand out, we have great people delivering exceptional service.

Jodi Brigman

Regional Manager

PNC Bank, Central & Northern New Jersey

MULTICULTURAL The rich and vibrant markets we serve feature customers with diverse ethnic backgrounds. We understand that and are making banking easier for this fast-growing sector of customers by providing banking services that are aligned to their needs. For example, we offer a toll-free line, 1-800-HOLA-PNC, for Spanish-speaking customers and more than 1,000 branch and call center employees who, in addition to possessing multi-language skills, can assist customers with access to financial solutions.

RETAIL BANKING

EASY AS PNC Consumers have many options, not only in where they bank but how they bank. PNC helps our customers by making these decisions as easy as possible for them. Our integrated system of products and wide range of distribution channels such as more than 800 branches, 3,700 ATMs, a premier call center and robust online banking services enable them to select from a range of accessible and appropriate solutions. And our devotion to understanding our customers needs earns their ongoing trust and confidence.

| 12 | PNC CORPORATE & INSTITUTIONAL BANKING |

| PNC 2005 SUMMARY ANNUAL REPORT | 13 |

Performance is Partnership

Our Corporate & Institutional Banking vision is to become the premier provider of financial services to each of the target markets we serve across the country. To achieve our vision, we continue to focus on expanding our value proposition to existing client sectors where we have a proven ability to compete and win. At the same time, we continue to add new client sectors where we can customize our offerings to meet their needs.

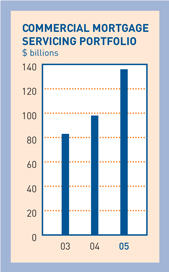

We have long been a premier financial services provider to middle market companies in our primary region. In recent years, we have also built one of the top-five asset-based lending practices across the country. And our real estate finance group which serves owners, operators and developers across the country grew its loan portfolio by 25 percent and its commercial mortgage servicing portfolio by 39 percent last year.

Reflecting our progress in these areas, PNC is now the nations number two syndicator of middle-market sized loan transactions. Underpinning our success is our outstanding set of credit, treasury management and capital markets products and services, many of which have been scaled to middle-market sized entities and are delivered by highly experienced relationship managers. We have also significantly expanded our value proposition to middle-market sized companies with the recent acquisition of Harris Williams, one of the nations largest mergers and acquisitions advisory firms for that sector.

Of course, success requires more than products and services. PNCs relationship managers invest their time and expertise with every client to help ensure that we understand their business, their strategy and their goals. As a result, we can provide the ideas, advice and solutions that give our clients greater confidence in making decisions and greater ease in achieving success.

Each client is served by a relationship team. And each team member is fully committed and accountable for delivering the comprehensive resources of PNC to help that client succeed.

| 14 | PNC CORPORATE & INSTITUTIONAL BANKING |

At December 31

To support our client relationship teams, we recently implemented an advanced customer relationship management system. This system provides us with a more efficient and effective method of identifying new opportunities, building the right teams to pursue those opportunities and accelerating the ongoing exchange of information among team members. And we continuously conduct research in each of our target markets to help ensure that we capture our clients views and focus all of our resources on delivering what our clients want.

In 2005, this approach resulted in continued new client growth across virtually all Corporate & Institutional Banking sectors. In addition, we grew average loans by 12 percent to $19 billion. PNCs relationship strategy, coupled with our prudent risk management practices, also enabled us to maintain strong asset quality, with nonperforming assets remaining at historically low levels.

Our industry-leading treasury management products fueled strong noninterest income growth and continued to help distinguish PNC from our peers. PNC offers a comprehensive suite of payables and receivables solutions, including the nations fifth-largest purchasing card program and, with the recent addition of our Boston site, a coast-to-coast lockbox system.

In addition, we have made key investments to customize our treasury and information management capabilities for new audiences such as healthcare and other financial institutions. Our healthcare offerings enable healthcare providers and payers to securely share federally mandated payment and services information online, while our financial institutions offerings provide banks and financial services companies with a range of services, including the type of risk management products BlackRock uses to help Fortune 100 companies.

PNC PERFORMANCE IS PARTNERSHIP

Leveraging the foundation we have built, and developing the exciting new initiatives under way, Corporate & Institutional Banking is carrying a great deal of momentum into 2006.

| PNC 2005 SUMMARY ANNUAL REPORT | 15 |

NATIONAL HEALTHCARE With demand for healthcare services growing every year, PNC has taken a different approach to helping providers and payers reduce administrative costs and maximize cash flow: we provide a full array of highly integrated solutions to both groups. We have combined state-of-the art clearinghouse capabilities with premier treasury management services into solutions that improve the healthcare revenue cycle. PNCs fully integrated client team works to ensure quality delivery of this capability, allowing us to become a financial services leader to the healthcare industry.

Our overriding priority is to do whats right for our clients. That enables us to deepen these relationships and forge a lasting trust with each client.

Forrest Patterson

Relationship Manager

PNC Bank, Philadelphia &

Southern New Jersey

TREASURY MANAGEMENT Treasury Management is a proven strength of PNC. As evidence, we now rank as the third-largest wholesale lockbox provider in the country, with a fully integrated system located in seven major cities. Our premier lockbox service, A/R Advantage, is an image-based solution that accepts both paper and electronic payments and consolidates them for more efficient collection and cash application. By combining our ongoing investments in an advanced suite of products and services with our commitment to achieving exceptional client satisfaction, we have become one of the nations leading treasury management providers, serving more than one-third of the Fortune 500.

CORPORATE & INSTITUTIONAL BANKING

HARRIS WILLIAMS Through the acquisition of Harris Williams, PNC now offers expanded mergers and acquisitions advisory and related services to middle market companies. Harris Williams is one of the largest and most successful advisory firms in the country focused on this targeted sector. With offices in Richmond, Boston, San Francisco and Philadelphia and plans for continued rapid growth Harris Williams further reinforces PNCs ongoing commitment to serve as a trusted advisor to middle market clients.

| 16 | PNC BLACKROCK |

| PNC 2005 SUMMARY ANNUAL REPORT | 17 |

Performance is Power

Globalization is driving enormous change within the capital markets with important implications for all investors. Few asset managers are better able to help both large institutions and individual investors maneuver the complexities of the investment environment more than BlackRock. Whether the need is for innovative investment products or BlackRock Solutions® analytic tools or advisory services, BlackRocks mission is to help clients solve problems.

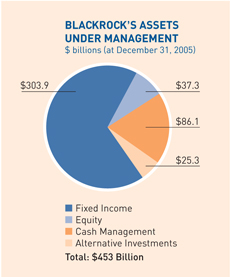

BlackRocks strong investment performance, expanding global reach and broader product offerings contributed to record organic growth during 2005. Assets under management rose 32 percent to $453 billion at December 31, 2005, including $50 billion in net new business awarded by clients in the United States and 43 other countries worldwide. Demand for the firms proprietary investment and risk management tools also increased, and BlackRock Solutions won 32 net new assignments during the year. Revenues surpassed $1 billion, and earnings were 64 percent higher than in the prior year.

To enhance client service around the globe, BlackRock is continuing to build its regional capabilities. The firm established new offices in London, Munich and Chicago in 2005, as well as adding to its efforts in Edinburgh, Tokyo and Hong Kong, and other major markets served by the firm. Growing recognition of the firms deep markets expertise and continued competitive investment performance is expected to support strong new business momentum going forward.

BlackRock is one of the worlds largest and fastest-growing investment firms, serving a diverse universe of both institutional and individual investors. Long known for its disciplined approach to fixed income investing, BlackRock is increasingly recognized for the breadth of its offerings across asset classes and investment styles. The firm now manages over $37 billion in equity assets, and more than $25 billion in alternative investments, including real estate debt and equity offerings, CDOs and other structured products, fixed income and equity hedge funds and funds of hedge funds products.

| 18 | PNC PFPC |

| PNC 2005 SUMMARY ANNUAL REPORT | 19 |

Performance is Progress

Through PFPC, PNC provides processing, technology and business solutions for the global funds industry. As an industry pioneer, we have the experience to help our clients navigate the ever-changing global investment environment including a thorough understanding of new products, new technologies, new service models and new regulations.

We take an open approach, which means we place our clients needs at the center of everything we do. We can support virtually any delivery option a client chooses, from full-service outsourcing to shared-service arrangements to remote servicing. That enables us to deliver personalized solutions that fit each clients specific preferences and evolving requirements, and help our clients to expand their capabilities, maintain a technical edge, maximize returns on internal resources, grow revenue and stay ahead of competitors.

For example, to meet the growing demand for managed account services, we have built a comprehensive and unified managed account platform for program sponsors and a full-service, back-office outsourcing solution for money managers.

PFPCs strategy helped drive new client growth and deepen existing customer relationships in 2005. We continued to grow our traditional businesses and expand our services to meet the needs of emerging markets. We provide accounting and administration services for $830 billion of net fund assets, an increase of 15 percent over last year, while custody services grew to $476 billion. We now provide managed account solutions for more than $51 billion in assets and service over $78 billion in alternative investment assets globally.

This growth, combined with a diligent approach to expense management, helped PFPC deliver record income of $104 million in 2005, a 49 percent increase over 2004.

PFPCs range of services and disciplined operating strategy positions us for continued growth in this highly competitive market.

PFPCs ties to Wall Street go beyond simple geography. PFPCs unique position within shareholder servicing has allowed it to create a new suite of services to assist broker/dealers and fund firms in automating information delivery and meeting important regulatory and compliance requirements.

PFPC now affords broker/dealers and fund firms the ability to maintain transparency across multiple accounts, thus facilitating the calculation of appropriate sales charges and the thwarting of market timing. These full-service solutions provide consolidated recordkeeping of and access to an investors total mutual fund holdings across multiple fund companies, making the information available to broker/dealers and fund firms alike for use in meeting their respective regulatory obligations.

| 20 | PNC IN THE COMMUNITY |

| PNC 2005 SUMMARY ANNUAL REPORT | 21 |

Performance is People

The community. It serves as the hub of activity. It reflects who we are. And it plays an instrumental role in the success and growth of our customers, our employees and, ultimately, our company. Contributing to the health and vitality of the communities we serve is a core objective of PNC. In 2005, our company and employees did more to achieve this goal than ever before.

PNC Grow Up Great, our 10-year, $100 million program to help prepare children from birth to age 5 for school and life, is the centerpiece of our community commitment. This program helps create stronger children and families and more vibrant communities, which should last for generations to come.

The largest and most comprehensive corporate initiative of its kind, PNC Grow Up Great is designed to help caregivers prepare children cognitively, socially and emotionally for school.

Since the inception of the program, we have provided more than $5 million in grants to support preschool programs that serve nearly 30,000 children in eight states and Washington, D.C.

Beyond the monetary support, PNC employees have contributed more than 35,000 volunteer hours to school-readiness related activities. To help encourage this generosity, PNC provides up to 40 hours of paid time off to our employee volunteers.

And by sponsoring conferences to discuss the economic impact of early childhood education, PNC is helping to raise awareness of this issue nationally with policymakers, educators, business leaders and parents.

In addition to helping future generations through PNC Grow Up Great, our companys community development activities support the ongoing needs of thousands of low- and moderate-income families and their communities. In 2005, PNC provided more than $1 billion in financing to low- or moderate-income individuals and related nonprofits and small businesses. In addition to innovative financing and contributions, we offer a range of financial education and home ownership programs to help promote sustainable affordable housing, economic development and revitalization of our underserved neighborhoods.

PNC has contributed more than $20 million through corporate sponsorships and PNC Foundation grants, including PNC Grow Up Great.

We take a unique and comprehensive approach to community giving. In one example, we collaborated with the Andy Warhol Museum of Pittsburgh and the Corcoran Gallery of Washington, D.C., to showcase a large selection of the famed artists works for the first time in our nations capital.

Continuing its long history of funding activities that drive economic development, the PNC Foundation made contributions to hundreds of health and welfare, education, and arts and culture organizations.

| 22 | PNC 2005 SUMMARY ANNUAL REPORT |

BOARD OF DIRECTORS

& EXECUTIVE MANAGEMENT

THE PNC FINANCIAL SERVICES GROUP, INC.

Board of Directors

Paul W. Chellgren (1, 2, 4)

Retired Chairman and

Chief Executive Officer

Ashland Inc. (energy company);

Adjunct Professor

Northern Kentucky University

Robert N. Clay (3)

President and

Chief Executive Officer

Clay Holding Company (investments)

J. Gary Cooper (1)

Chairman

Commonwealth National Bank

(community banking)

George A. Davidson, Jr. (1)

Retired Chairman

Dominion Resources, Inc.

(public utility holding company)

Richard B. Kelson (1)

Chairmans Counsel

Alcoa Inc.

(producer of primary aluminum, fabricated aluminum, and alumina)

Bruce C. Lindsay (1)

Chairman and

Managing Member

2117 Associates, LLC

(advisory company)

Anthony A. Massaro (3, 4)

Retired Chairman and

Chief Executive Officer

Lincoln Electric Holdings, Inc.

(full-line manufacturer of welding

and cutting products)

Thomas H. OBrien (5)

Retired Chairman

The PNC Financial Services Group, Inc.

Jane G. Pepper (3)

President

Pennsylvania Horticultural Society

(nonprofit membership organization)

James E. Rohr (2, 5)

Chairman and

Chief Executive Officer

The PNC Financial Services Group, Inc.

Lorene K. Steffes (5)

Independent business advisor

and consultant

Dennis F. Strigl (2, 4, 5)

President and

Chief Executive Officer

Verizon Wireless, Inc. (wireless telecommunications)

Stephen G. Thieke (2, 5)

Retired Chairman

Risk Management Committee

JP Morgan Incorporated

(financial and investment banking services)

Thomas J. Usher (2, 3, 4)

Retired Chairman

United States Steel Corporation

(integrated steelmaker)

Milton A. Washington (4, 5)

President and

Chief Executive Officer

Allegheny Housing Rehabilitation Corporation

(housing rehabilitation and construction)

Helge H. Wehmeier (3)

Retired President and

Chief Executive Officer

Bayer Corporation

(healthcare, crop protection and chemicals)

Board Committees

(1) Audit

(2) Executive

(3) Nominating & Governance

(4) Personnel & Compensation

(5) Risk

Executive Management

James E. Rohr

Chairman and Chief Executive Officer

Joseph C. Guyaux

President

William S. Demchak

Vice Chairman

William C. Mutterperl

Vice Chairman

Peter K. Classen

Executive Vice President

Corporate Banking

Laurence D. Fink

Chairman and Chief Executive Officer

BlackRock

Hugh Frater

Executive Vice President

Real Estate Finance

Joan L. Gulley

Executive Vice President

Retail Banking

Neil F. Hall

Executive Vice President

Retail Banking

Michael J. Hannon

Chief Credit Officer

Richard J. Johnson

Chief Financial Officer

Helen P. Pudlin

General Counsel

Robert Q. Reilly

Executive Vice President

Wealth Management

William E. Rosner

Chief Human Resources Officer

Timothy G. Shack

Chairman and Chief Executive Officer

PFPC

Thomas K. Whitford

Chief Risk Officer

John J. Wixted, Jr.

Chief Compliance and Regulatory Officer

| PNC 2005 SUMMARY ANNUAL REPORT | 23 |

CONDENSED CONSOLIDATED

INCOME STATEMENT

THE PNC FINANCIAL SERVICES GROUP, INC.

| Year ended December 31 In millions, except per share data |

2005 | 2004 | |||||

| Interest Income |

|||||||

| Loans |

$ | 2,669 | $ | 2,043 | |||

| Securities and other |

1,065 | 709 | |||||

| Total interest income |

3,734 | 2,752 | |||||

| Interest Expense |

|||||||

| Deposits |

981 | 484 | |||||

| Borrowed funds |

599 | 299 | |||||

| Total interest expense |

1,580 | 783 | |||||

| Net interest income |

2,154 | 1,969 | |||||

| Provision for credit losses |

21 | 52 | |||||

| Net interest income less provision for credit losses |

2,133 | 1,917 | |||||

| Noninterest Income |

|||||||

| Asset management |

1,443 | 994 | |||||

| Fund servicing |

870 | 817 | |||||

| Service charges on deposits |

273 | 252 | |||||

| Brokerage |

225 | 219 | |||||

| Consumer services |

287 | 264 | |||||

| Corporate services |

511 | 493 | |||||

| Equity management gains |

96 | 67 | |||||

| Net securities gains (losses) |

(41 | ) | 55 | ||||

| Trading |

157 | 113 | |||||

| Other |

341 | 289 | |||||

| Total noninterest income |

4,162 | 3,563 | |||||

| Noninterest Expense |

|||||||

| Compensation |

2,061 | 1,755 | |||||

| Employee benefits |

332 | 309 | |||||

| Net occupancy |

313 | 267 | |||||

| Equipment |

296 | 290 | |||||

| Marketing |

106 | 87 | |||||

| Other |

1,225 | 1,027 | |||||

| Total noninterest expense |

4,333 | 3,735 | |||||

| Income before minority and noncontrolling interests and income taxes |

1,962 | 1,745 | |||||

| Minority and noncontrolling interests in income of consolidated entities |

33 | 10 | |||||

| Income taxes |

604 | 538 | |||||

| Net income |

$ | 1,325 | $ | 1,197 | |||

| Diluted earnings per share |

$ | 4.55 | $ | 4.21 | |||

| 24 | PNC 2005 SUMMARY ANNUAL REPORT |

CONDENSED CONSOLIDATED

BALANCE SHEET

THE PNC FINANCIAL SERVICES GROUP, INC.

| At December 31 In millions, except par value |

2005 | 2004 | ||||||

| Assets |

||||||||

| Cash and due from banks |

$ | 3,518 | $ | 3,230 | ||||

| Federal funds sold, resale agreements and other short-term investments |

2,893 | 3,483 | ||||||

| Loans held for sale |

2,449 | 1,670 | ||||||

| Securities available for sale and held to maturity |

20,710 | 16,761 | ||||||

| Loans, net of unearned income of $835 and $902 |

49,101 | 43,495 | ||||||

| Allowance for loan and lease losses |

(596 | ) | (607 | ) | ||||

| Net loans |

48,505 | 42,888 | ||||||

| Goodwill and other intangible assets |

4,466 | 3,355 | ||||||

| Other |

9,413 | 8,336 | ||||||

| Total assets |

$ | 91,954 | $ | 79,723 | ||||

| Liabilities |

||||||||

| Deposits |

||||||||

| Noninterest-bearing |

$ | 14,988 | $ | 12,915 | ||||

| Interest-bearing |

45,287 | 40,354 | ||||||

| Total deposits |

60,275 | 53,269 | ||||||

| Borrowed funds |

||||||||

| Federal funds purchased and repurchase agreements |

5,819 | 1,595 | ||||||

| Bank notes and senior debt |

3,875 | 2,383 | ||||||

| Subordinated debt |

4,469 | 4,050 | ||||||

| Commercial paper |

10 | 2,251 | ||||||

| Other borrowed funds |

2,724 | 1,685 | ||||||

| Total borrowed funds |

16,897 | 11,964 | ||||||

| Allowance for unfunded loan commitments and letters of credit |

100 | 75 | ||||||

| Accrued expenses and other |

5,529 | 6,438 | ||||||

| Total liabilities |

82,801 | 71,746 | ||||||

| Minority and noncontrolling interests in consolidated entities |

590 | 504 | ||||||

| Shareholders Equity |

||||||||

| Preferred stock(a) |

||||||||

| Common stock $5 par value |

||||||||

| Authorized 800 shares, issued 353 shares |

1,764 | 1,764 | ||||||

| Capital surplus |

1,358 | 1,265 | ||||||

| Retained earnings |

9,023 | 8,273 | ||||||

| Deferred compensation expense |

(59 | ) | (51 | ) | ||||

| Accumulated other comprehensive loss |

(267 | ) | (54 | ) | ||||

| Common stock held in treasury at cost: 60 and 70 shares |

(3,256 | ) | (3,724 | ) | ||||

| Total shareholders equity |

8,563 | 7,473 | ||||||

| Total liabilities, minority and noncontrolling interests, and shareholders equity |

$ | 91,954 | $ | 79,723 | ||||

| (a) | Less than $.5 million at each date. |

| PNC 2005 SUMMARY ANNUAL REPORT | 25 |

REPORT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

To the Board of Directors and Shareholders of The PNC Financial Services Group, Inc. Pittsburgh, Pennsylvania

We have audited the consolidated balance sheet of The PNC Financial Services Group, Inc. and subsidiaries (the Company) as of December 31, 2005 and 2004, and the related consolidated statements of income, shareholders equity, and cash flows for each of the three years in the period ended December 31, 2005. We also have audited managements assessment of the effectiveness of the Companys internal control over financial reporting and the effectiveness of the Companys internal control over financial reporting as of December 31, 2005. Such consolidated financial statements, managements assessment of the effectiveness of the Companys internal control over financial reporting and our reports thereon dated March 3, 2006, expressing unqualified opinions (which are not included herein) are included in the Form 10-K for the year ended December 31, 2005. The accompanying condensed consolidated financial statements are the responsibility of the Companys management. Our responsibility is to express an opinion on such condensed consolidated financial statements in relation to the complete consolidated financial statements.

In our opinion, the information set forth in the accompanying condensed consolidated balance sheet as of December 31, 2005 and 2004, and the related condensed consolidated statement of income for the years then ended, is fairly stated in all material respects in relation to the basic consolidated financial statements from which it has been derived.

|

|

| Pittsburgh, Pennsylvania |

| March 3, 2006 |

| 26 | PNC 2005 SUMMARY ANNUAL REPORT |

BUSINESS SEGMENTS

THE PNC FINANCIAL SERVICES GROUP, INC.

| (Unaudited)(a) Year ended December 31 In millions |

2005 | 2004 | ||||||

| Earnings |

||||||||

| Retail Banking |

$ | 682 | $ | 610 | ||||

| Corporate & Institutional Banking |

480 | 443 | ||||||

| BlackRock |

234 | 143 | ||||||

| PFPC |

104 | 70 | ||||||

| Total business segment earnings |

1,500 | 1,266 | ||||||

| Minority interest in income of BlackRock |

(71 | ) | (42 | ) | ||||

| Other |

(104 | ) | (27 | ) | ||||

| Total consolidated net income |

$ | 1,325 | $ | 1,197 | ||||

| Revenue(b) |

||||||||

| Retail Banking |

$ | 2,857 | $ | 2,694 | ||||

| Corporate & Institutional Banking |

1,342 | 1,271 | ||||||

| BlackRock |

1,229 | 761 | ||||||

| PFPC |

846 | 763 | ||||||

| Total business segment revenue |

6,274 | 5,489 | ||||||

| Other |

75 | 63 | ||||||

| Total consolidated revenue |

$ | 6,349 | $ | 5,552 | ||||

| (a) | See our Current Reports on Form 8-K dated September 30, 2005 and December 28, 2005 and our 2005 Form 10-K regarding changes to the presentation of the results of our businesses. Our business segment information is presented based on our management accounting practices and our management structure. We refine our methodologies from time to time as our management accounting practices are enhanced and our businesses and management structure change. |

| (b) | Business segment revenue is presented on a taxable-equivalent basis. The interest income earned on certain assets is completely or partially exempt from federal income tax. As such, these tax-exempt instruments typically yield lower returns than a taxable investment. To provide more meaningful comparisons of yields and margins for all earning assets, we also provide revenue on a taxable-equivalent basis by increasing the interest income earned on tax-exempt assets to make it fully equivalent to interest income on other taxable investments. This adjustment is not permitted under generally accepted accounting principles (GAAP) on our Consolidated Income Statement. The following is a reconciliation of total consolidated revenue on a book (GAAP) basis to total consolidated revenue on a taxable-equivalent basis (in millions): |

| Year ended December 31 |

2005 | 2004 | ||||

| Total consolidated revenue, book (GAAP) basis |

$ | 6,316 | $ | 5,532 | ||

| Taxable-equivalent adjustment |

33 | 20 | ||||

| Total consolidated revenue, taxable-equivalent basis |

$ | 6,349 | $ | 5,552 | ||

| PNC 2005 SUMMARY ANNUAL REPORT | 27 |

CAUTIONARY STATEMENT

REGARDING FORWARD-LOOKING INFORMATION

THE PNC FINANCIAL SERVICES GROUP, INC.

We make statements in this Report, and we may from time to time make other statements, regarding our outlook or expectations for earnings, revenues, expenses and/or other matters regarding or affecting PNC that are forward-looking statements within the meaning of the Private Securities Litigation Reform Act. Forward-looking statements are typically identified by words such as believe, expect, anticipate, intend, outlook, estimate, forecast, project and other similar words and expressions.

Forward-looking statements are subject to numerous assumptions, risks and uncertainties, which change over time. Forward-looking statements speak only as of the date they are made. We do not assume any duty and do not undertake to update our forward-looking statements. Actual results or future events could differ, possibly materially, from those that we anticipated in our forward-looking statements, and future results could differ materially from our historical performance.

Our forward-looking statements are subject to the following principal risks and uncertainties. We provide greater detail regarding these factors in our Form 10-K for the year ended December 31, 2005, including in the Risk Factors and Risk Management sections. Our forward-looking statements may also be subject to other risks and uncertainties including those discussed elsewhere in this Report or in our filings with the SEC accessible on the SECs website at www.sec.gov or through our corporate website at www.pnc.com.

| | Our business and operating results are affected by business and economic conditions generally or specifically in the principal markets in which we do business. We are affected by changes in our customers financial performance, as well as changes in customer preferences and behavior, including as a result of changing economic conditions. |

| | The value of our assets and liabilities, as well as our overall financial performance, are affected by changes in interest rates or in valuations in the debt and equity markets. Actions by the Federal Reserve and other government agencies, including those that impact money supply and market interest rates, can affect our activities and financial results. |

| | Competition can have an impact on customer acquisition, growth and retention, as well as on our credit spreads and product pricing, which can affect market share, deposits and revenues. |

| | Our ability to implement our One PNC initiative, as well as other business initiatives and strategies we may pursue, could affect our financial performance over the next several years. |

| | Our ability to grow successfully through acquisitions is impacted by a number of risks and uncertainties related both to the acquisition transactions themselves and to the integration of the acquired businesses into PNC after closing. These uncertainties are present in transactions such as the pending acquisition by BlackRock of Merrill Lynchs investment management business and continue to be present with respect to the integration of Riggs National Corporation. |

| | Legal and regulatory developments could have an impact on our ability to operate our businesses or our financial condition or results of operations or our competitive position or reputation. Reputational impacts, in turn, could affect matters such as business generation and retention, our ability to attract and retain management, liquidity and funding. These developments could include (a) the resolution of legal proceedings or regulatory and other governmental inquiries; (b) increased litigation risk from recent regulatory and other governmental developments; (c) the results of the regulatory examination process, our failure to satisfy the requirements of agreements with governmental agencies, and regulators future use of supervisory and enforcement tools; (d) legislative and regulatory reforms, including changes to laws and regulations involving tax, pension, and the protection of confidential customer information; and (e) changes in accounting policies and principles. |

| | Our business and operating results are affected by the ability to identify and effectively manage risks inherent in our businesses, including, where appropriate, through the effective use of third-party insurance and capital management techniques. |

| | Our ability to anticipate and respond to technological changes can have an impact on our ability to respond to customer needs and to meet competitive demands. The adequacy of our intellectual property protection, and the extent of any costs associated with obtaining rights in intellectual property claimed by others, can also impact our business and operating results. |

| | Our business and operating results can be affected by widespread natural disasters, terrorist activities or international hostilities, either as a result of the impact on the economy and financial and capital markets generally or on us or on our customers, suppliers or other counter-parties specifically. |

Also, risks and uncertainties that could affect the results anticipated in forward-looking statements or from historical performance relating to our majority-owned subsidiary BlackRock, Inc. are discussed in more detail in BlackRocks filings with the SEC, accessible on the SECs website and on or through BlackRocks website at www.blackrock.com.

| 28 | PNC 2005 SUMMARY ANNUAL REPORT |

CORPORATE INFORMATION

THE PNC FINANCIAL SERVICES GROUP, INC.

| High | Low | Close | Cash Dividends Declared |

|||||||||

| 2005 Quarter |

||||||||||||

| First |

$ | 57.57 | $ | 50.30 | $ | 51.48 | $ | .50 | ||||

| Second |

55.90 | 49.35 | 54.46 | .50 | ||||||||

| Third |

58.95 | 53.80 | 58.02 | .50 | ||||||||

| Fourth |

65.66 | 54.73 | 61.83 | .50 | ||||||||

| Total |

$ | 2.00 | ||||||||||

| 2004 Quarter |

||||||||||||

| First |

$ | 59.79 | $ | 52.68 | $ | 55.42 | $ | .50 | ||||

| Second |

56.00 | 50.70 | 53.08 | .50 | ||||||||

| Third |

54.22 | 48.90 | 54.10 | .50 | ||||||||

| Fourth |

57.64 | 50.70 | 57.44 | .50 | ||||||||

| Total |

$ | 2.00 | ||||||||||

Corporate Headquarters

The PNC Financial Services Group, Inc.

One PNC Plaza

249 Fifth Avenue

Pittsburgh, Pennsylvania 15222-2707

412-762-2000

Stock Listing

The PNC Financial Services Group, Inc.s common stock is listed on the New York Stock Exchange under the symbol PNC. At the close of business on February 28, 2006, there were 43,120 common shareholders of record.

Internet Information

The PNC Financial Services Group, Inc.s financial reports and information about its products and services are available on the Internet at www.pnc.com.

Financial Information

We are subject to the informational requirements of the Securities Exchange Act of 1934. Therefore, we file annual, quarterly and current reports as well as proxy materials with the Securities and Exchange Commission (SEC). You can obtain copies of these and other filings, including exhibits, electronically at the SECs Internet website at www.sec.gov or on or through PNCs corporate Internet website at www.pnc.com in the For Investors section. Copies may also be obtained without charge by contacting Shareholder Services at 800-982-7652 or via e-mail at web.queries@computershare.com.

Corporate Governance at PNC

Information about our Board and its committees and about corporate governance at PNC is available in the corporate governance section of the For Investors page of PNCs corporate website at www.pnc.com. Shareholders who would like to request printed copies of the PNC Code of Business Conduct and Ethics or our Corporate Governance Guidelines or the charters of our Boards Audit, Nominating & Governance, and Personnel & Compensation committees (all of which are posted on the PNC corporate website) may do so by sending their requests to George P. Long, III, Corporate Secretary, at corporate headquarters at the above address. Copies will be provided without charge to shareholders.

Inquiries

For financial services call 888-PNC-2265. Individual shareholders should contact Shareholder Services at 800-982-7652.

Analysts and institutional investors should contact William H. Callihan, Senior Vice President, Director of Investor Relations, at 412-762-8257 or via e-mail at investor.relations@pnc.com.

News media representatives and others seeking general information should contact Brian Goerke, Director of External Communications, at 412-762-4550 or via e-mail at corporate.communications@pnc.com.

Trust Proxy Voting

Reports of 2005 nonroutine proxy voting by our bank trust divisions are available by writing to George P. Long, III, Corporate Secretary, at corporate headquarters.

Annual Shareholders Meeting

All shareholders are invited to attend The PNC Financial Services Group, Inc. annual meeting on Tuesday, April 25, 2006, at 11 a.m., Eastern Time, at One PNC Plaza, 249 Fifth Avenue, Pittsburgh, Pennsylvania 15222.

Common Stock Prices/Dividends Declared

The table on this page sets forth by quarter the range of high and low sale and quarter-end closing prices for The PNC Financial Services Group, Inc. common stock and the cash dividends declared per common share.

Dividend Policy

Holders of The PNC Financial Services Group, Inc. common stock are entitled to receive dividends when declared by the Board of Directors out of funds legally available for this purpose. The Board presently intends to continue the policy of paying quarterly cash dividends. However, the amount of future dividends will depend on earnings, the financial condition of The PNC Financial Services Group, Inc. and other factors, including applicable government regulations and policies and contractual restrictions.

Dividend Reinvestment and Stock Purchase Plan

The PNC Financial Services Group, Inc. Dividend Reinvestment and Stock Purchase Plan enables holders of our common and preferred stock to purchase additional shares of common stock conveniently and without paying brokerage commissions or service charges. A prospectus and enrollment form may be obtained by contacting Shareholder Services at 800-982-7652.

Registrar and Transfer Agent

Computershare Investor Services, LLC

2 North LaSalle Street

Chicago, IL 60602

800-982-7652

PNC Bank, Central & Northern New Jersey

Two Tower Center Boulevard East Brunswick, NJ 08816 Regional President: Peter K. Classen

PNC Bank, Central Pennsylvania

4242 Carlisle Pike Camp Hill, PA 17011 Regional President: Dennis P. Brenckle

PNC Bank, Delaware

222 Delaware Avenue Wilmington, DE 19801 Regional President: Connie Bond Stuart

PNC Bank, Greater Washington, D.C., Area

800 17th Street NW Washington, D.C. 20006 Regional President: Michael N. Harreld

PNC Bank, Kentucky & Indiana

500 West Jefferson Street Louisville, KY 40296 Regional President: Craig D. Grant

PNC Bank, Northeast Pennsylvania

201 Penn Avenue Scranton, PA 18503 Regional President: Peter J. Danchak

PNC Bank, Northwest Pennsylvania

901 State Street Erie, PA 16501 Regional President: Marlene D. Mosco

PNC Bank, Ohio & Northern Kentucky

201 East Fifth Street Cincinnati, OH 45202 Regional President: John T. Taylor

PNC Bank, Philadelphia & Southern New Jersey

1600 Market Street Philadelphia, PA 19103 Regional President: J. William Mills, III

PNC Bank, Pittsburgh

249 Fifth Avenue Pittsburgh, PA 15222 Regional President: Sy Holzer

PNC BANK REGIONAL OFFICES

THE PNC FINANCIAL SERVICES GROUP, INC.

1-888-PNC-BANK (1-888-762-2265)

The PNC Financial Services Group, Inc.

One PNC Plaza

249 Fifth Avenue

Pittsburgh, PA 15222-2707