SLIDE PRESENTATION

Published on February 15, 2006

The PNC Financial Services Group, Inc. Impact on PNC of the Merger of BlackRock with Merrill Lynch Investment Managers February 15, 2006 The PNC Financial Services Group, Inc. Impact on PNC of the Merger of BlackRock with Merrill Lynch Investment Managers February 15, 2006 EXHIBIT 99.2 |

2 Cautionary Statement Regarding Forward-Looking Information Cautionary Statement Regarding Forward-Looking Information This presentation contains forward-looking statements with respect to PNCs

outlook or expectations with respect to the planned transaction between BlackRock and Merrill Lynch and the impact of the transaction on PNCs future performance. Forward-looking statements are

subject to numerous assumptions, risks and uncertainties, which change over

time. The forward-looking statements in this presentation speak only as of the date of this presentation, and PNC assumes no duty, and does not undertake, to update them. In addition to factors previously disclosed in PNCs SEC

reports (accessible on the SEC website at www.sec.gov and on PNCs website at www.pnc.com) applicable to PNCs business generally, as well as factors previously disclosed in BlackRocks SEC reports (accessible on the SEC website and on BlackRocks website at www.BlackRock.com) applicable to BlackRocks business generally, the forward-looking statements in this presentation are subject

to the following risks and uncertainties: Completion of the transaction is dependent on, among other things, receipt of

regulatory and other approvals, the timing of which cannot be predicted

with precision at this point and which may not be received at all.

The impact of the completion of the transaction on PNCs financial statements

will be affected by the timing of the transaction and the market price of BlackRock at the time of closing. The impact of the transaction on PNCs future financial results depends on the

following: (1) BlackRocks future performance and BlackRocks ability to integrate its business with the Merrill Lynch Investment Managers business and to achieve planned synergies and cost savings,

(2) BlackRocks dividend payout ratio going forward, which is assumed to be 40%, and (3) PNCs

ability to take advantage of the increase in its capital resulting from

this transaction to pursue various capital management options such as share repurchases and making investments in its businesses, which could be affected by PNCs future financial performance and

other factors affecting PNCs capital needs and flexibility.

|

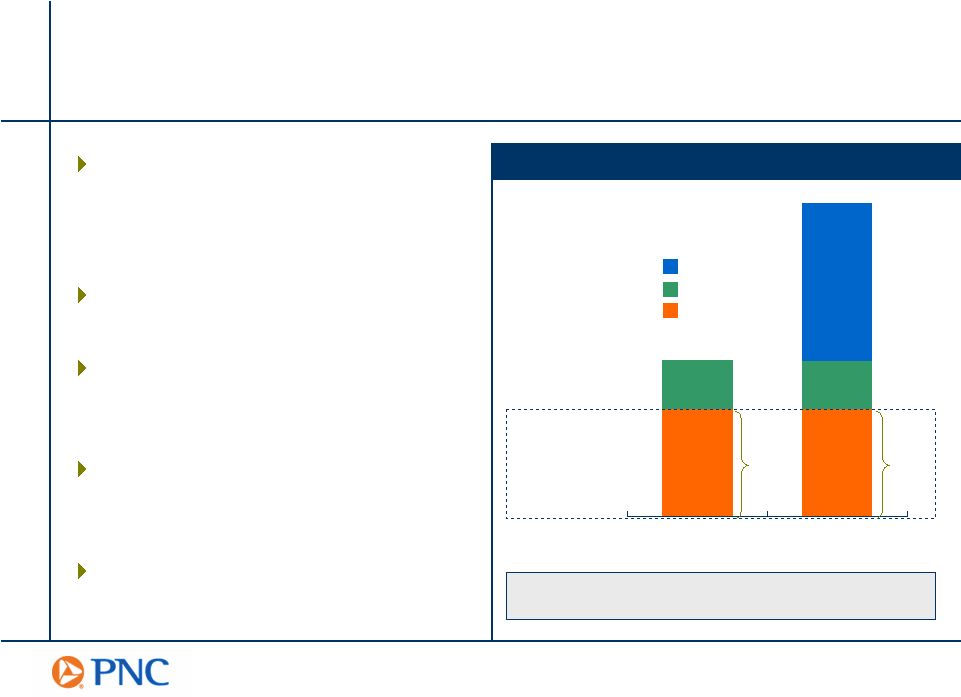

3 BlackRock Current BlackRock Pro Forma PNC Retains Share Ownership in Larger and More Valuable Company PNC Retains Share Ownership in Larger and More Valuable Company 19.5 44.5 Others PNC New BlackRock creates a top ten investment manager worldwide with approximately $1 trillion in assets under management Immediately accretive to PNCs earnings $1.6 billion after-tax gain expected to be recognized upon closing Additional unrecognized pre-tax gain on BlackRock investment of $2.6 billion Significantly enhances capital flexibility BlackRock Common Share Ownership 19.5 44.5 65.0* Merrill Lynch BlackRock contribution to PNC 2005 earnings 12% 13% PNC retains share ownership in much larger and more valuable company 64.0 129.0 70% 34% * Common Stock Equivalents Shares in millions |

4 PNCs Estimated Gain on Transaction PNCs Estimated Gain on Transaction Book Value Estimated Increase in Book Value After Closing $58 Value Per Share of BlackRock PNCs Investment Estimated Market Value Over Book Value $59 Unrecognized Gain $2.6 Billion Pre-tax Gain* $2.5 Billion $641 Million Investment Book Value $131.51 $72.48 65.0 Million Shares Issued @ $131.51 Market Value As of 2/10/06 Book Value As of 12/31/05 $14.41 BlackRock Shares Held by PNC X 44.5 million X 44.5 million X 44.5 million After-tax Gain $1.6 Billion Pre-tax gain is net of $55 million of goodwill Note: This calculation will adjust through the closing date * * |

5 Positive Financial Impact on PNC from BlackRock Transaction Positive Financial Impact on PNC from BlackRock Transaction BlackRock earnings contribution increases from 12% to 13% of total PNC net income Noninterest income to total revenue remains above 60% Efficiency ratio improves by 300 bps Tangible capital ratio improves from 5.0% to 7.3% (a) BlackRock net income is based on IBES 2006 mean estimate; pro forma numbers include projected

MLIM results and pre-tax synergies of $70 million (midpoint) plus other accounting related adjustments and assuming transaction closed on January 1, 2006 (anticipated closing is September 30, 2006) (b) PNCs 34% portion of BlackRocks estimated 2006 net income from combined company tax effected at 24%; assumes 40% dividend payout ratio (c) PNCs estimate of BlackRocks 2006 net income contribution prior to transaction tax effected at 7% (d) Assumes no PNC share repurchases BlackRock net income from combined company $746 (a) PNC after-tax portion of BlackRock net income: After transaction $193 (b) Before transaction 176 (c) Incremental BlackRock net income contribution to PNC $17 Accretion to PNCs earnings per share $0.06 (d) 2006 Estimate $ millions, except earnings per share Estimated 2006 Accretion to PNCs Earnings Per Share PNC 2005 Pro Forma Highlights Resulting from BlackRock Transaction |

6 |

Appendix 7 |

8 Cash $3.5 ($0.5) $3.0 Securities & short-term investments 23.6 (0.3) 23.3 Investment in BlackRock 0 0.7 $2.5 (a) 3.2 Goodwill & other intangible assets 4.5 (0.5) 4.0 Other assets 60.4 (0.6) 59.8 Total assets $92.0 ($1.2) $2.5 $93.3 Other liabilities $65.9 ($0.7) $0.9 (b) $66.1 Borrowed funds 16.9 (0.2) 16.7 Minority and noncontrolling interests in consolidated entities 0.6 (0.3) 0.3 Equity 8.6 0 1.6 (c) 10.2 Total liabilities & equity $92.0 ($1.2) $2.5 $93.3 $ billions PNC Consolidated 12/31/05 Impact of BlackRock Deconsolidation on PNCs Balance Sheet Impact of BlackRock Deconsolidation on PNCs Balance Sheet BlackRock Deconsolidating Adjustments (a) PNCs Investment equals its ownership percentage of BlackRocks pro forma book equity (b) PNCs Deferred Income Tax accrual (c) Increase equals the after-tax gain recorded on this transaction Appendix PNC Pro forma 12/31/05 Transaction Adjustments |

9 Impact of BlackRock Deconsolidation on PNCs Income Statement Impact of BlackRock Deconsolidation on PNCs Income Statement (a) Represents PNCs 2005 pro forma average ownership of approximately 35% of the 2005

pro forma net income of BlackRock excluding synergies and other accounting adjustments (b) Represents effective tax rate of 24% on BlackRocks pro forma net income Appendix Net interest income $2,154 ($35) $2,119 Noninterest income 4,162 (1,191) $221 (a) 3,192 Total revenue 6,316 (1,226) 221 5,311 Provision for credit losses 21 0 0 21 Noninterest expense 4,317 (851) 0 3,466 Income before minority and noncontrolling interest and income taxes 1,978 (375) 221 1,824 Minority and noncontrolling interest in income of consolidated entities 49 (74) 0 (25) Income taxes 604 (138) 53 (b) 519 Net income $1,325 ($163) $168 $1,330 $ millions PNC Consolidated 2005 BlackRock Deconsolidating Adjustments PNC Pro forma 2005 Estimated Pro forma BlackRock |