The PNC Financial Services Group, Inc.

Announces Agreement to Acquire

Mercantile Bankshares Corporation

October

9, 2006

Exhibit 99.2

1

The PNC Financial Services Group, Inc.

Announces Agreement to Acquire

Mercantile Bankshares Corporation

October

9, 2006

Exhibit 99.2

1

Forward-Looking Information

This presentation contains forward-looking statements regarding our outlook or expectations with respect to the planned acquisition of Mercantile,

the expected costs to be incurred in connection

with the acquisition, Mercantile’s future performance and consequences of its integration into

PNC, and the impact of the transaction on PNC’s future performance.

Forward-looking statements are subject to numerous assumptions, risks and uncertainties, which change over time. The forward-looking

statements in this presentation speak only as of

the date of the presentation, and each of PNC and Mercantile assumes no duty, and does not

undertake, to update them. Actual results or future events could differ, possibly materially, from those that we anticipated in these forward-looking

statements.

These forward-looking statements are subject to the principal risks and uncertainties applicable to the respective businesses of PNC and

Mercantile generally that are disclosed in the 2005 Form

10-K and in current year Form 10-Qs and Form 8-Ks of PNC and Mercantile (accessible

on the SEC’s website at www.sec.gov and on PNC’s website at www.pnc.com and on Mercantile’s website at www.mercantile.com, respectively).

In

addition, our forward-looking statements in this presentation are subject to the following risks and uncertainties related both to the acquisition

transaction itself and to the integration of the acquired business into PNC after closing:

Completion of the transaction is dependent on, among other things, receipt of regulatory and shareholder approvals, the timing of which

cannot be predicted with precision at this point and which

may not be received at all. The impact of the completion of the transaction on

PNC’s financial statements will be affected by the timing of the transaction.

The transaction may be substantially more expensive to complete (including the integration of Mercantile’s businesses) and the anticipated

benefits, including anticipated cost savings and

strategic gains, may be significantly harder or take longer to achieve than expected or may

not be achieved in their entirety as a result of unexpected factors or events.

The integration of Mercantile’s business and operations into PNC, which will include conversion of Mercantile’s different systems and

procedures, may take longer than anticipated or

be more costly than anticipated or have unanticipated adverse results relating to

Mercantile’s or PNC’s existing businesses.

The anticipated benefits to PNC are dependent in part on Mercantile’s business performance in the future, and there can be no assurance as

to actual future results, which could be impacted

by various factors, including the risks and uncertainties generally related to PNC’s and

Mercantile’s performance or due to factors related to the acquisition of Mercantile and the process of integrating it into PNC.

Any annualized, proforma, estimated, third party or consensus numbers in this presentation are used for illustrative or comparative purposes only

and may not reflect actual results. Any

consensus earnings estimates are calculated based on the earnings projections made by analysts who

cover that company. The analysts’ opinions, estimates or forecasts (and therefore the consensus earnings estimates) are theirs alone, are

not

those of PNC or its management, and may not reflect PNC’s or Mercantile’s actual or anticipated results.

2

Combination of PNC and Mercantile

Will Create a Mid-Atlantic Powerhouse

Mercantile is a premier franchise that fits well

into PNC’s footprint

PNC is accelerating its expansion into one of

the nation’s most affluent and attractive regions

Meaningful opportunities for value creation by

leveraging PNC and Mercantile’s strengths

Transaction consistent with PNC’s strategic objectives

3

Mercantile is a Premier Franchise in the

Mid-Atlantic Region

Financial Highlights

Total assets $17 billion

Loans $12 billion

Deposits $12 billion

Net income $144 million

Net interest margin 4.34%

Efficiency ratio 48%

Tangible common equity ratio 9.85%

Nonperforming loans to loans 0.24%

As of or for the

Six Months Ended

June 30, 2006

Leading commercial banking

and wealth management

businesses

Complements PNC’s footprint

with 240 branches primarily in

Maryland

High financial performance with

solid growth trends

Strong credit profile

One-of-a-Kind Opportunity

(1)

(1)

Mercantile’s efficiency ratio equals noninterest income divided

by sum of net interest income FTE and noninterest income

4

Combination Will Create Mid-Atlantic

Powerhouse

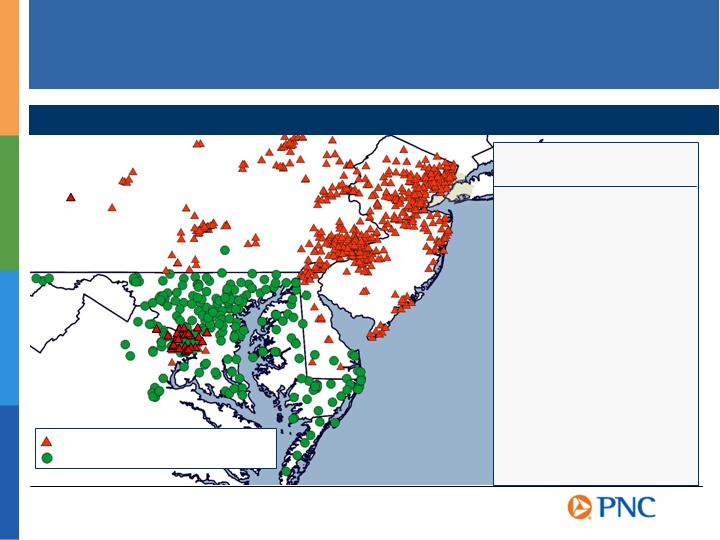

Existing PNC Mid-Atlantic Branch Locations

Existing Mercantile Branch Locations

West Virginia

Virginia

Maryland

Delaware

New Jersey

New York

Pennsylvania

Combined Proforma

Market Share(1)

69% of PNC Proforma Branches Located in the Mid-Atlantic Region

Deposit market share data as of 6/30/05

(1)

Maryland

Branches 198

Deposit market share 2nd

Virginia

Branches 57

Deposit market share 6th

Delaware

Branches 48

Deposit market share 2nd

Washington, DC

Branches 32

Deposit market share 4th

5

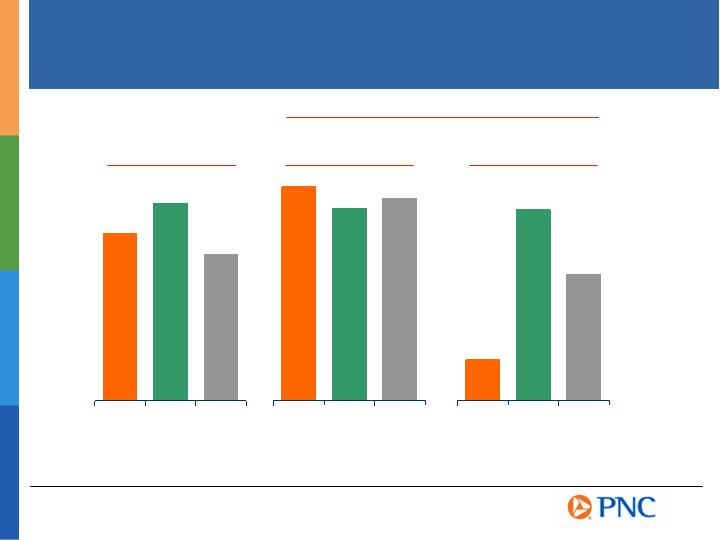

Fast Growing and Affluent Region

PNC - 78 county footprint

Mercantile – 38 county footprint

Source: SNL DataSource

PNC

MRBK

PNC

MRBK

PNC

MRBK

Median Household

Income

Projected 5-Year Growth

Household

Income

Population

$58,648

$69,363

18.8%

16.9%

2.1%

10.0%

$51,546

17.8%

6.7%

U.S.

U.S.

U.S.

6

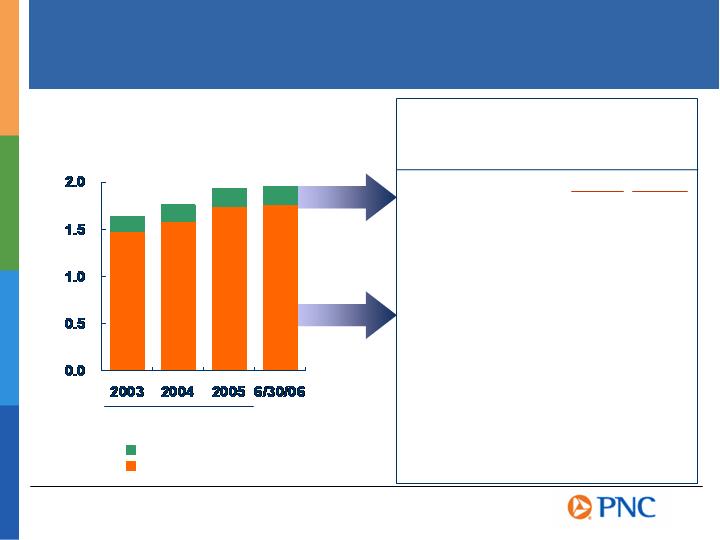

PNC’s Proven Model to Increase and Deepen

Checking Relationships

PNC Retail Banking

Checking Customer Base

millions

December 31

Small Business

Consumer

Small Business

Small Business debit

card revenue ($ millions) $5.8 +27%

Small Business online

banking users 45% +21%(2)

Consumer

Consumer debit card

revenue ($ millions) $48.9 +21%

Consumer online

banking users 51% +13%(2)

Consumer online

bill-pay users 17% +83%(2)

…Provides Opportunities to

Leverage Increased Ownership

in Payments Business

Growth(1)

Growth is for 1H06 vs. 1H05

Reflects growth in users

1H06

(1)

(2)

7

Success in Greater Washington, DC Market

Highlights Scalability of Model

Demonstrating Ease of PNC

Client retention exceeded plan

Leveraging successful

technology platform

Extended hours

Free ATMs

Established Business Banking

team

Improved Monthly Same Store

Sales Production for

PNCs Greater Washington Market

Increase

June ’06 vs

June ’05

Consumer

Checking relationships +19%

Average deposits +15%

Average home equity loans +15%

Small Business

Checking relationships +29%

Average deposits +22%

Average loans +207%

8

A Comprehensive Integration Plan

Begins Today

Leverage experienced integration teams for each

company

Minimize customer disruption by preserving

customer-contact business units and limited branch

consolidations

Roll-out intensive communication plans to

customers and employees

Leverage PNC’s world-class technology platform

Developing plans to:

9

Combination Will Result in Significant

Revenue Growth Opportunities

Significant opportunity to leverage PNC’s small business

capabilities across Mercantile’s banking footprint

Application of PNC Treasury Management, Capital

Markets and other corporate services to Mercantile’s

corporate customers

Enhance Mercantile’s retail consumer offerings to drive

additional growth such as home equity, credit card

lending and retail payment systems

Mercantile’s Wealth Management business will benefit

from having additional scale and product capability

10

Transaction Summary

Transaction total value $6 billion (1)

Implied consideration $47.24 per Mercantile share (1)

Consideration $2.1 billion in cash and 52.5 million shares

of

PNC common stock

Board composition Two additional directors from Mercantile

Due diligence Completed

Required approvals Mercantile shareholders and customary

regulatory

approvals

Termination fee $225 million

Anticipated closing First quarter 2007

Based on PNC closing price of $73.60 on October 6, 2006 and includes cash out of options. Implied consideration of

$47.24 per Mercantile share reflects a fixed exchange ratio of .4184 shares

of PNC common stock and $16.45 in

cash for each Mercantile share.

(1)

11

Transaction is Good for Mercantile

Constituents

Shareholders

Compelling transaction

Customers

PNC does business like Mercantile; similar philosophy and focus

Increase breadth and depth of consumer and commercial product offerings

Robust technology leading to even better service

Employees

Augments individual career opportunities within a large, diverse and growing

organization

Communities

Like Mercantile, PNC is very community oriented

$25 million commitment to a charitable foundation in Baltimore

12

Pricing Consistent with Recent Transactions

Price to

Estimated

Earnings

$5.99 28% 2.62x 3.84x 19.9x 40%

$1.90 25% 2.51x 3.79x 17.0x 31%

$14.37 31% 3.07x 3.73x 18.4x 39%

$7.43 24% 2.50x 4.51x 18.8x 48%

Price /

Tangible

Book Value

Premium to

Core

Deposits

Mercantile price reflects market closing price of $36.78 on 10/6/06; estimated earnings represent Mercantile 2006

IBES consensus estimates; Mercantile book value and tangible book value are as

of June 30, 2006.

Reflects median of bank and thrift deals announced after 1/1/04 with deal value between $1 and $10 billion, listed in

Appendix.

Source: SNL DataSource. Ratios at date of deal announcement.

Market

Premium

(1)

(2)

Price /

Book Value

Bank and

Thrift Deals

Wachovia/

SouthTrust

SunTrust/

Nat’l Commerce

Deal Value

($ billions)

(1)

(2)

(3)

(3)

(3)

(3)

PNC /

Mercantile

13

EPS Impact Based on Conservative

Financial Assumptions

EPS assumptions IBES consensus estimates for 2007 and 2008

Cost savings $108 million – 33% in 2007, 100% in 2008

Equals 25% of Mercantile’s 2006 annualized expense base

PNC synergies and

cost savings $27 million

One-time costs $141 million after-tax

Financing costs Financing costs on cash consideration and one-time costs

at 5.75% pre-tax cost of funds

Targeted capital ratios Tangible equity to tangible asset 5.5%

PNC and Mercantile proforma combined $5.61 $6.42

PNC consensus $5.68 $6.39

PNC GAAP accretion/(dilution) ($0.07) $0.03

PNC cash accretion/(dilution) $0.01 $0.11

2007

2008

Estimated EPS Impact

Excludes estimated one-time costs of $44 million after-tax and is reconciled to GAAP in the Appendix

(1)

(1)

14

Transaction Should Provide Solid Returns to

PNC Shareholders

Aggregate offer value ($5,992)

After-tax one-time cash costs ($141)

Cash flow from income 283 $364 $394 $427 $463

Expense savings 28 85 85 85 85

Excess Mercantile capital 777

Capital for asset expansion (68) (70) (75) (80) (85)

Terminal value (14x) 8,164

Incremental cash flow ($5,215) $102 $379 $404 $432 $8,627

Estimated IRR 14.8%

Closing

2007

2008

2009

2010

2011

$ millions

Returns Well in Excess of Share Repurchases and Cost of Equity

After-tax one-time cash costs, cash flow from income, expense savings, excess Mercantile capital and capital for asset expansion are based

on PNC management estimates after completing due diligence

and includes estimated purchase accounting adjustments.

Excess Mercantile capital over assumed 5.5% tangible common ratio

(1)

(1)

(1)

15

Summary

Creating powerhouse banking franchise in one

of the nation’s most attractive regions

Meets PNC’s acquisition objectives

Meaningful opportunities for value creation by

leveraging PNC and Mercantile’s strengths

16

The PNC Financial Services Group, Inc. and Mercantile Bankshares Corporation will be filing

a proxy statement/prospectus and other relevant documents concerning the merger with the

United

States Securities and Exchange Commission (the “SEC”). WE URGE INVESTORS

TO READ THE PROXY STATEMENT/PROSPECTUS AND ANY OTHER DOCUMENTS TO

BE FILED WITH THE SEC IN CONNECTION WITH THE MERGER OR INCORPORATED BY

REFERENCE IN THE

PROXY STATEMENT/PROSPECTUS, BECAUSE THEY WILL

CONTAIN IMPORTANT INFORMATION. Investors will be able to obtain these documents

free of charge at the SEC’s web site (www.sec.gov). In addition, documents filed with the

SEC

by The PNC Financial Services Group, Inc. will be available free of charge from

Shareholder Relations at (800) 843-2206. Documents filed with the SEC by Mercantile

Bankshares will be available free of charge from Mercantile Bankshares Corporation,

2 Hopkins Plaza, P.O. Box 1477, Baltimore, MD 21203, Attention: Investor Relations.

The directors, executive officers, and certain other members of management and employees

of Mercantile Bankshares are participants in the solicitation of proxies in favor of the merger

from

the shareholders of Mercantile Bankshares. Information about the directors, and

executive officers of Mercantile Bankshares is set forth in the proxy statement for its 2006

annual meeting of stockholders, which was filed with the SEC on March

29, 2006. Additional

information regarding the interests of such participants will be included in the proxy

statement/prospectus and the other relevant documents filed with the SEC when they become

available.

Additional Information About This

Transaction

17

Appendix

18

Combined Balance Sheet

Loans $49.9 $11.9 $61.8

Securities 21.7 3.1 24.8

Total assets 94.9 17.0 111.9

Noninterest bearing deposits 14.4 3.4 17.8

Total deposits 63.5 12.4 75.9

Loans to deposits 80% 98% 82%

PNC

Mercantile

Combined

$ billions

Appendix

As of June 30, 2006

Excludes purchase accounting adjustments

19

Combined Income Statement

Revenue

Net interest income - FTE $1,125 $323 $1,448

Noninterest income 2,415 125 2,540

Total revenue $3,540 $448 $3,988

Provision for credit losses $66 $0 $66

Net income $735 $144 $879

Net interest margin 2.93% 4.34% 3.16%

$ millions

Appendix

For the Six Months Ended June 30, 2006

PNC

Mercantile

Combined

Excludes purchase accounting adjustments

20

One-Time Expenses

$ millions

Customer communications $13

Signage 12

Technology / contract termination / buyouts 11

Training 9

Personnel / retention 8

State taxes 7

Travel / other 12

Total pretax charges $71

After-tax expense $44

Appendix

Estimated One-Time Costs to be Expensed During 2007

Total one-time costs of $141 million after tax comprised of $44 million expensed during 2007 and $97 million accrued through

purchase accounting

21

Bank and Thrift Acquisitions

National City Fidelity BankShares Inc.

National City Harbor Florida Bankshares Inc.

Citizens Banking Corp. Republic Bancorp Inc.

Banco Bilboa Vizcaya Argent SA Texas Regional Bancshares Inc.

Sovereign Bancorp Inc. Independence Community Bank

Wachovia Corp. Westcorp

TD Banknorth Hudson United Bancorp

Zions Bancorp Amegy Bancorp Inc.

BNP Paribus Group Commercial Federal Corp.

Capital One Financial Hibernia Corp.

TD Banknorth Financial Banknorth Group Inc.

Fifth Third Bancorp First National Bankshares of FL

SunTrust Banks Inc. National Commerce Financial Corp.

BNP Paribus Group Community First Bankshares

National City Corp. Provident Financial Group Inc.

North Fork Bancorp GreenPoint Financial Corp.

Sovereign Bancorp Inc. Seacoast Financial Services

Appendix

Bank and Thrift Deals Announced After 1/1/04 with Deal Value Between $1 Billion and $10 Billion

Buyer

Seller

22

Non-GAAP to GAAP

Reconcilement

Appendix

PNC and Mercantile Proforma Combined EPS

PNC projected net income $1,637 $1,793

Mercantile projected net income 279 360

Proforma combined net income 1,916 2,153

Adjustments (after-tax)

Synergies 28 85

Purchase accounting adjustments 14 7

Other (95) (119)

Net adjustments (53) (27)

Adjusted proforma combined net income $1,863 $2,126

One-time expenses 44

Adjusted proforma net income w/ one-time expenses $1,819

PNC shares outstanding (millions) 288.2 280.6

Proforma shares outstanding (millions) 331.9 330.9

PNC projected EPS $5.68 $6.39

Proforma combined EPS (excluding one-time expenses) 5.61 6.42

Accretion/(dilution) ($0.07) $0.03

2007

2008

$ millions

(1)

(1)

(1)

Based on EBIS consensus estimates

23